Listen to the latest episode of Ghost Wrap here:

Glencore’s earnings have also taken pain (JSE: GLN)

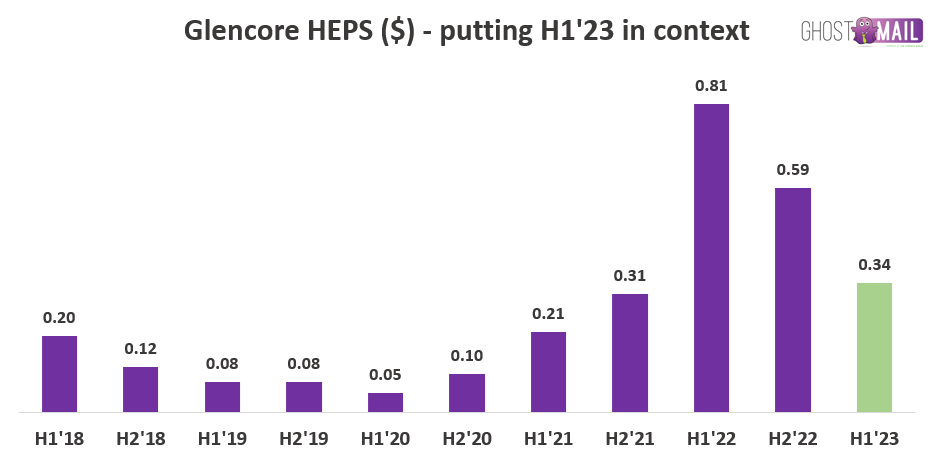

HEPS fell by 58% year-on-year

No mining group is safe from the negative move in the mining cycle this year. In many cases, we’ve seen HEPS more than halve. Glencore finds itself in that bucket, with a drop in HEPS of 58% for the first half of the year.

To help give context to that number, here’s a chart of Glencore’s six-monthly HEPS going back to 2018:

The good news is that the group is still making a lot of money, with adjusted EBITDA of $9.4 billion and cash generated from operations of $8.4 billion, a solid cash conversion rate. Net income attributable to equity holders was $4.6 billion.

Adjusted EBITDA mining margins were 25% in the metals operations and 50% in the energy operations, in both cases well down from 43% and 66% respectively in the comparable period.

From a capital allocation perspective, the group has been focusing on investing in “transition metals” like aluminium, copper and nickel.

As the group is running a net debt balance well below its target, there will be $2.2 billion in additional returns to shareholders. This will take the form of a $1 billion special cash distribution and a $1.2 billon buyback programme running until February 2024.

Glencore isn’t everyone’s cup of tea, but they sure do know how to manage a balance sheet and drive shareholder returns. I love seeing a company actively managing the debt:equity ratio and not falling into the trap of having a lazy balance sheet.

Hooray for Hulamin (JSE: HLM)

HEPS has approximately doubled for the six months to June

Hulamin caused a buzz in the morning with the release of a terrific trading statement for the six months to June. HEPS is up by between 94% and 113%, coming in at between 91 cents and 100 cents. It’s probably safer to use normalised HEPS, which increased by between 83% and 103%, which means a range of 66 cents to 73 cents.

Either way, the share price closed the prior day at R2.63 and shot up more than 25% in morning trade in response to these numbers. As Price/Earnings multiples go, this is one of the lowest ones around!

PowerChina goes Dutch with Kore Potash (JSE: KP2)

More costs are going to be incurred to finalise the EPC contract

Those who have been following Kore Potash will know that the company has been negotiating with SEPCO for a while now to finalise an Engineering, Procurement and Construction (EPC) contract for the construction of the Kola Potash Project.

The parent company of SEPCO is PowerChina International. PowerChina stepped in earlier this year to review the design and construction schedule and has now requested further engineering design work before finalising the EPC proposal.

The cost of this is $10 million. PowerChina is willing to incur roughly half of that cost, with exposure to overruns. Kore Potash’s contribution is capped at $5 million.

To achieve this, Kore Potash needs to immediately pay $1 million. The company has already raised $0.8 million from the Chairman of the company and a related party. There are other major institutions who have up to 21 business days to top up that amount if they so desire.

The remaining contribution by Kore Potash needs to be paid in three tranches between October 2023 and 12 months from the date of signature of the EPC contract. As is always the case in junior mining, investors can expect further capital raises and dilution.

The parties are aiming to sign the EPC contract before the end of January 2024. The Summit Consortium as key financiers remain supportive of this.

Nedbank’s metrics are heading the right way (JSE: NED)

As we’ve seen across the board though, impairments are climbing sharply

Hot on the heels of the Standard Bank trading update that looked incredibly strong, we have Nedbank with a more modest but still positive earnings update. This is a detailed set of numbers rather than just a trading update, covering the six months ended June.

Headline earnings per share (HEPS) is up by 11% and so is the interim dividend, with a payout ratio of 57%. The net asset value per share (a very important metric in banking, also called NAV per share) is 8% higher to R224.58. The share price is trading at a slight premium to NAV per share, with the market looking to a return on equity of 14.2% to support this number.

I would strongly debate whether 14.2% is high enough to support a premium to NAV. Banking stocks in some cases have perhaps run too hard.

Looking deeper into the income statement, revenue growth (including associate income) grew by 14% and pre-provision operating profit was up 22%. This shows you what would’ve happened in a consistent credit quality environment. With load shedding and such a poor macroeconomic environment, this is anything but a consistent credit environment. Impairments jumped by 57%, muting the story and explaining why HEPS only grew by 11%.

We can go one step deeper and look at what the key drivers of revenue growth were. As expected, net interest income was the winner with 18% growth vs. non-interest revenue at 7%. From an efficiency perspective (a measure of cost control), the cost-to-income ratio headed in the right direction from 56.1% to 52.9%.

The outlook isn’t great, with almost no economic growth in South Africa for the remainder of the year. Nedbank does expect interest rates to stay flat for the rest of 2023 though, so consumers will be hoping that this is the correct view.

Quilter is focusing on what it can control (JSE: QLT)

And as the latest numbers show, the company is doing a great job

Asset management and advisory firms are always going to be impacted by broader asset valuations in the market. They earn fees based on assets under management. As those assets increase, so do the fees. This generally makes them high beta stocks that move in line with broader market prices.

Within that framework, it’s important to understand that they can control (1) how successfully they attract inflows and (2) their cost base. This is the right way to judge the success or failure of a company in this space.

Quilter is nailing both of those things. Don’t focus on the growth in Assets under Management and Administration of just 2% during the six months to June. Rather focus on the core net inflows of £0.7 billion, an impressive result when you consider the higher interest rates environment across the world and the impact this is having on income available for saving. Unsurprisingly, the High Net Worth and Affluent channels did well here, as those people still have money to save.

Although group revenue only increased by 3%, operating margin improved from 20% to 24% and that was good enough to boost adjusted profit before tax by 25%. Great cost discipline really helps here and there are further savings planned under the “Simplification” project.

The dividend is up by 25% as well, so the cash is following the profits.

There are some big distortions in profitability even at HEPS level. The company discloses adjusted earnings per share that increased by 34% and that’s probably the right metric for profitability. If nothing else, look at the growth in the dividend.

Tongaat Hulett updated the market on business rescue (JSE: TON)

The monthly report has more details on the preferred equity partner, Kagera

Each month, Tongaat Hulett needs to update the market on its business rescue proceedings. Although the news of Kagera as the preferred strategic equity partner isn’t new, the report does go into further details.

The idea is that Kagera will acquire the complete sugar division of the business, including the investments in Zimbabwe, Mozambique and Botswana.

Kagera is owned by Tanzanian businessman Nassor Seif. This falls under a group called Super Group, with no relation to the JSE-listed group of the same name. They have over three decades of experience in sugar and agriculture in Africa. Other operations in the group are in the logistics and industrial sectors.

The ongoing existence of Tongaat Hulett is important for reasons that go far behind the plight of current shareholders. Based on Kagera’s experience in difficult operating conditions, this plan just might work!

Business rescue is about saving a business, not saving the shareholders or even the creditors.

Vodacom drops the pre-public holiday bombshell (JSE: VOD)

The Competition Commission wants to block the deal with Vumatel and Dark Fibre

This is very big news. The telecoms sector is not a great place for shareholders right now and the companies in the sector are trying to improve their fortunes by moving into new sources of revenue. Fibre is an obvious area of expansion for a company like Vodacom, which is why the company wanted to acquire 30% in a newly formed entity that would house Vumatel and Dark Fibre Africa.

ICASA had no problem with it, but that’s a totally different regulatory framework to the Competition Commission. Despite Vodacom and Community Investment Ventures Holdings (the joint venture party) having committed to address competition related concerns through a list given to the authorities, the Competition Commission has decided to recommend to the Competition Tribunal to prohibit the transaction.

There is clearly a long way to go here, as the Commission doesn’t have the final say. The Tribunal still needs to make a decision, with the Competition Appeal Court as last chance saloon thereafter.

A big part of the argument in favour of the deal is that Vodacom is ready to invest R60 billion over 5 years in South Africa. This investment of R13 billion is over and above that number.

But then again, if South African regulators prioritised investment in our economy, don’t you think our economic growth would look a little different?

Remgro (JSE: REM) is also part of this transaction. The company hasn’t released an announcement yet. This will presumably be coming on Thursday.

Little Bites:

- Director dealings:

- There’s a lot of action on the Novus (JSE: NVS) share register. In what can only be another block trade, the dynamic duo at A2 Investment Partners have acquired R95.7 million worth of shares in Novus. For context, this is a company with a market cap of just over R1 billion.

- A director of Lewis (JSE: LEW) has sold shares worth just under R2 million.

- Brimstone Investment Corporation (JSE: BRT) has released a trading statement for the six months ended June. The reason that this is only a “Little Bite” is because the trading statement focuses on HEPS, which isn’t the right metric for an investment holding company like Brimstone. Growth in HEPS of between 234% and 244% doesn’t really tell you much about the underlying portfolio. Net asset value (NAV) per share is the right metric. As there was no mention of this in the announcement, I can only assume that the movement is less than 20%. We will find out on 4 September.

- The Calgro M3 (JSE: CGR) share buybacks are marching forward, with 3.3% of the company’s share capital repurchased between 29 June and 7 August. This is an allocation of nearly R13 million worth of capital. The company has authority to repurchase up to 20% of its shares in issue until the next AGM.

- Zeder’s (JSE: ZED) special dividend of 5 cents per share has still not achieved approval from the SARB, so the payment date cannot be confirmed yet.

- Sygnia’s (JSE: SYG) lease agreements with related parties have been determined by PSG Capital as Independent Expert to be fair to shareholders.