Datatec brings you more details on Logicalis International (JSE: HLM)

This is a useful opportunity to learn more about the IT sector

Logicalis refers to itself as a “global digital channels company providing cyber security and networked cloud infrastructure” and goes on to talk about “technology distribution” as well as “technology infrastructure solutions and managed services” – quite a mouthful! Thankfully, there’s a presentation on the business to help you understand it.

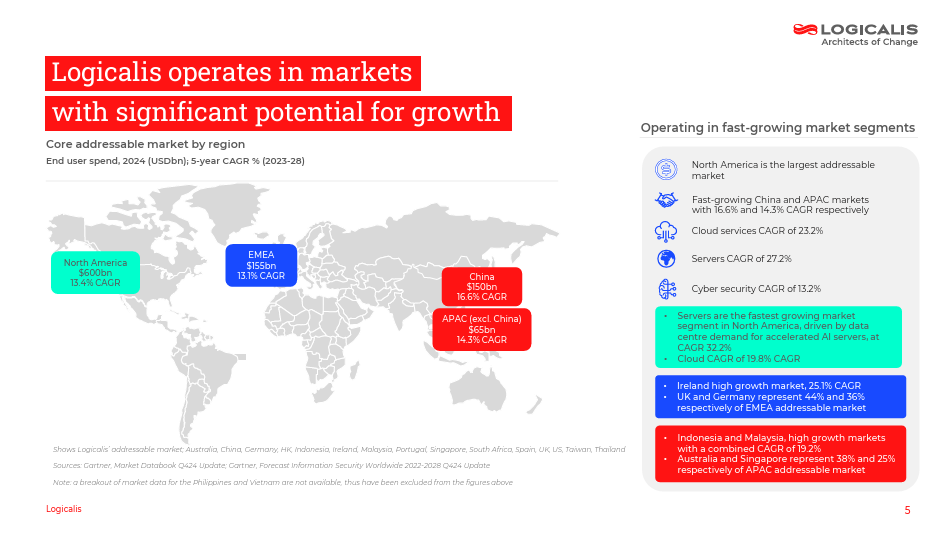

As part of Datatec, Logicalis operates across 20 territories and has over 6,000 clients worldwide. I found this slide particularly fascinating, as it shows that the US is the largest market by a country mile and is still somehow growing almost as fast as China despite that scale:

It’s a useful deck that goes into plenty of detail on the business. Ultimately, these types of operations always come down to the mix effect across relative margins (e.g. managed services vs. hardware) and regional contributions. Check it out here if you’re curious.

Another fat special dividend from enX (JSE: enX)

The proceeds from recent disposals will find their way to shareholders

enX Group recently closed the disposal of the 66% interest in Centlube, 100% interest in Ingwe Lubricants and 37% interest in Zestcor Eleven, along with the associated claims. This led to gross proceeds of R287.9 million, of which 10% went into an escrow account for the benefit of enX for 24 months for indemnity security purposes.

This still leaves enX with a whole lotta cash that they have no other use for, so a special distribution of R1.55 per share has been declared to shareholders. For context, the current share price is R5.74, so they are paying out 27% of their market cap to shareholders.

Ethos Capital finally has a spring in its step (JSE: EPE)

The underlying portfolio had a solid end to 2024

EPE Capital Partners, known as Ethos Capital, has generally been a disappointment over the years. The underlying exposure to Brait hasn’t helped. Of course, as the saying goes, every dog has its day – or even its six-month period!

For the six months to December 2024, Ethos Capital has to be viewed on an adjusted basis for net asset value per share due to the unbundling of Brait shares. If you’re giving part of your portfolio directly to shareholders, then you need to take that into account when measuring how the size of the portfolio has changed over time.

With that out the way, I can now tell you that net asset value (NAV) per share increased by 19.2% from R6.58 to R7.85 over the period, a strong return of 19.2% in six months! The share price is at R4.75 and the discount to NAV is a lot lower than it was previously, which is exactly what happens when you reduce exposure to listed shares that people can just own directly.

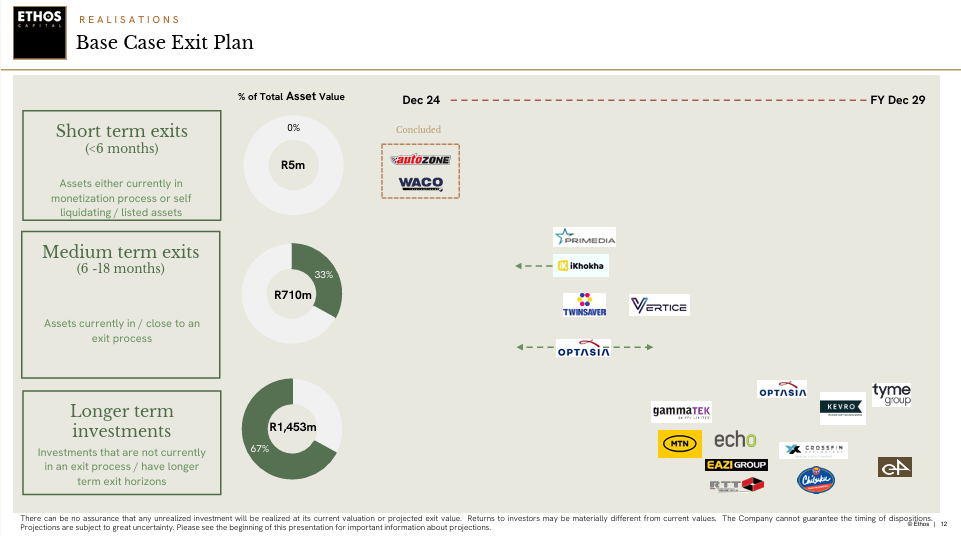

The underlying growth in NAV was driven by performance at the portfolio companies. Optasia seems to have been the highlight, with EBITDA on a last-twelve-months (LTM) basis up 24% at the fintech company. They also highlight positive contributions from medical technology company Vertice, E4 (another fintech), Primedia (you know this one) and Twinsaver (you know this one, too), while reminding the market that the value of Tymebank (another household name) keeps climbing beautifully.

The group retained exposure to Brait exchangeable bonds, which actually did well during the period. For once, Brait was a positive contributor to the NAV movement!

To add to the good news, capital allocation decisions over the period saw proceeds from disposals used to reduce debt and acquire shares. That’s exactly what investors would like to see.

I thought that this slide from the earnings presentation does a great job of showing the portfolio and the plans to exit:

Growthpoint squeezed out some growth and thinks the bottom is in for office property (JSE: GRT)

The V&A Waterfront remains the jewel in the crown

Growthpoint released results for the six months to December 2024. Thanks to an improvement in net property income in the South African portfolio of 6.2%, distributable income per share at group level actually increased by 3.9%. Within that result, the V&A Waterfront continues to deliver insane growth of 16.6% in net property income, while Growthpoint’s share of distributable income from that asset increased by 4.5% after taking into account the impact of external borrowings.

Speaking of debt, the loan-to-value ratio improved from 42.3% as at June 2024 to 40.8% as at December 2024. They are pushing hard in student accommodation, with that ring-fenced fund expanding its loan-to-value from 29.7% to 36.4%. Despite the improvement in overall debt ratios, they still saw an increase in net finance costs as the interest rate cycle played out.

The growth in income in South Africa wasn’t enough to save the overall net asset value per share performance, with that metric decreasing by 2.6% thanks to write-downs in Australia and the disposal of Capital & Regional. With that disposal having been implemented in December 2024, 37.9% of Growthpoint’s property assets (measured by book value) are located offshore.

Growthpoint has been very busy with asset disposals, particularly in districts that they see as deteriorating. Sadly, there are many of those in South Africa. Importantly, they believe that the bottom is in for office properties, so perhaps we will see improvement in that going forwards. They specifically highlight Cape Town and Umhlanga Ridge as areas where office properties are outperforming. The silence re: good news related to Gauteng is deafening.

Unsurprisingly, the capital allocation strategy in South Africa is tilted towards logistics properties and the Western Cape as a whole. The logistics portfolio is enjoying its lowest vacancy rate since 2018 as well as positive rental reversions.

Looking ahead, major redevelopment work at the V&A Waterfront is expected to impact growth for full-year 2025. Even then, they expect mid-single digit growth from that asset for the period. At group level, they expect distributable income per share to grow by between 1% and 3%, so it’s a slow year in the pipeline.

A nasty drop in earnings at Hulamin (JSE: HLM)

There were various factors at play here

Hulamin released a trading statement for the year ended December 2024. It tells a sad and sorry tale I’m afraid, with HEPS expected to drop by between 24% and 32%, while normalised HEPS will be down by between 43% and 48%.

In case you’re wondering, the normalised number excludes “metal price lag” and other non-trading items as the company sees fit. Whichever metric you use, it was a poor year.

Volumes were barely up due to operational challenges and particularly a fire at the can end finishing line. This impacted mix in the second half of the year, with capacity focused on lower margin products. The insurance claim was finalised within the reporting period, so we will need to wait for detailed results on 17 March to see the details.

Finally, the company noted that the extrusions division underperformed and is now subject to a strategic review. When companies say this sort of thing, they are often laying the groundwork for a disposal or perhaps even retrenchments. Time will tell.

Lighthouse: ahead of earnings guidance and expecting growth (JSE: LTE)

They rapidly expanded the portfolio in 2024

Lighthouse had quite a year in 2024. Their direct property holding increased by a substantial 78% to €1.14 billion. The loan-to-value ratio also increased substantially as they grew the portfolio and added debt, up from 14% to 25% as at December 2024.

The Iberian region is expected to be 86% of the direct portfolio by the end of 2025. The strategy makes sense to me, as this is one of the more interesting growth areas in Europe.

Although there’s a lot more debt on the balance sheet than before, there are no maturities until March 2027. There was a refinancing of debt in 2024 that came in at a much higher rate than before, a nasty reminder that the interest rate environment of the pandemic is far behind us.

Earnings for 2024 came in at 2.5671 EUR cents, ahead of guidance of 2.50 EUR cents. They distribute 100% of these earnings. Notably, as a balance to all the good news around the group, distributable earnings actually dipped 5% vs. 2023 and the net asset value per share was only 0.7% higher, so it wasn’t a great year.

In 2025, they expect a distribution of 2.70 EUR cents per share – or, a return to the 2023 number. Interest rate cycles are important things to understand in the property game.

This is why the share price is only slightly in the green over the past 12 months, with investors having to look at their dividends to make themselves feel better.

Metair has given more details on its capital restructuring plan (JSE: MTA)

The good news is that there’s no sign of a rights offer at this stage

If you’ve been following the Metair story, you’ll know that they have been having a very tough time of things. Net debt as at December 2024 was a gigantic R4 billion, the majority of which was short-term. The market was warned that a capital restructuring plan would be needed. When companies use language like this, the next step is often a rights offer.

Thankfully, there’s no such plan – for now, at least. Instead, the debt will be restructured into two separate packages. One relates directly to Hesto in the amount of R1.38 billion, while the other references the remaining South African subsidiaries in the amount of R3.3 billion. There are various underlying types of debt making up the R3.3 billion. First up we have a five-year senior loan of R1.7 billion, of which half is an amortising loan (capital paid over time) and half is a bullet (capital paid at maturity). Then, there’s R1.6 billion structured as a mezzanine instrument and repayable by 2027.

Mezzanine debt is fascinating. It incorporates elements of both debt and equity and where it lands on that spectrum can vary considerably. Frustratingly, we have to wait for details on this package until 26 March when annual results are released. Although there may not be a rights offer for now, just be cautious of the terms of that mezzanine instrument. It can easily have a similar dilutionary effect, depending on the terms related to convertibility to equity etc.

I cannot stress this enough – the devil will be firmly in the details there.

Sirius Real Estate announces another acquisition (JSE: SRE)

They have capital to deploy and cash drag to manage

When a fund raises capital, be it a property or even private equity fund in nature, cash drag is a tricky thing to manage. Investors need a far better return than what the cash will earn in a money market account. In other words, deploying the capital into proper opportunities is rather urgent.

Sirius Real Estate raised a lot of money last year. This means that they’ve been busy looking for the right assets. Of course, the risk with cash drag is that a company might panic and do poor deals, which is even worse than losing out on maximum returns. This is why we are still seeing deals announced for the proceeds raised in July last year – it takes time to find the right opportunities.

The latest such example is an acquisition of a business park in Southampton in the UK. The purchase price is £36.5 million and the net initial yield is 5.5%. There’s an adjoining piece of land for a further £4 million. This is mainly a warehouse asset with some industrial storage as well. The property is 80% occupied at present.

The asset will be operated by BizSpace, the platform that Sirius has built in the UK. Aside from the obvious development potential, Sirius will also target better occupancy rates and income using its platform.

Sirius raised €181 million in July last year and has now deployed over €100 million into income-producing assets at a yield of 7.1%.

Nibbles:

- Director dealings:

- Two directors of Spur (JSE: SUR) exercised share appreciation rights and retained shares worth R5.7 million.

- A director of Sea Harvest (JSE: SHG) bought shares worth R117k.

- Here’s another data point for those who enjoy seeing how debt is priced: British American Tobacco (JSE: BTI) has priced $2.5 billion worth of notes with three different maturities. Notes due 2032 were priced at 5.35%, notes due 2035 at 5.625% and notes due 2055 at 6.25%.

- Cafca Limited (JSE: CAC) is a Zimbabwean company that has close to zero liquidity on the JSE. They released a trading update for the quarter ended December 2024. Volumes were strong, driven primarily by aluminum and with a useful contribution from copper as well. The company has noted that margins were under pressure though.

Hope you had a belter of a 37th on Tuesday!!

Thank you – I did!