Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Harmony Gold had a great year – but watch that guidance (JSE: HAR)

The next financial year may not be as delightful as this one

Harmony Gold has released results for the year to June 2024. It was a goodie, thanks to a higher gold price and a rough period for the company from which to recover. HEPS increased by 132% to R18.52, which means the share price is currently trading on a Price/Earnings multiple of 8.6x.

This period also saw record operating free cash flow of R12.7 billion, up by 111%. By all accounts, it was a strong year for Harmony and they took advantage of the gold price.

The concern (and perhaps the reason for a 3.5% drop in the share price) is actually around the guidance, with an expectation for FY25 of production of between 1,400,000 ounces and 1,500,000 ounces. They produced 1,561,815 ounces in FY24, so that’s an expected decrease. Then we get to All-In Sustaining Costs (AISC) of between R1,020,000/kg and R1,100,000/kg, which is well above R901,550 for this period. The drop in production would be a factor here in terms of efficiencies.

The group highlights that the FY24 performance benefitted from performance at certain mines that was well ahead of expectations in terms of recovered grades. This is the reason for what seems like conservative guidance. Either way, share prices are forward looking and the market didn’t love this guidance.

Metair’s balance sheet still needs loads of work (JSE: MTA)

I’m not convinced by the share price rally over the past three months

Metair is an incredibly unlucky company. Over the past couple of years, this group really has been through the most in both South Africa and Turkey. The market has jumped in recently, with the share price up by 38% in the past 90 days (but still down roughly 15% for the year). Based on the latest operational update, I’m not sure the GNU-phoria upswing is warranted for Metair.

For example, one of Metair’s key businesses is to supply the South African OEM vehicle production sector. Volumes for the first half of the year fell by 8%, with an expectation for volumes to only normalise in the final quarter of the year. That would be less of a big deal if Metair had a strong balance sheet, but alas the situation on the ground couldn’t be further from that. At the moment, Metair is focusing on bank covenants and a debt restructure plan, so there’s no room for error.

At least in the energy storage vertical, volumes in both Turkey and Romania improved considerably. The South African battery business experienced a dip in volumes, in line with the other businesses in the automotive components vertical.

Yes, there are green shoots, but goodness knows they need them. They need to refinance the South African balance sheet and “ensure a sustainable capital structure” – a process that is rarely painless for shareholders. The debt restructure programme is anticipated to launch in the fourth quarter and progress has already been made with raising bridging loans.

And if that isn’t enough of an overhang for you, Metair is also dealing with the European Commission and concerns around potential anti-trust violations by the Romanian business between 2004 and 2017.

Detailed results are due on 26 September, which will of course include an updated balance sheet and information on what earnings looked like for this period. That could lead to share price volatility, as there really is so much uncertainty here.

Omnia’s capital markets day shows the focus on the mining sector (JSE: OMN)

The contribution to group profits from this sector has increased drastically

A capital markets day is a great opportunity to learn about a listed company, especially when the full presentation has been made available -as is the case at Omnia. You’ll find it here.

It obviously goes into loads of detail about the broader group, with a key takeout being that the investment in the mining segment has been a huge focus area. The contribution to group earnings before interest and taxes (EBIT) from that segment increased from 30% to over 50% between FY18 and FY24.

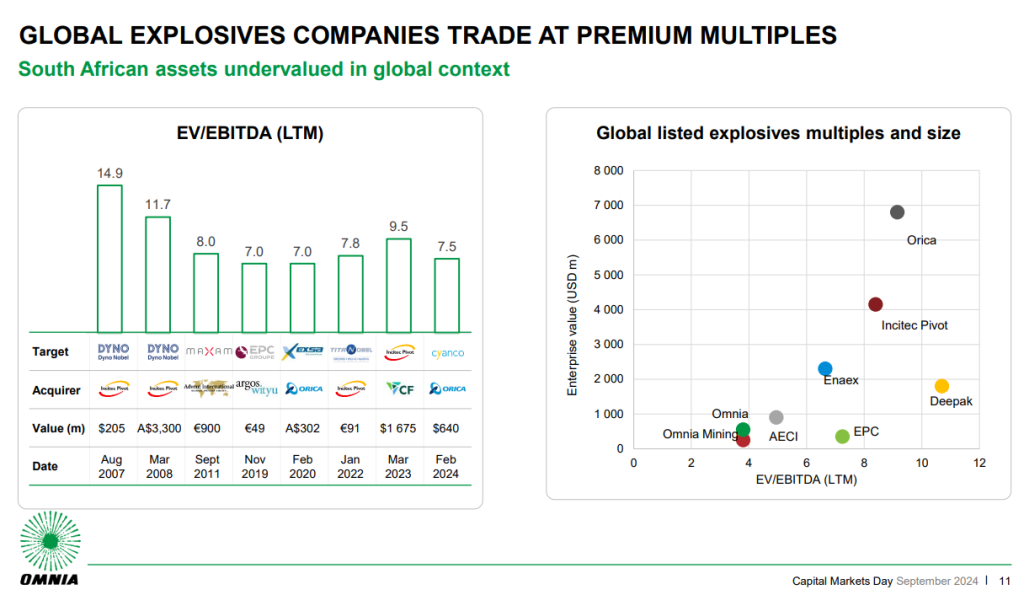

As interesting as that is, I see we’ve now reached the point where local companies are again feeling brave enough to make reference to the traded multiples of global peers. There are many good reasons, theoretical and otherwise, why South African companies trade at a discount to global peers. And yet, here’s the slide:

It is completely correct by the way that the chart on the right shows that larger companies also trade at larger multiples. A size discount is a real thing, as smaller players are seen as risker and less resilient – and therefore less valuable per unit of profit generated. Omnia cannot make the argument that they should be trading at the same multiple as much larger global companies.

Still, the wind is clearly in the sails of South African management teams once more. That’s a good thing!

Solid double-digit growth at OUTsurance (JSE: OUT)

And the local businesses are where you’ll find the magic

OUTsurance Group is one of those companies that doesn’t seem to get much attention. I don’t think I’ve ever seen it mentioned as a stock pick, yet this is a R76 billion company that has delivered a 16% share price return this year. Not bad at all.

An interesting element of the group is that OUTsurance Group holds 90.5% in OUTsurance Holdings, with regular transactions to flip those minority shareholders up to the group company. It’s probably not a bad thing to have this structure though, as it incentivises those minority shareholders in the right place.

The local performance looks strong, assisted by a favourable claims experience in South Africa and macroeconomic elements like higher interest rates that boosted investment income. OUTsurance SA grew earnings by between 12% and 22%, coming in at nearly R1.9 billion. OUTsurance Life jumped by a lovely 38% to 58%, admittedly off a small base. That business generated R142 million in earnings.

Looking abroad, Youi Group (the Australian business) grew by between 8% and 18%, contributing R1.4 billion in earnings. This is a rare example of success in that market for a South African corporate, with the difference being that OUTsurance grew Youi Group organically from the ground up. This is a vastly better (but slower) approach than buying an existing business in that market and hoping for the best.

OUTsurance is doing it again, this time in Ireland. They are incurring startup losses at the moment, with a loss of R56 million for the period. A successful group like OUTsurance can easily incubate initiatives like these. Again, I far prefer seeing startup losses vs. large, risky transactions.

At overall group level, normalised earnings per share grew by between 15% and 25%. HEPS was up between 14% and 24%, so no concerns there in terms of the extent of normalisation adjustments. Detailed results are due on 17 September.

Pan African Resources has enjoyed the gold price (JSE: PAN)

This mining group has taken advantage of better commodity prices

If there’s one thing we’ve certainly learnt this year, it’s that gold miners don’t always do well when the gold price is up. Sadly, they inevitably all do badly when the price is down. This return profile is why some investors prefer buying the yellow stuff itself vs. the underlying miners.

Thankfully, with a year-to-date share price performance of around 68%, Pan African Resources sits on the right side of that analysis. HEPS will be up by between 27% and 37%, measured in dollars as the group’s presentation currency.

This was driven by a 16.8% increase in revenue, with volumes of gold sold up by 4.9% and the gold price up by 11.3%.

Sanlam signs off on an excellent interim period (JSE: SLM)

HEPS growth of 40% will do nicely

Sanlam has released results for the six months to June. The numbers look really strong, with the net result from financial services (the key measure) up by 14%. This is the best way to gauge performance at Sanlam, as it talks to the underlying businesses like insurance, investment management and structuring. There are a lot of encouraging signs in the numbers, like impressive new business volumes in life insurance and a significant jump in net client cash flows.

The next important measure on the income statement is net operational earnings, with the major difference being the inclusion of investment returns on shareholder capital. This is largely outside of the control of management, as this is where the macro factors like interest rates and equity markets start to affect the returns for financial services groups. The growth rate of 8% in net operational earnings reflects the lower (but still positive) investment returns this year vs. last year.

There are a lot of other complexities in the numbers, including the elements that are captured between net operational earnings and headline earnings. Thanks to higher underlying earnings and fewer shares in issue, HEPS increased by 40%.

Initially, the next bit of disclosure caught me out until I was kindly corrected on X, which is by far the best finance audience you’ll find online. Sanlam disclosed that the return on group equity value per share came in at 9.3%, or 10.7% on an adjusted basis. Their hurdle rate is disclosed as 7.5%, which seemed oddly low to me. I therefore expected to see the current share price of R85.44 representing a discount to the gross equity value per share of R73.41, but instead it trades at a premium. That’s when I should’ve clicked that the return hasn’t been annualised and neither has the hurdle rate, which is highly unusual.

If we just double them for simplicity, the hurdle rate is 15% (which makes far more sense) and Sanlam is achieving a return on group equity value per share that beats most of the banking groups. That’s a lot more believable.

Still, I’m always nervous of buying a financial services group at a premium to equity value. Sanlam is a great business for sure, but the market already knows that.

Little Bites:

- Director dealings:

- A director of a subsidiary of KAP (JSE: KAP) – PG Bison, for what it’s worth – sold shares worth R708k.

- Something seems to be on the boil at Transaction Capital (JSE: TCP), with a cautionary announcement noting that the group has entered into a “series of negotiations” – with no further details given at this time. It’s surely more likely to be a disposal than an acquisition, but time will tell.

- Metrofile (JSE: MFL) announced that Pfungwa Serima, the group CEO, will be stepping down with effect from 30 September 2024. He has been in the role since February 2016. Thabo Seopa, currently an independent non-executive director, will take over in the CEO role. It’s extremely unusual to see a non-executive taking the top job. Seopa does have loads of relevant experience though, so hopefully he will inject some more life into the digitalisation and evolution of the business.

- Gemfields (JSE: GML) usually makes quite a song and dance of auction results, but the latest auction seems to have been a less important one as it focused on by-products of the mining process in the ruby business. Auction revenue came in at $2.3 million vs. $1.5 million for the comparable auction in the prior year. All the carets were sold, consisting of sapphire, corundum and a small amount of ruby.

- Trustco (JSE: TTO) has issued shares to a public shareholder at 36 cents per share. The total raised was nearly R1.8 million, so it’s a modest issuance. The current share price is 40 cents.