enX sells the lubricants division – and the market celebrates (JSE: ENX)

The share price closed 18% higher on the news

enX announced on Friday that it will dispose of its 66% interest in Centlube, its 100% interest (and loan claim) in Ingwe Lubricants and its 37% interest in Zestcor, all as part of one indivisible transaction. It’s so rare to see a company sell off effectively an entire segment in one go, particularly when there are different underlying companies and the stakes are all different sizes! It’s little wonder that enX jumped at this deal, with a disposal consideration of R276 million.

The purchaser is the Dunn family, who are not related parties to enX. They aren’t strangers to the group either, as the family already manages the Zestcor business and they have a key supply agreement with Centlube. This explains why they are happy to buy this range of assets in one deal.

For enX shareholders, the happy news is that the debt of Centlube and Ingwe will remain with those assets and surplus cash from the disposal will be paid to enX shareholders via a return of capital. Even though a portion of the selling price needs to be held in escrow, the board of enX is planning a return of capital of R281 million – yes, slightly more than the selling price! This works out to R1.54 per share.

There are a bunch of conditions precedent for the deal of course, so shareholders will need to be patient for the return of capital. The good news is that this is only a Category 2 deal, so no circular and shareholder approval is required.

One and Dunn just took on new meaning for me with this elegant deal, sending the share price 18% higher on the day to R5.90.

Yes, Labat Africa did indeed lose more money in 2024 (JSE: LAB)

But at least the losses are lower than in 2024

Labat Africa has finally released results for the year to May 2024. There isn’t much to hang your hat on here. From continuing operations, revenue was pretty flat at R48.5 million and they suffered a loss of R17.8 million at EBITDA level. By the time you reach the headline loss, it balloons to R25.6 million. That’s a pretty incredible loss off that revenue base!

In the prior year, the headline loss was R86.7 million. This means that over two years, they’ve lost a spectacular R112 million! The management commentary around the prospects for the integrated cannabis strategy is bullish. What really counts though is the numbers, with this balance sheet going up in smoke at the moment.

If you read the going concern report from the auditors, you’ll find a very important comment that the group is planning a rights issue of R80.3 million once the suspension from trading is lifted. The current market cap is R46.8 million and I suspect it will crash further once the shares can trade again.

It is very likely that a rights issue of that side will dilute existing shareholders down to almost nothing unless they follow their rights.

SA Corporate Real Estate’s pre-close presentation shows that retail isn’t a slam-dunk (JSE: SAC)

There is plenty of pressure on operating expenses

SA Corporate Real Estate has released a pre-close update. Despite the name, they actually have a bunch of different types of properties in the portfolio, including residential! That’s something that you won’t find in most REITs, with SA Corporate pushing harder into this space through the creation of an unlisted residential fund that has already raised R1.25 billion from a cornerstone investor.

The full-year forecast is for overall portfolio growth of 6.0% in net property income on a like-for-like basis. That’s a decent outcome. Within that guidance, we find the Afhco residential portfolio as the shining star, up 7.4% thanks to rental increases and cost efficiencies due to investment in off-grid solutions for both electricity and water. The industrial portfolio also did well, with 6.9% growth and almost full occupancy.

Something had to be a drag on performance in order for the total to come out at 6.0%. The retail portfolio is the culprit, growing just 4.4% at net income level despite 6.8% revenue growth. This was because of 9.7% growth in operating expenses, with security costs as a major issue and huge municipal expenses inflation of 13.5% as well. Our country certainly isn’t out of the woods just yet from a governance perspective, especially at municipal level.

The retail portfolio could only manage slightly positive reversions overall, so that makes it difficult to offset this level of inflationary pressure. Long-term leases with high escalations were renewed at negative reversions to make up for the escalations. Those tenants simply enjoy better negotiating power as well, as anchor tenants have far greater ability to fight for great leases than smaller line shops.

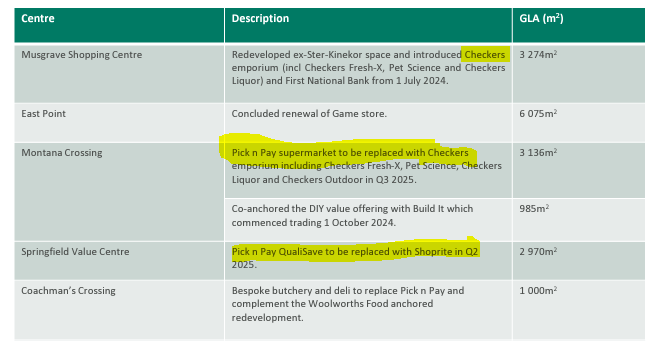

The retail portfolio is a bit scrappy at SA Corporate, with lots of work needed on issues like redeveloping Ster-Kinekor space and replacing Pick n Pay as a tenant in some cases. I decided that this table from the update was worth including here to show you just how quickly Shoprite group is eating up Pick n Pay space (and space in general):

The forecast loan-to-value ratio for December 2024 is 42.6%. They expect this to drop substantially to 33.7% based on the unlisted residential fund.

Distribution guidance for 2024 is for growth of at least 5%. For 2025, they are guiding for growth above inflation.

Sabvest has reduced its interest in Apex Partners Holdings (JSE: SBP)

The proceeds are being used to reduce debt in Sabvest subsidiaries

Sabvest has unlocked R140.5 million by reducing its economic and voting interest in Apex. It now has a 40.6% economic interest, down from 46.4%. The voting interest is also 40.6%, down from 49.8%.

Apart from aligning economic and voting interests, this deal also increased the shareholding of Apex management and thus created more alignment in the business itself.

The proceeds will be used to reduce term debt in Sabvest subsidiaries. This debt was R600 million as at December 2023 and is now down to R160 million after various inflows.

South32 gets a regulatory win in Australia (JSE: S32)

Environmental conditions have been amended

South32 is working towards a mine life extension project at Worsley Alumina. The Western Australian Environmental Protection Authority has recommended that the project be approved, but the associated environmental conditions were onerous and went beyond reasonable measures – at least in South32’s opinion!

The good news for South32 is that the Western Australian Minister for Environment seems to agree, with a decision to approve the project with conditions that aren’t as onerous as the original proposal. A formal approval through a Ministerial Statement is expected later this month and federal approval is expected early in 2025.

Supermarket Income REIT quietly joins the local market (JSE: SUPR)

Apparently, omni-channel is something worth highlighting in the UK

The JSE is trying to convince international companies to have a secondary listing on the JSE. The benefit to local investors is that it makes it far easier to invest in these companies when they are available on your local brokerage account, as you don’t need to first fund an offshore brokerage account and suffer the forex spread along the way.

The listing of Supermarket Income REIT plc on the JSE certainly isn’t the first time that an offshore property fund has come to the JSE. We have a few of them, some of which have practically zero liquidity and end up being somewhat pointless listings.

I’m hoping that won’t be the case here, with the London-listed property company needing to convince investors that there is something special about the “omnichannel” model at its tenants. These are supermarkets that provide in-store shopping and online fulfilment. I have no idea whatsoever why this is considered interesting or different, as basically every grocery store in South Africa fits this description these days. The UK market is far more developed than South Africa when it comes to online shopping, so it seems even stranger that this would be a characteristic worth shouting about.

Nibbles:

- Director dealings:

- There’s yet more forced selling by Barry Swartzberg of his Discovery (JSE: DSY) shares, based on the share price being higher than the strike price on call options as part of hedge transactions entered into a couple of years ago. The latest sales are worth nearly R120 million!

- Acting through Titan Premier Investments, Dr. Christo Wiese bought a big chunk of Brait (JSE: BAT) ordinary shares to the value of R47 million! He’s been buying up plenty of ordinary shares recently as well as exchangeable bonds in the company, with a purchase of R64k worth of those bonds in Titan Fincap Solutions to add to the tally.

- A director of AngloGold Ashanti (JSE: ANG) received share awards and sold the whole lot to the value of R16.1 million.

- It’s a mixed bag at RFG Foods (JSE: RFG) in terms of directors and their approach to share awards. Directors at the group holding company seem to retain their share awards (which are much larger in size of course), while directors of a major subsidiary all sold their share awards worth a total of R22 million.

- A prescribed officer of Capitec (JSE: CPI) bought shares worth R1.1 million.

- A director of a subsidiary of Oceana (JSE: OCE) sold shares worth R620k.

- A director of Momentum (JSE: MTN) bought shares worth R186k.

- Shareholders of Clientèle (JSE: CLI) have approved the acquisition of Emerald Life, as well as the creation of the preference shares that will be issued to fund the deal. I still feel like they’ve paid a full price here, but hopefully it works out well!

- DRA Global (JSE: DRA) has announced the results of the buyback as part of the delisting of the company. The maximum number of shares eligible to be bought back was 11,088,080 shares and they didn’t hit the cap, with only 10,621,863 shares being bought back at A$2.08 per share. This is only 19.14% of shares in issue, so most of the current shareholder register will now move into unlisted territory.

- In perhaps a sign of where the advisory relationship has shifted and what future deals could look like, Pick n Pay (JSE: PIK) changed its JSE sponsor from Investec Bank to RMB. The sponsor helps the company with applying the JSE Listings Requirements. It is often, but not always, the company’s corporate advisor as well.

- I am not even slightly surprised to see that Global Credit Ratings changed the outlook on Sasfin’s (JSE: SFN) credit rating from Rating Watch Evolving to Rating Watch Negative. In other words, the current credit ratings (which already aren’t great) are at risk of getting worse.

- In case you are somehow a shareholder in totally illiquid property counter Deutsche Konsum (JSE: DKR), then be aware that they’ve received EUR 7.4 million in a repayment on a loan that they had previously raised a loss provision against. Not only does this help them reduce overall debt, but it allows them to recognise income based on the reversal of the provision.