Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Coronation loves making us go look for historical AUM (JSE: CML)

This really frustrates me

Every time that Coronation announces its assets under management (AUM) on SENS, the company neglects to include comparable levels. This is irritating and it makes me want to highlight the reason why that might be the case.

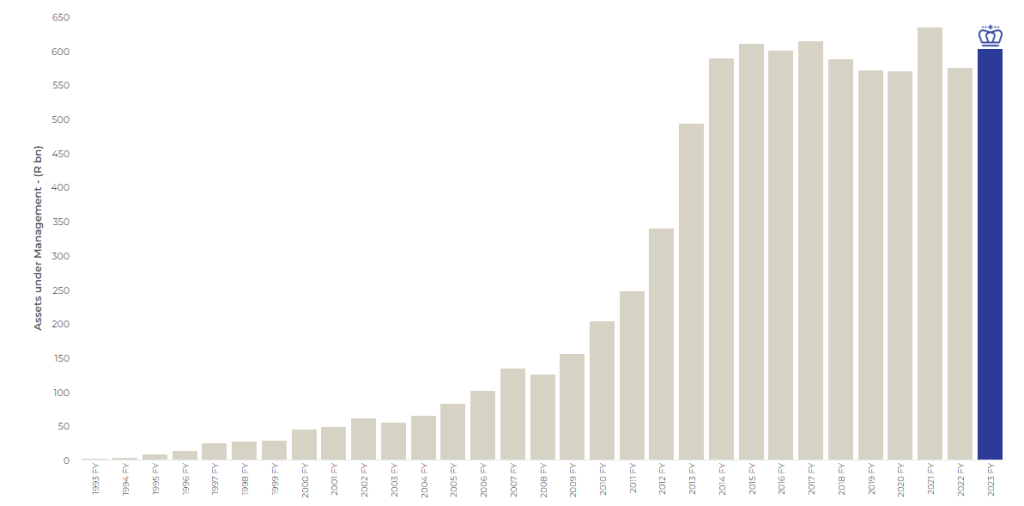

If you go digging on their website, there is a chart dealing with annual AUM going all the way back to 1993. I’m afraid that the last decade tells quite the story:

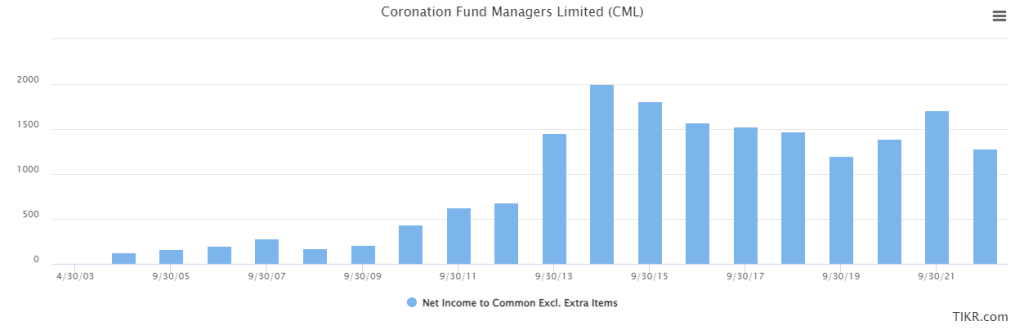

When AUM has essentially gone nowhere in 10 years and costs have been rising, it shouldn’t come as a shock to see a net income chart that looks like this:

I often hear the argument that Coronation is attractive as a dividend paying stock. Even if we ignore the recent tax problem, I’m afraid that this is a classic case of the dividend yield not even offsetting the share price decline, so the total return is practically non-existent.

The lesson here? Don’t invest in a stagnant business just because of the dividend. Different strokes for different folks I suppose, but I can’t get my head around taking equity risk on something that isn’t growing.

This historical performance is important context when looking at the results for the year ended September 2023. Although we only have a trading statement to work off at this stage, it’s detailed enough to get a good idea of what the performance looks like in this period.

The tax fight with SARS is heading to the Constitutional Court. It was worth 205 cents per share in this period, so this has been the driver of the drop in HEPS of between 164.8 cents and 201.4 cents. It’s also important to reference fund management earnings per share as a purer view on operational performance, with earnings down by between 212.8 cents and 251.5 cents per share. Through that lens, the tax issue is certainly the largest driver of the drop, but it’s not like the core business is going in the right direction either.

With South African investors under pressure from every angle, it’s hard to get excited about Coronation’s prospects.

Finbond is much closer to being profitable (JSE: FGL)

Core growth metrics are looking positive

Finbond has had a tough time, including in the US where regulatory changes in Illinois hurt the business. Things are looking considerably better for the six months ended August, although the group is still loss-making with a headline loss per share of -2.3 cents vs. a loss of -8.2 cents in the comparable period.

The value of loans advanced increased by 23.2% and total revenue was 14.3% higher. As encouraging as that is, the overhang of stimulus in the US is that US volumes are still only 75% of pre-COVID levels, as customer savings levels are 30% higher than pre-COVID.

One of the problems with higher growth is that the loans in the US are 18- to 24-month products, yet the expected credit loss must be recognised at the commencement of the loan. The interest is only earned over the period of the loan. This drives a substantial lag in profitability. Another issue for profitability is the fixed cost base, so scale is important and needs to improve.

It’s interesting to note that the average size of a retail deposit at Finbond Mutual Bank is over R356k, with a weighted average interest rate of 9.3% and weighted average deposit term of 27.9 months. The group has R583 million in retail deposits. This is still much smaller than the R2.4 billion in commercial paper in South Africa. The rest of the funding is in the US, worth R466 million. The balance sheet is built around a strategy of having long-term liabilities and short-term assets, which minimises liquidity risk.

And in case you’re wondering, the average consumer loan size in South Africa is just under R2k. The entire loan portfolio turns over approximately four times a year.

The net impairment is 21.7% of revenue.

Finbond is trading at 35 cents per share. It’s up around 30% in six months but has lost 90% of its value over five years. I must say, it’s looking kinda interesting as a more speculative play.

Gemfields gives a summary of its share buybacks (JSE: GML)

The company has repurchased 4.59% of its issued share capital since November 2022

Under JSE rules, a company must make an announcement once 3% of issued shares have been repurchased. Gemfields is operating under the general authority at the last AGM to repurchase shares and has reached 4.59% of the shares that were in issue at the date of that meeting.

This means that R176 million has been invested in share buybacks at an average price of R3.1751 per share. That’s practically the same as the current traded price.

Merafe reports on nine-month production figures (JSE: MRF)

There was a deliberate reduction in production over the winter months

Merafe has reported its attributable ferrochrome production from the Glencore Merafe Chrome Venture for the third quarter ended September. It came in at 40kt, way below the run-rate for the nine-month number of 225kt.

This is because of a pullback in production in response to market conditions, with only one smelter operating over the winter season when electricity was more expensive.

For the nine months, production is 21.4% lower year-on-year.

Reinet’s fund NAV dipped this quarter (JSE: RNI)

This is a precursor to the NAV of the listed company

The bulk of Reinet’s NAV is captured in Reinet Fund, which includes the investments in Pension Insurance Corporation, British American Tobacco and others. The group always releases the NAV of the fund before releasing the NAV of the group. The NAV itself is different at group level but the direction of travel is usually consistent.

As at 30 September, the NAV per share of Reinet Fund was €32.79. This has dipped by 0.6% in the past three months.

The cycle seems to be turning against Santova (JSE: SNV)

This had to happen eventually

Logistics group Santova has been a darling of the local small cap universe, with the share price up 133% over five years. If you bought in the depths of COVID, you’re up 277% over three years.

The group was a net beneficiary of supply chain pressures across the world, assisted by a solid expansion strategy. At some point though, the cyclical nature of logistics had to play a role.

In a trading statement dealing with the six months to August 2023, HEPS is down by between 20.9% and 25.9%. The actual guided range is 57.87 cents to 61.78 cents vs. 78.11 cents in the comparable period.

The share price closed 3% lower on the day of the announcement at R7.61.

Noel Doyle is on his way out at Tiger Brands (JSE: TBS)

It won’t do much for his self-esteem that the market rallied in response

Markets are cruel things. They well and truly don’t care about your feelings. Noel Doyle has “jointly agreed” to part ways with Tiger Brands, with the company saying that “new leadership was required to respond to the challenges currently facing the company” – in other words, he was asked to leave after over 20 years of service with the company. The market responded with the share price closing 11% higher.

If you ever want to know what the challenges are, just walk to the baked beans aisle at your local grocery store. There, you will see Koo beans priced at a premium to various other competitors because of the supposed strength of the brand. I am quite sure that consumers eating baked beans don’t really care about the strength of the brand at a time when prices have basically doubled over the past couple of years. Ditto for Albany Bread, which is more expensive than competitors.

Doyle’s replacement is Tjaart Kruger. He is no stranger to Tiger Brands, having worked in the group from 2001 to 2007. He then ran Premier Foods from 2011 to 2021. Kruger has signed a 26-month contract with Tiger Brands, which is a weirdly specific tenure. It also means that this a transitionary period in leadership, as the group will be looking for a CEO to take over from Kruger. Doyle will remain available to Tiger Brands until March 2024 to help with the handover.

In case you still don’t believe me about the baked beans, perhaps a trading statement for the year ended September 2023 will convince you. The performance at segmental level varies considerably (as one might expect), with HEPS from total operations expected to differ by between -5% and 2% vs. the comparable period. Notably, the Groceries and Snacks & Treats businesses are experiencing overall volume declines.

KOO sometimes isn’t the best you can do.

Little Bites:

- Director dealings:

- The CEO of Equites (JSE: EQU) has sold shares worth R26 million. This represents around 18% of his stake in the company. The share price is down 28% this year and this sale won’t do the trajectory any favours.

- A director of a major subsidiary of Woolworths (JSE: WHL) sold shares worth R5.1 million. The Woolworths share price is down 16% in 90 days, so I wouldn’t ignore that.

- A prescribed officer at ADvTECH (JSE: ADH) has sold shares worth R2.6 million.

- Des de Beer has bought another R1.75 million worth of shares in Lighthouse Properties (JSE: LTE)

- There have been various recent off-market purchases of shares in DRA Global (JSE: DRA) by Apex Partners, an associate of director Charles Pettit.

- As part of the buyout and delisting of Transcend Residential Property Fund (JSE: TPF) by Emira Property Fund (JSE: EMI), there is a “clean-out dividend” to be paid to Transcend shareholders to cover the period from 1 April 2023 until the date of the implementation of the deal. The board has determined that this dividend is 29.44 cents per share.

- CORRECTION: The Quilter (JSE: QLT) odd-lot offer doesn’t follow the usual approach at all. It applies to 200 shares rather than 100, but more importantly you needed to be on the register on 28 April to qualify.

- The weirdness around aReit Prop (JSE: APO) never seems to end. In an announcement dealing with a special resolution for financial assistance, I learnt that aReit Prop can’t collect the rentals directly on a property because it hasn’t been able to finalise a VAT registration since March 2022. The company hopes to finalise this in October 2023. Even more hilariously, the website doesn’t work (or at least not when I tried to access it).

As a baked beans connoisseur, please do not EVER compare Koo beans to the rest. There is a reason why you pay more. Only beans I knew that could give Koo a run for its money is All Gold. Do you also think all coffees are the same? Tomato sauces? Meats? Cars? Koo IS the luxury brand of beans. Nuff said. 😌 Goedkoop koop.

Could you do a write up or interview with Des de Beer explaining why he is buying up Lighthouse as well as an assessment of the value in Lighthouse. What investment opportunity exists to invest alongside Des.

Regarding the Quilter Odd lot offer. It looks like it is for those holding under 200 shares and according to their website…”Friday 28 April 2023″ is the “First Record Date, being the first date on which a shareholder must be an Odd-lot Holder to be eligible to participate in the Odd-lot Offer”

Hi Michael. You are absolutely right, this doesn’t follow the usual structure and they didn’t make a point of reminding the market in the latest announcement! I’m going to publish a correction in Ghost Mail tomorrow morning and I’ve corrected Ghost Bites. Thanks so much!