Clientèle managed to grow even in this environment (JSE: CLI)

The dividend hasn’t kept up with HEPS though

For the year to June 2023, Clientèle grew revenue from contracts with customers by 59% thanks to rewards revenue and single premium products. Net insurance premiums fell by 1.7% though, with higher than expected withdrawals due to tricky economic conditions.

Operating expenses jumped by 20% because of acquisition costs linked to a funeral parlour insurance transaction.

The growth in HEPS of 15% hasn’t really been driven by the core operational performance, which I think is why the dividend is only 4% higher at 125 cents per share. That’s still a very good yield on a price of R11.55 per share.

If you’re wondering what gave HEPS a boost, the major contributor was the recognition of future funeral parlour profits based on expectations around that book.

Insurance results are difficult to understand and require a lot of specialist knowledge. If you remember nothing else, just remember that this result was largely driven by improved assumptions in the long-term insurance segment. The short-term insurance book (Clientèle Legal) saw a 10% drop in profit.

Fortress: as I suspected, there’s life after REIT (JSE: FFA | JSE: FFB)

The portfolio is larger than ever and portfolio vacancies are the lowest since 2009

After all the noise around Fortress losing its REIT status, things seem to be chugging along for the company. The focus has been on recycling capital, which has led to a portfolio with a vacancy of 3.7%, the lowest since the company listed in October 2009.

Despite higher net operating income, an environment of higher prevailing rates has led to flat investment property valuations. Speaking of rates, 85% of interest rate risk is hedged for 3.5 years.

It’s worth remembering that Fortress holds a 23.9% stake in NEPI Rockcastle (JSE: NRP), one of the best performing property funds on the local market.

There’s a rather cryptic comment in the announcement about how the new Real Estate Investment Company structure might have tax benefits that reduce leakage. I’m not sure what those might be and the announcement doesn’t give any details.

The announcement notes that the A and B shares remain a difficult structure to live with. The suggestion from the company is to buy A and B shares in equal numbers to get a share of the equity of the company. Because of the threshold rules for the classes of shares, there’s no dividend on either of them for this period despite the company having nearly R1.8 billion in distributable earnings.

Hammerson makes a tender offer (JSE: HMN)

No, this isn’t something you say to your significant other

Companies like Hammerson actively manage their balance sheet, which typically includes a variety of different instruments that mature on different dates. Sometimes, a company will take proactive steps on debt that is maturing a couple of years in the future. This can be to reduce debt costs or manage the asset-liability maturity ladder on the balance sheet, depending on what the group is planning.

Hammerson has invited holders of 3.5% bonds due 2025 and 6% bonds due 2026 to tender their bonds for purchase by the company for cash. Before you panic about why this cheaper debt is being purchased early, the price for each bond isn’t 100% of the face value. It will be at a discount, so the effective purchase yield is higher.

This is complicated stuff. Fixed income instruments aren’t easy to understand. The thing to remember is that the income doesn’t change (hence the name) but the traded value does change based on the effective yield that the market is willing to pay for the instrument.

To help pay for this tender offer, Hammerson is issuing a further £100m of its existing 7.25% bonds due in 2028. This is called a “bond tap” as the company is issuing more bonds of a type that already exist in the market.

Corporate treasury management is a fascinating thing.

Volumes and revenue per ounce fell at Impala Platinum (JSE: IMP)

The release of annual results fully explains the 43% drop in HEPS

The year ended June 2023 will be remembered by Impala Platinum for the acquisition of Royal Bafokeng Platinum rather than for happy news around earnings. This is because refined 6E production fell 4%, 6E sales volumes fell 6% and rand revenue per 6E ounce declined 4%. To add further pain into the mix, the 6E unit costs increased by 14% per ounce. There’s only one direction for HEPS to move in with numbers like that, in this case a 43% drop.

The only thing that shielded this result from being a lot worse was rand depreciation. This is why Impala Canda suffered a R10.9 billion impairment, as the decrease in dollar palladium pricing was material.

Even capital expenditure increased substantially, with “stay-in-business” spend up by 16%. Replacement capital expenditure jumped 61% and expansion capital increased by 41%.

The outlook isn’t great, with a tight PGM market thanks to discounted metal flows from Russia and destocking by major PGM users. Coupled with an inflationary environment that drives higher mining costs, there’s absolutely no room for error in operations.

Nampak announces the rights offer price (JSE: NPK)

R450 million of this R1 billion raise is underwritten

The rights offer price for the Nampak capital raise has been announced as R175, which is a 23.49% discount to the 30-day VWAP of the shares.

As a reminder, R450 million of the R1 billion raise is underwritten by three investment houses. The underwriting fee is 2.33%, which is higher than I’m used to seeing but Nampak doesn’t exactly have a choice. A further R500 million of the raise has been committed to by shareholders, so in theory Nampak should get this one away.

Sanlam expects earnings to more than double (JSE: SLM)

There are many IFRS adjustments in these numbers

The introduction of the IFRS 17 Insurance Contracts accounting standard is going to cause some big movements in the numbers for insurance companies. Sanlam is a perfect example, with HEPS for the six months to June expected to rise by between 113% and 123%.

Before you get out the champagne bottles, take note that the net result from financial services per share is 20% to 30% higher. Net operational earnings per share increased by between 60% and 70%. Without taking anything away from those impressive numbers, this shows how significant the distortions are in the HEPS number for this period.

Some of the underlying drivers of the positive result include a better risk experience in life insurance, improved underwriting performance in general insurance, higher investment returns on insurance funds and stronger performance in India.

Santam has also reported a big jump in HEPS (JSE: SNT)

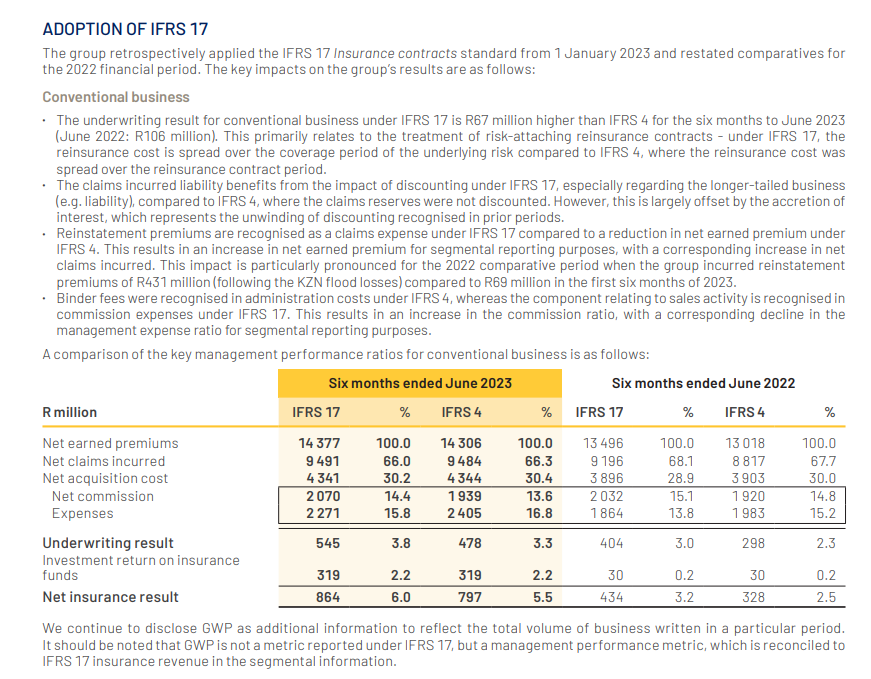

Like at Sanlam, the IFRS 17 insurance standard is really distorting things

Sometimes, accountants wonder why investors ignore most of what they see in odd IFRS adjustments and focus on the cash instead. IFRS 17 appears to be just as silly as the recent changes in lease accounting that caused so many distortions in retailer financials.

It’s hard to feel supportive of a change in accounting policy that leads to an outcome like a 146% increase in HEPS at Santam for the six months to June, while the dividend has only increased by 7%.

The conventional insurance business achieved gross written premium growth of 7%. Net underwriting margin of 3.8% was below the group’s target range of 5% to 10%, but was higher than 3% in the comparable period (as restated for IFRS 17). As we’ve seen at other insurers, investment returns on insurance funds also increased substantially.

Here’s an excellent example of how IFRS 17 is making it so much easier for investors to understand financial statements:

Truworths grows by high single digits on a comparable basis (JSE: TRU)

In retail, you always have to be aware of 53-week trading periods

Make no mistake, this was a decent result for Truworths. It’s just important to compare apples with apples, not apples with a fruit basket that has extra stuff in it. The comparable period is a 53-week trading period and that makes a difference. There is also a tax settlement that means SARS owes Truworths R105 million based on a long-outstanding VAT dispute.

Normally, results compared to 53 weeks would look worse than when compared to 52 weeks, as an extra week of trading in the base period means an extra week of profits to be compared to. This is the case for sales revenue but not for HEPS, as the VAT settlement has a positive impact on HEPS in this period.

For a genuine operational view on the company, the right metrics are retail sales up 13.2%, operating margin under pressure (down from 24.3% to 22.7%) and diluted HEPS (which takes into account share options etc.) up by 8.7%.

As reported, diluted HEPS is up 11.8% and the dividend is 12% higher, so they’ve maintained the payout ratio year-on-year.

Although the HEPS result is solid but not thrilling, the low valuation of the retailer relative to peers means a year-to-date share price performance of around 30%!

Little Bites:

- Director dealings:

- A director of a subsidiary of Dis-Chem (JSE: DCP) has sold shares worth R15.7m. That’s a pretty big disposal, with the share price down around 16% this year.

- Value Capital Partners (which has board representation at the company) has bought shares in Altron (JSE: AEL) worth R10.2m.

- Maria Ramos has bought R1.28m worth of shares in AngloGold Ashanti (JSE: ANG).

- Equites Property Fund (JSE: EQU) released pre-close investor presentation that gives further details on the strategic focus areas of the group. You can find it here.

- In case you wonder why I have such little interest in Blue Label Telecoms (JSE: BLU), here’s another perfect example of how shareholders are treated. Despite a share price that is basically flat over 3 years, management has banked a substantial tranche of 2020 share options as the performance criteria exceeded the targets. I don’t think the performance exceeded targets for investors.

- Putprop (JSE: PPR) released a trading statement for the year ended June, noting that HEPS has decreased by between 16% and 21%.

- Acquisitions aren’t easy, especially large ones that carry significant integration risks. Afrimat (JSE: AFT) has announced to the market that the current CFO will also act as the integration officer for the Lafarge South Africa transaction when it becomes effective, with an expected period of 6 to 10 months. He will remain as CFO, but will be assisted by internal resources who will step up for that period. This is a good indication of the bench strength at Afrimat.

- DRA Global (JSE: DRA) is another JSE-listed company that doesn’t trade very often. In results for the six months ended June, the company noted a significant swing into profitability despite an 11% drop in revenue. Underlying EBIT was A$23.5 million vs. a loss of A$16.4 million in the comparable period.

- Randgold & Exploration Company (JSE: RNG) is an obscure company with almost no liquidity, so I’ll give the results for the six months to June 2023 only a passing mention here. The headline loss per share deteriorated to 16.61 cents. The net asset value per share is down 19.4% to 105.39 cents. The share price isn’t very helpful because liquidity is so low, but the last trade was at 60 cents.

- There might be an improvement in liquidity in Trustco (JSE: TTO) shares, with the company initiating a share buyback programme from 1 September. The maximum price is 10% above the 5-day VWAP. With such a huge bid-offer spread, the price tends to jump around a lot, so that will be an interesting one for the appointed broker to manage.

- In further news related to Trustco, Finbond (JSE: FGL) is acquiring Trustco Finance Namibia and the parties have agreed to extend the fulfilment date for the conditions precedent from 31 August to 30 September.

- Shareholders of Investec Property Fund (JSE: IPF) approved the change of name to Burstone Group Limited (JSE: BTN), with the new name and ticker becoming effective on 26 September.

- PSG Financial Services (JSE: KST) (previously PSG Konsult) has had its credit rating affirmed by Global Credit Rating Company, which isn’t much of a surprise if you’ve been following the solid results from the group.