The Italtile share price momentum is beyond me (JSE: ITE)

The market is definitely applying rose-tinted glasses here

On paper, Italtile is well positioned to benefit from improved trading conditions and sentiment in South Africa. Decreasing interest rates will help with disposable income and the generally improved mood in the aftermath of the elections will help with the confidence needed to take that income and use it on home improvements. The disappearance of load shedding also plays a major role here. These are all the reasons why I’m sitting with a long Cashbuild position, as that business has many of the same underlying drivers.

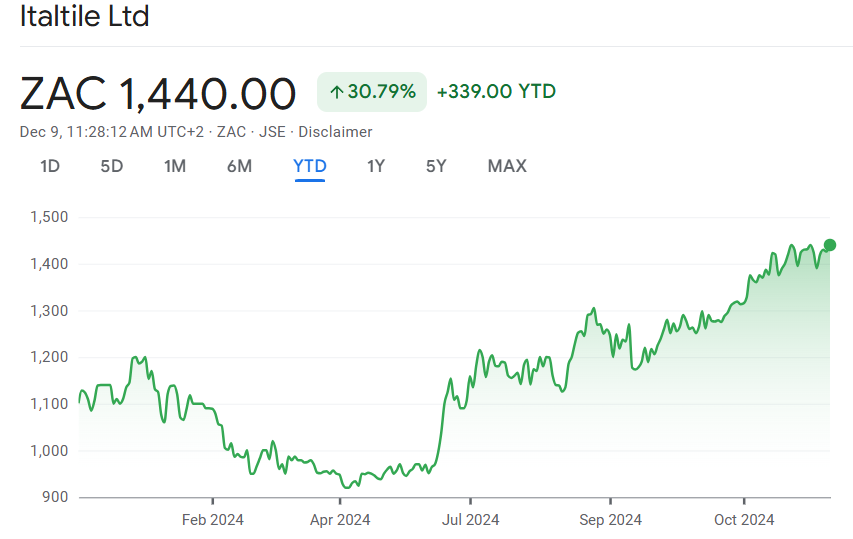

The market has latched onto these concepts, giving the Italtile share price a massive boost since the election:

So, what’s the problem? Well, here’s the first clue: in the five director dealings announcements since the start of October, every single one has been an update of directors selling shares. They are selling into this strength that everyone else seems to be buying, which is a red flag for investors.

Is there a good reason for this selling? There absolutely is, with Italtile having told the market several times that the manufacturing side of the business is facing a substantial problem of over-capacity in the local industry. This is exactly why I hold Cashbuild instead of Italtile, as Cashbuild doesn’t have a manufacturing business.

In a voluntary sales update covering 1 July 2024 to 30 November 2024, Italtile has noted system-wide retail turnover growth of 2.2%. That’s not exactly exciting, but at least it’s green. The real benefits of lower interest rates and the two-pot system will take time to filter through to consumers.

As for the manufacturing business, revenue fell by 1.6%. This comes after a decline of 5.9% in the base period. You can be sure that costs aren’t decreasing, so you can imagine what this means for margins. They are talking about “predatory pricing” in the market, which isn’t good.

Results for the six months to December will be published by March. I really wouldn’t be surprised to see more director selling before then.

Nictus has had a year to remember (JSE: NCS)

Profits are nearly 4x higher than last year!

With a market cap of around R70 million, Nictus is really tiny by listed company standards. The market cap used to be even smaller if you can believe it, with the share price up strongly this year. The starting date for the share price return makes a huge difference which is why I didn’t include a percentage. This is an illiquid stock that can very easily double and then halve again over just a few days!

Illiquidity aside, the trajectory has been upwards. The share price is R1.40 at time of writing and it traded all the way down at 50 cents for most of January this year. Those who somehow navigated the bid-offer spread made solid gains.

These gains have been supported by a huge jump in HEPS for the six months to September from 6.94 cents in the comparable period to 26.51 cents in this period. The cause of this jump was a R14.5 million increase in investment income in the insurance business. Considering that profit before tax for the period came in at R20.2 million vs. R5.1 million in the prior year, you can see that the rest of the business was flat.

Sibanye-Stillwater finds a developer for the Beisa uranium project (JSE: SSW)

They retain exposure through royalties and an indirect shareholding

Sibanye-Stillwater is fighting the good fight against a PGM market that continues to create many sleepless nights for those involved. The company also has frequent examples of bad luck, which certainly don’t help. It therefore makes sense that they are entering into a deal that will see Neo Energy Metals acquire the Beatrix 4 shaft and therefore the Beisa uranium project. This puts the development risk onto Neo Energy’s balance sheet, allowing Sibanye to focus on the rest of its business.

Beatrix 4 was placed on care and maintenance in 2023 based on the declining gold reserves and pressure on uranium prices. With uranium prices having moved higher and enjoying a positive outlook, Neo Energy is swooping in to pay Sibanye R500 million for the shaft. This will be paid 50% in cash and 50% in newly issued shares, giving Sibanye a 40% stake in Neo Energy and thus significant indirect exposure to Beatrix 4.

Sibanye will also be paid royalties based on the spot uranium price, with a maximum of $5.00/lb. For context, the current price is $77/lb and it peaked in 2024 at $106/lb.

It sounds like a great deal for Sibanye then, as the group can enjoy long-term exposure to the asset without having to fund either the development or the rehabilitation and environmental liabilities of Beatrix 4. The parties just need to jump through a few regulatory hoops to get the deal across the line.

Brace yourself for the Transaction Capital results, when they eventually come (JSE: TCP)

They have been delayed due to changes to the disclosure notes related to SA Taxi

Transaction Capital is on the verge of releasing another horrible set of numbers. To give you some idea, the “core loss” – and this is the most favourable view of things after adjusting for discontinued operations and other distortions – will be between R82 million and R102 million for the year to September 2024. The headline loss without any adjustments and including total operations is between R2.18 billion and R2.36 billion!

With Nutun as the main business going forward, the market is going to place a lot of attention on those numbers when they come out. The financials were actually due for release already, but have been delayed due to disclosure changes in the notes for SA Taxi.

Every year in December, there’s a set of numbers somewhere on the market that are very ugly. Will Transaction Capital be the coal under the Christmas tree this year? It seems very possible.

Nibbles:

- Director dealings:

- The huge trades by Discovery (JSE: DSY) directors related to their derivative structures continue, with Adrian Gore selling shares worth R105 million and Barry Swartzberg selling shares worth around R195 million. In both cases, these are forced sales as part of the structures rather than sales by choice.

- A prescribed officer of Gold Fields (JSE: GFI) acquired shares worth R2.1 million. Notably, this is towards the company’s minimum shareholding requirement, so it’s not as bullish a signal as would normally be the case.

- Vodacom (JSE: VOD) and Remgro (JSE: REM) are keeping their options open just in case something major comes up in the Maziv fibre deal. They are therefore extending the longstop date by just a few weeks at a time, while they navigate the process of trying to get the regulators across the line. The latest extension is to 15 January 2025.

- The Datatec (JSE: DTC) scrip dividend alternative was a success for the company, although I’m sure the extent of management shareholding in the group played a role here. The cash dividend came to R58.6 million and the company retained R116 million in cash by issuing shares in lieu of a dividend to shareholders who elected that alternative.

- Oasis Crescent Property Fund (JSE: OAS) announced that holders of 41.1% of units elected to reinvest their distribution and the remaining 58.9% chose to receive cash distribution. I’m not sure if I’m missing a tax trick here, but considering the reinvestment price is the NAV of the units rather than the share price (and the NAV is a lot higher), I’m not sure why people would choose to reinvest.

- Never heard of Assura plc (JSE: AHR)? Don’t worry, me neither! It popped up on SENS with an announcement of directors buying shares under a matching shares plan (a common incentivisation mechanism in the UK), forcing me to go find out how I somehow missed this company. As it turns out, this is a UK REIT that listed very quietly on the JSE on 21 November as part of a fast-track secondary listing process. It’s a large company, although local liquidity is close to zero.

- Sable Exploration and Mining (JSE: SXM) planned to transfer certain subsidiaries to James Allan, the previous CEO. This will no longer proceed and the subsidiaries will be deregistered instead.

- Sygnia Limited (JSE: SYG), AYO Technology (JSE: AYO) and Marshall Monteagle (JSE: MMP) are transferring their listings to the general segment of the JSE, as many small- and mid-cap companies have now done.