Corporate finance corner (M&A / capital raises)

- There’s more action in the property sector, with Emira Property Fund making a general offer to acquire all the shares it doesn’t already hold in Transcend Residential Property Fund. Emira holds a 40.69% stake, a position that has been built up since late 2018 through underwriting acquisitive growth by Transcend i.e. injecting capital for ongoing property purchases. Emira’s rationale talks to an overarching theme on our market: JSE investors have gone cold on multi-layered structures that offer various entry points into the same or a similar basket of assets, usually resulting in a significant discount to underlying value. The offer price of R5.38 per share looks somewhat stingy though, with a premium of just 10.5% to the 90-day volume weighted average price (VWAP). This is significantly lower than the control premium we typically see in JSE buyout offers. Despite this, a major holder of 16.7% of Transcend has already said yes. This tells you something about the lack of liquidity in the stock, as Transcend has a market cap of under R1 billion. Transcend’s net asset value at 31 December 2021 was R8.08 and the company has reiterated guidance for a FY22 dividend of 57.50 cents. The offer price is a guided forward yield of 10.7%. Transcend will issue a response circular in due course. Take note that this is a general offer, not a scheme of arrangement and attempted delisting. In other words, Emira is happy to mop up any number of shares at this price.

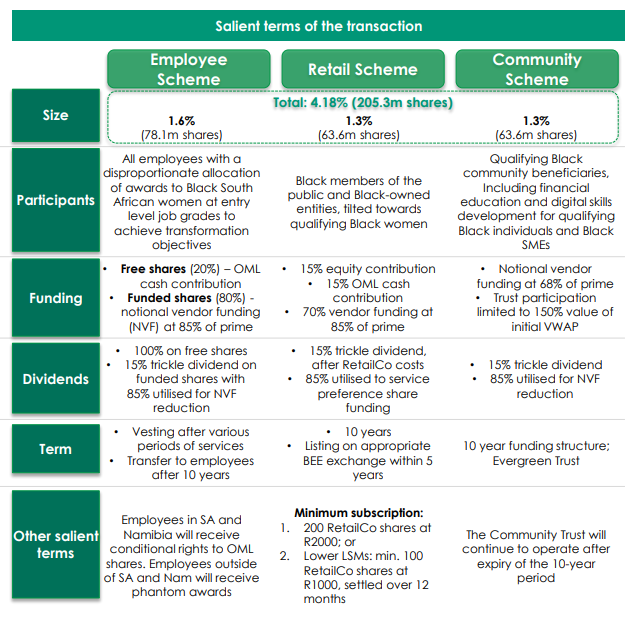

- Old Mutual has released the circular related to the proposed Bula Tsela B-BBEE transaction. This is a complicated structure that will see a 4.2% stake held by three types of investors through the issuance of new shares. An employee ownership scheme will hold around 1.6%, a community trust will hold 1.3% and qualifying members of the public will hold 1.3%. The shares held by the public will be listed on a B-BBEE exchange within the next 5 years, so there’s no liquidity here for a long time. There’s a useful summary on the Old Mutual website that I’ve included below. You can find all the documents, including the circular and earnings transcript, at this link on the Old Mutual site.

Earnings updates

- None – come back tomorrow!

Share buybacks and dividends

- As there were no other buybacks or dividends, I may as well remind you that British American Tobacco and Glencore are buying back shares on a daily basis.

Notable shuffling of (expensive) chairs

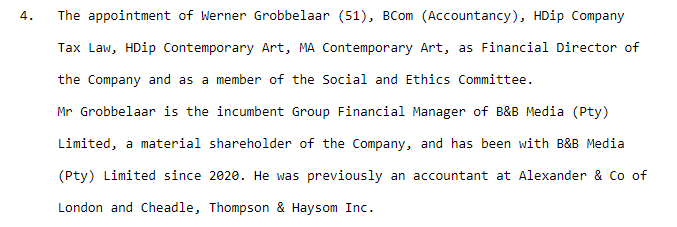

- The board changes at Buka Investments (previously Imbalie Beauty and I can’t find a new website yet) have been made, with the ex-CEO staying on in a non-executive role. I have to highlight the appointment of a certain Werner Grobbelaar, who has such an interesting variety of degrees that it warrants a screenshot. For more on Buka Investments, read this feature article by Ghost Grad Kreeti Panday.

- The CEO of Newpark REIT (the tiny property fund that owns the JSE building and 24 Central in Sandton along with a couple of other properties) has resigned to “focus on other opportunities” – I would also be bored if I was running a portfolio that I could count on one hand. Auri Benatar will be taking over and has previous experience as the Head of Acquisitions and Disposals at Redefine, so that’s an interesting development. Pun intended. This share almost never trades on the JSE, which is rather ironic since they own the building.

Director dealings

- A director of PSG closed out a zero-cost collar structure with a South African bank that was related to a loan agreement. The bank exercised its call option and bought R8.7 million worth of shares at a price of R49.33. The current traded price is around R85.

- Capitalworks is a long-standing partner of listed food business RFG Holdings. After the private equity investment house bought R195k worth of shares at the end of June and another R154k earlier this month, there have been more purchases with an aggregate value of nearly R108k. This is announced on the market because two of the RFG Holdings directors are from Capitalworks.

Unusual things

- I don’t usually comment on institutional ownership, as this can change significantly for a multitude of reasons. With the Tiger Brands share price having caught a bid in the past month, I’ll highlight that the PIC has increased its stake above 15%. At least we know who one of the recent buyers was.

- Steinhoff is going to bleed more cash for its poor prior behaviour, with an administrative fine from BaFin (the financial regulator in Germany) for late publication of the 2016/2017 annual financials and for failing to publish voting rights notifications within the prescribed period. They don’t play games in Germany. The fine is a whopping €11.3 million (R192 million) payable in three similar-sized tranches between March 2023 and September 2024. Steinhoff has lost around half its value this year, so I’m very glad I took my profit after the strong run in 2021. The company will be hosting a virtual analyst day on Friday 29th July.

- Jubilee Metals has announced important updates regarding the copper and cobalt strategy in Zambia. The cobalt refining circuit at the Sable Refinery entered the commission phase during June 2022 and commercial production is targeted for August 2022. The Project Roan concentrator has reached 65% of designated capacity and should reach 100% by the end of July, which would mean 830 tonnes of copper concentrate per month. Jubilee has come a long way, with operations across PGMs and chrome in South Africa and cobalt and copper in Zambia.