If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

MC Mining taps the market

A fully underwritten A$40 million rights issue will fund the project in Limpopo

In addition to MC Mining’s underwritten equity raise, there are written commitments of A$26 million for the continued development of the Makhado Project (most of which is from the IDC). These are exciting times for the company, with construction at the hard coking coal project expected to start in early 2023.

The pricing is a 48% discount to the 30-day VWAP on the JSE. When a rights offer is heavily discounted, it’s because the company wants existing shareholders to follow their rights. When the discount is lower, it’s because the underwriter is hoping to mop up shares. The underwriters are Senosi Group Investment Holdings and the Dendocept Group.

The proceeds will also be used to settle the current standby facility from Dendocept, which is sitting on $5.09 million. Payment obligations for new shares will be offset against this facility and any remaining balance will be settled in cash.

There will be also be a working capital allowance of $3.8 million, so $31.11 million of the raise is expected to be used for the Makhado Project.

Here’s an interesting nugget: if any shareholder ends up with more than 20% in the company, it will need to enter into a “market standard relationship agreement” with the company to ensure that the company is run for the benefit of all shareholders, not just that shareholder. This is a rule on AIM, the development market of the London Stock Exchange.

It’s lovely to see capital raising activities like these. This is exactly why the market exists in the first place!

Holy Mackerel

Oceana Group’s voluntary update is a mixed bag – or even a mixed net

Let’s start with pilchards, with Oceana reporting a 16.2% increase in sales volumes for the 11 months to 27 August. A significant local catch helped mitigate some of the pressures from freight costs and the weaker rand against the dollar.

In African fishmeal and fish oil, production volumes were 24% higher in recent months. Sales volumes were only 5% higher for the 11-month period, with the weaker rand resulting in a 40% increase in the average rand selling price.

In the US, the weather has been favourable. There has been a 63% increase in landings this season, 28% above the long-term average. Strong dollar pricing has been great for results translated into rand.

As for hake and horse mackerel, high fuel and quota costs have made things tough alongside poor catch rates. Sales volumes for the 11-month period are 10% lower, mainly due to scheduled vessel maintenance in Namibia in the first half.

Commercial cold storage performance was impacted by a 5% decline in occupancy levels. This is due to lower imports in the Western Cape region and excess market capacity, which ties in with the news of strong local production.

For traders, there’s been plenty of volatility this year as the group has struggled with major executive changes under questionable circumstances:

Remgro jumps after releasing results

Intrinsic net asset value per share is 20.2% higher at R213.10

Remgro certainly can’t be accused of just sitting on its hands. There’s been a flurry of recent corporate activity: the deal to take Mediclinic private, the Distell transaction with Heineken, the investment in CIVH and the Rand Merchant Investment Holdings transaction. Three of those deals are still subject to various approvals.

I tend to ignore headline earnings in a group like this, as accounting rules differ considerably depending on the extent of the ownership stake in each portfolio company. Intrinsic net asset value (INAV) per share is what counts, as Remgro acts as an investment holding company.

With the share price closing 7.57% higher at R138.62, it is currently trading at a discount to INAV of 35%. This is in line with the usual discount that the market places on Remgro’s INAV.

In addition to the investments I mentioned in the opening paragraph, Remgro holds 80.3% in RCL, 2.5% in FirstRand, 100% in Siqalo Foods, 7.7% in Discovery, 50% in Air Products South Africa, 24.9% in TotalEnergies and 43.5% in KTH. In addition to Mediclinic, CIVH, Distell and RMIH, these investments contribute 84% in total to Remgro’s INAV.

The ordinary dividend per share of 150 cents means that Remgro is trading on a trailing yield of 1.1%.

As a final comment, regular readers will know that Remgro has announced the unbundling of its stake in Grindrod. This comes a few months after the stake in Grindrod Shipping was sold, bringing to an end Remgro’s investment in that stable. The timing of both exits has been great.

Stor-Age keeps doing the right things

For the five months to August, occupancies and rentals are higher

Stor-Age is a terrific business.

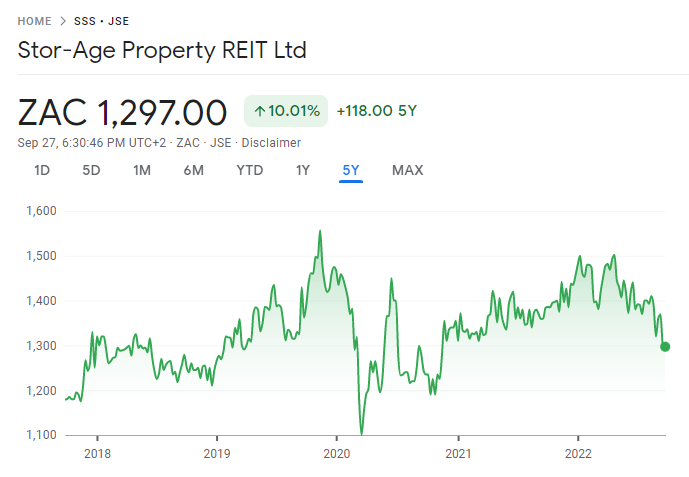

It tends to be priced like a terrific business though, so it hasn’t necessarily been an exciting investment. Investors buy it because of the rock solid dividend yield and the defensive business model. If you only looked at a share price chart though, you would be shaking your head on this one:

In South Africa, the average rental rate increased by 6.7% year-on-year and the average occupancy was 2.0% higher. In the UK, average rentals were up by a substantial 10.8% and occupancies were 1.3% higher. The UK is practically an emerging market these days!

The group is still acquiring existing facilities (like Think Secure Self Storage in Parklands, Cape Town) and has a development pipeline in South Africa of ten properties with an approximate development cost of R900 million, most of which will be in a joint venture with Nedbank. This will add an estimated 60,800sqm to the local portfolio which currently measures 387,900sqm.

The UK development pipeline is four properties with a total development cost of £45 million. This will add around 21,180sqm to the portfolio of 129,600sqm. The new developments are in the Moorfield joint venture.

By all accounts, it looks like Stor-Age continues to do a great job of executing on its strategy. I just wish the share price was cheaper!

Little Bites

- Director dealings:

- An associate of a director of CA Sales Holdings has bought shares worth over R75k

- An independent non-executive director of Stadio has bought shares worth R4.5k – not the most earth-shattering purchase around

- In a pretty embarrassing situation for Ascendis Health and its reporting accountants for the Ascendis Pharma circular, the pro-forma financial effects have been restated. There’s a lot of detail for those interested. As a quick overview, the NAV will increase by 43.2% if shareholders approve a sale for Pharma-Q / Imperial and by 52% if the sale to Austell goes ahead. The difference is because the Austell offer is significantly higher.

- Gemfields seems to have auctioned the polony-equivalent gemstones from the ruby mine in Mozambique. Sapphire, corundum and low-quality rubies were auctioned off with revenues of $4.2 million generated in the process. All lots were sold.

- Datatec has completed the sale of Analysys Mason and proceeds received for the sale will be returned to shareholders as soon as possible. In other words, a large dividend is coming.

- Putprop released a trading statement for the year ended June 2022. HEPS will increase by between 15.3% and 25.3%.

- Wesizwe Platinum has released a trading statement for the year ended June 2022. The group has swung into the red, with a headline loss of between 2.59 cents and 5.59 cents per share vs. earnings of 15.02 cents in the comparable period.

- Telemasters Holdings also jumped on the trading statement train, indicating a loss of between 3.64 cents and 3.73 cents for the year ended June 2022. The losses have approximately halved year-on-year.

- If you are a junior mining enthusiast, you should note that Orion Minerals has released its annual report. I quite enjoyed the description in the announcement of the Prieska copper-zinc project being fully permitted and “shovel ready”!