Corporate finance corner (M&A / capital raises)

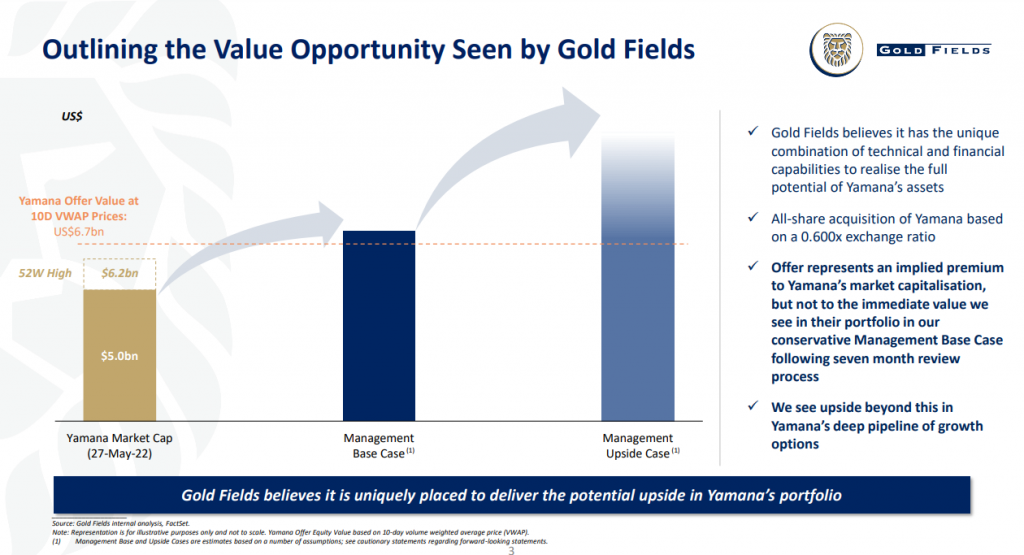

- Gold Fields really upset the market at the end of May when the company announced the major acquisition of Yamana Gold, an offshore business trading at a much higher multiple than Gold Fields. To help cheer shareholders up, the company has announced an update on its dividend and listing strategies, as well as rationale of the deal. The first bit of good news is that the revised dividend policy is to pay 30% to 45% of normalised earnings each year, with the 2023 payout ratio expected to be at the top end i.e. 45%. Another important update is that Gold Fields will list on the Toronto Stock Exchange as part of this deal, which will hopefully attract international investors. In terms of Yamana itself, Gold Fields sees this as a strategic fit that will bring high-quality, long-life assets into the group in attractive jurisdictions. There are still major shareholder approvals required (two-thirds of Yamana Gold shareholders and at least 75% of Gold Fields shareholders), so the deal is by no means a certainty. To help get it across the line, Gold Fields has released a detailed presentation that you can find at this link. As a Gold Fields shareholder, I’m hoping this chart from the update comes to fruition:

- Capital & Regional Plc has completed the £21.65 million sale of the Walthamstow residential development to Long Harbour. This project is found at a community shopping centre in London. The proceeds will be used to reduce debt. This is a classic “precinct” strategy, with the residential development expected to drive stronger performance at the retail centre. The share price showed its appreciation with a 7.6% rally.

- Super Group has raised R500 million in a debt issuance under its Domestic Medium-Term Note Programme on the JSE. It could’ve raised far more if it wanted to, as bids of over R1.7 billion were received for the tranches.

- FirstRand is in the process of proposing a scheme of arrangement with a standby general offer to holders of the B preference shares in the bank. If you are the proud owner of such a preference share, I suggest you refer to this circular for more information.

- Sebata Holdings is now trading under cautionary after noting that the company is in negotiations for a potential disposal of one or more businesses.

Earnings updates

- None – come back tomorrow!

Share buybacks and dividends

- As there were no other buybacks or dividends, I may as well remind you that British American Tobacco and Glencore are buying back shares on a daily basis.

Notable shuffling of (expensive) chairs

- The expensive chairs stayed where they were today.

Director dealings

- The ex-Naspers financial director (who still sits on the board) exercised share options and disposed of shares to the value of over R149 million. To put that number in perspective, if he invests it in fixed income instruments at just 7% per year, the interest would be R200k per week in round numbers. Aah well, back to work the rest of us go.

- Capitalworks is a long-standing partner of listed food business RFG Holdings. After the private equity investment house bought R195k worth of shares at the end of June, it has topped up the position with a further purchase of nearly R154k. This is announced on the market because two of the RFG Holdings directors are from Capitalworks.

- There’s yet another purchase of shares in Kaap Agri by one of the directors, this time to the value of nearly R72k.

- The financial director of Dipula Income Fund has bought nearly R54k worth of Dipula B ordinary shares.

- The management team of The Foschini Group has been granted chunky forfeitable share awards, which is a common long-term incentive mechanism. Buried deep in the announcement is a note that the company secretary sold a batch of shares previously granted, putting over R233k in the bank in the process.

Unusual things

- Renergen is still using SENS to provide an unofficial online course to anyone who wishes they had studied engineering. The latest update is the introduction of “gas to plant” at the Virginia Gas Project, which sets the scene for final commissioning workstreams over the coming weeks. Commercial operation is anticipated once customer sites are ready to begin accepting product, which Renergen expects towards the end of July 2022.

- If you would prefer to study geology online rather than engineering, Orion Minerals is an ongoing source of technical updates about the Prieska project. I usually skip to the quote from the CEO, which is the only bit I really understand. In this case, he continues to sound very happy. Orion is working on an early production strategy at Prieska and latest drilling results seem to be supportive of this.

- Old Mutual’s shareholding in Quilter has now moved below the 5% mark, a symbolic step in the Old Mutual story after Quilter was separated from Old Mutual in 2018, rebranded and listed as a UK wealth investment business.

- Pembury Lifestyle Group has renewed its cautionary announcement as the company is still trying to pull enough money together to just settle the bills from its auditors. Once that is sorted out, audits need to be done for the 2019 – 2021 financial years. A property in Northriding that was originally built as a school has now been converted to a commercial building, which should provide the cash flows needed to pay the auditors. The designated advisor and company secretary have also resigned, so things are just going SO well there.