Exxaro suspends its CEO (JSE: EXX)

The Finance Director has been appointed as interim CEO

This is the kind of thing that you certainly don’t see every day: the suspension of a listed company CEO. Exxaro has announced that Dr. Nombasa Tsengwa has been placed on precautionary suspension, pending the outcome of an independent investigation by ENS into allegations relating to workplace conduct and governance practices.

They are talking about a need to “stabilise leadership” and if you do some research into this, you’ll find articles about recent resignations of several executives at Exxaro.

Riaan Koppeschaar, the current Finance Director, has been appointed as interim CEO.

It will be very interesting to see the outcome of the investigation!

MAS Real Estate’s share price has fully recovered from the wobbly around dividends (JSE: MAS)

Management’s conservative approach has paid off here

The management team of MAS Real Estate took the brave but necessary decision in mid-2023 to stop paying dividends. This was based on their forecasts regarding debt refinancing requirements and the state of capital markets for funds that don’t have high quality credit ratings, particularly in emerging markets.

As this chart shows, the share price has fully recovered since the sell-down in 2023 when the market panicked about the lack of dividend:

Those who simply held their shares throughout the noise haven’t done well, as they haven’t received dividends along the way and have simply recouped their capital value. The worst decision in retrospect was to sell after the panic, with the best decision being to buy into the panic. It doesn’t work out like this every time, obviously, or nobody would ever panic!

In a voluntary trading update, MAS indicated that the Central and Eastern European countries in which it operates have performed strongly. Like-for-like tenant sales increased 7% year-on-year for the four months to October. Occupancy rates are stable and so are occupancy cost ratios, so that all sounds good. This is driving diluted adjusted distributable earnings guidance for the year to June 2025 of 9.54 to 10.45 eurocents per share.

The management team has made a great deal of progress on the balance sheet, although there is still more to do. Also keep in mind the recent cautionary announcement regarding a potential acquisition of Prime Kapital’s 60% interest in the joint venture between the parties. This would give MAS better credit rating prospects, which would in turn assist with getting the balance sheet right.

Resilient gives slightly better guidance for full-year earnings (JSE: SPG)

The stake in Lighthouse seems to be the highlight at the moment

Resilient released a pre-close update for the year ending December. The South African retail portfolio hasn’t had the best time of things, with sales up 2.9% during the 10 months to October 2024 or 3.6% on a rolling 12-month basis. This is despite the exposure to malls in lower-income areas, which are generally seen as high growth opportunities.

Resilient has been busy with construction activities at several malls, so that impacts sales. A further challenge has been the mining industry performance, hurting malls in key mining areas. There have been some other delays as well, related to key tenant decisions and even labour unrest!

It seems like a scrappy period overall for the local portfolio, although at least lease renewals came in 4.7% higher and new leases were a juicy 15.9% higher.

The likeliest source of the slight uptick in guidance is therefore the performance of Lighthouse (JSE: LTE), as Resilient owns 30.4% of that group. Lighthouse released an update recently that shows exactly why a country like Spain is seen as lucrative.

When interim results were released, Resilient estimated that the full-year distribution would be 428 cents per share. They have upgraded this slightly to a range of 428 to 433 cents per share.

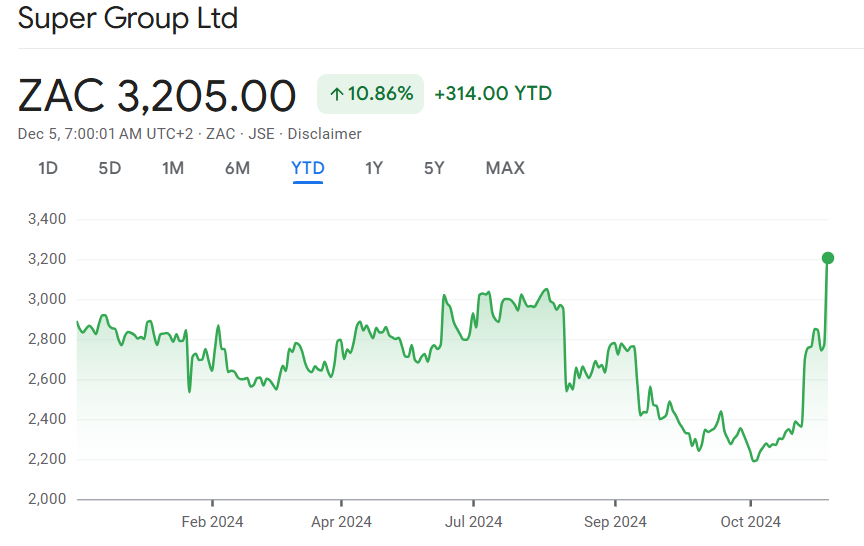

It’s go-time for the Super Group disposal of SG Fleet in Australia (JSE: SPG)

The Super Group share price jumped 15.6% in response

Towards the end of November, Super Group announced that a potential bidder was sniffing around SG Fleet in Australia. Agreeing to a really tight deadline for a due diligence and binding offer seems to have worked, as Pacific Equity Partners came through with a scheme implementation deed at AUD3.50 per SG Fleet share.

SG Fleet is separately listed, so that would’ve helped greatly with the due diligence. Here’s the SG Fleet share price chart, showing how well-timed the offer was:

And here’s Super Group, with this good news helping to reverse some of the damage from the poor performance of the German economy and other jitters around new car sales:

Of course, this deal doesn’t fix any of the other challenges being faced by Super Group. It’s just a really helpful value unlock. If the deal ends up being implemented, Super Group will receive R7,53 billion for its 53.584% stake in SG Fleet. They plan to use up to R1.96 billion to reduce debt, which will take the net debt to EBITDA ratio way down from 2.96x to 0.77x. That’s going to make a big difference!

The remainder of the selling price will be used for a special distribution to shareholders in Super Group of around R16.30 per share depending on exchange rates at the time.

This is a Category 1 transaction, so a circular will be issued and shareholders will vote on the deal. I can’t see them saying no.

Strong numbers at Sygnia (JSE: SYG)

The group now has over R350 billion in assets under management

Credit where credit is due: 10.1% growth in assets under management and administration at Sygnia is impressive. It’s especially impressive when some other players in the industry have thrown their hands in the air and claimed that they simply cannot grow assets due to South Africa’s savings culture. It’s amazing what a bit of innovation can achieve, with Sygnia having achieved net inflows in the retail business of R3.1 billion for the year.

This performance has driven revenue growth of 12.1% and profit after tax growth of 15.6%. Diluted HEPS came in 15.9% higher, which is excellent.

The disappointment is surely the dividend, which for some reason is up just 3.3%. A capital-light business like this should have a consistent and high payout ratio, so I found this rather odd. I couldn’t find any commentary in the report that gives a satisfactory explanation for the decrease in the payout ratio.

It’s certainly not due to any underlying worries about the business, as they sound very confident about exceeding R400 billion in assets under management soon!

More of a meow than a roar at Tiger Brands – yet the market liked it anyway (JSE: TBS)

The share price is up roughly 30% year-to-date

Tiger Brands released results for the year ended September. The underlying metrics aren’t going to blow your socks off, with revenue up just 1% and HEPS up by 4%. The total dividend for the year is 4.3% higher. None of these percentages provide a good explanation for the share price move this year, which tells you that the market is baking in some strong assumptions around growth and the ongoing recovery.

Within the revenue story, we find price inflation of 7% and volume declines of 6%. Consumer affordability is clearly still an issue. The price increases did good things for gross margin though, up from 27.7% to 28.3%. This was further boosted by manufacturing efficiencies.

Operating income was pretty flat for the year. Income from associates increased 4% thanks to Carozzi. On the downside though, net finance costs jumped by a nasty 25.6% thanks to higher debt levels and interest rates in the first half of the year.

The sale of non-core businesses resulted in Tiger banking a substantial non-operational profit on those disposals. This is the major reason why earnings per share (EPS) increased 13% and headline earnings per share (HEPS) only increased by 4%. HEPS excludes stuff like profit on sale of businesses.

The market is looking for things to like about this turnaround, so a metric that probably stood out for investors was the volume performance in the second half (-2%) vs. the first half (-9%). I must point out that price inflation was 5% and 8% respectively, so it’s not as though there was a volume recovery with prices held equal. When inflation is lower, one would expect volumes to do better.

Another potential highlight is in cash operating profit, which increased from R4.3 billion to R4.8 billion. Together with working capital improvements, this took the group to a net cash position vs. a net debt position at the end of the comparable period. This will make a big difference to HEPS in the coming year.

Looking deeper, the more staple products are particularly competitive, as evidenced by the milling and baking division suffering a 10% revenue drop and a 7% decline in operating income. There are a lot of bakeries out there selling bread. On the more unusual stuff, like in the Culinary division, revenue was up 5% and operating income was 51% higher.

Over the short- to medium-term, Tiger expects volume growth of 1% to 3% and revenue growth ahead of inflation, with operating margin in the high single digits.

Nibbles:

- Director dealings:

- Adding to the recent slew of derivative trades and forced sales under collar structures, we have more trades by Adrian Gore at Discovery (JSE: DSY). The forced sales were worth R137 million. He’s also added another collar structure, buying puts (downside protection) with a strike price of R164 per share and selling calls (giving away upside) with a strike price of R278 per share. The current share price is R194 and these options expire in 2027.

- An executive member of the board of directors of Richemont (JSE: CFR) sold shares worth R11.2 million.

- The CEO of Growthpoint (JSE: GRT) sold shares worth just over R7 million.

- A prescribed officer of Omnia (JSE: OMN) received share awards and seems to have kept the whole lot, with a value of R2 million. This is towards achieving the minimum shareholding requirement in accordance with Omnia’s policies though, so I’m not sure it counts as a bullish signal in the traditional sense.

- A director of Clicks (JSE: CLS) has bought shares worth just under R1 million in terms of the minimum shareholding policy at the group. As with Omnia above, I’m not sure how much flexibility the directors have in terms of timing to achieve this, so it’s not the strongest bullish signal around.

- A director of a major subsidiary of The Foschini Group (JSE: TFG) sold shares worth R700k.

- A prescribed officer and director of a major subsidiary of Mpact (JSE: MPT) sold shares worth just over R200k.

- You might recall that Nampak (JSE: NPK) had to jump through a few hoops to get the share incentivisation package for its key turnaround execs across the line. The issuance of shares has finally settled, so Nampak shareholders should feel good about the level of management alignment here.