Listen to the latest episode of Ghost Wrap here:

Eastern Platinum gets a boost from chrome prices (JSE: EPS)

Despite the name, around 94% of revenue is from chrome concentrate sales

Eastern Platinum has reported results for the quarter and six months ended June, so you have to be careful when reading the results to see whether you’re looking at a quarterly or interim (six months) number.

Revenue increased by 78.5% year-on-year for the quarter, or 54.9% for the six months. Gross margins also improved, so mine operating income was over three times higher for the quarter. By the time we get to net income attributable to ordinary shareholders, we find a huge jump from $1.2 million in Q2 last year to $7.7 million in Q2 this year. On a six-month basis, it more than doubled from $4.2 million to $9.0 million.

The balance sheet remains a problem though, with a working capital hole of $16.1 million (current assets minus current liabilities). That’s better than it was a year ago (a deficit of $39.5 million) but remains a significant concern. Union Goal has now stopped taking shipments of chrome concentrate due to payment disputes, so revenue since June 2022 has been generated from third-party sales.

Be very careful here, as chrome sales from the retreatment plant are expected to end by early 2024. After that date, PGMs will be the main source of revenue based on the restart of the Zandfontein underground section of the Crocodile River Mine. The company needs to raise additional capital for that project.

The share price has lost over 70% of its value this year. Whistleblower allegations regarding undisclosed related party transactions have been part of the market pressure, with an investigation by a special committee underway.

Exxaro flags a drop in earnings (JSE: EXX)

Like most of the mining sector companies, earnings went the wrong way this year

The story of the mining sector this year is one of lower commodity prices, production challenges thanks to Eskom and distribution problems thanks to Transnet. We are a resource-rich country that is exceptionally good at scoring own goals.

Exxaro hasn’t escaped this unfortunately. With coal prices and volumes have dropped, earnings could only go in one direction.

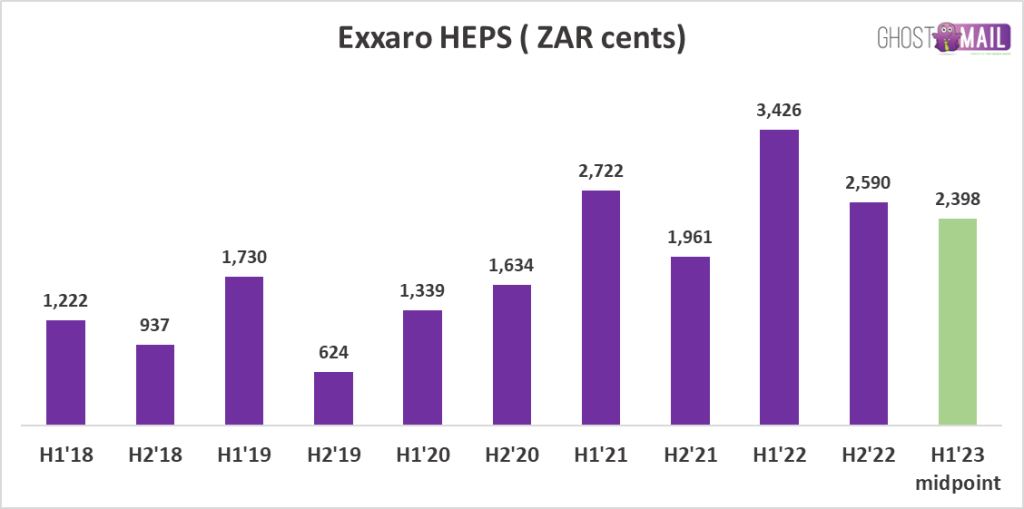

Headline earnings per share (HEPS) is expected to drop by between 23% and 37%, which means an earnings range of between R21.58 and R26.38. This is for the six months to June.

Using the midpoint of that guidance, here’s a chart of earnings at Exxaro in recent years:

As I always remind you: if you want a low-stress investment that you can buy and forget about, stay as far away from mining as possible.

Here’s what the share price has looked like over the past five years:

The return does not reflect the dividends along the way, which are typically the biggest component of the total return in a mining house like this.

Finbond proposes a huge special repurchase (JSE: FGL)

The Massachusetts Institute of Technology (yes, that MIT) wants out

In case you’re wondering quite why MIT has a big stake in Finbond, you aren’t alone. MIT must be wondering much the same thing in terms of how it all went so wrong. The famous education institution invested in a local fund that didn’t work out. When the fund was unwound, they ended up holding shares directly in Finbond (and a few other companies too).

Net1 Finance Holdings also wants to exit its stake in Finbond, with these two investors collectively holding 38.55% of Finbond’s total issued ordinary shares.

This is a huge stake to try and sell, which is why the parties have agreed an exit price of 29.11 cents per share. That’s quite a bit lower than Friday’s closing price of 35 cents, although I think they would be a lot worse off if they tried to sell on the open market. Finbond doesn’t have nearly enough share price liquidity for an exit of a stake that size to be possible.

Finbond has enough cash or existing debt facilities available for this repurchase, which comes to just under R100 million. The company likes the deal because it can take shareholders off the register at a significant discount to the current share price. Whether or not the market will support this allocation of capital is a different question.

As this is a repurchase from a related party, a circular will be sent to shareholders. If the repurchase isn’t approved, I genuinely don’t know how MIT and Net1 will sell their stakes.

Little bites:

- Director dealings:

- A director of Argent Industrial (JSE: ART) has sold shares worth roughly R400k.

- A director of Altron (JSE: AEL) has bought shares worth nearly R158k.

- Quite hilariously, a director of Afine Investments (JSE: ANI) bought shares worth R380. No, there isn’t a “k” missing there. 95 shares at R4 each!

- Those following Novus Holdings (JSE: NVS) will want to know that A2 Investment Partners now holds 28.20% of the issued share capital in the company after Caxton and CTP (JSE: CAT) sold out completely. Will we see a takeout offer at some point?

- Grindrod Shipping’s (JSE: GSH) extraordinary general meeting went to plan, with almost unanimous approval for a $45 million capital reduction. In other words, a large cash payout to shareholders is coming up, which is part of why the share price closed over 9% higher on Friday.

- Cognition’s (JSE: CGN) sale of its head office for R11.875 million has met all required conditions, so the transaction will now be implemented. It may sound like a silly update, but the market cap is under R200 million so this is a material unlock of cash.