Master Drilling put in a solid year in ZAR (JSE: MDI)

In a great show of masochism, the company also likes to report in dollars

For the six months to June 2023, Master Drilling continued to benefit from an improved global mining environment after the pandemic. Although commodity prices have come off pretty sharply this year, mines are still making money and need to develop their assets on an ongoing basis. That’s good news for Master Drilling.

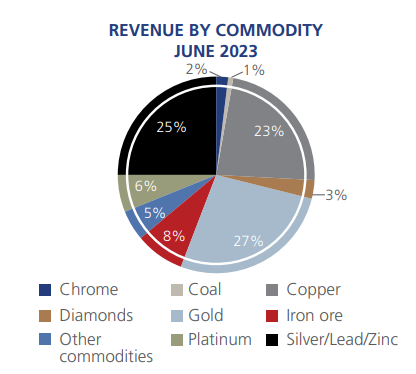

If you’re wondering which commodities are relevant, there’s a really nice spread:

The company focuses on its numbers in dollars, which tends to blunt the experience. In the world’s hardest currency, revenue increased 12.1% and profit was up 8%. HEPS increased by just 5.7%. If you put that HEPS number in ZAR instead, you get growth of a much more exciting 25.0%.

Investors will want to keep an eye on cash from operating activities, as this decreased by 5.7% in dollars. A decrease in cash vs. an increase in profits is an eyebrow-raiser regardless of which currency you look at. There has been substantial investment in inventory this period of $1.8m vs. a release of $0.2m in the comparative period.

The share price is down roughly 13% this year. Be careful with this one, as liquidity is low and the bid-offer spread can really bite you. Welcome to trading locally listed mid-cap names.

Get ready for Nampak’s rights offer (JSE: NPK)

The circular should be released on 4th September

Nampak needs to raise R1bn in equity through a partially underwritten renounceable rights offer. A simple way of saying this is that the company is going with hat in hand to shareholders to save it. The balance sheet has really deteriorated over the course of the pandemic, with management interventions to steady the ship not being enough. Sometimes, a company just has no choice but to raise fresh capital.

Commitments to the value of R500m have been received from existing shareholders. Importantly and in addition to this (unless the wording in the announcement is extremely poor and this amount is included in the R500m), there is R450m worth of underwriting from Coronation (R300m), A2 Investment Partners (R100m) and Numus Capital (R50m), all of whom will receive an underwriting fee of 2.33% of the underwritten amounts. That’s a little bit high as a fee but to be quite frank, Nampak has no choice.

In addition to the R1bn rights offer, the group needs to raise R2.6bn from asset disposals.

Full details, including the price for the rights offer, will be announced on Thursday 31st August. The circular is expected to go out on 4th September.

The market dished out more punishment for Sibanye (JSE: SSW)

Despite a decent day for commodities, the share price fell 6.7%

Now trading at R30 after trading as high as R73 during the pandemic, Sibanye-Stillwater investors have been on the receiving end of a real hammering. In case you think it can’t get worse, this thing was trading below R8 five years ago.

For the six months to June, lower platinum group metal (PGM) prices dominated the story. Group adjusted EBITDA fell by 37% and HEPS tanked by 51%.

In the US, because of production issues due to unfortunate events, all-in sustaining costs in this period of 1,717 US$/2Eoz were a problem compared to the average basket price of 1,390 US$/2Eoz. The US business still generated adjusted EBITDA of $53m, but this was way down on $261m in the comparable period. The US PGM recycling business also went the wrong way, with adjusted EBITDA of $20m vs. $39m in the comparable period.

This all pales in comparison to the South African PGM business performance, which is far larger and hence more important than the US business. The average basket price is different vs. the US because the US business is measured based on 2Eoz and the local business is 4Eoz. Rand depreciation offered a partial shield, with the local price dropping from R43,379/4Eoz to R34,006/4Eoz. All-in sustaining cost also moved higher but cost control was decent. Despite this, the net result was a squeeze on margins and adjusted EBITDA of R11.8bn vs. R21.2bn in the comparable period.

In the gold operations, the comparable period was a catastrophe because of labour issues. This is why gold production increased from 5,962kgs to 12,962kgs. The average gold price also moved firmly in the right direction, so adjusted EBITDA swung wildly from -R3.1bn to R2.4bn. This helped offset some of the pain in PGMs.

On top of these pressures, the investment in metals like nickel and zinc is not doing the income statement any favours at this stage. The nickel operations lost R0.6bn and the zinc business in Australia lost R0.5bn. Sibanye really has had the worst luck recently, with the nickel operations in France impacted by social unrest in the country. If you want to guess where the next disaster or social issue will be, perhaps just draw a map of Sibanye’s operations.

They can’t even catch a break in the US, where Tiehm’s buckwheat has been classified as an endangered species at the Rhyolite Ridge lithium project, necessitating an alternative mine plan and updated feasibility study.

One of the silver linings is the balance sheet, with a net debt to adjusted EBITDA ratio of just 0.01x. There is nearly as much cash as there is debt. The other positive spin is that with the shaft now repaired at the US PGM operations, the second half of the year should be better.

A performance befitting Super Group’s name (JSE: SPG)

Although there’s margin pressure, HEPS has grown beautifully

For the year ended June 2023, Super Group put in a solid performance with revenue up 30.6% and EBITDA up 20.8%. Although this immediately tells you that margins went the wrong way, HEPS growth of 23.3% is a lovely outcome for the company, with a 31.5% increase in net finance costs not having spoiled the party.

Operating cash flow increased by 18.9%, so cash conversion is decent as well.

A big portion of the group’s business sits outside of South Africa. 54% of revenue and 56% of operating profit came from beyond our borders, with the UK as the largest international revenue business and Australia as the biggest contributor to operating profit.

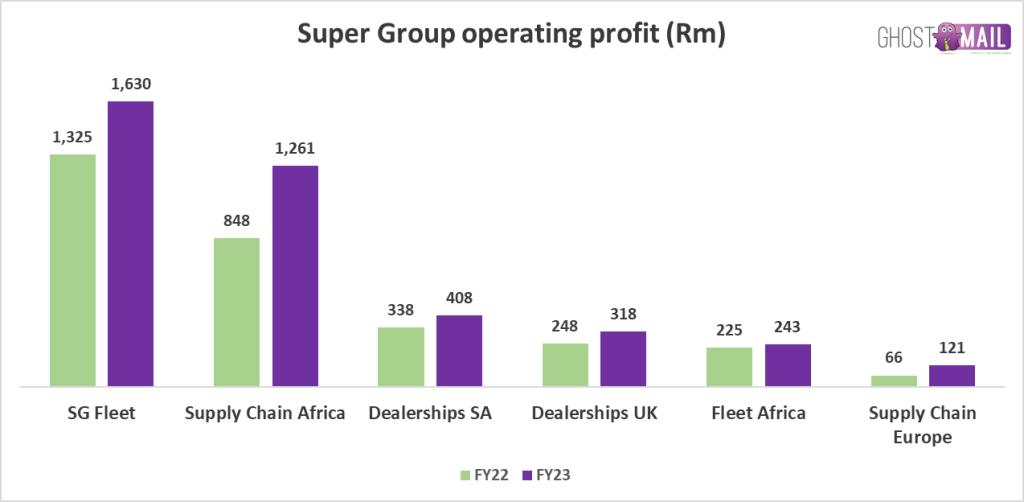

The segmental story is best told with a chart. It’s not every day that operating profit increases in every single segment:

The next set of numbers will include the acquisition of Amco, a transport company in the UK. Super Group raised R1.81bn in debt during this financial year and R810m was for this acquisition, which was concluded after year-end.

With net debt of R4.38bn and EBITDA of R8.49bn, the net debt to EBITDA ratio is more than manageable.

A final dividend of 80 cents a share has been declared. The share price traded 1.7% lower at time of writing at R34.78, with the ALSI down by 0.59%. This doesn’t take anything away from the year-to-date share price performance of roughly 33%.

Thungela goes in search of a life beyond Transnet (JSE: TGA)

The acquisition of the Ensham mine in Australia has been concluded

Earlier this year, Thungela told the market that it would be investing in Australia. The biggest appeal of this transaction must surely be the prospect of having coal operations in a country with a working rail network.

The mine is expected to achieve export saleable production at an FOB cost of between $110 and $120 per tonne. Based on the announcement, the correct price to work off is the Newcastle export coal price. From what I could see on the Trading Economics website (and please correct me if I’m looking at the wrong price), the current level is around $158 a tonne. But don’t get too comfortable, because in June it was trading at a level similar to Ensham’s production cost.

It’s been a rough ride for Thungela shareholders this year, with the share price having approximately halved based on a drop in coal prices.

Transpaco signs off on a great result (JSE: TPC)

This is a wonderful example of growth despite difficult conditions

For the year ended June, Transpaco’s revenue increased by 10.8% and operating profit was up 13.3%. That tells a good story around operating margins (10 basis points higher at 9.7%). It gets better as you move through the result, with HEPS up by 19.4%. As the final icing on this cake, the dividend is 20.9% higher, so the cash has followed the profits.

The packaging industry can be a dangerous place because of the fairly low operating margins. The best businesses are rewarded though, winning market share and increasing those margins off a low base, which does terrific things for shareholders. In this result, both the Plastics division and Paper and Board division did well, with revenue up 7.4% and 15.0% respectively.

And on top of all of this, the balance sheet is in great shape too.

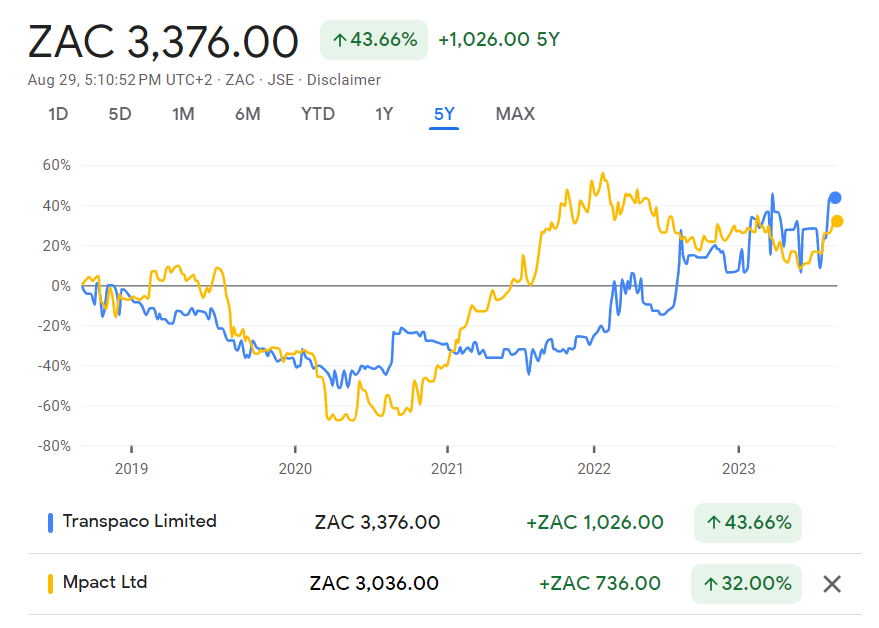

I can’t be bothered to include Nampak on this chart because we all know how that played out. Instead, here’s Transpaco vs. Mpact over 5 years:

Little Bites:

- Director dealings:

- Des de Beer has bought R1.02m worth of shares, but this time in Resilient (JSE: RES). Before you wonder whether he’s neglecting Lighthouse (JSE: LTE), he also executed purchases there of R1.46m.

- An associate of a prescribed officer of Dis-Chem (JSE: DCP) has sold shares worth R799k.

- The CEO of AECI (JSE: AFE) has bought shares worth R416k.

- A director of Adcorp (JSE: ADR) has bought shares worth over R134k.

- NEPI Rockcastle (JSE: NRP) has released a circular dealing with the scrip dividend alternative. The cash dividend is 25.67 euro cents per share and the scrip alternative is valued at 27.10 euro cents, a 5.6% premium to the cash dividend to entice shareholders to take the scrip instead of the cash. Furthermore, the issue price of the shares for the scrip alternative will be at a 3% discount to the five-day VWAP that will be calculated on 5th September. Property funds incentivise the scrip dividend as a way to retain cash. You can almost think of it as a small rights offer.

- The timetable for the disposal by Rebosis (JSE: REA | JSE: REB) of the Standard Bank-funded properties has been extended once more. The finalisation of sale agreements has been pushed out from 28 August to 4 September.

- There is yet another updated trading statement from Woolworths (JSE: WHL), with the benefit of the completion accounts process for the David Jones sale having been concluded. This only affects Earnings Per Share (EPS) rather than Headline Earnings Per Share (HEPS), which is why I’ve only mentioned it in Little Bites. For the total group, EPS is up by between 35% and 45% for the 52 weeks ended 25 June and HEPS is up by 25% to 30%. Adjusted HEPS is up by between 30% and 40%.

- RCL Foods’ (JSE: RCL) disposal of Vector Logistics has become unconditional. To refresh your memory, the buyer is A.P. Møller Capital – Emerging Markets Infrastructure Fund II K/S. Private equity buyers don’t always have names that roll off the tongue!

- In case you are in the unfortunate position of being stuck with shares in W G Wearne (JSE: WEA), you’ll probably want to know that the company is in discussions with buyers for the Muldersdrift property and mining right. The sale of this property would enable the company to pay VAT and employees tax going all the way back to 2018. Yes, that’s how bad it is.