If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Corporate finance corner (M&A / capital raises)

- Prosus has announced the acquisition of the remaining 33.3% stake in iFood from Just Eat for €1.5 billion in cash. There’s a potential further payment of up to €300 million if the food delivery sector “re-rates” its multiples in the next 12 months. The announcement doesn’t indicate how this is calculated, but it basically protects the seller if the market recovers. The loss attributable to Just Eat was a meaty €62 million in the six months to June 2022. Grossed up for the shareholding, this implies that the group lost around €185 million in that period. You certainly need to place a lot of value on hopes and dreams to be investing in this stuff.

- The latest company to annoy the Takeover Regulation Panel (TRP) is Emira Property Fund, although it appears to be a minor transgression. In mid-July, Emira announced a firm intention to make a general offer to the shareholders of Transcend Residential Property Fund. Marketing materials were subsequently released that included views that were not included in the firm intention announcement. The TRP directed Emira to remove these materials from social media. Takeover law is enshrined in the Companies Act and the TRP is one of our strongest regulators in South Africa. When a company is under offer, the regulations become critical.

Financial updates

- Standard Bank announced results for the six months ended June 2022. It has been a wonderful time for the banks, with record headline earnings of R15.3 billion, up 33% on the prior period. Return on equity (ROE) improved from 12.9% to 15.3% (the target by 2025 is to reach 17% – 20%). Net asset value grew by 15% and there’s a tasty interim dividend of 515 cents per share, representing a payout ratio of 55%. Margin growth is very important and the banks measure this as either “positive jaws” or “negative jaws” – with the positive variant describing a scenario where income growth exceeds expense growth. In such a scenario, margin expands. Positive jaws in this period was 450 basis points, reflecting the difference between income growth and expense growth. Looking ahead, income growth for the rest of the year is expected to be strong (double digits in net interest income and single digits in non-interest revenue), with ongoing positive jaws and a credit loss ratio in the lower half of the through-the-cycle range of 70 to 100 basis points. The share price is up around 14.5% this year.

- Aveng has released a trading statement for the year ended June 2022. Headline earnings per share (HEPS) is expected to fall by between 74% and 78%, with the company pointing out significant non-recurring gains of R868 million in the prior period. Headline earnings (vs. earnings) usually adjusts for such issues, but not all non-recurring items can be adjusted in HEPS. The company provides a view on normalised earnings per share in an attempt to show the true underlying performance of the business. Normalised basic earnings per share is expected to be between 76% and 92% higher than the comparable period. In cases like these, I tend to just focus on the actual HEPS range given and I ignore the percentage movements. HEPS was between 226 and 261 cents, so the Price/Earnings multiple is somewhere around 7x.

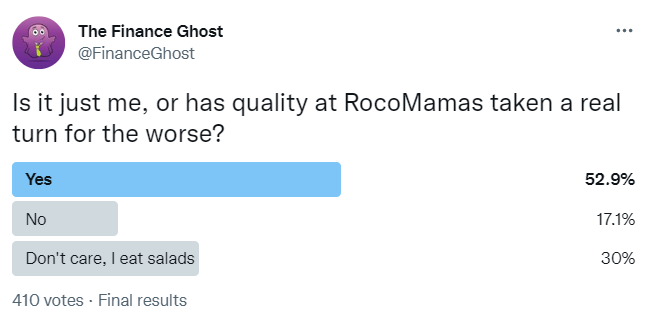

- People with a taste for profits will be happy to learn that Spur’s HEPS for the year ended June 2022 increased by 31% to 144.22 cents. There is no debt on the balance sheet and the cash position is up by R29.8 million to R290.7 million. With 631 restaurants across 15 countries, Spur managed to grow solidly throughout the year with a fairly similar growth rate in the first half (H1) and second half (H2). A dividend of 78 cents per share has been declared and the share price closed at R21.50. Looking ahead, the group has flagged macroeconomic issues and rising inflation as concerns. I would perhaps argue that a more stressful country may push more parents to use Spur as Friday night childcare while sipping a cold ale! RocoMamas is where my concern lies, where sales were up 25.3% (vs. say 30.1% in Spur itself, or 31.4% in Panarottis). All these numbers look amazing of course, but remember the base period had Covid lockdowns. My recent experience at RocoMamas was disappointing and a poll I ran on Twitter suggests that I’m certainly not the only one feeling this way:

- Afrimat will host a pre-close briefing session related to the interim results for the six months ending 31 August 2022. It will take place on 26 August and those who are keen to attend the virtual event should contact Keyter Rech Investor Solutions for details.

Operational updates

- Purple Group (the controlling shareholder in EasyEquities with a 70% stake) has announced that EasyEquities has partnered with an e-wallet provider in the Asia Pacific region to launch investing services within that application. The user base is described as “tens of millions of users” which sounds like a very large market indeed. The launch is planned for September and the counterparty has asked to remain unnamed until the launch. Like a ghost, really.

Share buybacks and dividends

- Much like those who smoke every day, British American Tobacco is still busy with share buybacks every day.

- Karooooo has confirmed that the interim dividend is R10.053 per share and that it will be paid on 12th September.

Notable shuffling of (expensive) chairs

- There was no shuffling on Friday.

Director dealings

- A director of Thungela has acquired shares in the company worth nearly R100k.

- A Dis-Chem director has sold shares in the company worth R24.6 million. That buys a few nice things.

- Des de Beer continues to buy shares in Lighthouse Properties, this time with a R1.1 million purchase.

- The interim CFO of AngloGold Ashanti exercised share options and promptly sold the whole lot, putting R382.5k in his pocket.

- An executive director of Trematon has bought shares in the company worth R53k.

- An entity related to the CEO of Industrials REIT sold shares worth just over £5.2 million. The proceeds will be used as partial repayment of a £6.5 million debt owed by the CEO’s related entity to a subsidiary of the REIT. The loans were made between 2015 and 2017 as part of a company share purchase plan. The balance of the loan will be repaid in the next seven working days. After this sale, the CEO will still hold around 4.55% of the issued share capital.

Unusual things

- The Takeover Regulation Panel (TRP) is being kept very busy lately. Aside from the usual regulatory issues related to offers in the market, the TRP also deals with complaints and allegations of misconduct or breaches of takeover law. Complaints have been related to transactions involving a share repurchase in African Phoenix Investments, a general offer from Peresec Prime Brokers and Zarclear Holdings, a share repurchase by Zarclear, the mandatory offer in EnX Group and the scheme of arrangement involving African Phoenix and Zarclear. The complaints boil down to one thing: parties acting in concert and failing to disclose this. There are other elements to the complaint, like the independent expert not considering the potential liability of African Phoenix in respect of the Extract Group mandatory offer. The first decision for the Executive Director of the Panel is whether the complaints are “frivolous or vexatious” – in this case, the decision has been made that there is reasonable suspicion of an infringement and that this deserves a proper investigation. It’s important to note that no adverse findings have been made at this stage. All that has happened is the decision to take a closer look.

- Raven Property Fund was set up to hold properties in Russia, which seemed like a good idea until war broke out. After needing to sell its stake in those properties, the listed vehicle will be disappearing from the JSE. It’s hardly a loss, as the share price chart looks like the company traded once in the past 3 years!

Did you note the Prosus puff piece editorial in BD today. They have spun the 300 million euro payment as protecting Prosus. They also mention the revenues and make no mention of the 185 million euro loss for the 6 months. Would be interesting to know your thoughts as you also write for DB.

Hi Ian! It’s a tricky one. I have some sympathy for the media as those sponsored articles go a long way towards paying the bills. Personally, I try hard to build the business in such a way that my views are clear and remain independent. It’s ridiculous to talk about the acquisition and not the losses! Just shows how sensitive Prosus is to that issue.