Equites joins Redefine in the property naughty corner (JSE: EQU)

A sell-off in the share price greeted the news of a nasty drop in net asset value per share

Sentiment in the property sector isn’t great at the moment. Property valuations are under pressure in this environment and that’s not good for the share prices, which are usually valued on a combination of yield and a reference to net asset value (NAV) per share.

After Redefine released results that upset the market, Equites Property Fund followed suit and fell nearly 6.5% on the day. Despite distribution per share growth of 4.1%, the market looked at the drop in NAV per share of 10.5% and acted accordingly.

The pain was especially felt in the UK portfolio, where values fell by 21.4% on a like-for-like basis because logistics yields shifted outwards by a huge 175 basis points from 3.25% to 5.00%. An increase in the South African portfolio value of 4.3% looks a little odd in that context (shouldn’t our yields also be higher?), but that local performance managed to turn a gaping wound into a bad scratch instead.

I’ve written on this topic a few times in Ghost Mail, but it is worth repeating here: property funds may offer inflationary protection in cash distributions as rentals increase, but they don’t help you with property values as the yields move higher and the values come down accordingly.

In a much simpler explanation that brings it closer to home (literally): what happens to the price of your house when interest rates have moved higher? If you aren’t sure, pour yourself a strong one before phoning an estate agent.

Industrials REIT releases the circular for the Blackstone deal (JSE: MLI)

As we already knew, the board is recommending the cash offer

An acquisition process is highly regulated and full of paperwork. You can expect to see several complicated announcements as Blackstone’s buyout offer for Industrials REIT goes through the motions.

This is especially true as the process is playing out in English law, which from my observations is even more complicated than our local takeover law. If they can go to such lengths in that country to recognise a new king, then you can imagine what a takeover process looks like.

The important point is that the directors of Industrials REIT unanimously recommend the deal to shareholders in the circular. It would be a surprise if it doesn’t get approved by shareholders.

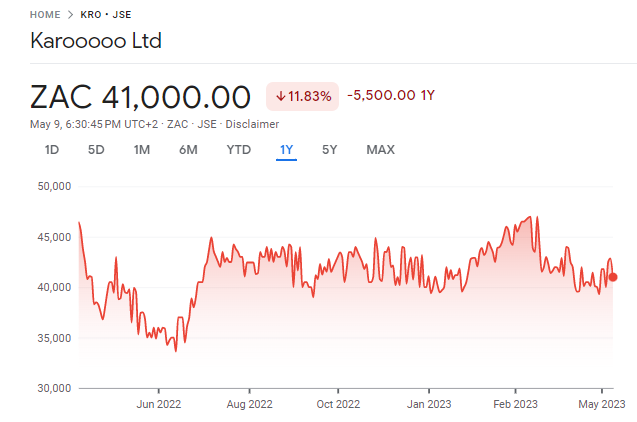

Karooooo is growing, but not as quickly (JSE: KRO)

The world’s most stubborn traded range continues

If ever you wanted an illiquid stock where you could just patiently sit on the bid or offer to try and capture the spread, you could do far worse than Karooooo:

With more sideways action in the share price than a Monster Energy drifting competition, Karooooo has released its results for the quarter and year ended 28 February 2023. The numbers aren’t going sideways even if the share price is, with subscribers up 13% year-on-year.

There’s a concern about the rate of growth, with subscriber growth in Q4 2023 coming in 31% slower than in Q4 2022. This is measured based on the number of net new Cartrack subscribers (38,471 in this quarter vs. 55,587 a year ago).

Total revenue increased by 22% on a constant currency basis and subscription revenue only increased by 16% on a constant currency basis, as the group has increasingly moved away from the focused model that made me buy shares in the first place.

The core business (Cartrack) grew operating profit by 28% for the full financial year and expanded its operating margin from 27% to 30%. That is the gem in this group.

Sadly, management continues to be distracted by the Carzuka project, a used car business that should’ve been called bazooka as a fairer reflection of what it does to group profits. The loss this year was R38 million vs. R13 million the prior year as that business scales up.

Record free cash flow for the year of R547 million was achieved vs. R379 million a year before.

Interestingly, there’s been a change in the accounting policy that sees 56% of costs of acquiring a subscriber capitalised rather than 66% a year before. This is a more conservative approach. Although there is no impact on free cash flow, it does mean that adjusted EBITDA is lower than it would’ve been under the old policy.

Can it get any worse for Quantum Foods? (JSE: QFH)

Load shedding, meet bird flu

The poultry industry is seeing absolute flames at the moment. Even Nando’s Peri-Peri isn’t a fair reflection of what’s going on out there.

Back in February, Quantum Foods released a trading statement that reflected an expected decrease in HEPS of at lest 100% for the six months ended March. In other words, the company expected to be loss-making.

An updated trading statement reflects a decrease of between 76% and 87%, which is still horrible but obviously better than expected. Load shedding and consumer pressures are causing havoc for this business and the broader industry.

Just when things were looking up, the second half of April 2023 saw an outbreak of highly pathogenic avian influenza (HPAI) at Lemoenkloof layer farm in the Western Cape. This resulted in 420,000 layers being culled at a cost of R34 million. Competitor farms in the region were also affected, so eggs are likely to be more expensive in the fairest Cape for the rest of the year.

This industry literally cannot catch a break at the moment.

Sibanye is still a rollercoaster (JSE: SSW)

Many hearts (and wallets) have been broken by this stock

If you’re looking for a steady, safe investment that won’t keep you up at night, Sibanye-Stillwater should be at the very bottom of your list. If the company isn’t dealing with a gold strike, it’s dealing with floods. When those disasters are finally gone, PGM prices fall over. It’s wild.

At least the “green” metals are starting to show signs of promise. The Finnish government is supportive of the Keliber project, having agreed to increase their equity stake to 20%. The Rhyolite Ridge JV has received support from the United States Department of Energy through a conditional $700 million loan.

The South African gold operations have returned to profitability, thankfully. It couldn’t have come at a better time, as the PGM operations have suffered a dip in production and a nasty drop in average basket prices.

With all said and done, adjusted EBITDA for the quarter ended March 2023 is down to R7.8 billion from R13.7 billion a year ago. Yikes. It even looks bad compared to the quarter ended December 2022, which came in above R10 billion.

The culprit is the local PGM business, where production was impacted by Eskom load curtailment and copper theft of all things. Adjusted EBITDA fell 43% year-on-year (admittedly vs. a record base period) and the company believes that the outlook for the second quarter is more positive.

The share price closed 11.3% lower on the day.

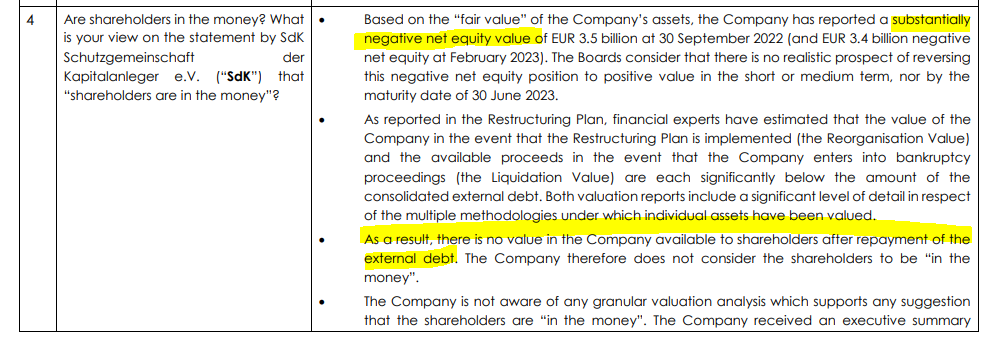

Steinhoff: what the FAQ? (JSE: SNH)

This frequently asked questions list makes for entertaining (and rather sad) reading

I don’t know how many more times the Steinhoff board needs to tell investors that the thing is worthless. A frequently asked questions (FAQ) list is the latest attempt, which you can find here.

To save you the time, here’s a pretty blunt answer to this ongoing debate:

The document even includes perhaps the most important question of all:

Jokes aside, there is some important deal news from the company. Mattress Firm and Tempur Sealy International have reached a deal that would see Tempur Sealy acquire all the shares in Mattress Firm in a cash and share transaction valued at $4 billion. Steinhoff holds an economic interest of 45% on a fully-diluted basis in Mattress Firm.

$2.7 billion of the price is payable in cash and the rest is in shares in Tempur Sealy. This will give Steinhoff a 7.5% stake in the combined company, which I’m sure makes the debt holders happy. As per the FAQ, this doesn’t exactly help the equity holders, as the price doesn’t differ materially from Steinhoff’s recent disclosures. Sorry to disappoint.

The deal is only expected to close in the second half of 2024 as there is an extensive regulatory process to be followed. The Federal Trade Commission (FTC) has requested additional information and documentary material, so this won’t be a slam dunk.

Vukile chooses more Spain vs. local pain (JSE: VKE)

And City of Joburg is living up to expectations

Let’s start with the bad news, although some on Twitter felt it might be good news.

Vukile Property Fund’s deal to acquire the Pan Africa Shopping Centre is dead. One of the conditions precedent was for the seller to obtain a written amendment to the notarial head lease from City of Joburg (COJ). It’s hard enough to renew a driver’s licence with those people or pay a traffic fine, so I have no idea why anyone thought this would be successful. Unsurprisingly, the initial deadline of November 2022 was pushed out to April 2023 and then missed again.

The deal is off and I wish the seller luck in ever successfully selling this property. Relying on COJ for something is a horrible position to be in.

Perhaps reminded of just how poorly run parts of our country are, Vukile has exercised its call option to acquire more shares in the Spanish subsidiary, Castellana Properties. This is for a meaty amount, coming in at €63.9 million (note the currency). When this is finalised, Vukile will own 99.6% of Castellana.

Little Bites:

- Director dealings:

- GMB Liquidity (an associate of newly minted Grand Parade Investments (JSE: GPL) director Greg Bortz) is still mopping up shares in the company, this time buying R2.67 million worth of shares.

- Two prescribed officers of Capitec (JSE: CPI) have bought shares worth R2.15 million in total.

- An associate of Gareth Ackerman has bought shares in Pick n Pay (JSE: PIK) worth R627k as the price has continued to slide.

- A director of KAL Group (JSE: KAL) has bought shares worth R22.7k.

- OUTsurance Group (JSE: OGL) has completed the acquisition of 50% in Youi Holdings (the Aussie business) from Willem Roos, co-founder of the business. Minority shareholdings are a feature of the OUTsurance structure, as OUTsurance Group only owns 89.7% of OUTsurance Holdings, which in turn has bought the 50% stake.

- Octodec (JSE: OCT) has announced a new asset and property management agreement with City Property Administration (CPA). As a reminder of how incestuous the property industry actually is, this is a related party deal as the chairman and managing director of Octodec are also shareholders in CPA and directors of that company. CPA also holds shares in Octodec. With more surprising related parties running around than at a hillbilly’s birthday party, an independent expert will need to opine on the agreement and a circular will be released to shareholders.

- Investors in Ethos Capital (JSE: EPE) should note that an investor update presentation will be made available on Wednesday morning as part of an event scheduled for 9am. I’ll revisit it in Ghost Bites this week.

- PSV Holdings (JSE: PSV) is suspended and in business rescue. The updates are always a bit of a soap opera, with the latest news being that DNG Energy will put forward a proposal to recapitalise the company during the next 3 months.