These numbers are in Harmony (JSE: HAR)

Nine months into the financial year, Harmony is on track to meet full year guidance

In the latest quarterly result, Harmony focuses on the year-to-date numbers as there are now three quarters out of the way. Although gold revenue is only partially in the company’s control, it increased by 11% year-on-year. A 13% increase in the average gold price was the magic here, with a 2% increase in production if we allow for the closure of Bambanani at the end of FY22.

With only an 8% increase in group all-in sustaining costs (AISC), group operating free cash flow increased magnificently by 49%. This biggest driver was a 94% increase in South African underground operating free cash flow that enjoyed higher recovered grades.

Net debt to EBITDA has improved to 0.5x from 0.6x at the end of the prior quarter.

The company is on track to meet FY23 production, cost and grade guidance.

When looking at Harmony, don’t forget that the company has strategically decided to increase exposure to copper. One wonders if the name Harmony Gold will be changed at some point in future.

Lesaka Technologies is still loss-making (JSE: LSK)

There’s a long way to go here, as profits aren’t sufficient to cover finance costs

Lesaka is in the process of a turnaround, which included the recent acquisition of the Connect Group. Although such a large acquisition obviously did wonderful things for revenue, the reality is that there is still an attributable net loss. In fact, it is bigger in the latest quarter ($5.8 million) that it was a year ago ($3.3 million).

If you make several adjustments, including casually ignoring the net interest expense, you’ll arrive at a positive operating income number. In other words, the group doesn’t have sufficient profits to cover the debt on the balance sheet after the acquisition of Connect Group.

With a market cap of R3.5 billion, the market seems to still believe in the long-term story of taking FinTech services to mass market consumers.

A little ray of sunshine (JSE: SSU)

Southern Sun released solid numbers and fell 1.8% anyway in the market sell-off

Nothing with substantial exposure to South Africa was spared on Wednesday. As commentators on Twitter lamented the volumes on the market, South African equities were wiped out amid concerns about our country. It’s hard to argue at this point.

Southern Sun tried its best to cast some light on a dark day, releasing numbers that reflect a strong return to profitability. There is noise in the numbers (a separation payment this year from Tsogo Sun Gaming and an insurance payout in the prior year), so adjusted HEPS is probably the most sensible measure here. For the year ended March, that metric has increased to between 27.0 and 32.0 cents vs. the prior period headline loss of 8.0 cents.

Obviously, this was driven by improved conditions in the travel industry. It’s also exciting to note that demand for conferencing and events has increased. The one exception is Sandton, which is performing below pre-Covid levels as companies adopted a hybrid working culture during the pandemic and have stuck with it.

Net debt is down at R1.3 billion. For reference, the group market cap is R6.6 billion.

The share price has fully recovered to pre-Covid levels, though it does seem to be running out of steam:

TFG lost R1.5 billion in turnover this year to Eskom (JSE: TFG)

Where else could the R200 million in power backup capex have been spent?

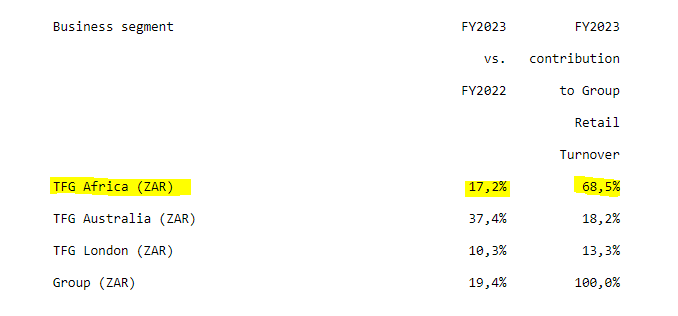

The Foschini Group (TFG) achieved retail turnover growth of 14.3% in the fourth quarter of 2023. It’s important to understand where the group makes its money, so here’s a snippet with TFG Africa optimistically highlighted in yellow as a symbol of my desire for electricity:

As we dig into the South African numbers, turnover growth was 6.0% excluding Tapestry Home Brands, which reflects a likely drop in volumes based on where inflation has been. So, it makes sense to see such high revenue growth at group level when you take the major acquisition into account, as South Africa was up 15.6% without that adjustment.

That’s still an impressive number when you consider the substantial impact of load shedding, something that is only getting worse. Significant power cuts over the festive period led to markdowns of inventory as sales didn’t meet expectations, so gross margins fell 2.1% in TFG Africa for the full year compared to the prior year.

Good news in my view is the split between cash and credit sales growth, with the former up 17.8% in TFG Africa and the latter only up by 9.6%.

At first blush, it looks like TFG London performed poorly with a turnover decline of 5.2% in the fourth quarter. The group expected this, as a strategic decision has been made to make the business smaller and more profitable. The profits are what actually count.

TFG Australia managed 6.7% growth in local currency in the fourth quarter.

I was quite pleased to see online retail turnover increasing its contribution to group turnover. I firmly believe that many of the consumer habits created during the pandemic will stick around, so this supports my thesis. Online sales contributed 10.8% to group turnover vs. 10.5% a year ago. The country-level contribution still varies wildly, with TFG Africa at 3.5%, TFG London at 49.6% and TFG Australia at 6.4%.

TFG loves a good bolt-on acquisition and the latest example is the acquisition of Street Fever, a group operating through the Sneaker Factory brand. All conditions have been met and the deal has closed.

The group is treating 2024 as a year of “consolidation and focusing on improving operating leverage” – in other words, taking a defensive approach in response to local operating conditions. There is also a high base effect in both offshore businesses, with sales down year-on-year in April in both London and Australia.

The share price is down 14.6% this year, reflecting the broader problems in our economy.

The only transaction in Transaction Capital was the sell button (JSE: TCP)

A 35% drop in the share price says as much about SA Inc. as it does about the company

The last time we were this upset as a country, Donald had dropped the bat and we walked away empty-handed from a Cricket World Cup. That trauma feels very mild compared to the current cocktail of doom being served up by Eskom and its effect on our economy. It’s like a cancer that is growing in intensity by the day, with many victims along the way.

Having been smashed by 35% on Wednesday after releasing results, Transaction Capital is now way down at R7.11. For reference, my average in-price is R12.23 and that was after adding to my position at a similar level to where the directors recently bought shares. I would also point out that if you show me someone who has never suffered a loss in the market, I’ll show you a liar. I’ll take this one (and of course several others) on the chin.

This is where the “be greedy when others are fearful” approach really gets put to the test. It’s also where a banking concept called “value at risk” becomes extremely important. Adding to a position is great if you believe in the long-term story, but you also have to be aware of exposure in relation to the rest of a portfolio. Until Transaction Capital settles and starts delivering meaningful and sustained share price gains, I can’t see myself buying more.

With that out of the way, Transaction Capital’s results for the six months to March reflect a 355% decrease (not a typo) to a loss of 183.3 cents per share vs. earnings of 71.9 cents a share in the comparable period.

Even if you use core earnings (management’s view on things), this dropped by 48% and return on equity came in at a paltry 7.3%. This is officially lower than Sasfin’s levels and that’s quite the benchmark for underperformance.

The market is panicking about the balance sheet and whether we are headed for another Ascendis / EOH situation. Management has made strong statements like the balance sheet being “sufficiently capitalised” and “debt covenant levels remaining intact” – the first part being the key.

There are no cross-default clauses at subsidiary level, so the real question is whether SA Taxi could go to zero and what value would then be left in the rest of the group. The group has thrown the kitchen sink at the SA Taxi numbers, taking huge restructuring provisions in one shot. Another big claim is made that “Mobalyz” (the new name for SA Taxi) should settle into “sustainable and predictable profitability during the 2024 financial year” – management won’t say things like this lightly.

Of course, as Shakespeare reminds us, that by which we call a rose by any other name would still smell as kak. We need more than a rebrand here.

With core attributable earnings at Nutun up by 15% and core attributable earnings at WeBuyCars down by 22%, it’s not like the combined impact in the rest of the business is fantastic either. In case you’re wondering, the WeBuyCars issue is a margin problem rather than a volumes problem, with Transaction Capital noting a high base effect.

Here’s what a very painful ride looks like:

Universal Partners reports a drop in NAV per share (JSE: UPL)

Transaction Capital may be in the toilet, but this crowd has reinvented it

The JSE is nothing if not an entertaining place. One of the investments in the Universal Partners stable is a business called Propelair. It makes some pretty bold claims:

Jokes aside, Universal Partners has an incredibly interesting portfolio that includes various growth businesses in Europe and particularly the United Kingdom.

One of the them is Dentex Healthcare Group, a dental practice consolidation group focused on the UK. Through a merger with Portman Dental Care, Universal Partners has taken cash off the table and now holds a stake in a much larger business.

There’s also an accountancy and payroll company in the UK called Workwell, which Universal Capital has supported in executing a couple of bolt-on acquisitions. None of the services are sexy, but they are effective.

A more exotic business is SC Lowy Partners, a specialist financial group covering high-yield and distressed debt market-making and investment management. This literally couldn’t be more different to a vanilla accounting business.

That’s not all, folks. There is also Xcede (a global recruitment specialist) and of course Propelair, the toilet innovators mentioned at the start.

This investment holding company’s net asset value (NAV) per share has decreased year-on-year from GBP 1.458 to GBP 1.420. That’s roughly R33.80 per share, with the price currently trading at R24.00 per share. This is a discount of below 30%, which is actually rather good for a group like this.

Little Bites:

- Director dealings:

- An associate of a director of Ascendis Health (JSE: ASC) has bought shares in the company worth just over R92k.

- In a move that might be more interesting than it sounds, PSG Konsult (JSE: KST) wants to change its name to PSG Financial Services Limited. This is a nod to the existing service offering and might be a clue to ambitions to broaden that offering further.

- Go Life International (JSE: GLI) is the penny stock you’ve probably never heard of. You haven’t missed out, since it spectacularly destroyed shareholder value and trades (very rarely) at one cent per share. The company has announced a specific issue of shares for R4.75 million, the proceeds of which will be used to settle creditors. Management reckons there are “sound prospects” yet when I tried to access the website link they provided, I found a GoDaddy domain parking page. There really are some inexplicable zombies on the JSE. PS: I eventually found the right website.

I share your TransCap pain with a similar average in price. Your note helped me sort out my strategy going forward! Thanks

On 13-19 December 2022 the CEO of Transaction Capital David Hurwitz sold a large parcel of shares. On 13 March 2023 Transaction Capital released a trading statement which caused a sharp drop in the share price. On 15 March 2023 Transaction Capital issued a SENS statement in which they said:

“• In considering the matter and after consulting with some of the other Transaction Capital directors, the Chairman approved the Share Sales after noting that the results for the year ended 30 September 2022 had been released to the market and there was no price sensitive information or inside information of which he or the other directors consulted, were aware that should preclude permission to deal;” Does anybody actually believe this?