Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

At Cognition, the balance sheet is what counts (JSE: CGN)

The gap between HEPS and NAV per share confirms it

After the sale of Private Property for a tremendous price, Cognition is now a group that is highly pregnant with cash. The group generated HEPS of just 2.48 cents for the six months to December 2023, yet the tangible NAV per share is 103.85 cents. That’s a huge difference, explained by R207 million worth of cash on the balance sheet vs. liabilities of just R28.2 million.

Cognition is currently in discussions with controlling shareholder Caxton & CTP Publishers and Printers (JSE: CAT), which may lead to an offer to delist Cognition.

The share price is currently trading at R1.05, which is already in line with the tangible NAV per share. It’s not obvious to me why Caxton would pay a significant premium to this price.

More insult and injury for Delta Property Fund (JSE: DLT)

It’s very debatable whether a fine a few years down the line actually punishes the right people

Delta Property Fund is another great local example of a company that turned into a financial disaster. The problems started with an announcement in 2020 dealing with problems in the financials. This would turn out to impact the 2018 and 2019 numbers as well.

The company initiated forensic investigations in 2020 that found a host of problems. To Delta’s credit, the JSE acknowledges that the company was transparent in dealing with the issues.

Still, there has to be some kind of punishment for not complying with IFRS, although share prices tend to dish out their own punishment when it comes to these things. The JSE has publicly censured Delta and imposed the maximum fine of R7.5 million, of which R5 million is suspended for a period of five years provided no other listings requirements are breached as they pertain to financial performance.

Far more importantly, the investigation into the individuals involved (rather than the company) is ongoing. It feels like that’s a much better way to punish the right people, rather than putting even more pressure on the company’s balance sheet and causing more damage to minority shareholders.

Transaction Capital releases the WeBuyCars unbundling circular (JSE: TCP)

Perhaps more importantly, there’s also a WeBuyCars management presentation to work through

In around April 2024 (and how I wish the Transaction Capital share price was just an April Fool’s Day joke), WeBuyCars will be separately listed on the JSE if all the conditions along the way are met. This is exciting stuff, particularly as our local universe of stocks tends to shrink a lot faster than it expands. WeBuyCars is that rare beast on the market: a pure-play view on a business model. They focus on doing one thing and doing it well.

It’s quite incredible to consider the history of WeBuyCars. It was started in 2001 and took another nine years until the first car supermarket was built in Pretoria with capacity for 100 vehicles. Fast forward to 2024 and they sold 14k vehicles just in January.

The company consistently reminds investors that Motus and CMH are not directly comparable, as WeBuyCars only sells used cars. There’s no noise from a rental business, or new car sales, or after-market parts. In fact, the strategy to expand the existing product offering is at this stage focused only on finance and insurance penetration, which means a higher value per customer. They are looking to make the value-added margin in addition to the gross margin on a sale. That’s a solid organic growth strategy, rather than a foray into something new or unrelated.

The group is looking to add at least 2,000 bays in FY25 to FY26, reaching regions of South Africa that aren’t currently serviced by sales outlets. They will need to be careful here that they don’t build supermarkets in areas that can’t support them.

Fascinatingly, they expect market share to grow from the existing 10% – 12% up to 23% by FY28. That’s a very bold chart to put in an investor deck! In theory, there’s no reason why they can’t achieve this.

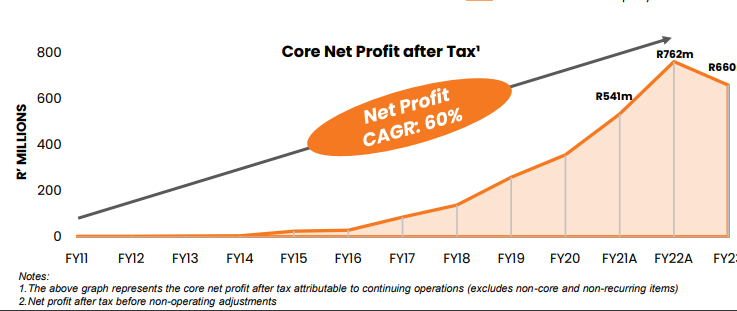

FY23 was a wobbly in terms of the profit growth story. If you understand what happened to used vehicle prices over this period, then you’ll also understand why this chart (1) accelerated in FY21 and FY22 and (2) fell off in FY23:

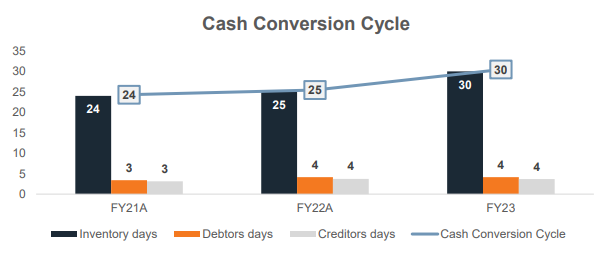

For me, where the economic reality does bite WeBuyCars is on the inventory days calculation. This is simply how many days worth of sales they have in inventory at any point in time. This has increased from 24 days to 30 days in the past two years, which is a material negative impact on working capital:

On the whole, in case it isn’t obvious, I’m bullish on WeBuyCars. This is exactly why I took exposure on Transaction Capital when they did the deal. Sadly, as you will no doubt be aware, the problems at SA Taxi blew up the Transaction Capital share price and I took that knock. At least the end result is direct exposure to WeBuyCars and some hope of an outcome for the “rump” of Transaction Capital, even if that might be a take-private of SA Taxi and Nutun. That is 100% speculation from my side, so please treat it as such. It just seems to make sense, as that rump will very much be the ugly duckling after the unbundling of this swan.

As a reminder, the structure of the unbundling and related capital raising activities will see Transaction Capital unlock between R900 million and R1.25 billion in cash. This will do wonders for the balance sheet. When you look through all the complex steps in the process, the equity value of WeBuyCars has been set at R7.5 billion.

The one hangover of this structure that I’m not a fan of is that Gomo (a finance and insurance business) will still be in Transaction Capital even though it services WeBuyCars in addition to SA Taxi. I’m sure everything is arms’ length and goodness knows a service provider doesn’t always need to be in the same group as the company it services, but it does mean there is still a legacy link to what is being left behind in Transaction Capital.

The WeBuyCars pre-listing statement is due for release on 12th March. That’s the day after my birthday and I’ll assume this is my gift from Transaction Capital.

Little Bites:

- Director dealings:

- The CFO of Nampak (JSE: NPK) has acquired shares worth R4 million.

- In one of the strangest director dealings I’ve seen, a director of Afine Investments (JSE: ANI) bought shares worth R655k and then sold R606k worth of shares on the very same day at the same price per share. Then, a day later, he bought shares worth R1.85 million.

- An associate of a director of Huge Group (JSE: HUG) has bought shares worth nearly R33k.

- For those of you who like to keep track of the cost of debt for corporates, British American Tobacco (JSE: BTI) has priced notes due in 2031 at 5.834% and notes due in 2034 at 6.000%. The total issuance is a meaty $1.7 billion.

- As indicated by the company earlier in the week, André van der Veen has officially replaced Peter Surgey as chairman of Nampak (JSE: NPK).

- In a rather funny update that calls into question whether an investment strategy can also include a preference for similarity of names, an international investment house called Hosking Partners LLP has increased its interest in Hosken Consolidated Investments (JSE: HCI) to 5.05%.

- Anglo American Platinum (JSE: AMS) announced that the Mototolo and Amandelbult mines are the first PGM mines to South Africa to complete an IRMA audit, achieving the IRMA 75 and IRMA 50 levels respectively. Whilst this doesn’t exactly do anything about the PGM prices, it does help with fussier buyers who track their supply chain and it helps keep Amplats on the right side of investors with an ESG slant to their mandates.