Combined Motor Holdings has another massive year (JSE: CMH)

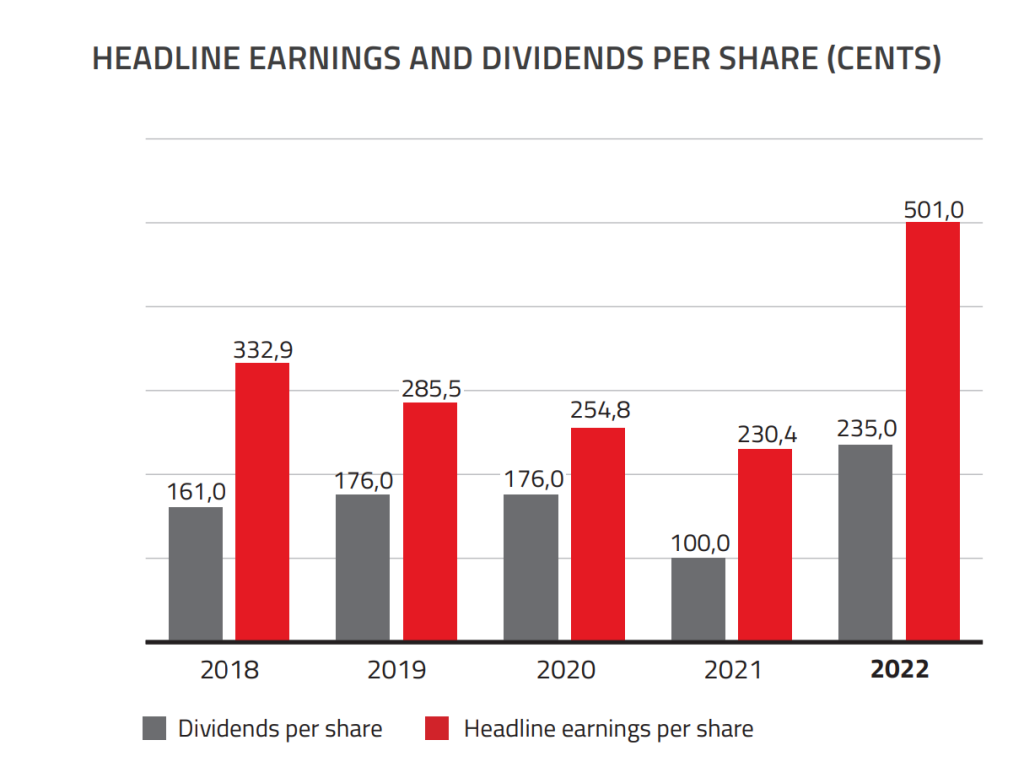

I decided to go back to the annual report for the 2022 financial year to look for a chart that I remembered seeing previously. Here it is:

This sets the scene for the 2023 numbers, which I really didn’t expect to post much growth on top of the 2022 performance. I was absolutely wrong, with CMH expecting headline earnings per share (HEPS) of between 601.2 cents and 651.3 cents, a jump of between 20% and 30% vs. that ridiculous 2022 base.

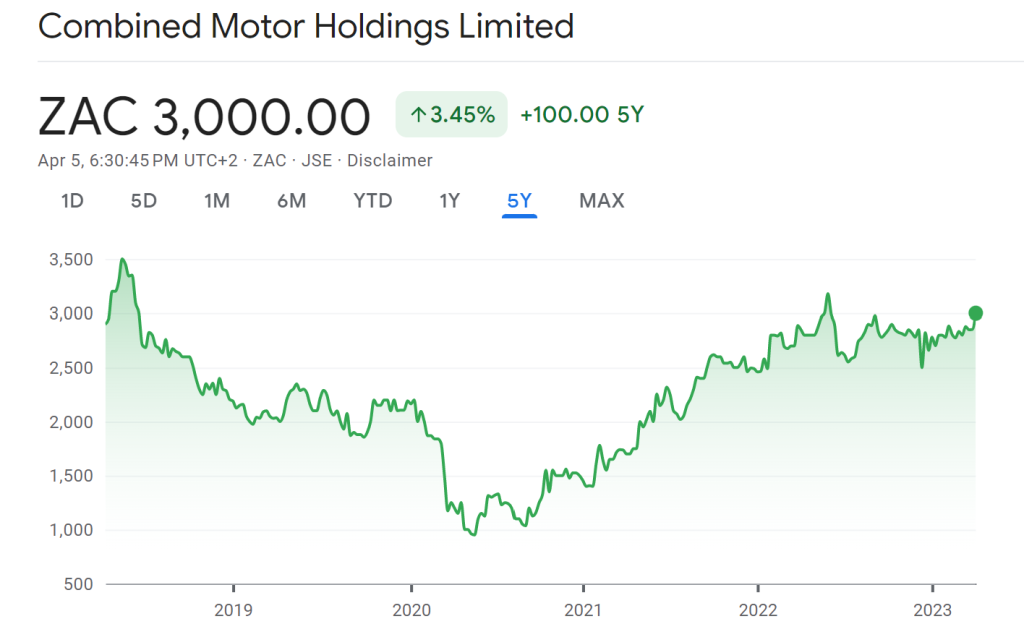

Based on this, you might expect the share price to have reported massive growth over the last five years. Instead, here’s your chart:

All revved up and nowhere to go…the market has been skeptical of these high earnings continuing, with the company trading on a modest multiple and substantial dividend yield. The share price did close 4.9% higher after this trading statement, so there was some positive surprise in the market, but not much.

Copper 360 Limited is coming to the market (JSE: CPR)

I’m really hoping that the share code isn’t a sign of pain to come

Will shareholders need CPR? I hope not. It’s rare to see a new listing on the JSE and I wish Copper 360 Limited all the best with this.

Unless you’re an “invited investor”, you’ll have to wait to buy shares on the open market. Genuine IPOs are more unusual on the JSE than an honest politician, as our market just isn’t supportive of those deals. The company will raise around R152.5 million from investors.

To find out more about this pure-play copper opportunity, refer to the pre-listing statement here.

EOH catches another bid (JSE: EOH)

The release of detailed results added another 4% to the share price

EOH had given us a very good idea of what was coming in these numbers, with a recent update suggesting growth in operating profit and a far stronger platform going forward.

Detailed numbers have confirmed this, with operating profit for the six months ended January 2023 of R110 million. I misread the original announcement, as operating profit for FY22 was R100 million, not just for the comparable half-year. The comparable half-year profit was actually much higher, which shows how messy these numbers have been, as profits are actually lower year-on-year when looking at just the interim period.

The principle is unchanged, which is that EOH now has a profitable core business. Although this period doesn’t reflect the benefit of the rights issue in reducing debt, the next period will.

Europa Metals doesn’t waste any time (JSE: EUZ)

The drilling campaign at Toral has begun

With the twelve month joint venture budget with partner Denarius Metals now agreed, Europa Metals has moved quickly in getting the drilling programme underway.

This initial programme forms the bulk of the €1.8m budget agreed with Denarius. There are two rigs onsite and the company will update the market as results come in.

Industrials REIT is now a pure-play business (JSE: MLI)

But that benefit is most likely to accrue to Blackstone over time

A focused strategy doesn’t just make you a better business; it can make you a better acquisition target as well. Industrials REIT is proof of that, with a potentially huge offer on the table from Blackstone that sent the share up over 35% in recent days.

If the Blackstone offer goes ahead, the company would be buying a pure-play view on multi-let industrial property in the UK. This is the case after Industrials REIT announced the sale of the German care home joint venture for net proceeds of £15.6 million, which the company will use for further acquisitions in the UK.

It hasn’t been an easy journey, with a disposal programme to get to this point of more than £600 million over five years.

ISA Holdings plays its cards close to its chest (JSE: ISA)

The initial trading statement has the bare minimum details

Under JSE rules, a company needs to release a trading statement when it believes that earnings for a period will differ by more than 20% vs. the comparable period.

For the year ended February 2023, IT company ISA Holdings expects headline earnings per share (HEPS) to be at least 20% higher. As I said, this is literally the bare minimum disclosure. It could be 21% and it could be 50% – we just don’t know until a further update is released.

After all that, Northam Platinum walks away (JSE: NPH)

RIP to this year’s One Capital corporate finance budget

This is incredible, really. After a monumental fight at the regulators that must’ve cost an absolute fortune in professional fees, Northam Platinum has walked away from the Royal Bafokeng Platinum deal. This leaves Impala Platinum’s offer as the only one in the market.

Northam was able to do this because of the drop in prevailing PGM prices, with a sustained drop below a certain level being considered a material adverse change (MAC).

A MAC clause is there to protect the potential buyer of an asset. If a MAC occurs, the buyer has the option to walk away from the deal. Although it provides a convenient escape hatch, buyers don’t easily invoke these clauses unless they were looking for a way out.

In the case of Northam Platinum, they used the MAC clause to walk away. The biggest loser here is surely One Capital, with a history of charging eyewatering advisory fees to Northam. I hope they got decent retainers along the way, as that success fee has got to sting.

Texton sells Alrode Business Park (JSE: TEX)

The focus is on office assets – an interesting play in this environment

Texton is one of the stranger property companies on the local market. A rally of 16% was the market’s response to this latest update, but huge amounts of value have been lost over the years.

The latest news is the sale of Alrode Business Park for R50 million. That may not sound like much, but the market cap is around R770 million. With a book value of R55 million, capital has been recycled at fairly close to book value and the share price responded positively.

I’m not convinced by this rally, as the cash isn’t going to be paid to shareholders. Instead, it will be used to repay debt and “develop its SME strategy” – hmmm.

Little Bites:

- Director dealings:

- Value Capital Partners has bought R7.1m worth of shares in ADvTECH (JSE: ADH)

- The Group CFO of MTN (JSE: MTN) has bought shares worth R4.4m.

- A director of Lewis (JSE: LEW) has sold shares worth R695k.

- Several NEPI Rockcastle (JSE: NEP) directors have made the scrip distribution election, as one would expect.

- Novus Holdings (JSE: NVS) is busy selling a letting enterprise for R125 million. The due diligence deadline has been pushed out to mid-April and other conditions to June.

- Conduit Capital’s (JSE: CND) sale of wholly-owned subsidiary Constantia Life and Health Assurance Company Limited has been delayed, with the fulfilment date for suspensive conditions pushed out to the end of April.

- The CEO of Grand Parade Investments (JSE: GPL) has resigned from his position, having achieved the turnaround strategy that he set out to achieve. A replacement will be named in due course.

- If you are a shareholder in Calgro M3 (JSE: CGR) then keep an eye out for the circular related to the introduction of an employee share incentive scheme.