Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

The market expected more from Mondi (JSE: MNP)

The share price didn’t enjoy the quarterly earnings release

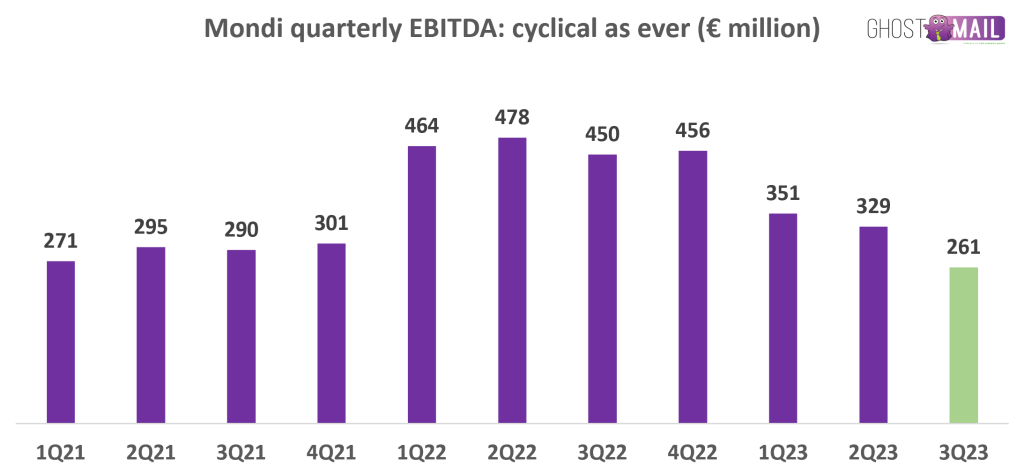

Mondi closed 6.8% lower after providing a quarterly trading update dealing with the three months ended September. Market demand was “soft” and selling prices came under pressure, a combination that investors never want to see.

To add to this pressure on EBITDA, there was a far lower forestry fair value gain in this quarter. The fair value gains sit in EBITDA, which is part of why the earnings can be this volatile:

It’s difficult for cyclical companies to make long-term decisions, but Mondi still believes in the structural growth in the packaging markets that it serves. For this reason, the €1.2 billion expansionary projects pipeline remains in place and is running within budget.

Sasol asks shareholders to give it flexibility on the convertible bonds (JSE: SOL)

If shareholders give the green light, the convertible bonds can be equity settled

In November 2022, Sasol announced that $750 million had been raised through the issuance of convertible bonds. The conversion is currently cash-settled, with Sasol wanting shareholders to give the company the flexibility to settle any future conversion by issuing ordinary shares instead.

The problem for Sasol is that if the only way to settle the conversion is through cash rather than shares, then the company constantly has this potential conversion hanging over its head. If shares can be issued instead, it frees up cash for other corporate purposes.

Of course, for shareholders, the prospect of equity settlement is dilutionary and technically puts an overhang on the share price instead of on the management team.

For this reason, Sasol is asking shareholders extra nicely to say yes. In case you’re interested, the circular can be found here.

Vunani’s earnings drop but the divi is steady (JSE: VUN)

If you read carefully, the insurance business is carrying the team

Vunani reported a 4% increase in revenue and premiums and a 7% drop in profit after tax for the six months ended August. There are many things that happen between those two numbers, including fair value movements.

We therefore need to dig deeper into the business. The largest revenue contributor is the insurance business, responsible for 36.5% of group revenue. It’s also the major growth driver in the group, up roughly 25%.

The next largest segment is asset administration, with revenue up by 6.8%. This segment contributes over 30% of group revenue.

Fund management is up next, with this segment heading in the wrong direction. It’s down roughly 12.5% in revenue. Because of the operating leverage in that business, profit is down 47%.

Within the smaller investment banking business, advisory revenue fell to R14.8 million but at least that business turned positive at profit level, so costs were presumably cut. No such luck in institutional securities broking, with that race-to-the-bottom business reporting yet another loss. Revenue was flat and the loss has worsened from R940k to R3.4 million.

Overall, HEPS fell by 10.8% to 18.2 cents and the dividend was steady at 9 cents per share.

Little Bites:

- Director dealings:

- You’ll never believe it, but Des de Beer bought R352k worth of shares in Lighthouse Properties (JSE: LTE)

- I’ve seen some views in the market that the extensive sales of shares by the CEO of Truworths (JSE: TRU), Michael Mark, is a strong sell signal. These sales related to share options issued many years ago. Given that information and Michael Mark’s age, I’m still not sure these are such a strong signal, especially as many shares are also being retained when the options are being exercised.

- The CFO of Mpact (JSE: MPT) and his associates have sold shares in the company worth R67k.

- An associate of a director of Brimstone Investment Corporation (JSE: BRN) sold shares worth R42k.

- Primeserv (JSE: PMV) announced the acquisition of a business back in May 2023 for almost R11 million. The resolutive conditions have now been fulfilled. A resolutive condition is different to a suspensive condition in that the deal actually closes when there are resolutive conditions, with an attempt made to subsequently unscramble the egg if a resolutive condition isn’t met. It’s rare to see this in practice because it can be a practical nightmare.