Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Ethos Capital’s year was heavily impacted by Brait (JSE: EPE)

And not in a good way

Ethos Capital has reported a 17.9% decline in group net asset value per share for the year ended June. That’s a nasty outcome, with the precipitous decline in the Brait share price of 73% as the major driver of the problem. The Brait hot potato was subsequently passed to shareholders in the form of an unbundling, but the damage was done in the FY24 results.

At least the unlisted portfolio put in a better performance, with revenue growth of 12% and EBITDA growth of 18% when viewed overall. Optasia is the biggest investment in the group and achieved EBITDA growth of 10% in USD. The valuation has unfortunately been impacted by the Nigerian currency issues.

There were various sales of underlying assets in the year under review. The disposals were achieved at a premium to carrying values, so that does give some support to the director’s valuations of the assets.

The net asset value per share at the end of June was R7.03. Adjusting for the Brait unbundling, it would drop to R6.58. The current share price is R5.00, so the discount to net asset value has reduced considerably.

MC Mining focuses on the future with Kinetic Development Group (JSE: MCZ)

The numbers for the year ended June show why this capital raise is necessary

MC Mining has attracted investment from Kinetic Development Group, a company listed in Hong Kong. When all is said and done and assuming all approvals are obtained, Kinetic will hold 51% in the company. The appeal is definitely the underlying mining assets and what they could achieve in future rather than what they are achieving today.

This is confirmed by the loss after tax of $14.6 million in the year ended June, of which non-cash charges were $5.9 million. If you can believe it, revenue was $36.7 million and cost of sales was $36.5 million. It’s not every day that you’ll a company that is barely break even at gross profit level!

Going forward, it’s all about the Makhado Project and what can be achieved with the substantial foreign investment.

Nampak has successfully refinanced its group (JSE: NPK)

This is a major achievement after plenty of hard work and asset disposals

Blood, sweat and more tears than usual – that’s surely been the story of Nampak’s journey to refinance the balance sheet. Lenders required the company to repay R720 million in net debt by the end of September 2024 and this was achieved through various asset disposals. The disposal of the Nigerian Beverage business is still underway and wasn’t required to achieve that specific debt milestone. There are still other assets classified as discontinued operations as well.

Thanks to these heroics, Nampak has managed to conclude the refinancing of the group with a simplified funding structure that has only a small foreign debt element to it. Standard Bank has financed it in full, but Nampak has the option to include other lenders in the structure by 25 March 2025. Debt covenants have also been reset.

Results for the year ended September are due for release on 2 December.

Netcare is on track to meet full-year guidance (JSE: NTC)

This income statement shape looks encouraging

Netcare has released a voluntary update on how things looked for the year ended September. Overall, it sounds pretty decent, with the group believing that full-year guidance was met and strategic project goals were achieved.

Group revenue is expected to have increased by between 5.5% and 6%, while normalised EBITDA margin should be up by between 25 and 60 basis points thanks to a decent effort on costs and the level of investment in new projects. It also helped that diesel costs more than halved year-on-year thanks to reduced load shedding. Total capex of R1.4 billion is expected to be in line with guidance.

This implies an encouraging shape to the income statement, with margins up and cash flows hopefully following suit. To add to what should be a good outcome for HEPS, the group repurchased 60 million shares during the year. Since September 2023, they have repurchased 5.9% of total shares in issue at an average price of R12.27 per share (well below the current price of R 15.35).

As has been the recent theme, growth in the mental health business has been stronger than in the acute hospital business. As another sign of the times, the trend of declining maternity cases is continuing.

On the topic of NHI, government has requested Business Unity South Africa to put forward specific proposals on issues of concern. There’s still much uncertainty in this sector going forward.

GNU-related benefits are taking their sweet time to get to PPC (JSE: PPC)

The recent months have been disappointing and the outlook doesn’t sound very bullish

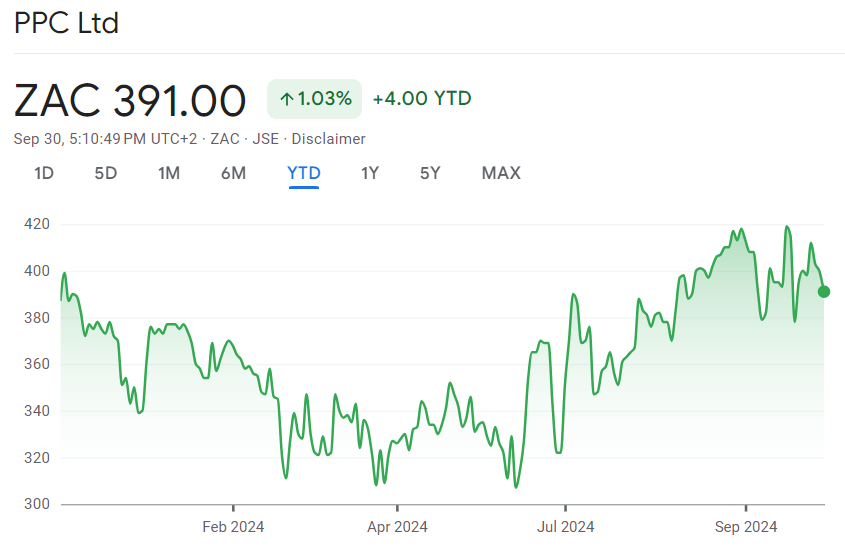

PPC is a name that came up pretty often on stock picking lists for an environment of improved South African sentiment. Alas, the share price is actually flat for the year, although it did indeed get quite the bump in the aftermath of elections:

The earnings haven’t caught up to the recent exuberance in the slightest. In fact, for the four months to July, group revenue fell by 2.1%! SA and Botswana were down 1% and Zimbabwe fell 4.5%. Zimbabwe is an important part of the group with a 30% revenue contribution over the four months, so the dip there is a worry. Remember that PPC recently sold the business in Rwanda, hence why you won’t see any further references to that country.

Cement contributes 90% of group revenue at PPC, so that is clearly the key product. Although selling prices increased, sales volumes were 5.3% lower than the comparable period. In South Africa and Botswana, cement volumes were down 4.6% and selling prices increased 5.5%, so revenue was up 1.6%. In Zimbabwe, cement volumes were down 10.9% and prices increased 4% in dollars, helping to mitigate the pain in revenue.

Remember that South Africa and Botswana saw a revenue decrease of 1% overall, so this tells you that the materials business (which includes the readymix products) had a tough period.

At least the materials business managed to improve its EBITDA to be slightly positive vs, slightly negative in the base period. That trajectory is more than we can say for cement, where EBITDA declined by 10.4%, with EBITDA margin down from 11.6% to 10.3%. The South African cement business is the focus of turnaround efforts. As for Zimbabwe, EBITDA margin fell from 29.8% to 29.0%.

Due to these underlying pressures, group EBITDA margin declined from 15.9% in the comparable period to 13.7% in this period. This means that EBITDA has fallen year-on-year. Despite this, cash generation increased from R129 million to R192 million as working capital improved, particularly on the inventory line. This helped group cash balances increase despite the payment of an ordinary dividend in this period. Group debt sits at R775 million and cash is at R969 million.

Zimbabwe is an important part of the group with a 30% revenue contribution over the four months, so the dip there is a worry. A $4 million dividend has been declared by the Zimbabwe business in September 2024, so cash is still making its way to the mothership.

The outlook section isn’t hugely comforting, with PPC noting that there is “still no clear evidence of large-scale infrastructure or retail developments” – these things take time, but it would be nice to see momentum. The overall outlook for South Africa and Botswana is described as subdued, while Zimbabwe’s outlook is positive only thanks to cost containment, with volumes under pressure there due to imports.

A bright Rainbow indeed (JSE: RBO)

Full details of a strong turnaround year are now available

Rainbow Chicken has released results for the year ended June 2024. Although revenue was only up 7.9%, it was enough to help them move through the inflection point at earnings level. For example, EBITDA increased by R599.9 million to R629.7 million! When people talk about revenue “dropping to the bottom line” in a business with high fixed costs and low variable costs, this is what they mean.

We’ve seen these numbers before, as they were included in the RCL Foods earnings release because Rainbow was still part of RCL as at the reporting date. To give shareholders more information and to make sure the performance is clear, Rainbow has now released its own set of financials that are effectively an extract from the RCL results. You’ll find them here.

There really aren’t many highlights at Spar (JSE: SPP)

The Switzerland business is looking like the next headache in line after Poland

As you may recall from recent announcements, Spar is literally paying to get rid of its business in Poland. That’s not something you’ll see too often, with the group having to raise debt facilities just to be able to get out of there! It’s a proper mess.

With the business in Switzerland reporting a 5.8% decrease in turnover in local currency for the 47 weeks to 23 August, I’m starting to wonder if that might be next on the list of problems. People in Switzerland literally travel across the border to buy groceries because it’s a cheaper option. That doesn’t sound like a great business, with Spar “assessing” the business and deciding what to do next.

At least BWG Group in Ireland and South West England was up, with turnover growth of 2.6% in EUR and 7.0% in ZAR. The business in England suffered a decline in volumes.

This leaves us with the South African business as the only other potential source of good news. There are a couple of highlights, like pharmaceutical business S Buys up 14.9% and liquor sales up 10.5%. Thanks to Build it managing just 1.2% growth and core grocery putting in a pretty soft performance, total sales in South Africa only increased by 3.5%.

Overall, this is a slowdown from the numbers we saw for the first half of the year. They have a lot of work to do to sort the business out. Prepare yourself for more IT drama, as they are planning their rollout of SAP at the remaining distribution centres. Somehow, I’m not confident that it will go well after the catastrophe in KZN.

York’s numbers are all over the place (JSE: YRK)

Revenue up, adjusted EBITDA and cash flows down, yet there’s a swing into headline profits

The first thing to understand about York Timber is that the accounting rules for biological asset valuations lead to some pretty huge swings. For example, the fair value adjustments on those assets was positive R250 million in the year ended June vs. negative R386 million in the comparable year. That’s a casual swing of over R630 million!

In the context of a net profit for the year of R136 million this year vs. a loss of R313 million in the prior year, you’re hopefully starting to see the problem here in terms of earnings consistency. The biggest driver by far is the underlying valuation of the plantations, which in turn is impacted by various economic factors.

This is why I tend to look at metrics like revenue (up 5%), adjusted EBITDA before the fair value movements (down 17.9%) and cash generated from operations (down by a nasty 78%). I find that more useful than getting excited about a move from a headline loss per share of 75.89 cents to HEPS of 30.11 cents that was mainly driven by fair value moves.

Nibbles:

- Director dealings:

- The group COO of Woolworths (JSE: WHL) sold shares worth a whopping R38 million. The group company secretary sold shares worth R3.9 million and directors of major subsidiaries sold shares worth R12.6 million. I’ve excluded the one sale in the batch that was related to tax obligations.

- The CFO as well as a prescribed officer of WBHO (JSE: WBO) sold shares worth a total of R7.3 million.

- A director of Sun International (JSE: SUI) sold shares worth nearly R4.5 million.

- A director of Anglo American (JSE: AGL) bought shares in the company worth around R2.6 million.

- Directors of Goldrush Holdings (JSE: GRSP) participated in the swap to receive Astoria (JSE: ARA) shares in exchange for Goldrush shares to the value of R1.4 million. Over half of that amount relates to directors who are also on the board of Astoria and so there is a director dealings announcement for both companies.

- A non-executive director of Metrofile (JSE: MFL) has added to the recent buying of shares by directors at the company, this time to the value of R335k.

- MultiChoice (JSE: MCG) announced that the merger control filing for the Canal+ deal has been submitted on a joint basis to the Competition Commission. They are also engaging with ICASA and other relevant regulatory authorities.

- Burstone (JSE: BTN) has released the circular dealing with the proposed sale of a majority stake in the Pan-European Logistics portfolio to Blackstone. Support from holders of 50.27% of shares in issue has already been received. Burstone incurred a massive R159 million in transaction costs, with the overseas advisors charging an absolute fortune. The circular is available here.

- In other circular news, Metair (JSE: MTA) released the circular dealing with the disposal of the shareholding in the Turkish business. The bill there is R55.4 million, with RMB getting the lion’s share with a R25.4 million fee. You’ll find the circular here.

- Renergen (JSE: REN) released a quarterly update that doesn’t have much in the way of fireworks. The focus now is on achieving stable LNG and helium production over a meaningful time period. Annual maintenance was completed in September and the key will be to avoid any production issues. The company also spent R8.3 million on drilling two high helium concentration wells in the Free State.

- TeleMasters (JSE: TLM) is a step closer to potentially being the subject of a mandatory offer. In a previous announcement, they noted that the two largest shareholders had been approached by a B-BBEE investor to sell their shares. If they do, it’s big enough to trigger a mandatory offer for the rest of the shares by that investor. The legal and financial due diligence is done and the investor has submitted a funding application to a financial institution. If that goes well, then there could be an offer on the table. There are absolutely no guarantees of this.

- Insimbi Industrial Holdings (JSE: ISB) reminded the market that earnings for the six months to August are expected to decrease by at least 20%. The company has been negatively impacted by difficult local and international trading conditions.

- Mantengu Mining (JSE: MTU) announced that subsidiary Meerust Chrome has installed and dry commissioned its JIG plant that is expected to produce 7,500 tonnes per month of chrome chips. They are aiming to complete the cold and hot commissioning within 45 and 60 days respectively. This coincides with various upgrades to the existing chrome beneficiation plant.

- Junior mining group Southern Palladium (JSE: SDL) is busy with completing a pre-feasibility study for the Bengwenyama PGM project. This means that their annual financials at the moment are all about cash burn, as there is no revenue. The operating loss for the year was A$6.7 million, which is below A$7.2 million in the prior year. The group has cash of A$5.4 million.

- Sasfin’s (JSE: SFN) results are delayed due to the audit not being finalised in time. The annual financials for the year ended June are expected to be released by 14 October.

- In great news, the suspension of the listing of Efora Energy (JSE: EEL) was lifted today, so trade can finally take place in the shares once more. From time to time, companies do make it back from being suspended.

- Here’s a perfect example of a company that is struggling to get its listing back on track: PSV Holdings (JSE: PSV) has been suspended for ages and has renewed its cautionary regarding negotiations with DNG Energy and a potential recapitalisation of the company. I can never find PSV’s website, which tells you how long this suspension has been going on for.

- Chrometco (JSE: CMO) is getting closer to getting its suspension lifted at least, with the audits of 2022 to 2024 underway. The group also noted that the business rescue practitioner for subsidiary Black Chrome Mine is following a Mine Restart and Trade Out Plan approach, with that mine being restructured into an integrated chrome producer and processor with a low risk strategy.

- In the fourth and final example for the day of a suspended company, Conduit Capital (JSE: CND) noted that work is underway on the accounts for the six months to December 2022. Thanks to the mess around its subsidiaries, they really are that far behind. There are a bunch of moving parts, ranging from attempted sales of underlying businesses through to efforts to enforce an award of R50 million that was made in favour of the company against a business in the Trustco group.