Murray & Roberts nosedives – again (JSE: MUR)

When a trading statement starts with multiple paragraphs of fluff, you know it’s going to be a bad time

Murray & Roberts has released a trading statement dealing with the six months to December 2024. It takes a while to get to it though, as they’ve padded it with lots of commentary that serves as a “reflection” on the 2024 full financial year. Much patting of their backs later, they actually get to the point: earnings will be down at least 20% for the interim period.

If you’re a regular reader, you’ll know that “at least 20%” is massive danger zone stuff. It’s the minimum disclosure required for a trading statement, so there’s every chance that the words “at least” are working really hard here, with a potentially far more severe drop. With the share price down 22%, the market is clearly cautious. I’m not sure that it is being cautious enough.

One of the problems here is the weak balance sheet. Although the banking consortium has agreed to kick the remaining R409 million in debt out to January 2026 (which isn’t that far away anymore), Murray & Roberts is light on working capital and this is impacting their operations. It’s a real chicken-and-egg problem, as raising money is difficult when results are poor. The Optipower business is being particularly influenced by this.

In America, things are off to a slow start due to a ramp-up of work in Mexico and the USA that is behind expectations. The Cementation APAC efforts in Australia are leading to bids for projects in Indonesia, but there’s nothing guaranteed yet. And in South Africa, the Venetia project for De Beers is now a major risk because De Beers has pulled back its operational plans there.

Remember all that stuff I wrote about lab-grown diamonds and how they were hurting De Beers? It’s all happening as expected, with big downstream impacts as well.

It’s a disaster for Murray & Roberts, as the Venetia project represented more than 50% of Murray & Roberts Cementation’s business in South Africa.

Pan African Resources announces an acquisition in Australia (JSE: PAN)

They played these cards close to their chests

Pan African Resources recently joined us on Unlock the Stock (watch it here) and the theme was one of the company being able to just carry on doing what it’s doing, with a solid gold portfolio and a favourable price. They managed to do an excellent job of keeping this Tennant Consolidated Mining Group deal under wraps!

Having already acquired 8% in March 2024 (really the only clue as to what they might be doing here), they’ve decided to pull the trigger on the whole thing and acquire the remaining 92% in a share-swap deal worth $50.8 million. The 9% was acquired for cash ($3.4 million), so they will now issue shares for the rest. The total purchase price is therefore $54.2 million for 100%.

The shares being issued constitute less than 6% of Pan African Resources’ existing shares, so this is a meaningful deal but they aren’t betting the farm on it.

They expect payback on the initial capital investment in less than 3 years and the base case financial model anticipates returns above the required 20% per annum. In fact, as you read further, the mineral reserves suggest a real ungeared IRR of 144%! With an expected all-in sustaining cost of $1,300/oz and the current favourable gold price, it is quite literally a gold mine.

First gold is expected by July 2025, with the processing plant construction more than 50% complete. Importantly, there’s an opportunity for more mining exploration at the site over time.

Try not to fall off your chair – Sibanye has a positive update! (JSE: SSW)

Group EBITDA increased in the latest quarter

Sibanye-Stillwater closed over 10% higher on a day that saw the company release a positive announcement. Even before you know any other details, that’s a pretty big deal. Sibanye has been consistently drawing the short straw in the mining industry, with problems and bad luck everywhere you look.

In the third quarter of the 2024 financial year (i.e. the three months to September), group adjusted EBITDA increased by 9% year-on-year!

The SA PGM operations certainly weren’t the highlight, with ongoing pressure in the PGM basket price leading to a drop in EBITDA from R2.53 billion to R1.58 billion. The US PGM underground business is also a problem, with EBITDA down from R397 million to a loss of R108 million. US PGM recycling fell from R147 million to R98 million. A positive contribution from Reldan of R149 million vs. nil in the previous year wasn’t enough to offset that.

So, why is EBITDA higher? Where was the good news, if not in PGMs?

Look no further than gold, where a drop in production of -9.3% didn’t matter when the average gold price jumped by a wonderful 23.7%. Due to the thin layer of profitability previously, this percentage increase led to EBITDA increasing spectacularly from R344 million to R1.35 billion.

Heck, that’s so good that the board might even take home massive share-based payouts thanks to the gold price, just like they did for the PGM price previously! For context to the general irritation in the market towards the company, here’s the five-year share price chart – and yes, this is after the 10% rally:

Cheeky jokes aside, they’ve also quantified the benefit of the recently announced changes to the US tax situation: $140 million for 2023 (presumably claimed retrospectively) and $100 million for 2024. That’s certainly helpful!

Sirius makes another two acquisitions in the UK and Germany (JSE: SRE)

They are deploying the recently raised capital, as they should

Sirius Real Estate has announced two acquisitions.

The first is a multi-let light industrial park in the UK for £9.05 million at a net initial yield of 11.4% excluding acquisition costs. They say that it is fully let, so I’m unsure how they managed to get it at such a juicy yield unless the tenants are two adult stores and a nightclub! The site even comes with permission for further new industrial space. On the face of it, that sounds like a solid deal.

Sirius has also acquired a €3 million strategic land parcel in Ruhr, Northwest Germany. Unless you count the resident wildlife as tenants, there’s no net initial yield here and they will look to develop this at the right time.

Zeder declares a chunky special dividend (JSE: ZED)

The proceeds from the recent farm sales are on their way to shareholders

Zeder is in the process of selling its assets and returning capital to shareholders. The fancy term for this is a “value unlock” and it tends to take a long time.

After the recent disposals of two farming assets by an entity owned by Zeder Pome Investments (in which Zeder owns 87.1%), that entity subsequently declared a dividend and the proceeds of R309.3 million have now been received by Zeder.

This enables Zeder to declare a dividend of 20 cents per share, which works out to basically the entire amount received as a dividend from Zeder Pome. This is as it should be, considering that Zeder has promised to return capital to shareholders.

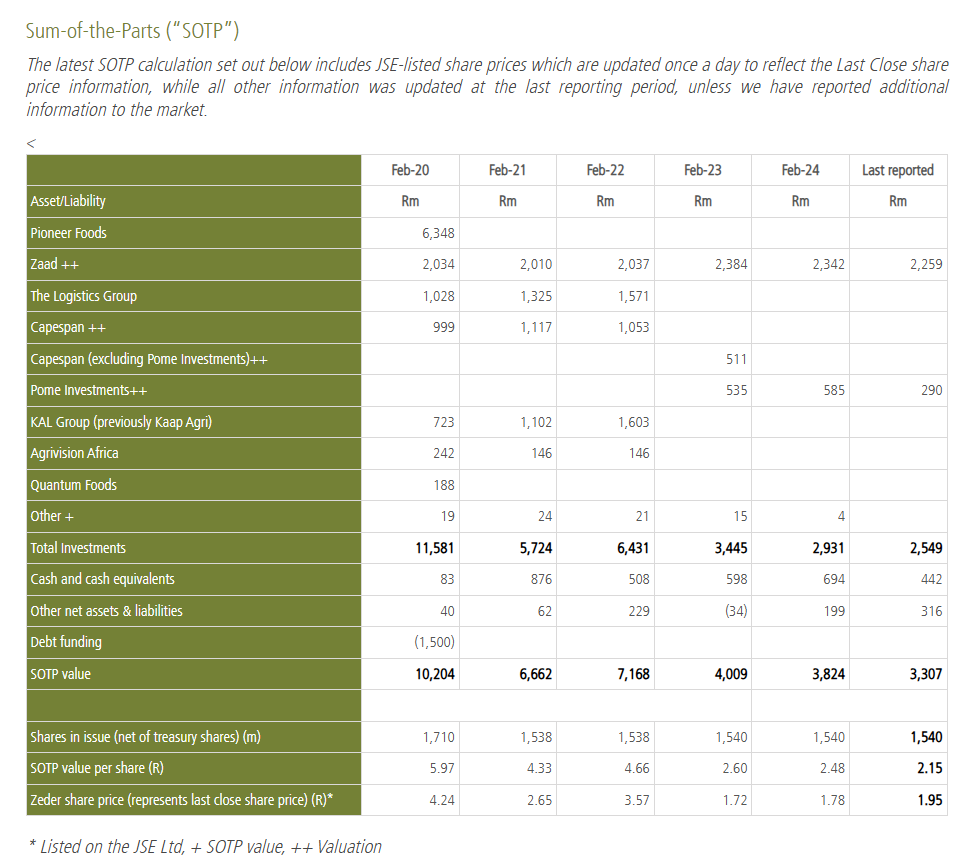

To give context to the size, Zeder’s share price is around R1.95. The latest sum-of-the-parts calculation on the website shows a value of R2.15 per share. The table from the website is a great way to see how the portfolio has been disposed of in recent years and the size of the group reduced as cash is paid to shareholders:

Nibbles:

- It probably won’t come as a surprise that Fortress (JSE: FFB) shareholders are keen on the underlying stake in NEPI Rockcastle (JSE: NRP). Holders of 75.94% of Fortress shares elected to receive a dividend in species of NEPI Rockcastle shares rather than a cash dividend from Fortress. This allowed Fortress to retain R642 million in cash.

- As Kore Potash (JSE: KP2) recently indicated in an update, the company is close to finalising the signing of the critical EPC contract for the Kola Potash Project. To get them across the line, they have raised $900k from certain existing shareholders as well as new institutional and high net worth investors. This is at a 15% discount to the price of the shares on 1st November. Annoying as that might feel for other shareholders, the reality is that this is a really small raise in the context of the overall investment story.

- In a good example of more proofreading being required on SENS, Motus (JSE: MTH) has made changes to the boar committee. What’s that saying again about the bulls make money, the bears make money and the pigs get slaughtered?

- London Finance & Investment Group (JSE: LNF) has always been a bit of a mystery to me. The company’s assets are mainly a portfolio of global equity stocks and now those have been sold anyway, with a cash balance of £23 million sitting on short-term deposit. I’m genuinely not sure what the plan is here.

Murray and Roberts CEO and management – biggest destroyers of value