City Lodge doesn’t want you to skimp on your summer

Since the end of September, the share price has jumped 39%!

The City Lodge operating update really tugs at the heartstrings in an effort to keep driving demand for travel, reminding us that people are “experiencing life while nurturing relationships which had suffered” during lockdowns. Few would argue that this isn’t true.

International flights are almost at pre-Covid levels and many companies have returned to offices. This is driving demand for domestic leisure travel and City Lodge is loving it, with the food and beverage offering making a difference in a post-Covid world.

Year-to-date occupancies are at 56.5% and some months have even exceeded the equivalent 2019 levels. November occupancies are 60% thus far, with the outlook for December decidedly positive. To add to this happy story, room rates are up 9.5% on the prior year and similar to 2019 levels.

The group has R300 million in debt and a positive bank balance of R226 million.

Sadly, despite operating metrics being back to 2019 levels, the share price may never get back there after having to do highly dilutive equity issues just to settle the B-BBEE structure and shore up the balance sheet during lockdowns:

Invicta posts a sharp jump in earnings

The offshore operations now contribute more than 35% of group profits

For the six months ended September, Invicta managed to grow revenue by 7.2%. That’s good going, but not as impressive as the gross margin performance that saw a 190 basis points expansion to 32.5%. In this environment, any increase in margins is a great result for investors as it demonstrates pricing power in the business.

In many companies, we’ve see pressure on the balance sheet as inflationary issues cause a big jump in working capital. Although Invicta has certainly felt the working capital pressure, an increase in cash generated from operations of just under 3% is also an impressive outcome for shareholders.

As a further driver of shareholder value, the company repurchased 4.4% of its ordinary shares and 5% of its preference shares in the past six months. Net debt to equity is at 23%, which the group is happy with. This implies that there is more room to make attractive capital allocation decisions.

Group HEPS increased by 42.6% and HEPS from continuing operations was 52.3% higher. The net asset value per share increased by 16.8%.

It’s worth noting that these numbers were assisted by the acquisition of KMP on 1 January 2022. With reference to a group revenue number of R3.83 billion, KMP increased revenue in the RPE segment from R198 million to R470 million. That’s a material contribution and continues Invicta’s history of being quite happy to make significant acquisitions.

The goal is to have 50% of group earnings outside of South Africa by 2026. The current contribution is around 35%, so more offshore deals are likely to come in the next few years.

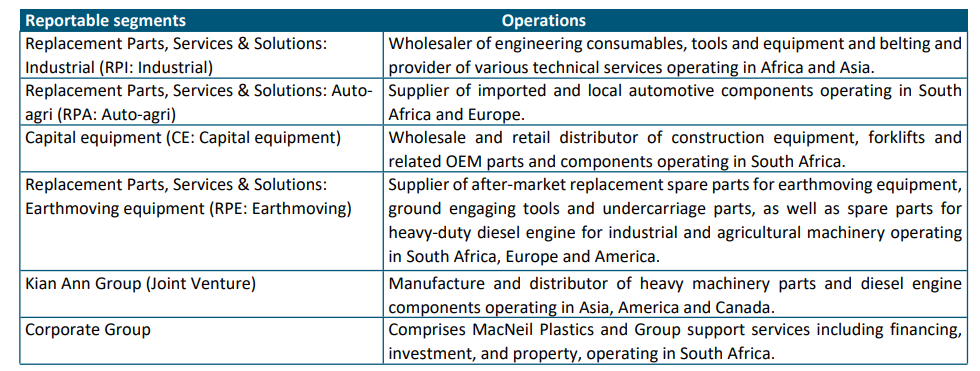

For those who were familiar with Invicta before the group was restructured, segments like “Bearing Man Group” would ring a bell. Those days are over, with a new segmental breakdown in place:

As you can see, the winds of change have certainly blown under CEO Steven Joffe. With results like these, shareholders (like me) aren’t going to complain.

A nutritional circus

Nutritional Holdings never fails to deliver entertainment

With its listing suspended since May 2021 and the company fighting for its survival from liquidation, the end can’t be far away for Nutritional Holdings in one way or another. To add insult to extensive injury, the JSE has now imposed a censure on the company.

The JSE has highlighted examples where the company “failed to comply with several important provisions of the Listings Requirements” – not good, but hardly surprising if you’ve been following this company with your popcorn in one hand.

For example, in February 2021 the company announced that it was disposing of Nutritional Foods. The very next day, it announced that the company will be placed into business rescue instead. Then, in May of the same year, the company announced that the company had not been placed into business rescue. Shareholders should’ve been told immediately, not three months later.

The list goes on.

The JSE found that in the Cannacrypt initial coin offering (an astonishing few words in a row that remind us of how stupid 2021 was), the company made it sound like the coins were backed by Nutritional Holdings as a JSE-listed company. In reality, the coins were being issued by a company that isn’t even an associate of the company, let alone a subsidiary. There are also issues related to the interim financial statements for the six months ended August 2020 and the lack of renewal of a cautionary announcement in 2021. The company has also neglected to provide the JSE with monthly progress reports regarding its suspension.

Short of someone driving to the JSE’s head office and setting the reception area on fire, I’m not sure what more a company can do to deserve to have its listing terminated. Instead, the JSE has imposed a public censure on the company. It feels like far too small a punishment for the reputational damage this company did to the market.

Reunert jumps 7.5% after releasing results

The market (and the FinTwit community) seemed to like what it saw

Thanks to growth in all three segments at Reunert, the segmental operating profit increased by 16%. This was an impressive result off revenue growth of a similar percentage, as it shows that the group was able to maintain its margins in the year ended September.

The year wasn’t without its challenges, with supply chain dynamics and chip supply shortages hurting businesses like Nanoteq, Omnigo and Nashua. This also impacted the cash flows of the group, as investment in working capital was necessary. We are seeing this story play out across so many listed companies.

The pressure further down the income statement from equity-accounted investees (which swung into a loss) is part of why attributable profit only grew by 6% and HEPS by 9%. The final dividend was 8% higher.

Looking deeper, Electrical Engineering grew revenue by 13% and operating profit by 17%. ICT grew revenue by 4% and operating profit by 6%. Applied Electronics pumped out revenue growth of 27% and operating profit growth of 64% in a strong recovery.

The announcement also touches on the attractive renewable energy ecosystem within Reunert, the acquisition of Etion Create for R202 million and the progress made to redeploy funds from Quince into other initiatives.

Standard Bank’s strong momentum continues

The announcement includes those two magic words: positive jaws

Positive jaws has nothing to do with sharks and everything to do with margins. In the banking industry (where I cut my teeth after varsity), jaws refers to the difference between percentage growth in revenue and percentage growth in costs. If revenue is growing faster than costs, you have positive jaws because margins are going up.

Like this: < (get it?)

Dorky finance terms aside, I wrote right at the beginning of 2022 that an environment of inflation and higher rates would be good for banks, at least initially. With the Standard Bank share price up 26.4% this year, that was a good call.

Inflation helps because corporate balance sheets get a larger. A bigger balance sheet gets funded by a mix of debt and equity, so this creates demand for lending by banks. With higher prevailing interest rates, the bank also earns more on each rand that is loaned to corporates.

In the ten months to 31 October, Standard Bank achieved double-digit net interest income growth. Non-interest revenue growth was also strong, thanks to transactional activity, trading revenue and insurance earnings.

Although cost growth was higher than expected, the strong revenue growth plus the group’s initiatives around costs meant that positive jaws was achieved. Yes, margins are higher.

Critically, credit impairment charges were higher vs. the comparable period but the expectation for the full-year credit loss ratio is that it will be in the lower half of the through-the-cycle target range of 70 to 100 basis points. This means that the bank expects to lose between 0.7% and 1% of every rand loaned to clients.

Return on equity is above the cost of equity (15.1%) and is higher than the number achieved in the first six months of the financial year (15.3%). By 2025, the bank is aiming for return on equity of between 17% and 20%.

Zeda will be separately listed from 19 December

The abridged pre-listing statement is now available

Barloworld will be distributing its stake in Zeda to Barloworld shareholders in the next few weeks. Because the company essentially inherits the Barloworld shareholder register, 58.42% of issued shares will be held by public shareholders.

Zeda operates the Avis and Budget brands across South Africa and 10 other sub-Saharan African countries. There’s more than just car rental here, with products including vehicle mobility solutions, fleet management and leasing solutions in addition to the car rental operations that most people would be familiar with.

For example, the leasing business focuses on corporates, SMMEs and public sector entities and the average lease duration is 45 months. There are also 14 Avis retail branches that sell vehicles in the car rental business or leasing business that have been identified for de-fleeting.

The fleet size is 33,000 vehicles across the businesses and the leasing businesses manages an additional 215,000 vehicles. The car rental business has estimated market share of 38% and the full maintenance leasing component of the leasing business has market share of nearly 22%.

With revenue of R7.67 billion for the year ended September and EBITDA of nearly R2.2 billion, the group has managed to emerge from the pandemic in good shape. The lockdowns forced the business to become as efficient as possible, with those learnings likely to benefit investors for years to come.

It will be interesting to see how this business performs on the JSE!

Little Bites:

- Director dealings:

- A prescribed officer of Impala Platinum has disposed of shares worth just over R1 million.

- A director of Spear (not the CEO this time) has bought shares worth R118k for a minor child – it’s always encouraging seeing this.

- A director of a subsidiary of Novus sold R41.5k worth of shares at R4.15 and then bought shares worth R4.2k at R3.80 the very next day. I can’t recall ever seeing a director playing the spread like that! To make it worse, no clearance to deal was obtained. I suspect there was an awkward meeting about this.

- Rand Merchant Investment Holdings will trade as OUTsure with the share code JSE:OUT from 7 December.

- Safari Investments announced that Heriot REIT and related parties now own a 40.46% stake in the company.

- Huge Group released results for the six months ended August. The company now puts itself forward as an investment holding company with nine portfolio investments, an entirely different accounting regime that is based on fair value movements rather than consolidated profits. The portfolio is valued at R1.54 billion and there is R209 million in interest-bearing debt. The group earned R32.5 million in investment income and R13.7 million in management fees. The positive fair value movement on the portfolio was R53 million. With net asset value per share of R9.39 and a share price of R2.32, the discount to NAV is…huge.

- Sibanye-Stillwater has approved the implementation of the Keliber project and has begun construction of the Kokkola lithium hydroxide refinery. The capital expenditure for Keliber has been approved as €588 million, with the refinery as the first step. The project is located in the colourfully-named Central Ostrobothnia region of Finland, one of Europe’s most significant lithium-bearing areas. The financial model suggests a 20% IRR that could increase to 27% if long-term forecast prices for lithium hydroxide by SFA Oxford are accurate. Sibanye holds an 84.96% stake in Keliber.

- Regular listeners to the Magic Markets podcast will be familiar with the AnBro team. The Dynamic Compound Portfolio is listing on the JSE on 29 November as a UBS Actively Managed Certificate, which allows investors to gain exposure to the portfolio. You can listen to the podcast about this portfolio at this link (and remember to always do your own research – nothing you read here is financial advice!)

- Nictus Limited has a tiny market cap of R33 million. It’s getting even smaller, with the share price closing lower after reporting a headline loss per share of between 1.74 cents and 2.32 cents for the six months ended September.

- YeboYethu (Vodacom’s B-BBEE investment scheme) recorded a loss in the six months to September because of the decline in the Vodacom share price. That’s a paper loss. The more important point is that debt is lower by R428.6 million with a further R343 million reduction planned once the dividend from Vodacom is received. An interim dividend of 70 cents per share has been declared.

- Visual International Holdings released a trading statement for the six months to August. The headline loss per share has improved by 24.2% but is still a loss of 0.72 cents.

Long term Barloworld shareholders may well have originally acquired their shares when Barloworld acquired Avis in a scheme of arrangement. Avis had been unbundled from Servgro which went on to become PSG.