Listen to the latest episode of Ghost Wrap here:

Equites is reducing debt through a UK land disposal (JSE: EQU)

The Equites Newlands subsidiary is also being appointed to develop the land

With its share price down 30% this year, Equites is having a difficult time. The company needs to reduce debt and looks set to put a 300 basis points dent in the loan-to-value ratio thanks to a major sale of land in the UK.

The sale is worth R1.435bn and this will reduce the group’s land holdings by 32%. After costs and taxes, Equites will unlock R1.2bn worth of equity that will help with the development pipeline in South Africa.

There are a number of conditions to the sale (like town planning and environmental), with an incredible longstop date of 9 February 2025. I almost wonder if that’s a misprint. The company hopes that the conditions will be fulfilled before the end of 2023.

The development isn’t without risk, as the purchaser will cover all costs up to R1.889bn. Over and above that, it gets shared on a 50-50 basis. Equites has maximum exposure of £15m based on a guarantee given in respect of Equities Newlands.

The sale and development profits attributable to Equites are expected to be £6.3m. This won’t be included in distributable earnings and won’t be distributed by Equites. The transaction is expected to be marginally accretive to net asset value (NAV) per share. The highlight here really is the reduction in the loan-to-value ratio as the company words towards a target of 35% by the end of February 2024.

Distribution per share guidance of between 130 and 140 cents for FY24 has been maintained.

Grindrod is a major winner in this environment (JSE: GND)

Some industrials companies are having the time of their lives

Grindrod has released a trading statement for the six months to June 2023. The correct measure to look at is headline earnings per share (HEPS) from continuing operations, as Grindrod Bank was disposed of in November 2022. The base period for continuing operations thus excludes the bank, making the numbers more comparable.

On this measure, HEPS jumped by between 47% and 57%. Tasty, isn’t it? This implies a range of 70.5 cents to 75.6 cents. The share price closed slightly higher at R9.51 and detailed results are due on 25 August.

A flat result at Homechoice with retail going backwards (JSE: HIL)

All the growth is in the Fintech side of the business

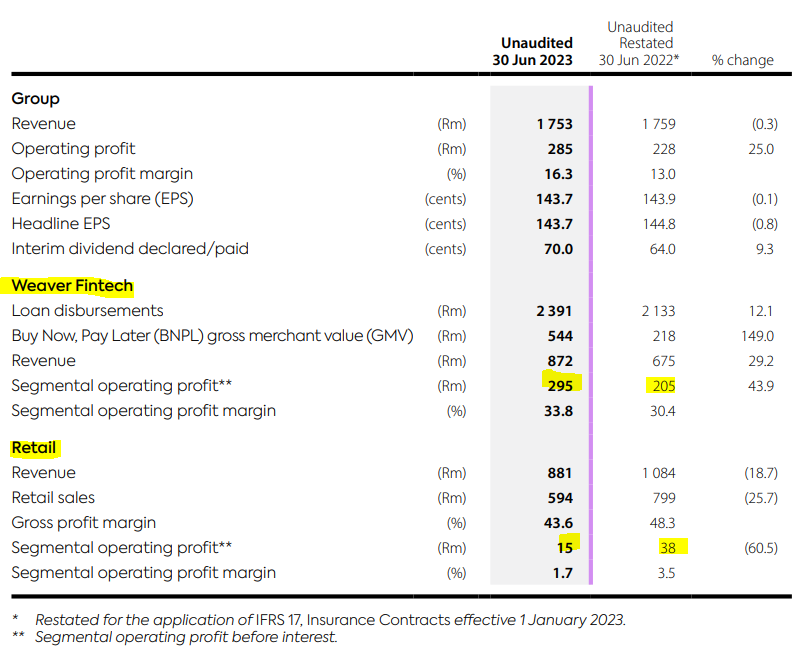

For the six months to June, Homechoice reported flat revenue of R1.8bn and HEPS of 143.7 cents, marginally below the 144.8 cents achieved in the comparable period. The interim dividend is higher at least, up from 64 cents to 70 cents as the payout ratio increased.

You don’t need to be a finance expert to spot where the money is being made:

Weaver offers personal lending, payment solutions and insurance products in a mobile-first platform. That is working well. Homechoice is an omni-channel retailer focused on homewares. That isn’t working so well, particularly when there is reliance on the South African Postal Service, which is arguably an even sadder state of affairs than Transnet.

The group has transformed into what is essentially a microlender, with a combination of lending and buy-now-pay-later products. There will always be demand for this when consumers are under pressure. The bigger question for investors is around credit quality in this environment, particularly in light of recent banking commentary.

The group recognised a provision for impairment based on 16% of gross receivables in this period, up from 15.2% in the comparable period, so that seems reasonably conservative at least.

As expected, Implats is a lot more than 20% down (JSE: IMP)

Regular readers knew this was coming because we did the maths together

When Impala Platinum first released a trading statement, the company indicated that HEPS would drop by at least 20%. I worked through the maths with you in Ghost Bites and concluded that the drop would be considerably more than 20% based on commodity pricing and the cost of mining the stuff.

In an updated trading statement, the company has confirmed that the drop in HEPS will be between 39% and 45%. This implies HEPS for the year ended June of between R21.17 and R23.52. On the closing share price of R101.75, that’s a Price/Earnings multiple of 4.55x.

Things are tough at KAP (JSE: KAP)

This has been a terrible year for the share price

Industrial companies have generally had a decent year on the local market, in many cases outperforming consumer-focused businesses. KAP hasn’t seen much of that love unfortunately, with a share price that has tanked 40% in 2023.

In May, the company guided that earnings for the year ended June would drop by at least 30%. The wording “at least” was very important here, with an updated trading statement tightening the guidance to a drop of between 37% and 47%. This means HEPS of between 39.2 cents and 46.6 cents, with the same range given for continuing operations and total operations.

On a share price of R2.61 and using the midpoint of that guidance, KAP is trading on a Price/Earnings multiple of 6x. That’s not exactly a bargain, particularly as South Africa’s growth outlook remains uninspiring.

Investors should take particular note of challenges at Unitrans, where trademarks and goodwill have been impaired based on performance. An impairment isn’t a cash cost but it tells you about the outlook, with a major food retail contract having been lost.

There is some good news at least, with working capital brought back in line with historical levels and debt reduced since December 2022. The balance sheet will be the highlight of this result, not the income statement.

Merafe rallies based on earnings (JSE: MRF)

How does an interim dividend of 20 cents on a share price of R1.31 sound?

Ferrochrome producer Merafe is well known for trading on an extremely low Price/Earnings multiple. The latest earnings confirmed just how low, with interim HEPS of 42 cents. Although annualising mining earnings is extremely dangerous, a breakeven result in the second half of the year would put this thing on a multiple of 3.1x! If we annualise, the multiple is under 1.6x.

The truth is somewhere in the middle, particularly with an outlook that notes pressure on chrome ore prices and inflationary increases in costs. To help manage energy costs, the group only produces at one smelter during the winter season when electricity demand is higher. Sales units are drawn down from inventory accordingly.

We can debate earnings multiples all day, but cash is a language that everyone understands. The interim dividend has jumped from 12 cents to 20 cents for this interim period. That’s an interim yield of 15%, which shows why this company has a group of die-hard supporters in the local market.

Rebosis needs a bit more time to evaluate offers (JSE: REB)

The public sales process has significant ramifications for the bankers

Rebosis has given its monthly update on its business rescue and public sales process – basically a garage sale of, well, garages (attached to buildings of course). After the expression of interest phase, the joint business rescue practitioners took 22 participants into the due diligence and offer phase. These bidders ranges from private groups through to JSE-listed REITs.

Binding offers were received on 17 July and final offers were submitted on 7 August, with the team now working through sale agreements with successful bidders. Although it was hoped that agreements would be finalised by 14 August, this wasn’t managed in the end.

The Nedbank portfolio properties will be finalised by 21 August. The Investec and Standard Bank portfolio properties will be finalised by 28 August.

Resilient’s interim dividend isn’t very resilient (JSE: RES)

A 30.8% decrease certainly wasn’t helped by Hammerson’s antics

Resilient REIT has released interim results for the six months to June. The dividend per share has come in at 203.22 cents, which is similar to the 2H’22 dividend (i.e. the immediately preceding six months) but is over 30% down year-on-year. The full-year dividend is forecast to be 400 cents per share, so the second half of the year is likely to be similar to the first half.

Hammerson didn’t declare a dividend in respect of the second half of its 2022 financial year and for the first half of 2023, the company went with a payout ratio of only 65%. Industry best practice is 85%. Resilient is rather gatvol here, disposing of Hammerson shares worth R982 million. This represents roughly 80% of Resilient’s stake in Hammerson.

In the South African portfolio, net property income grew by 5.8%. Rentals for renewals and new leases increased by an average of 9.6%. That’s encouraging. The story isn’t great elsewhere, with the investments in France dealing with tenants who never recovered from Covid and the properties in Nigeria suffering a downward revaluation based on challenges in the country.

Resilient is investing heavily in solar, on track to soon generate 27.7% of electricity consumption from solar installations. That’s a proper achievement and it doesn’t come cheap, which is why the company sold down Hammerson and will rather invest in renewable energy.

The net asset value has increased by 5.79%, so there’s some good news to slightly offset the pain of the dividend. Investors will want to take note of a 400 basis points increase in the loan-to-value ratio to 36.1%, though it helps that Hammerson disposals after the end of the reporting period would take this down to 34.9%.

The big news at management level is that Des de Beer is retiring as CEO. He will remain on the board in a non-executive capacity, with Barry Stuhler also joining the board. Johann Kriek has been appointed as CEO elect.

Santam reports a huge jump in earnings (JSE: SNT)

The year-on-year movement is a little crazy

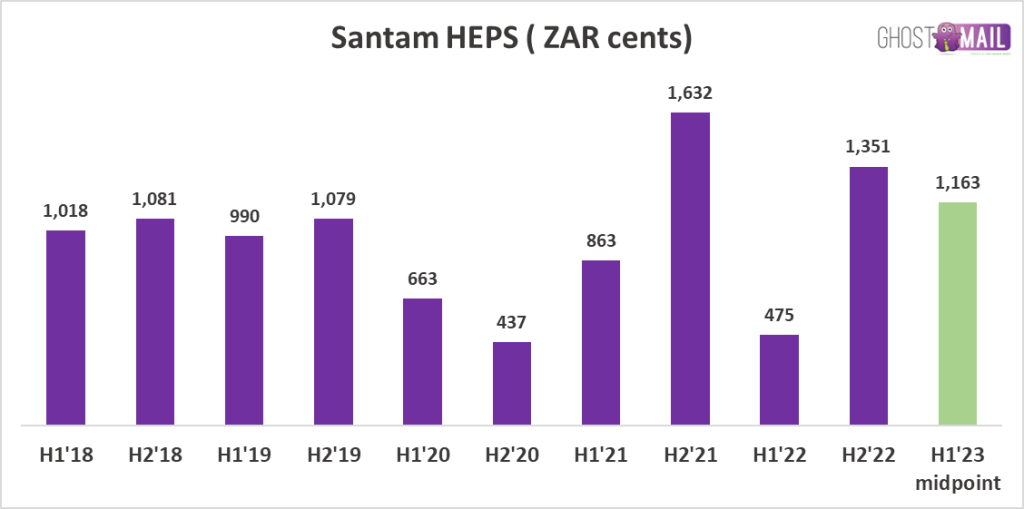

Whenever I see a big increase or decrease in earnings, I immediately want to look back and understand the through-the-cycle picture. This means that Santam’s trading statement was my inspiration for today’s chart:

It’s not perfect, as there are accounting restatements and it gets murkier in terms of comparability the further back you go. The 4-year compound annual growth rate (CAGR) from H1’19 to the midpoint of H1’23 guidance is just over 4%, so that gives you some idea of the growth Santam is managing to grind out.

An increase in investment income and improved underwriting results helped boost earnings in this interim period, although the net underwriting margin is expected to be lower than the long-term target range because of various factors ranging from weather conditions to large fire claims. A release of Covid-related contingent business interruption claims provisions also helped.

Detailed results are due on 31 August.

Trustco’s management agreement is set for renewal (JSE: TTO)

If nothing else, the official statement by the deputy CEO is entertaining

Next Capital is the investment entity of the CEO of Trustco. The CEO’s incentivisation is structured as a management agreement, like you often see in investment holding companies. No provision has been made for fees since April 2021 when the previous agreement expired, so fees of NAD87m will now be provided for. I think that’s rather a lot for a CEO, but then again I would personally rather invest in a dying earthworm than in Trustco, so it makes no difference in my life.

Here’s the official statement, including a wonderful quote:

Here’s a chart of the proven track record of superior historical returns:

I’m sure it must be superior to something. Steinhoff, maybe? Getting stabbed in the eye?

Little Bites:

- Director dealings:

- Value Capital Partners, which has board representation at Altron (JSE: AEL), has bought shares worth R6.8m.

- Encha Properties, an associate of a director of Vukile Property (JSE: VKE), has sold another R6.5m worth of shares. The company has been selling down shares to settle debt owed to Investec.

- Sales by directors and their associates of Argent Industrial (JSE: ART) raised a few eyebrows on the market. The CEO sold shares worth R1.35m and an associate of two other directors sold shares worth R448k.

- An associate of the CEO of Mahube Infrastructure (JSE: MHB) has sold shares worth R143k.

- The company secretary of Oceana (JSE: OCE) has sold shares worth R21.2k.

- Zeder (JSE: ZED) has obtained SARB approval for its special dividend of 5 cents per share. The current share price is R1.79.

- As has been the standard practice at Lighthouse Properties (JSE: LTE) recently, there is a scrip dividend alternative to the cash dividend that has been declared. I’m almost willing to bet which option Des de Beer is planning to take!

- Shaftesbury (JSE: SHC) has confirmed the exchange rate for its dividend, so the interim dividend will be 36.10725 ZAR cents per share. That’s not exactly an exciting yield on a share price of R29.83.

- AYO Technology (JSE: AYO) has renewed its cautionary announcement related to ongoing negotiations with the GEPF and PIC regarding the terms of the settlement agreement and the proposed repurchase of shares. AYO is also engaging with the JSE about the application of the listings requirements to this transaction.

Any comment on the failed Sanlam BEE initiative? See that Std Bank are safe with Pref share holdings but I do wonder how Patrice Motsepe and his Trusts hold their shares? Any idea of the potential impact this collapsed deal will have on normal investors using Sanlam as their investment Managers?

Hi Jane. Great questions here. B-BBEE deals are usually structured in a way that you would never otherwise structure a deal, with a tiny equity layer and tons of debt. The hope is that the dividends will cover most of the finance costs (almost never happens), with share price growth being sufficient to leave some equity behind at the end when shares are sold to pay off the debt. The winners here are the funding providers, whether debt or preference shares. Standard Bank is fine here, as they rely on exactly what has happened: Sanlam jumping in to avoid a mess. The specifics of each deal vary in terms of how much risk the B-BBEE partners genuinely take. Sometimes, they effectively get only the upside, as there is little or no initial equity contribution. Often, they also suffer a loss. In this case, Sanlam shareholders suffer the value drop, with B-BBEE effectively a cost of doing business. This would have zero impact on anyone investing in Sanlam products unless those products own a big chunk of Sanlam shares. Even then, it’s unlikely to be a material issue.