Corporate finance corner (M&A / capital raises)

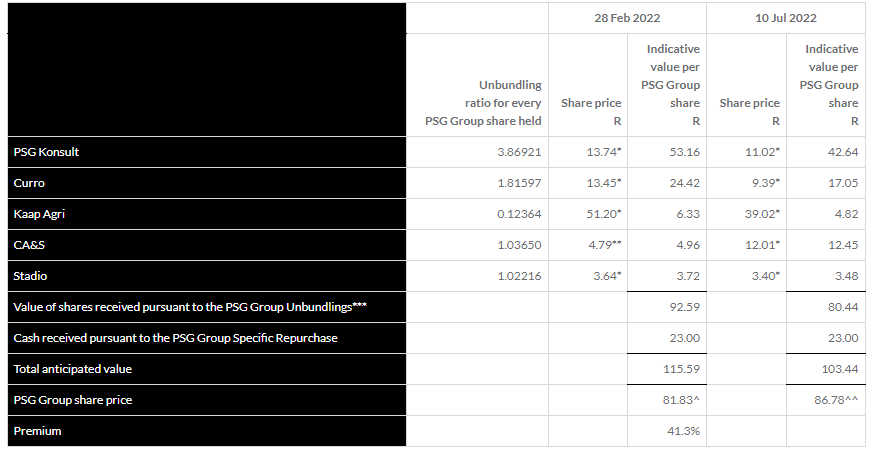

- The big moment is here for PSG shareholders, with the restructuring circular now available to shareholders. It deals with the “unlocking of value” for the PSG Group i.e. the unbundling of almost all the assets. This means that 61.1% of PSG Konsult, 63.6% of Curro, 34.7% of Kaap Agri and 47% of CA&S will be unbundled to shareholders. Only a portion of Stadio is destined for PSG shareholders (25.1% of the company), with the PSG founding management holding on to some of their Stadio shares. PSG is proposing that the assets that aren’t unbundled should be sold to the PSG founders for R23 per share. BDO Corporate Finance has already given its opinion as Independent Expert that the terms are fair and reasonable to shareholders. The table below indicates the value being distributed to shareholders. If you want to see how complicated corporate restructurings can become, there’s a 254 page circular for you to sink your teeth into at this link.

- Capital & Counties Properties (Capco) is in the process of proposing a deal with shareholders that would see Shaftesbury merger with Capco. A circular and prospectus have been sent out, as there are so many new shares being issued that this isn’t just a standard acquisition (hence the word “merger”). If you want to see the sheer number of documents required from a regulatory compliance perspective for a deal like this, check out this section on the Capco website. Please also note the earnings update from Capco further down in Ghost Bites today.

- Back in November 2021, Vivo Energy announced that Dutch energy and commodity trading company Vitol would be making a cash offer for all the shares it didn’t already own in Vivo. After working through the various shareholder and regulatory approval processes, the offer has now met all conditions. As the effective date is prior to the interim dividend record date, Vivo Energy has declared a special dividend of $0.02 per share. The shares are expected to stop trading on the JSE on 25th July, with the dividend then paid and the listing terminated on 29th July.

- Banks have been buying up their issued preference shares in the market, as this has become a less appealing source of capital since Basel rules changed (these are the rules governing the way banks measure their capital adequacy). At one point, banking preference shares were all the rage as a source of funding. FirstRand is the latest bank to make this move, with an offer to repurchase all the “B” variable rate preference shares. This is being structured as a scheme with a standby offer, with means that FirstRand’s ideal scenario is to repurchase all the shares (achieved through a scheme of arrangement), with second prize being a repurchase of shares from any shareholder willing to sell (the standby offer). The repurchase price is a 12.8% premium to the 30-day volume weighted average price.

- In case you are keeping an eye on service station forecourts business Afine Investments, you’ll be interested to know that Petroland Group and Terra Optimus now own 6.22% and 5.55% respectively.

Earnings updates

- Capital & Counties Properties (Capco) already earned a mention in Ghost Mail this morning for the release of regulatory documents related to the Shaftesbury merger. The company also gave the market an update on its business, headlined by a 5% increase in the value of the Covent Garden estate in the first half of the year. This was driven by a 4% improvement in the estimated rental value (ERV) and a decrease in the cap rate that the property is valued on, reflecting improved leasing activity and market conditions. Sales value is running ahead of 2019 levels and footfall is still recovering. The vacancy rate at 30 June is 2.5%. The loan to value ratio of Covent Garden is 20% and Capco has cash of £139 million and £300 million in undrawn loan facilities. Capco repaid £200 million in loans in the first half. Interim results for the six months to June will be released on 2 August.

- PBT Group has released its integrated annual report for FY22. Although there is no change to the previously announced results, the report is a worthwhile read for PBT shareholders because the company does a great job of giving proper disclosures about the business. For example, PBT discloses the percentage of revenue earned from each industry, with financial services now contributing 74% of revenue (way up from 49% in FY19). For more great insights into this company, refer to the integrated annual report at this link.

- Brait is firmly on the radar for investors, so it’s worth mentioning that the integrated annual report is now available at this link.

- African Dawn Capital has released results for the year ended February 2022. Revenue increased by over 58% and the headline loss per share improved by 12% to -20.3 cents. This group has a colourful history to say the least, including a fight with SARS and failed transactions. Today, the group has a lending business and a platform that claims to increase due diligence efficiency.

Share buybacks and dividends

- I don’t mention it every day as it would just become annoying, so this is your occasional reminder that British American Tobacco and Glencore are both busy with share buyback programmes and are releasing daily updates.

Notable shuffling of (expensive) chairs

- There was no shuffling today!

Director dealings

- Another day, another purchase of shares by a director of Kaap Agri. The latest purchase was to the value of R95k.

Unusual things

- BHP is defending a group action claim in the United Kingdom related to the failure of the Samarco dam in Brazil in 2015. I’ve seen offshore media reports that this is a £5 billion claim, so the stakes are high. There is incredible footage of the dam collapsing, which you can find here on YouTube (be warned: many lost their lives and it’s not hard to see how from the video). The UK High Court previously ruled that proceedings in the UK were an abuse of process. The Appeal Court has overturned that ruling, which allows the group action to continue in the UK. This has nothing to do with the merits of the claim and is purely a procedural ruling. BHP is deciding whether to seek permission to appeal to the UK Supreme Court. BHP has already provided £1.5 billion in compensation to over 376,000 people and legal proceedings in Brazil are ongoing.

- Imbalie Beauty has released the last integrated annual report that will carry that name, as the company has rebranded to Buka Investments. Covid caused incredible pain for the group’s beauty franchises, leading to a restructure of the group that included the beauty businesses being stripped out along with the debt raised during Covid. The remaining listed shell will focus on investments in the fashion industry.