Gemfields doubles down on Mozambique (JSE: GML)

The company is making its largest-ever single investment

It really wasn’t that long ago that the Gemfields share price was coming under a lot of pressure from violence in Mozambique. Thanks to what is essentially terrorist activity in the region, many investors got spooked.

Perhaps thanks to the right working relationship with government, the Montepuez Ruby Mining (MRM) business has managed to escape harm. Gemfields is clearly feeling confident about its future there, as the company has committed to constructing an additional processing plant at the facility.

This project will triple MRM’s processing capacity, so the company must also be feeling good about ruby prices achieved at recent auctions.

The investment required is around $70 million but the price has actually been agreed in rands. The cost is spread over three years, starting in 2023 and on a 30% | 60% | 10% basis. The mining fleet will also need to be expanded in 2025 as this processing plant is put to work.

Impala Platinum flags a big drop in earnings (JSE: IMP)

Sales volumes and price per ounce both fell this year

This environment has been somewhat of a perfect storm for the mining industry, particularly the local platinum players although we’ve also seen pain at the likes of AngloGold. In a trading statement, Impala Platinum has flagged a drop in HEPS for the year ended June of at least 20%.

Importantly, that is the minimum required disclosure from a JSE perspective. I would wager that the earnings drop is a lot worse than that.

Group production increased by 2% (managed operations up 6% and joint ventures down 1%), hamstrung by issues ranging from load curtailment by Eskom through to cable theft challenges. Mining in South Africa is an extreme sport, with the operations in Zimbabwe also suffering load shedding.

Producing the stuff is one thing. Selling it is quite another. Sales volumes fell by 6% and the price per ounce dropped by 4% per ounce in rands. Even a 16% depreciation of our currency against the dollar wasn’t enough to offset the pressure on PGM pricing.

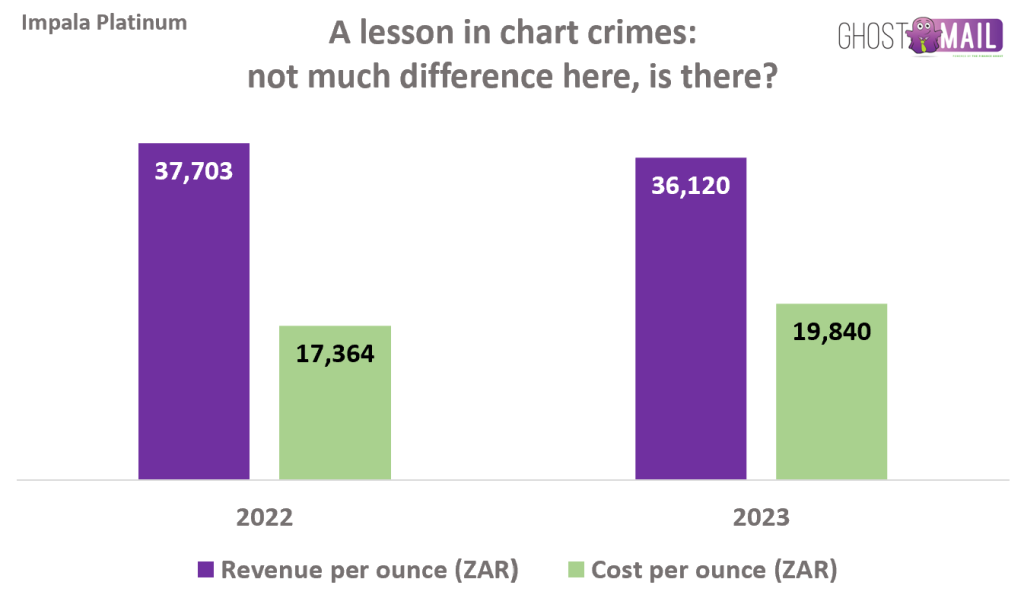

To make it worse, Impala Platinum didn’t escape the inflationary pressure on input costs. Whenever a company doesn’t disclose a comparative number, it’s because the answer is ugly. I went digging in the 2022 report and discovered a cost per 6E ounce of R17,364 vs. the cost this year of R19,840. The price per ounce sold fell from R37,703 per 6E ounce to R36,120.

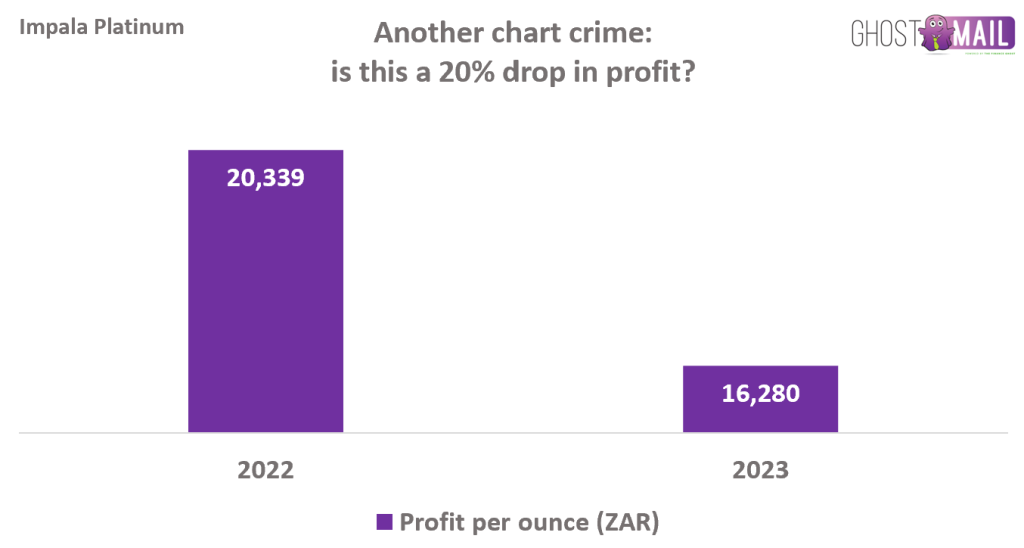

So, this tells us that profit per 6E ounce has been smashed from R20,339 per 6E ounce to R16,280 per ounce. That’s a 20% drop in profit per ounce along with a drop in sales volumes of 6%.

A 20% drop in HEPS? It’s going to be a whole lot more than that. The free cash flow is going to be even worse, with capital expenditure up from R9.1 billion to R11.5 billion.

As an aside, I decided that the Impala Platinum numbers would be perfect to use in illustrating chart crimes to you. This is no reflection on the company whatsoever – I simply used these numbers to make the point clear to you. After all, Ghost Bites is all about empowering you to be a better and more informed investor and trader.

The first crime is when a big difference is made to look like a small one:

The second crime is when a fairly big difference is made to look absolutely gigantic:

The lesson here? Be very aware of charts with a Y-axis that has been set up to trick you. This is especially problematic when the Y-axis is hidden and there are no gridlines, like in these examples!

Pan African achieved revised production guidance (JSE: PAN)

Net debt has come down significantly

Back in May, Pan African Resources gave the market revised production guidance. Considering that the year-end of June was soon thereafter, one would hope that the company would have met that guidance. This is indeed the case, with production of 175,209oz.

Sadly, this is well off the record production achieved in FY22 of 205,688oz. The group has given production guidance for FY24 of 178,000oz – 190,000oz, so that’s still not a recovery to FY22 levels.

All-in sustaining cost is between $1,325/oz and $1,350/oz, significantly higher than $1,284/oz in the prior year. When production levels come off, the cost per ounce increases.

The good news is that net debt declined from $49.9 million at the end of December 2022 to $18.9 million at the end of June.

PPC executes an employee B-BBEE deal (JSE: PPC)

This deal is for 10% of PPC South Africa, but is the funding rate too high?

There are a number of different approaches to B-BBEE transactions. Whilst I continue to wish that the universe of investable B-BBEE schemes on the JSE would improve, the reality is that most companies seem to shun this approach in favour of either employee schemes or that old favourite, a well-connected consortium.

PPC has at least taken the route of empowering employees, with a deal for 10% of PPC South Africa that will be weighted in favour of historically disadvantaged individuals. To facilitate the deal, PPC will loan R380 million plus R975k for securities transfer tax to the B-BBEE trust. The loan will be repaid through allocating 75% of dividends to the debt, with 25% distributed to the trust’s beneficiaries. As “trickle dividends” go, that’s quite high.

Those dividends have quite a mountain to climb, as the debt is priced at the South African prime rate. Unless there is a material improvement in PPC’s local business, I can’t see much value being transferred to staff through this scheme. They will get the dividend and not much else.

Spur: people with a taste for profits (JSE: SUR)

Even with a through-the-cycle lens, these are big numbers

Despite the pressure that South African consumers are clearly under, the kids still like ice cream and stressed out parents need calories and usually something to drink as well. Perhaps assisted by load shedding and the alternative of a cold meal at home, Spur has released exceptionally strong numbers.

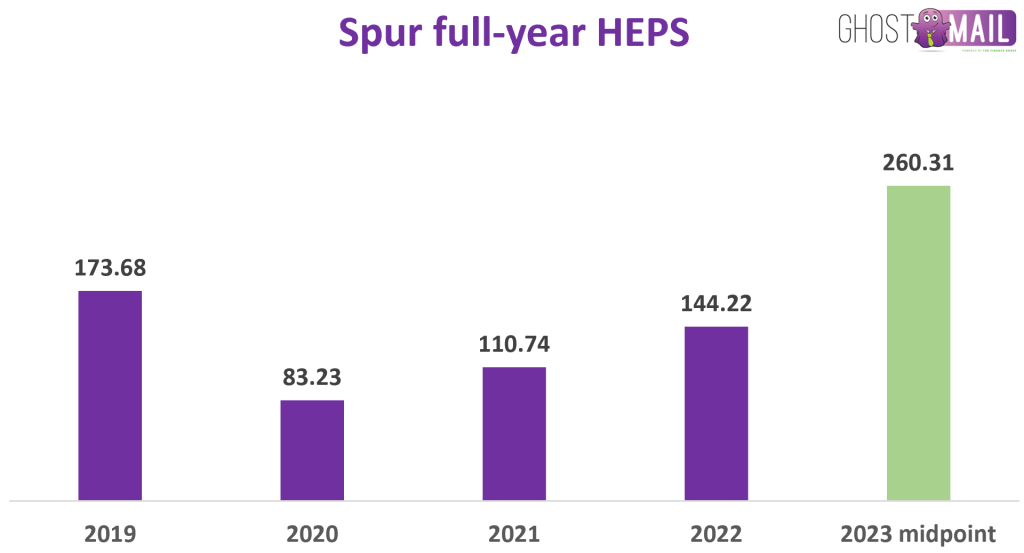

In case you’re wondering whether this is just a Covid base effect, as the exact timing of lockdowns is starting to become a hazy memory, here’s a chart of HEPS over the past few years:

As you can see, the latest performance is incredibly impressive. This is more good news after Spur recently announced the acquisition of a 60% stake in the Doppio Group, a deal that seemed to be well received on Twitter / X / whatever you want to call it.

I used the midpoint of 2023 HEPS guidance in the chart. The range in the trading statement is growth of between 78% and 83%. Although there were once-offs in the base (like the settlement of a dispute with SARS), the chart shows you how strong these latest numbers are.

Share buybacks are useful in boosting HEPS but a result like this still needs a strong top-line performance. That’s exactly what Spur delivered, with total South African sales up 22.5% for the year ended June. There was a notable slowdown in the second half of the financial year, with sales growth of 14.4% vs. 31.3% in the first half. For whatever reason, John Dory’s bore the brunt of that issue with a 1% decline in the second half, a really poor performance vs. the next-worst Roco Mama’s at 4.7% growth. Panarotti’s managed 9.6% growth in the second half, with Spur as the big winner with 16.9% growth in this load shedding environment.

Although a relatively small part of the group, Speciality Brands (Hussar Grill, Casa Bella and Nikos – the segment that Doppio Zero will slot into) grew by 42.2% for the full year. The second half performance was 27.2%, which confirms that a glass of wine in a restaurant is more fun than staying home in the dark.

Little Bites:

- Director dealings:

- The COO of Kibo Energy (JSE: KBO) has sold shares worth roughly R540k.

- The company secretary of Oceana (JSE: OCE) sold shares worth R103k.

- In something that you certainly won’t see every day, 96.4% of shareholders in Acsion (JSE: ACS) voted against the reappointment of PKF Octagon as the auditor at the AGM.

- In case you’re wondering just how many obscure holdings of certificated shares are in existence out there, Invicta’s (JSE: IVT) odd-lot offer achieved a repurchase of 37,501 shares of which 9,513 were still in certificated form! Yes, that literally means a situation of share certificates hiding away in your granny’s top drawer.

- If you are a shareholder in Crookes Brothers (JSE: CKS), then you may want to refer to the circular for the disposal of the deciduous fruit farming business at this link.

- Montauk Renewables (JSE: MKR) used SENS like a PR system with its announcement about a letter of intent signed with EE North America to deliver CO2 volumes to the company. The announcement gives no financial information whatsoever and the delivery period (assuming it goes ahead) will only begin in 2026.

Thanks for adding in the graphs!