Is De Beers the canary in the luxury coal mine? (JSE: AGL)

The commentary on diamond sales is a helpful read-through into luxury demand

De Beers isn’t a big enough component of Anglo American to drive the share price by itself. For that reason, updates on diamond sales are very useful in giving us a sense of luxury demand and not necessarily useful for anything else.

Even the sales numbers themselves don’t mean much, as sales cycles aren’t directly comparable in absolute terms because of seasonality etc.

I skip straight to the management commentary. The last cycle included bullish commentary from management around demand in China. The latest cycle? Not so much. The CEO of De Beers has flagged a “slower pace of recovery in consumer demand from China than was widely anticipated.”

Although I wouldn’t put diamonds in the same league as other luxury goods because of the traditional association with weddings (thankfully nobody expects a Louis Vuitton engagement present), this is something that should be noted with luxury sector companies trading at such high levels.

Dipula grows its NAV by 7% (JSE: DIB)

The per-share numbers have been impacted by a share capital restructure

In June 2022, Dipula Income Fund achieved what the artist formally known as Fortress REIT could not: a restructure of its capital to collapse a dual share class structure into a single class. Through a scheme of arrangement, A shares were repurchased and more B shares were issued. This has a significant impact on the numbers per share, as Dipula specifically reported on the A shares and B shares in the prior period and now only has B shares.

So for the six months to February, it makes more sense to look at group level numbers.

In that period, Dipula grew net property income by a humble 1% and NAV by 7%. There are some fancy balance sheet swings in NAV linked to derivatives and the infamous “other” line that all investors fear in an set of financials, so I would focus on the increase in property value of 4.9% as a better indication of year-on-year improvement.

Although tenant retention has improved across the types of property, Office vacancies are up from 17.3% as at February 2022 to to 27.4% as at February 2023. The loan-to-value ratio sits at 36.9%, slightly higher than 36.7% a year prior.

There’s juicy HEPS growth at enX Group (JSE: ENX)

The industrials group has posted a positive set of numbers

Other than in the headlines related to the recent Takeover Regulation Panel investigations into activities in the company’s shares, you may not have heard much about enX. The company operates in the fleet, equipment and petrochemicals industries, so it sits at the heart of the South African economy. This perhaps makes it even more impressive that HEPS is up.

There are no more discontinued operations in this period, so we can just look at continuing operations. Revenue is 22% higher and HEPS has increased by 32%. As net finance charges came down year-on-year (which helps HEPS), just looking at those two numbers hides the fact that operating profit before tax was only 5% higher. This means that there was underlying margin pressure in the operations.

The group sounds happy with the balance sheet even after paying substantial special and ordinary dividends to shareholders, which led to a large increase in net debt since August 2022.

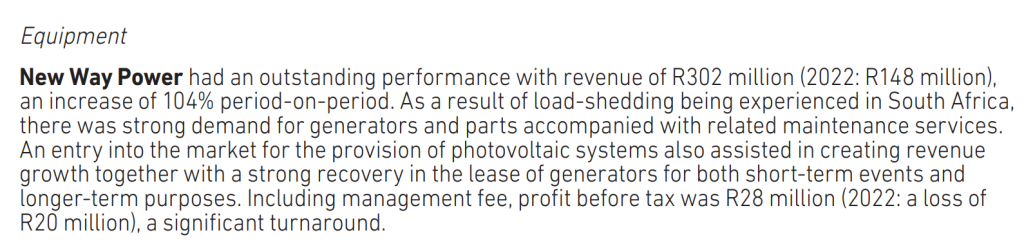

And as a final note on this company, here’s today’s reminder that no matter what crisis is going on out there, someone is making money:

NEPI Rockcastle gives a first quarter update (JSE: NRP)

Even on a like-for-like basis, net operating income has jumped sharply year-on-year

At a time when South African property funds are taking strain from load shedding, NEPI Rockcastle shareholders are enjoying exposure to Eastern Europe. In the first quarter of 2023, net operating income jumped by 27% year-on-year and 17% on a like-for-like basis (i.e. excluding acquisitions).

This has been driven by a strong performance in the malls. Tenant sales are up 25% year-on-year, with a 14% rise in footfall and most of the rest coming from a higher spend per visit.

Retail vacancies have fallen to 2.4%, with the management team highlighting that international retailers have taken an interest in the region based on growth being achieved in the retail sector.

The loan-to-value ratio looks comfortable at 34.7%, below the company’s “strategic threshold” of 35%.

And even without the pain of load shedding in that region, NEPI Rockcastle has cleverly raised “green” funding and is investing in solar PV projects at the malls.

With guidance of full-year growth of 11% in recurring distributable earnings per share, it’s hard to find fault with this performance. The share price has climbed 15% in the past year.

Ninety One sees HEPS drop by 15% (JSE: N91)

Asset management firms tend to be highly geared to equity market performance

How does an asset manager make money? Simply, they charge a combination of fixed fees (based on assets under management – AUM) and performance fees (also linked to AUM but only applicable when markets do well).

When markets perform poorly, there’s a double dose of pain. AUM drops and performance fees evaporate. When markets do well, the reverse happens and profits are great, although asset managers tend to reward staff more than shareholders even in those scenarios. It’s an industry-wide issue for investors.

The year ended March 2023 wasn’t a happy time for equity markets around the world. It’s therefore not surprising that Ninety One’s average AUM fell by 3% and total AUM fell by 10% year-on-year. Of concern is the net outflow number of £10.6 billion, as outflows represent a decision by clients to walk away from the products.

HEPS has fallen by 15% and the dividend per share is down by 10%, so the payout ratio increased.

Although market prices have improved thus far in 2023, the outlook statement is still cautious. It helps at least that Ninety One carries no debt, so shareholders are the beneficiaries of any profits, rather than bankers.

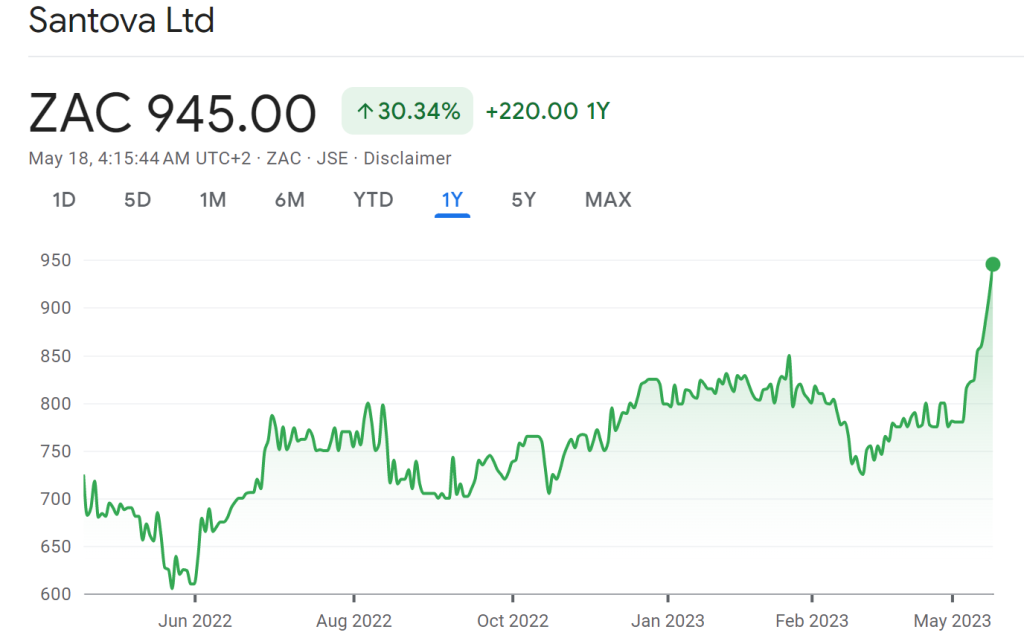

Santova adds another 4% to the share price (JSE: SNV)

Be very wary of sharp upward moves like we’ve seen at Santova recently

Santova is a solid company. As small caps on the JSE go, the company has done exceptionally well at punching above its weight and generating returns for shareholders. The share price is up more than 193% in 5 years!

Still, I have a rule about never chasing a chart that looks like this:

Big upward moves like that tend to pull back, although not always of course. If we knew what a price would always do, then we would all have yachts on Instagram.

Santova might be linked to the shipping industry, but not with yachts. The company falls into the broader supply chain industry, with freight forwarding and other services (and not just regarding ships). For the year ended February, that was a fun place to play, evidenced by a 22.1% increase in HEPS to 154.83 cents.

The net asset value (NAV) is R7.51 per share and the share price closed at R9.45. Although NAV is little more than a guideline in most sectors, I become a little nervous when companies trade at a significant premium to NAV unless we are talking about a manufacturing business with depreciated assets that are still operating. An exception is where a company generates return on equity far in excess of the cost of equity, which is the return required by shareholders.

Another important point is that although Twitter tends to get excited about the proportion of cash on Santova’s balance sheet and the quantum relative to the market cap, this is a working capital intensive business and they need a lot of cash to operate. The company is in a solid position, but don’t assume that all the cash on the balance sheet is sitting around waiting for a special dividend.

There isn’t even an ordinary dividend, with Santova electing to reinvest everything in the business instead. This says a lot about the growth prospects, which is why the valuation has run higher.

Telkom: a R13bn company with a R13bn impairment (JSE: TKG)

Telkom has shed over 43% of its value in the past 12 months

Value investing is a tough game. There are companies that are cheap for a reason, often due to market emotions or sheer apathy, creating opportunities. Then there are companies that are cheap because the underlying business units are rubbish, creating a value trap that is tough to explain to your friends.

“I lost money on Telkom.”

“But what were you expecting?!? Everyone hates using Telkom!”

Common sense is often a better analytical tool than reading the numbers in detail. With a 15.6% drop in the share price in response to a trading update, Telkom shareholders won’t want to read these numbers.

For the year ended March, Telkom is going to recognise an impairment across the business of approximately R13 billion. After yesterday’s sell-off, that’s approximately equal to the group market cap!

Even if we strip out this non-cash charge and ignore the restructuring cost related to a 15% headcount reduction across the group, normalised HEPS fell by 60% to 80% this year.

Telkom is a technological dinosaur that is trying to migrate to new technologies in an economy that is making this incredibly difficult to achieve.

You know what happened to the dinosaurs, right?

Tsogo Sun Gaming flags a jump in HEPS (JSE: TSG)

In today’s accounting LOL, one of the drivers is “hedge ineffectiveness”

For the year ended March, Tsogo Sun Gaming welcomed many customers back to its properties for nights of gambling, drinking and generally doing things that nobody was allowed to do during the pandemic. It’s not surprising to see a solid uptick in HEPS vs. a base period that still had the impact of lockdowns.

With HEPS up by between 34% and 42%, the company has grown into the share price rather than grown the actual share price in the past year. You could always range-trade this share rather than go to any of the casinos:

The hotel management contract cancellation had a negative impact on HEPS, as the company expected. The funnier update (just because of how it reads) is a R57 million after tax benefit from “hedge ineffectiveness” – if a hedge isn’t going to work out as a hedge, it may as well work out as a trading profit!

Little Bites:

- Director dealings:

- A director of Ninety One (JSE: N91) has bought shares worth £19.3k.

- A director of a subsidiary of Sappi (JSE: SAP) has bought shares worth just over R190k, an interesting play as you don’t often see dealings in Sappi and the cycle has turned against the company, driving a large sell-off in the shares.

- A director of KAL Group (JSE: KAL) has bought shares worth R50k.

- There isn’t much liquidity in tech microcap ISA Holdings (JSE: ISA), with a market cap of just over R210 million. In a further trading statement, the company guided HEPS for the year ended February of between 12.95 cents and 15.05 cents, an increase of between 23.3% and 43.3%. The shares trade (occasionally) at R1.25 per share at the moment.

- Sygnia (JSE: SYG) seems to be intent on recycling executives. After outspoken founder and CEO Magda Wierzycka returned to the top job, we now have Niki Giles returning as Financial Director after serving in that role between 2015 and 2017 and subsequently leaving Sygnia in 2018.