Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Copper 360 invokes the spirit of Steve Jobs (JSE: CPR)

As the genius told us: real artists ship

One of my favourite quotes is from Steve Jobs, who said that real artists ship. That’s it. Simple as that. It’s easy to sit on the couch and talk about other people’s success and what they do. Get off the couch and ship something to show everyone what you can do.

At Copper 360, they’ve shipped alright – in this case, the first copper concentrate from the Northern Cape in 21 years. It’s a cleverly written bit of hype and I’ll go with it as a proud South African who wants to see our country move forward.

The first concentrate plant was commissioned within the planned period and is forecast to be ahead of planned production within the first few months of operation. The second concentrate plant is scheduled to start production at the end of July 2024. The SX/EW plant that produces copper cathode is also ramping up.

Speaking of ramping up, the share price closed over 19% higher on the news. The company recently made allegations of suspected market manipulation. Whilst those allegations still need to be proven, I bet they aren’t complaining about being 19% up for the day.

Gemfields and the G-Factor (JSE: GML)

The G is allegedly unrelated to Gemfields’ name

Before you get excited, I’m really just including this because I find it interesting. There’s no real news here about Gemfields as an investment.

The company releases a metric it calls the G-Factor, which apparently takes its name from government, governance and good practice. I’m quite sure the cute branding alongside Gemfields gave them some ideas on the name as well.

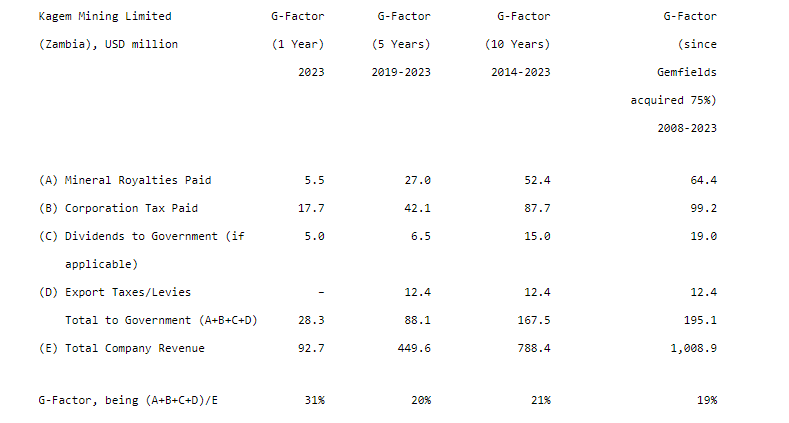

What makes this interesting is that it shows the value to a country of developing its mineral resources. It combines mineral royalties, corporate taxes, dividends to the government (if they are shareholders) and export taxes. It then divides this by revenue, showing what percentage of revenue is effectively going to the government.

Here’s the calculation they show for Kagem Mining:

It’s even higher at MRM in Mozambique, which might explain how they’ve managed to keep operating there despite security risks. Having the government on your side is of critical importance in Africa.

The company also notes that this measure isn’t perfect. It leaves out benefits to the country like taxes on employee salaries.

Long story short: driving the mining industry forward is good for any economy. Somebody please tell the South African government so that we fix our trains and ports.

Quilter’s distribution power shines through (JSE: QLT)

Much like at PSG Financial Services locally, it helps to have a sales force

I’ve commented a few times recently on how pure-play asset managers are struggling to meaningfully grow assets under management, while financial services groups with strong distribution networks are doing a solid job of attracting inflows. Of course, a sales team comes at a cost, so clearly they have to attract enough flows to make it a net positive strategy.

Quilter operates in the UK market and they make a big deal of their various distribution channel strategies. It’s working overall, with core net inflows in the first quarter coming in at almost double the comparable period. Gross Assets under Management and Administration were up 5% over the quarter i.e. between December 2023 and March 2024. These are impressive numbers.

It’s also great to see that productivity (measured as Quilter channel gross sales per advisor) was up 22% vs. the comparable period.

Quilter’s share price is up 30% in the past year, with all of that happening in the past six months. It trades at a high Price/Earnings multiple that is typical of a quality stock like this. Investors always have to be careful with such high multiples, even when the underlying company is strong.

RMH declares a special distribution (JSE: RMH)

This time, it’s funded by the exit from Divercity

If you’ve been following RMB Holdings, then you’ll know that the company has absolutely nothing to do with RMB anymore. In fact, it’s just a property holding company that is looking to achieve orderly exits of the portfolio, thereby returning capital to shareholders. That’s not the easiest thing to achieve in the current environment.

Step by step, it’s happening though. The exit from Divercity has now been completed, with RMB Holdings monetising its equity stake and loan claims in the company. This has led to the declaration of a special dividend of 3.5 cents per share (before withholding tax). The share price closed at 38 cents a share after the news.

Zeder: shareholders await news on Pome Investments and Zaad (JSE: ZED)

Patience will be needed, as these things take a long time

Zeder has released results for the year ended February 2024. It was an important period for the company, as it included the disposal of its stake in Capespan (except for Pome Investments) for proceeds of R511 million in cash. This led to the payment of a special dividend, with yet another special dividend of 10 cents per share declared as part of the year-end results.

The remaining assets are Pome Investments and Zaad, with Zeder having appointed PSG and Rabobank as co-advisors to consider any Zaad-specific approaches, given the size of that asset and the need to achieve the best possible exit – assuming such a deal materialises.

Based on management valuations in the sum-of-the-parts disclosure, Zaad is R2.34 billion of the total value of assets of R3.5 billion as at 10 April 2024. The reason for the strange date that doesn’t line up with the reporting period is that the company is trying to show the position after special dividends. On that basis, the value per share according to management is R2.29. Zeder currently trades at R1.75, with the discount due to many factors ranging from the costs of being listed through to the likelihood of a deal for Zaad and Pome coming through.

With Zaad having reported a decrease in recurring headline earnings of 38% for the six months to December 2023, investors should keep in mind that the farming industry and associated value chains remains a tough place to do business.

Little Bites:

- Director dealings:

- Two big-hitter directors at OUTsurance Group (JSE: OUT) bought shares in the company worth a total of R9.8 million.

- At the group AGM, British American Tobacco (JSE: BTI) reminded the market that one of their values is “love our consumer” – a wonderful reminder of just how much ESG-washing goes on in that place. It’s like they just forget what products they produce each day. Anyway, the useful investment news is that the outlook for 2024 remains in line with guidance: low single digit growth in revenue and adjusted profit from operations. They expect performance to be weighted towards the second half, so don’t expect great news from the first half. By 2026, they expect organic growth of 3% to 5% in revenue and mid-single digits in adjusted profit.

- Brimstone (JSE: BRT) issues shares to employees and executive directors as part of their remuneration. With such limited liquidity in the stock (both ordinary and N shares), it’s very hard for the staff to realise the value. Brimstone therefore likes to conduct a specific repurchase to help the staff members and executives monetise the stakes at a price equal to the 30-day VWAP. The value is going to be roughly R7.9 million in ordinary and R3.9 million in N shares. There are a bunch of minority holders who I’m sure would also love to monetise their stakes, but alas.

- Conduit Capital (JSE: CND) is still trying to sell off CRIH and CLL to TMM Holdings. There have been multiple extensions to the fulfilment date, as the Prudential Authority hasn’t approved the transaction yet. It’s now gone on so long that a further extension to 31 May comes with new conditions giving the purchaser the right to cancel the agreement if the Conduit liquidator issues high court proceedings against CRIH before the effective date. There are also some amendments to how and where the money for the deal would be paid, assuming it goes ahead.

- In the highly unlikely event that you are a shareholder in Eastern European property fund Globe Trade Centre (JSE: GTC), you will want to know that the company has released results for the year ended December 2023. Rental revenues were up 10% and funds from operations also moved higher. So did debt, with the loan-to-value ratio up from 44.5% to 49.3%. There is no, and I mean no trade in this stock.