Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Equites is focused on “portfolio optimisation” (JSE: EQU)

And in the meantime, the distribution is heading lower

With a share price down around 25% this year, it hasn’t been a happy time for Equites. The logistics-focused fund has been hurt by the interest rate cycle and these types of funds were generally trading at lofty valuations coming into this year, unlike office funds that had been decimated during the pandemic.

The strategy with the portfolio is to reduce exposure to land holdings (down from 8% of portfolio value to 5%) and dispose of the UK development pipeline, while also selling non-core assets with sub-optimal sustainability credentials. Equites owns 60% in the ENGL development platform in the UK and the idea is to sell non-income producing assets in favour of income-producing assets. The long term impact is a smaller land bank, which may hurt growth down the line. For now though, the focus is on reducing the loan-to-value ratio.

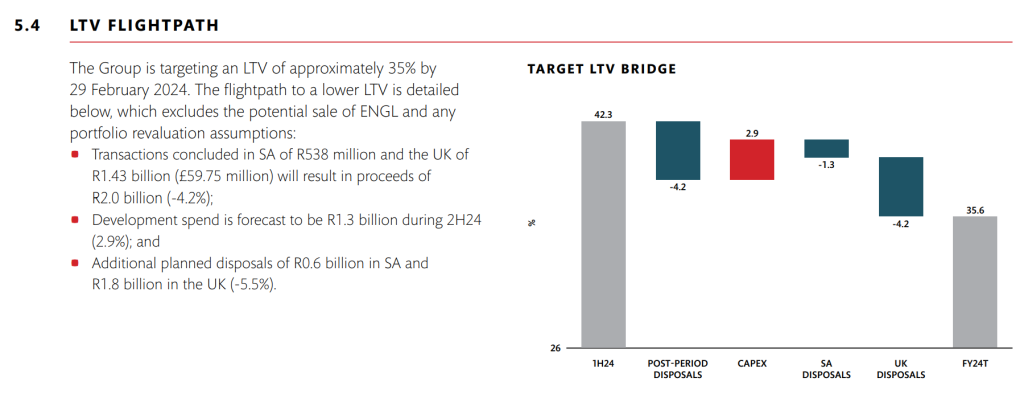

The results include this creatively named “LTV flightpath” that reflect the target of 35.6% by February 2024:

The SA and UK portfolios are performing “in line with expectations” – and those expectations were clearly for a drop, as distributable earnings fell 19.6% for the six months to August. The dividend per share is down 19.9%. The net asset value per share is down 10.9% to R16.73, with the share price having closed at R12.60.

Despite the obvious pressure in the markets in which Equites operates, the SA portfolio valuation increased by 1.7% and the UK is up 2.1% in GBP terms.

At this stage, Equites is focused on pre-let developments in South Africa. No further substantial development expenditure in the UK is expected.

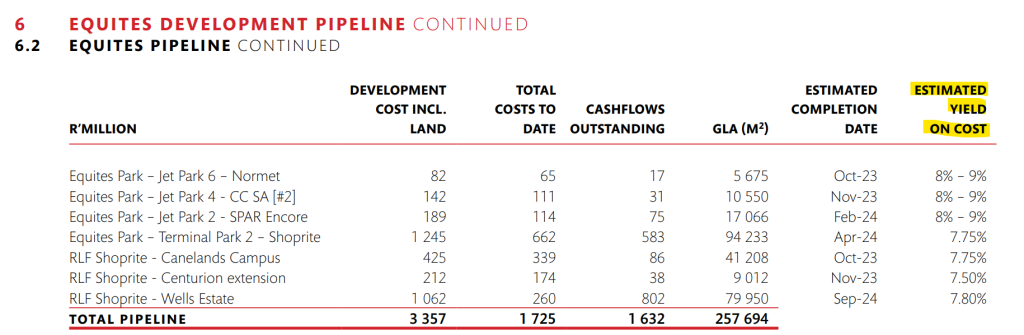

To give you an idea of why developments are under pressure, look at the initial yield on these developments and consider them in the context of where 10-year government bond yields in South Africa are sitting (10.8%):

The principle is that over say 20 years, the internal rate of return ends up being attractive. In the initial years though, the yields aren’t lucrative.

Based on the interim dividend of 65.37 cents, the annualised yield is 10.4%. I’m not a buyer at that yield.

MiX Telematics has attracted a US suitor (JSE: MIX)

The lovely news is that we won’t be losing a listing here

There’s just about an audible groan when we see an offer come in for a JSE-listed company, as it inevitably ends in the loss of yet another listing on the local market. The good news is that this is a share-for-share offer to MiX Telematics shareholders by a company named PowerFleet and the plan is for the enlarged PowerFleet to list on the JSE, so we’ve actually gained something as a market in the form of additional underlying businesses to consider.

I know, right? Unreal.

PowerFleet describes itself as being a global leader in “Internet of Things” solutions, so the buzzwords are coming to our market. That’s really just a fancy way of talking about monitoring of assets and related services. The company has been listed on the Nasdaq since June 1999. It also happens to be listed on the Tel Aviv Stock Exchange.

If the deal goes ahead and MiX Telematics shareholders swap their shares for a holding in the enlarged PowerFleet instead, then they will hold 65.5% in that enlarged company. In other words, PowerFleet isn’t exactly a global giant planning to swallow up MiX, which explains why the JSE listing of PowerFleet will be part of the deal.

The enlarged business would obviously have the benefits of scale, with lots of promises around the combined data strategy and R&D capabilities as well. One would certainly hope that liquidity will benefit as well.

The share price closed 15.6% higher on the day, with the scheme circular and prospectus due for circulation on 5 December. This will be an interesting one to dig into!

Nikkel Trading acquires another block of Brikor shares (JSE: BIK)

More shares have changed hands at 17 cents per share

On 12 September, Brikor announced that Nikkel Trading 392 reached a 64.11% holding in the company. This triggers an offer to remaining shareholders at a price of 17 cents per share.

This doesn’t preclude Nikkel Trading from picking up more shares along the way, also at 17 cents per share. This is exactly what has happened, with the stake now up to 68.01%.

Sappi is facing serious challenges in graphic paper (JSE: SAP)

Another European mill faces closure

Cyclical businesses are tough things to stomach. It gets even more volatile when you look at specific segments in Sappi, rather than just the businesses as a whole. For example, the graphic paper market is struggling with overcapacity, which means there simply isn’t enough demand for the level of supply. This forces periods of downtime at the mills, which destroys profits.

In July 2023, Sappi started the process to possibly close the Stockstadt Mill in Germany. An agreement has been signed to sell the site, although the announcement also mentions that the site will be closed during Q1 of 2024. Either way, the impact on Sappi is cash neutral.

As conditions have worsened since then, the Lanaken Mill in Belgium is next on the list. A closure is possible, although Sappi is also looking at how to cut overheads, presumably in an attempt to avoid closure and the impact on the 644 workers at the mill.

Sappi will continue to serve the graphic paper market through the mills that can operate competitively. The overall focus in Europe is the packaging and specialities segment. In a business like this, it’s all about knowing where to focus.

Southern Palladium gives us a geology lesson (JSE: SDL)

Latest drilling results from Bengwenyama have been released

Junior mining updates are incredibly good at alienating nearly everyone. For example, here’s an actual sentence from the Southern Palladium announcement: “Assay results for 39 UG2 intersections from SPD’s 70% owned Bengwenyama project have now returned an average grade of 8.00g/t (3PGE+Au) and 9.63g/t (6PGE+Au) over an average reef width of 69cm.”

Wonderful. I’m sure someone, somewhere knows what that means.

I always just skip to the commentary by the executives, in this case noting that the consistency of the grade and continuity of the reef continue to be confirmed by the latest drilling results. You don’t need a geology degree to understand that this is a good thing.

The company is busy with a second Mineral Resource update, scheduled to be announced in the fourth quarter of this year.

Little Bites:

- Director dealings:

- If I understood the announcement correctly, two directors of Capital & Regional (JSE: CRP) exercised options for shares worth R1.3 million. I usually ignore share awards, but the difference here is that the directors cash funded the tax i.e. didn’t sell shares to cover the tax. That’s a buy in my books.

- A prescribed officer of Sasol (JSE: SOL) retained shares worth R4.7 million and sold shares worth R4.3 million. I’m including this as a good example of how share-based awards usually play out, with a big sale to cover the tax.

- Substantial share awards have vested for several ADvTECH (JSE: ADH) directors. The announcement doesn’t note any selling, but I’ll be surprised if we don’t see any in days to come.

- The current CFO of Hulamin (JSE: HLM), Mark Gounder, has been appointed as the CEO of Hulamin. He replaces Geoff Watson who was appointed interim CEO in October 2022. Pravashni Nirghin will be appointed as interim CFO, an internal appointment.

- The CFO of WBHO (JSE: WBO), Charles Henwood, is retiring after 12 years in the role. His replacement is Andrew Logan, who has been with the group for 20 years.

- I’ve previously noted a truly poetic end to Steinhoff’s (JSE: SNH) unfortunate life, with the company due for liquidation on Friday the 13th. This is also the date on which the company will be delisted in Frankfurt. The JSE delisting date is the 16th of October. Good riddance.