Clicksbait: why the acquisition of Sorbet makes sense

This is a good strategic fit, though it is debatable how long Sorbet’s growth runway is

Clicks is acquiring Sorbet Holdings for R105 million, giving it ownership of a franchise business that boasts a franchise chain of over 190 outlets across South Africa. Remember, this is a franchise group, so Clicks won’t own the actual stores. It owns the brand and the royalty stream along with other sources of income like supplying those stores.

This investment relationship goes back to 2015, when Clicks acquired a 25% stake in Sorbet Brands (which holds the intellectual property). The seller is Old Mutual Private Equity, which acquired the business when it bought out Long4Life and delisted that company.

The obvious synergy here is for Sorbet products to be sold in Clicks stores. This will be scrutinised by the Competition Commission as part of the process of granting approval.

The Sorbet franchise model will be retained, which means that this is Clicks’ first adventure into franchise chain ownership. The base principle behind a franchise group is that it can scale a lot faster than corporate-owned stores, as the capital used for that expansion is provided by entrepreneurs buying franchises.

The question I have is around the growth trajectory of Sorbet. Having been hit hard by the pandemic (along with other salons), it’s clear that Sorbet will now be benefitting from increased footfall in malls. This is recovery story rather than a growth story. Without much in the way of new retail development though, how much bigger can the footprint realistically get?

Growthpoint gears up for tourist season

The strength of the balance sheet and the liquidity position remain the priority

Growthpoint has a vast property footprint and the most diversified operations of any property fund. We recently hosted the fund on Unlock the Stock to give an overview of the business and answer questions:

In the quarter ended September, the vacancy rate reduced marginally from 10.3% to 10.2%. Office vacancies are still a huge challenge at 21.4%, with retail at 5.8%, industrial at 4.3% and healthcare at 0.1%. The renewal success rate is also the lowest in office at just 61.2%. Although industrial’s renewal success rate is only slightly higher at 63.9%, these numbers are lumpy and retention was at 79.1% before the timing of a specific re-letting hit this number.

Ironically, the community centres benefit from growth in on-demand shopping, like Sixty60 and its competitors. This is because the sales are still going through the tills of the retailers in those centres. Rental reversions worsened from -13.6% to -15% because of the conclusion of the Ster Kinekor business rescue process. Without that issue (and two other significant renewals), it would’ve been -8.1%. The Bayside Mall in Cape Town remains a headache for Growthpoint with substantial vacancies. I drive past that mall regularly and I can confirm that it has serious problems in terms of design and general appeal.

In the office segment, smaller businesses are returning to offices. Staff occupancies at many offices are now up to 70%. Still, space consolidation is negatively impacting vacancies. The biggest challenge here is Sandton, where Growthpoint has 21.5% of its gross lettable area in office properties. Sandton vacancies appear to have peaked at a frightening 27%.

In the industrial portfolio, Growthpoint has been taking advantage of demand by non-institutional investors for these properties, disposing of non-core assets. The overall operating environment has improved, particularly in coastal areas.

Although there are many other potential areas of focus in the group, the V&A Waterfront is always important to mention. International tourist arrivals recovered to about 84% of pre-pandemic levels. Despite footfall only recovering to 79% of the “last normal” levels, retail sales exceeded those levels by 19%. A major improvement in room rates led to revenue per available room (RevPAR) recovering to 97% of pre-pandemic levels, despite an occupancy rate of only 53%. In the coming cruise season, the V&A will welcome 75 visits from vessels!

Growthpoint is confident that the upcoming summer season will see the V&A make a full recovery. As a resident of Cape Town who loves this beautiful city, I certainly hope that this will be the case!

Kaap Agri signs off on another strong year

Over the pandemic period, revenue has grown at a CAGR of 22.9%

In the year ended September, Kaap Agri achieved like-for-like revenue growth of 24%. Reported growth is 48.4%, but this has been skewed by the acquisition of PEG Retail Holdings, with three months of results included in this period.

Product inflation has been the major driver here, estimated at 24.2%. With fuel excluded, inflation was a more palatable 9.3%. The higher contribution of fuel revenue to the group result isn’t good for margins, with gross margin decreasing because fuel is a lower margin business.

Although the outlook is always subject to the weather (the joys of the agri sector), the management team sounds upbeat about its prospects.

The total dividend for the year increased by 11.3% to 168 cents per share. More conservative investors will probably point to that growth rate as a more sustainable view on performance.

Lewis posts another result that shows why buybacks help

Headline earnings is up just 4.4%, but HEPS has jumped by 19.2%

The furniture retail industry isn’t exactly seen by many as the land of milk and honey, yet Lewis has been a consistently good performer for shareholders.

How?

Lewis is the very best case study on the JSE of the power of share buybacks. When shares are trading at a low earnings multiple, then repurchasing them means the company is effectively investing in itself at a low price. For the shareholders who choose to remain, this is lucrative.

Still, share buybacks can only get you so far. With weakening trading conditions, investors need to be careful here, even if management has given upbeat commentary about the business model.

I was surprised to note Lewis’ commentary around ongoing improvement in the quality of the debtors book, with collection rates strengthening. I question for how long that can continue, particularly when cash sales are under pressure and hence more consumers need credit to keep the tills ringing.

For example, the “traditional” segment in the group grew sales by 6.5% and cash retail brand UFO reported a decline of 9.5%. Overall, credit sales were up 16.4% and cash sales declined by 8.1%.

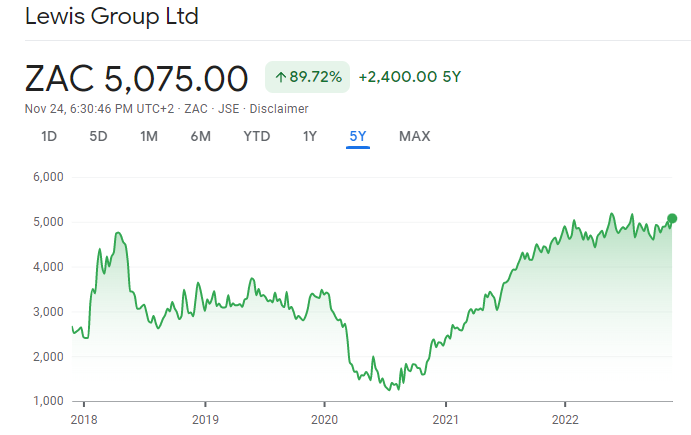

An interim dividend of 195 cents has been declared. The share price closed 2.7% higher at R50.75, with the year-to-date increase now at 6%. I would argue that this share price is running out of steam as we head into a weak consumer environment:

Mr Price: a red cap and a red share

Interim results were greeted by an 8% drop in the share price

For the 26 weeks ended 1 October, Mr Price grew HEPS by 10.6% and the dividend per share by the same percentage. That hardly sounds like a bad result, yet the market punished the company.

Group revenue increased by 6.5%, gross margin expanded 60 basis points and expense growth was only 5.9%, so operating margin also improved by 80 basis points. That doesn’t seem bad to me in a period that lost 80,000 trading hours across the footprint because of load shedding. In a rather shocking comment that reminds us of how terrible our government is, the company also points out inconsistent and sometimes non-existent payments of social grants during the period.

The market potentially got a fright from the impact of load shedding in September, which led to a 6.7% decline in sales in that month. Another potential worry could’ve been the loss in Apparel market share over the last two quarters, a function of the implementation of a new ERP system. The Homeware segment is also under pressure, with a drop in comparable store sales of 9.9% and an acknowledgement by Mr Price that competitor activity has been aggressive over the last 12 months. The Homeware segment contributes 23.1% to retail sales.

Looking deeper, online sales growth of 11.2% is bucking the current trend in the market where most retailers are experiencing a slowdown in online. The online contribution is now 3% of sales. There’s also a very long way to go for the cellular handsets and accessories business, exceeding the 5% market share threshold for the first time. This is way down on Pepkor, with that company claiming to sells 7 of every 10 new handsets in South Africa.

Mr Price is expanding, with weighted average new space growth of 6.3%. The total number of store locations increased by 4.1%. This footprint is supporting a business model based predominantly on cash sales (84.9% of group sales), although credit sales grew faster than cash sales in this period (11.5% vs. 5.2%).

Demand for credit among consumers is increasing, reflecting the pressures facing South African households. New account applications increased by 45.5% and new accounts grew by 20%, so Mr Price is being careful here with a significantly reduced approval rate. Wherever possible, Mr Price is converting declined account applications into lay-bye customers. The higher prevailing interest rates led to 19.6% growth in revenue in the Financial Services segment.

As we are seeing in most retailers, inventory levels are high due to supply chain concerns. Retailers have stocked up, which is a concern against a clearly deteriorating consumer backdrop. A poor festive season will be a bloodbath for retailers across the board, with Mr Price particularly exposed after paying R3.6 billion for the Studio 88 acquisition after the close of this period. The cash balance at the end of the period was R3.3 billion, so you can do the maths on how important this festive season is.

The share price closed at R170.55 and the interim dividend is 312.5 cents per share.

Southern Sun (formerly Tsogo Sun Hotels) is profitable again

Unsurprisingly, all year-on-year metrics are up

If the rooms are empty, the income statement is ugly. When the rooms are full, hotels make plenty of cash. Operating leverage is the name of the game here, as the fixed cost base in a hotel group is substantial. This is similar to the hospital groups, as recently discussed in Ghost Bites.

During the six months to September, Southern Sun’s occupancy levels increased to an average of 46% vs. 21.9% in the prior comparative period. In October, the group reached occupancy of 59.2%, the first time this level has been reached since March 2020.

There’s some noise in these numbers, like the proposed sale of the 75.55% stake in Ikoyi Hotels Limited in Nigeria. This has been recognised as a discontinued operation. There’s also the once-off payment of R399 million received from Tsogo Sun Gaming under the separation agreement. Southern Sun has excluded this payment from EBITDAR (the “R” isn’t a typo – this is a hotel industry measure) and adjusted headline earnings. Importantly, the payment is included in HEPS.

EBITDAR has jumped from R139 million to R449 million. Adjusted HEPS has improved drastically from a loss of 10.9 cents to a profit of 1.2 cents.

The share price has made a strong recovery since the horrors of the initial lockdows:

And now for the casinos, with Tsogo Sun Gaming

People love rolling the dice (and not just in the markets)

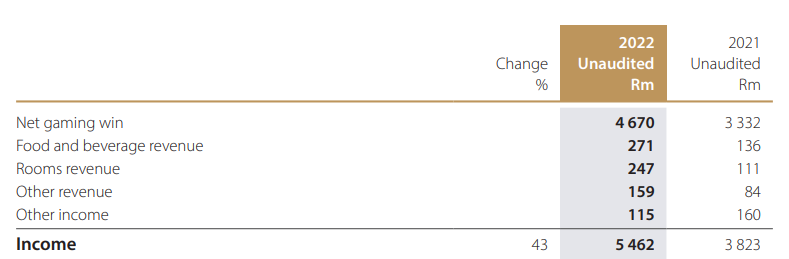

In the six months to September, Tsogo Sun Gaming also reported a sharp increase in all key metrics. Income is up 43%, EBITDA is up 52% and HEPS is 88% higher, including the impact of the payment made to Southern Sun that was discussed in that section.

The balance sheet is healthier, with net debt : EBITDA down from 2.89x to 2.22x. This gives far more room vs. the covenant of 3.0x.

The group is still running below 2019 levels though, with income down 8% and EBITDA down 2% vs. that period. With major focus on cost control throughout the pandemic, an expansion in EBITDA margin of 240 basis points has been achieved. The dividend per share of 30 cents is higher than the 2019 dividend of 26 cents.

In an ironically named blemish on the group’s performance, the Emerald casino in the south of Gauteng is performing way below Covid levels. It is the sixth largest casino in the stable and the smallest of the fourteen casinos by EBITDA, with a margin of 10% vs. the other casinos with an average of 40% and a lowest margin of 30%.

The bingo division is still below pre-Covid levels, impacted by load shedding. The Limited Payout Machine (LPM) division achieved record EBITDA of R285 million. An online offering, playTsogo, will be launched in December 2022.

If you’ve ever wondered whether casinos make most of the money from gambling or from ancillary revenue, this will make it clear:

Little Bites:

- Director dealings:

- Ben Kruger (ex-joint CEO of Standard Bank and now an independent director) sold shares in the bank worth R9 million

- An executive of Gold Fields sold shares worth nearly R2 million

- Thungela has agreed with its B-BBEE partner, Inyosi Coal, to acquire the 27% shareholding in Anglo American Inyosi Coal in exchange for shares in Thungela. This allows Inyosi to hold a far more liquid investment than is currently the case and it increases Thungela’s ownership of the underlying Zibulo operation and Elders production replacement project to 100%.

- Hosken Consolidated Investments (HCI) released a trading statement for the six months ended September, which the market considers alongside results from portfolio companies eMedia, Frontier Transport Holdings and Deneb. HCI expects a huge jump in HEPS from 271 cents to between 1,101.9 cents and 1,129.1 cents. Shareholders will have to wait until 1 December for the detailed results release.

- eMedia Holdings has released results for the six months ended September. Although revenue increased by 2.1%, operating profit fell by 17.6% and HEPS declined by 24.6%. Despite the drop in earnings, the dividend per share only fell by 4.5% to 21 cents. The group is dealing with the impact of load shedding on television advertising (no electricity means no eyeballs on the family TV) and a battle with Multichoice over the removal of four eMedia channels off its bouquet.

- Frontier Transport Holdings released results for the six months ended September and the revenue story is promising at least, up 15.2%. The owner of Golden Arrow bus services didn’t have such a happy time at HEPS level though, with that metric down 8.2%. Interestingly, the group plans to recapitalise the entire fleet with electrically powered buses. I’m not sure how wise that is in the context of (1) load shedding and (2) protest violence that frequently leads to buses being set on fire. In good news, debt is lower and the cash dividend is 10% higher at 22 cents per share.

- Stefanutti Stocks released results for the six months ended August. Despite revenue falling 9%, the group swung from a loss of R188 million to a profit from continuing operations of R9.2 million. At HEPS level though, the loss improved by 67% but is still a loss of 25.02 cents. The restructuring plan is focused on getting the lenders to extend the duration of the loan to February 2024 because of delays beyond the group’s control. With the loan bearing interest at prime plus 5.4%, this is practically a personal loan! Trying to escape the deep, dark hole of a broken balance sheet isn’t easy.

- Safari Investments released interim results for the six months ended September. Property revenue increased by 9.5%, the NAV per share increased by 4.3% and the distribution per share was 33% higher at 33 cents. As regular readers will know, Safari is currently under offer from Heriot REIT.

- Anglo American will work together with Aurubis to provide assurance around the way copper is mined, processed, transported and brought to market. The focus here is on an ethical supply chain that can be traced, including the new Quellaveco mine in Peru.