Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

MTN’s profits have been decimated (JSE: MTN)

The depreciation of the naira has ruined the numbers

There really is no respite for MTN and the experience that the company has had in Nigeria. In a trading statement for the year ended December 2023, MTN announced that group numbers have been well and truly ruined by the naira. There are vast forex losses that have been a disaster for MTN as a whole, not just the Nigerian business.

HEPS is expected to be between -60% and -80% lower, which means a range of 231 cents to 462 cents vs. 1,154 cents in 2022. The company notes that 889 cents of the problem (i.e. all of it) was attributed to non-operational items, like hyperinflation adjustments of 151 cents and forex losses of 715 cents. The naira depreciation was a problem worth 593 cents per share.

As you might expect, the EPS result is even worse thanks to the impact of impairments, with that number expected to be between -70% and -90% lower.

Separately, MTN Nigeria released its results for the latest quarter. The top-line revenue growth isn’t the problem, with 22.7% growth in FY23 in local currency service revenue and an acceleration in Q4 (up 25%). Sadly, much of the cost exposure (operating costs and finance costs) is dollar denominated, so the devaluation of the naira severely impacts the company. MTN Nigeria reported a loss after tax of N137 billion vs. a profit of N348.7 billion in 2022.

Were it not for the forex losses, profit would have been N344.5 billion i.e. down by 14.3%. Free cash flow was up 11.6% to N631.6 billion. Sadly, we cannot simply ignore the impact of the naira.

The MTN share price is down 41% in the past 12 months. Considering it peaked at over R200 in February 2022, the ride down to the current level of R84 has been painful.

Despite earnings collapsing at Northam, there’s a dividend for this period (JSE: NPH)

Profit margins sharply deteriorated in 2023

This was an action-packed period for Northam Platinum, with the six months to December 2023 including some major corporate activity and the ugliness of a drop in PGM prices.

Dealing with the former, Northam Platinum accepted the mandatory offer from Impala Platinum for Royal Bafokeng Platinum and obtained R9 billion in cash and a whole lot of Impala Platinum shares. This was because Northam effectively gave up on the bidding war for Royal Bafokeng. Northam subsequently disposed of the shares in Implats for R3.1 billion and recognised a R800 million loss. All in all, shareholders won’t look back on the Royal Bafokeng gamble with any joy.

Moving on to the operational stuff, it’s never going to end well when the PGM basket price drops by 42.3% in a given period in ZAR. The pressure on the palladium price has been driven by lower demand for catalytic converters in internal combustion engine vehicles. The rhodium price has dropped because of substitution for platinum in the fibreglass industry, which sounds to me like a more permanent problem.

Northam gives a bearish outlook that notes a depressed pricing environment for the next 12 to 24 months. They are therefore fully focused on preserving liquidity, which is why they got out of the Royal Bafokeng / Implats situation as quickly as they could, taking the tried and tested approach in the markets of the first loss being the best loss.

Despite the focus on liquidity, the company declared an interim dividend of 100 cents per share despite HEPS collapsing by 92.5% to 121.4 cents. That’s a pretty high payout ratio for such a tough environment. The decision to declare this dividend would’ve been supported by the cash position of R11.8 billion in the group, with undrawn banking facilities of R11 billion.

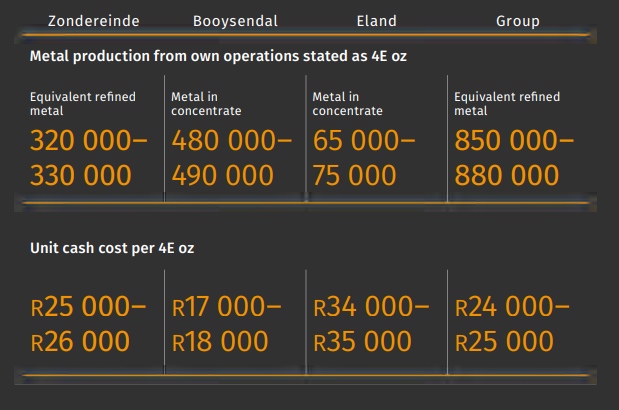

The real concern for Northam is the cash cost of the various operations vs. the current PGM price. Bearing in mind that the ZAR 4E basket price was R24,269 for the six months to December 2023, this unit cash cost guidance for 2024 is not encouraging:

At these commodity pricing levels, only Booysendal is profitable. Eland is losing money at an alarming rate and Zondereinde is marginal. The group as a whole is therefore marginal as well.

The Northam share price is down 30% in the past 12 months and unless there is a meaningful improvement in PGM basket prices, things won’t get better from here. The light at the end of this tunnel could be the world realising that EVs may not be the answer, with plenty of headlines suggesting that the EV-or-nothing silliness of global automotive manufacturers is being toned down significantly. This would be supportive of PGM prices.

Little Bites:

- Director dealings:

- Johan Holtzhausen is a non-executive director of KAP (JSE: KAP) and has vast experience in corporate finance, so I would pay attention to the fact that an associate entity of Holtzhausen bought shares in battered and bruised KAP worth R750k. The average price was R2.21.

- An associate of a director of Huge Group (JSE: HUG) bought shares worth R107k.

- Stefanutti Stocks (JSE: SSK) has reached an in-principle agreement with lenders to extend the capital repayment profile of the loan out to June 2025. They are busy amending the current facility agreement, with a short-term extension given until 27 March 2024 to conclude the amendments.

- Salungano Group (JSE: SLG) is going through a tough time at the moment and is suspended from trading. In positive news, the company has announced the appointment of three new independent non-executive directors, all of whom are highly experienced in various commercial roles.

- London Finance & Investment Group (JSE: LNF) is one of those completely off-the-radar listed companies on the local market. For the six months ended December 2023, HEPS fell by 51.6% (measured in GBP) and the dividend increased by 9.1% to 0.60 pence per share.