Coronation increased its AUM this quarter

Hopefully they can afford to fix the sign outside the Claremont office now

While walking back from the cricket at Newlands over the weekend, I couldn’t help but laugh at the Coronation sign that appeared to be suffering from partial load shedding. With “oro” out of service, it shone “Conation” brightly to thousands of people leaving the cricket. Cue the bear market jokes.

The irritating disclosure by the company continues, with updates on assets under management still not giving any comparatives. This means I have to go digging through the SENS archives.

Here’s the recent trend:

- 31 Dec 2022: R602bn

- 30 Sep 2022: R574bn

- 30 Jun 2022: R580bn

- 31 Mar 2022: R625bn

- 31 Dec 2021: R662bn

With AUM still a lot lower than it was a year ago (not least of all because of broader market prices), perhaps the sign will have to be patient to be fixed?

The booze cruise

We have an update on how much money Capevin and Gordon’s Gin makes for Distell

Due to the length of time it is taking to implement Distell’s transaction with Heineken International, the company was required under law to issue a revised prospectus. This is only exciting if you were one of the lawyers earning a fee to draft the thing.

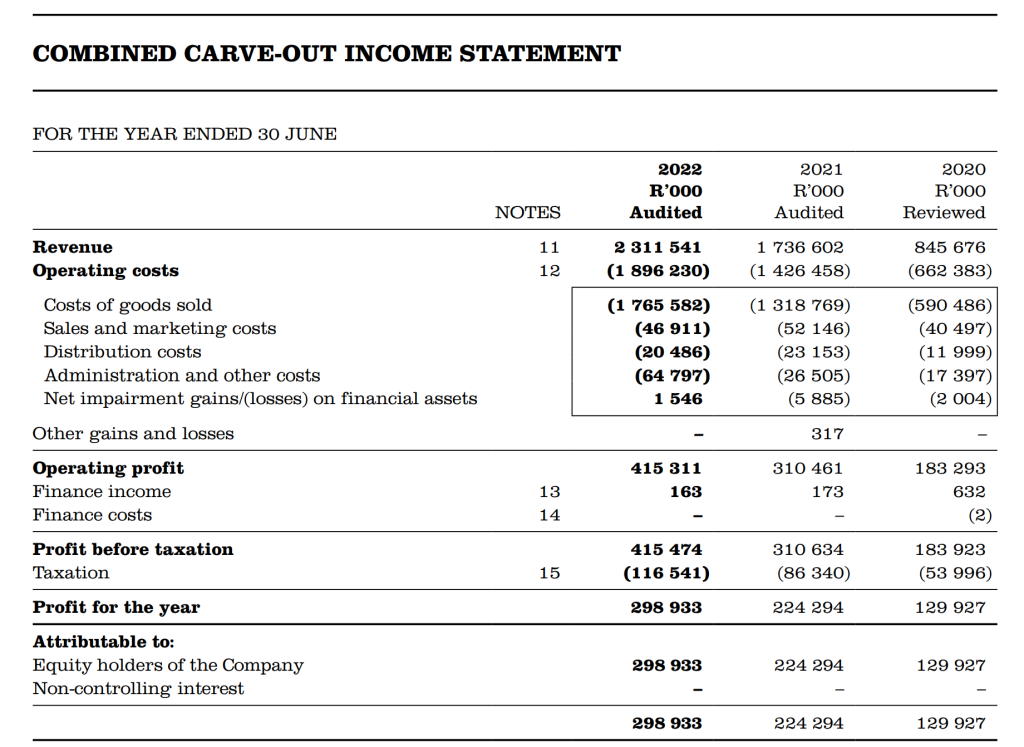

The far more interesting document is the carved out historical financial information of Capevin and Gordon’s Gin, which the company has issued to give shareholders an updated view on the business.

I’ve included a screenshot of the income statement below. I think the movement between 2020 and 2022 is truly breathtaking. With a year-end of June, this is presumably because of Covid restrictions on alcohol.

Perhaps the most interesting thing is that profit before tax margin decreased from 21.7% in 2020 to below 18% in the subsequent years. I am very surprised that a much smaller version of the operation is more efficient!

Nampak: meeting adjourned

Shareholders gave this proposed adjournment unanimous support

As reported in Ghost Bites earlier in the week, Nampak is in discussions with “a number of stakeholders” regarding the way forward. We don’t know yet who the parties are, but we can speculate.

To give those discussions more time to come to fruition, the company proposed an adjournment of the meeting that would’ve seen shareholders vote on the resolutions for a proposed rights offer. The fact that 100% of shareholders in attendance at the meeting gave approval for the adjournment tells us that the rights offer is a truly horrible outcome that everyone would prefer to avoid.

The meeting has been adjourned until 8th March, so Nampak has a few weeks to try and work and miracle.

Richemont needs the reopening of China to stick

The company’s most important region has been going backwards

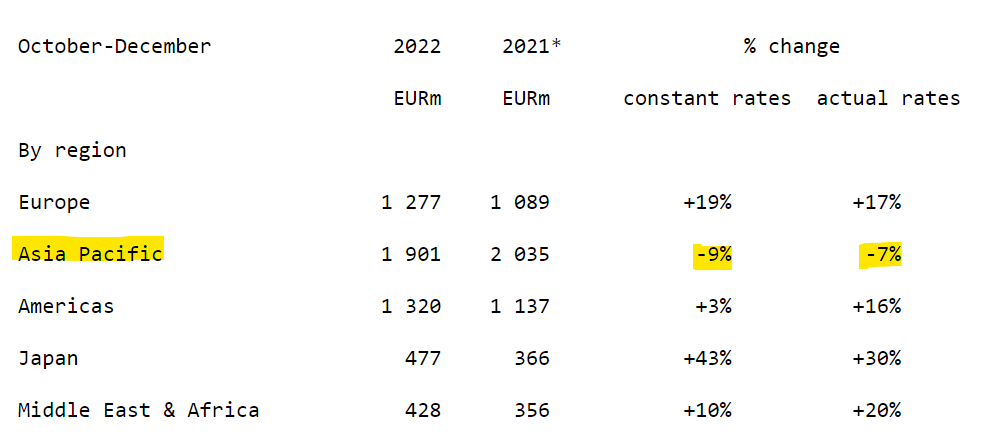

Richemont has reported sales growth of 8% for the quarter ended December 2022 and 18% for the nine months ended December. It would’ve been so much better had the Chinese economy been open for business.

Even in ultra luxury goods, it makes a big difference when an economy is locked down. The proof is very clearly in the numbers:

I also found it interesting to note the performance of the underlying product categories. The Jewellery Maisons (yes, this is the official term used by Richemont, dripping with caviar and 1st world problems) grew by 8% in constant currency and the Specialist Watchmakers (surely a missed opportunity to call them Timepiece Maisons?) fell by 5%.

Messy online business YOOX NET-A-PORTER (this name definitely doesn’t work alongside “Maisons”) posted a 6% drop in sales. It is now presented as a discontinued operation as Richemont is selling a controlling stake.

Steinhoff offloads some of its Pepco stake

Don’t get excited – plebs like us couldn’t get any

With Pepco (Steinhoff’s European discount retail business) having released solid results recently, Steinhoff took advantage by selling off some of its stake to institutional investors. Unless you’re in the little black book of banks like Goldman Sachs or J.P. Morgan, it’s unlikely that you were called about these shares.

This is a “private placement” which means VIP section only. The goal is for the bankers to make a few phone calls, place large blocks of shares and take a juicy fee along the way.

Pricing was finalised through the process and it happened very quickly, with the results of the offer announced just one hour after the initial announcement. I can almost guarantee that calls had already been made overnight. Steinhoff offloaded a 6.6% stake in Pepco and raised EUR315 million in the process. This reduces Steinhoff’s stake in the company to 72.3%.

Steinhoff must have liked the pricing that came through, as the original plan was to sell a 6% stake. An upsized offer means that investors were putting proper numbers down on the table. The banks definitely did their jobs here.

To be clear, the cash will flow from the investors into Steinhoff, not into Pepco. Steinhoff will use that money to help reduce debt. This is distinct from the previously announced plan to restructure the debt and leave shareholders with very little.

Little Bites:

- Director dealings:

- The Group Risk Officer of Investec sold shares worth R10.8 million and a person who I would guess is his wife sold shares worth R8.6 million.

- The interim CFO of Sirius Real Estate has sold shares worth £848k.

- There are significant changes to the board at Novus, including the (expected) retirement of the CEO. Further announcements of replacements will be made in due course.

- The final payment to shareholders by Etion will take place on 6th February and the delisting will be effective from the morning of 7th February.