Efora Energy: suspended, but buying property (JSE: EEL)

This stock hasn’t traded since 2020

The only reason I’m including anything related to this story is that you may find it interesting that a company that is suspended from trading can still carry on with its day-to-day business. The JSE has the power to suspend a listing that doesn’t meet the continuing obligations of being listed (like financial reporting), but it doesn’t have the power to prevent the company from doing corporate actions – provided those listings requirements are still adhered to.

Even though the shares of Efora Energy haven’t traded on the JSE since 2020, the company can still go ahead with a Category 2 transaction to acquire a property worth R3.8 million. Interestingly, the property is owned by Labat Africa!

The property supports Efora’s wholesale strategy by providing storage in a key industrial node that is close to major oil companies.

A major funder of Kibo has converted exposure to shares (JSE: KBO)

This is highly dilutive for shareholders but gives the company more breathing room

Kibo Energy announced that a whopping 500,000,000 new shares were issued to RiverFort Global Opportunities PCC Limited, based on conversion rights attached to a debt facility. This is interesting, considering that Kibo is trading at R0.01 per share i.e. as low as it can go. The company seems to spend most of its time at the moment trying to persuade a potential joint venture partner to figure out how internet banking works so that payment can be made!

Following this conversion, RiverFort will have a stake representing 11.68% of shares in issue. This is a substantial switch from debt to equity. I think the positive signal attached to this more than outweighs the dilution at this stage. Kibo is priced like a binary outcome and any reduction of debt can only help.

Sean Summers makes his leadership changes at Pick n Pay (JSE: PIK)

The old guard is out and some major internal promotions have been made

Pick n Pay’s share price has carried on this year where it left off in 2023. The share price is already down 6% in 2024, taking the 12-month drop to around 65%. It’s very ugly for the retailer right now.

In desperation, they dusted off Sean Summers in the hope that he can bring some bull market magic back to the retailer. This is a major changing of the guard, which comes with various leadership changes in the structure.

The man entrusted with returning Pick n Pay Retail to profitability is Dallas Langman. He was running the Rest of Africa division, so he knows all about running businesses in tough situations. This kind of get-the-hands-dirty operator is probably the right choice.

There are various other changes in the structure. Most of all, I’m pleased to see Pick n Pay Clothing getting recognised at executive level. That business is a little gem and needs to be given as much capital as possible to grow.

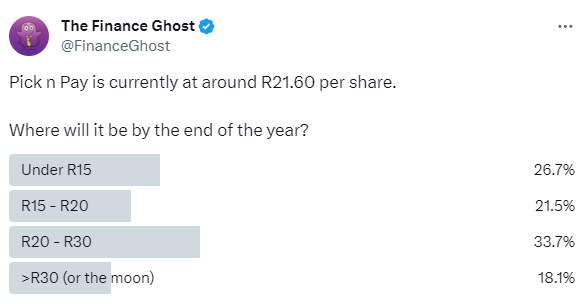

Will we finally see an improvement in Pick n Pay? I ran a poll on Twitter / X to see what people think. The poll hadn’t finished running by the time this was published, but the provisional results tell a story of a market with no consensus on the direction of this stock:

Tharisa worked hard over the festive period (JSE: THA)

The three months to December 2023 saw a significant improvement in production

The quarter ended December 2023 represents the first quarter of the 2024 financial year for Tharisa, so don’t get confused when it gets referred to as Q1’24 even though it was at the end of the 2023 calendar year.

In this period, production of PGMs increased vs. the immediately preceding quarter (Q4’23) and record chrome output was achieved. The PGM basket price moved just 1% higher in dollar terms and the average chrome price was steady.

Despite the improved production story, net cash fell from $126.6 million to $94.9 million.

Production guidance for FY24 remains between 145 koz and 155koz for PGMs and between 1.7 Mt and 1.8 Mt of chrome concentrates. It would also help if PGM prices continuing ticking upwards from here, giving some relief to a battered sector.

Little Bites:

- Director dealings:

- An associate of a director of Huge Group (JSE: HUG) has bought shares worth R85k.