If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Corporate finance corner (M&A / capital raises)

- Universal Partners has one of the most interesting portfolios of any JSE-listed investment holding company. There is news in the offshore portfolio, as the Dentex business in the UK looks set to be sold. Dentex will be merging with Portman, the largest private dental consolidator in the UK. Dentex has over 130 practices that administer pain to their victims on a daily basis. Just kidding, I love going to the dentist… moving on, the deal will create the largest privately focused dental group in the UK and one of the biggest in Europe. Universal Partners will sell its entire shareholding in Dentex for a combination of cash and shares in the merged entity, so shareholders can claw back some of their dental traumas by being invested in the industry. Competition regulators in the UK need to approve the deal and completion is expected in the first half of 2023. Universal Partners notes that the deal doesn’t have a material impact on the current value of Dentex, but that an increase in value is likely as the deal moves to completion. This rather cryptic comment implies that the current valuation on the books is similar to the basis for the office price, with the eventual price reflecting the ongoing growth in the business between now and completion.

- MiX Telematics is acquiring Trimble Inc’s Field Service Management business in the US for between $6.7 million and $9.5 million. This business is involved in the sale and support of telemetry and video solutions for fleet services management across different industries, so the strategic fit with MiX Telematics looks pretty obvious. The business has more than 40,000 subscribers. A price of $300 per contract has been agreed where the remaining term is at least 18 months, with between $200 and $300 paid for other contracts. This is why the transaction price can vary so much. Operating profit was $3.2 million, so the earnings multiple looks incredibly low. The assumption is clearly that many contracts won’t be renewed. If they are, this could be a lucrative acquisition. This is a Category 2 Transaction under JSE Listings Requirements and so MiX shareholders won’t be asked for their opinions.

- With all conditions to the restructure now met, PSG has announced that the unbundling of assets and delisting will be implemented on 26th September. This iconic holding company will disappear from the market soon!

- Advanced Health has confirmed that the strategic review of the group is ongoing and that it has received inbound approaches from several parties interested in PresMed Australia. The company has noted that it is evaluating these approaches and that shareholders will be kept abreast of any developments. At this stage, there is no guarantee or even a likelihood of any transaction being proposed.

- As you are no doubt aware by now, Impala Platinum is trying to get its offer to Royal Bafokeng Platinum shareholders across the line. The remaining hurdle is the Competition Tribunal. In the meantime, Impala is allowed to keep buying Royal Bafokeng shares in the market. The latest purchase is for a further 0.16% of shares in issue, taking the total stake to 38.1%.

- AYO Technology and AEEI keep playing with our emotions. After planning to acquire the romantically-named Italian Summer business and that deal subsequently falling through, the companies have now removed their cautionary announcements related to a potential disposal of a business. We don’t know which business was on the chopping block and I guess we never will. AEEI remains under cautionary for a different reason though, namely the dispute related to the call option exercised by British Telecommunications South Africa (BTSA).

- OneLogix has done the right thing and released a clarification regarding the disposal by NJB Investco and acquisition by Best-Krug Saco of around 34% in the company. As I suspected, the companies have the same ultimate shareholders. There has been no change in indirect beneficial ownership of OneLogix.

- Jubilee Metals announced that two warrant holders notified the company that they will be exercising warrants to subscribe for shares at R1.22 each. The total value is R16 million. The current share price is R2.74, demonstrating the value of warrants to those who get them early in a company’s life. A warrant is just a share option issued by the company itself, giving the holder the right to subscribe for shares at a certain price.

Financial updates

- South32 released results for the year ended June 2022, capping off a year of record earnings and cash flow. Revenue from continuing operations was 69% higher and EBITDA margin expanded from 26.4% to 47.1%, so you can already guess that the result at net profit level is extraordinary. HEPS is over 6x higher than the prior year at $0.595 vs. $0.095. The final dividend is $0.14 per share and a special dividend of $0.03 per share has been added for good measure. The total dividend for the year (including special) was $0.257 per share, vastly higher than $0.069 in the prior period. In addition to strong results, this was a period of considerable corporate activity. South32 acquired 45% in the Sierra Gorda copper mine, an additional 16.5% in Mozal Aluminium and a further 18.2% in the MRN bauxite mine. Development work is focused on battery metals. Subsequent to year-end, South32 sold base metals royalties for up to $200 million and acquired 9.9% in the Altar copper project in Argentina. The share price is up around 60% this year.

- Gold Fields has released results for the six months to June 2022. The group operates nine operating mines in Australia, Peru, South Africa and West Africa and has one project in Chile. The company is highly respected as an operator and the latest results show why, with HEPS up by nearly 29% to $0.58 per share. Normalised earnings increased by 16%. Net debt to adjusted EBITDA has dropped from 0.49x to 0.33x, so the balance sheet is stronger too. The interim dividend is quoted in rands and 300 cents per share has been declared. The group is being kept busy with the proposed acquisition of Yamana, a major global deal that spooked Gold Fields shareholders. The share price is down 13.5% this year. Gold miners tend to trade at higher multiples than other mining groups, resulting in a lower dividend yield. The interim dividend is a 2% yield.

- Sibanye-Stillwater released results for the six months to June 2022 and the market was prepared for bad news after a previous update that showed the full extent of the financial damage from the floods in the US and the local gold strike. Although the share price closed higher on Thursday, all the platinum companies rallied. The good news is that although it was an ugly year, debt remains manageable and there is still an interim dividend. A three-year wage settlement was reached in the gold operations, so that problem shouldn’t come back for a while. It’s worth comparing headline earnings for this six-month period (R11.9 billion) to the immediately preceding six months (R12 billion) rather than just the comparable six months in the prior year (R24.8 billion). The year-on-year picture is terrible but the sequential story isn’t so bad. The worst problem was in gold, with production down 65% vs. the preceding six months at a time when the average gold price was 7.3% higher. Adjusted EBITDA collapsed to a loss of R3.1 billion vs. profit of R2.8 billion in the preceding six months. In the interests of finding a silver lining (not least of all because I’m a shareholder), this was the third highest interim profit performance since the group listed in 2013. An interim dividend of R1.38 is a yield of 3.3% on Thursday’s closing price, which is solid by most company standards but not terribly exciting by mining standards. The share price is down more than 15% this year.

- Italtile’s share price remains in the red this year, but it enjoyed a 3.6% rally on Thursday off the back of a solid financial performance for the year ended June 2022. Although system-wide turnover fell by 2% as consumer spending shifted away from home improvement, trading profit was up 6% and HEPS increased by 9%. This is a classic example of grinding out a result under pressure. The dividend increased by 9% to maintain the payout ratio despite a substantial drop in the cash balance of 60%. Although one may be tempted to attribute this to strategic investment in stock and raw materials to mitigate supply and pricing volatility, the cash flow statement suggests otherwise. The biggest year-on-year difference in cash was the payment of dividends! Italtile is ultimately exposed to the mood of South Africans and especially wealthier homeowners, so the “widespread despondency” noted in the announcement is a concern.

- Blue Label Telecoms announced that Cell C will release results in mid-September, followed by an investor roadshow over two days. The company acquired a 45% stake in Cell C in 2017 for R5.5 billion which has subsequently been impaired to zero, so that’s been a wonderful investment. Not. The relationship with Cell C is incredibly complicated, with a web of transactions and important dependencies, as Blue Label sells Cell C airtime. In fact, to help keep Cell C afloat, Blue Label has been pre-purchasing airtime. With all said and done, Cell C owes R2.6 billion to Blue Label on a gross basis and R1.75 billion if you offset the amount owed by Blue Label to Cell C. For context, Cell C lost R2.45 billion in the year ended May 2022. Blue Label also released results for the year ended May 2022, reflecting 10% growth in revenue on a consistent accounting basis. The reported number looks very different as a new accounting policy is being applied to sales of value-added services. Core HEPS from continuing operations increased by 18% to 96.56 cents, a measure that excludes non-recurring income in this year and the comparable year. The share price is up more than 41% this year, rewarding those who have taken a punt at a balance sheet that makes Prosus – Naspers look simple.

- Adcock Ingram released results for the year ended June 2022. The benefits of operating leverage are clear to see, with revenue up 12% and trading profit up 22%. HEPS increased by 24% and the dividend is 25% higher, so it all checks out. The next year is all about managing margin, with a significantly weaker rand and high fuel prices. Looking into the segmentals reveals that the Consumer segment brought the magic with a 23% increase in revenue and 49% increase in trading profit as the world normalised after Covid. I was surprised to note that the hospital segment only grew revenue by 6% despite the base period being significantly impacted by a lack of elective procedures. The full report notes that there was price deflation of 3.8% in this segment, which would help explain this. Despite that revenue pressure, gross margin was in line with the prior year. The share price is down around 3% this year and is now trading on a Price/Earnings multiple of 9.9x.

- Distell Group has released results for the year ended June 2022. Group revenue climbed by 20.8%, driven primarily by volume growth of 17.6% as the world normalised and people returned to pre-Zoom life. As South Africa was particularly strict on alcohol restrictions, international revenue growth of 7.9% is probably a more realistic view on growth. Interestingly, volumes were 9.4% higher internationally which means pricing must’ve decreased. Group EBITDA increased by 20.8% and HEPS was 36.8% higher. Due to the Heineken transaction, there is no dividend.

- Balwin Properties released a trading statement for the six months to August 2022. HEPS is expected to increase by between 40% and 50% vs. the comparable period, which means a range of 34.93 cents to 37.43 cents. The share price has lost 23.5% of its value this year and is flat over 3 years, which means you were probably better off investing in a Balwin property itself rather than the shares.

- Hulamin released a trading statement for the six months to June 2022. HEPS has jumped by between 137% and 153%, with an expected range of 45 cents to 48 cents. The company also reports “normalised HEPS” which excludes metal price lag and non-trading items. If you are happy to work with that number, the range is only 35.75 cents to 36.75 cents and the increase is a rather daft range of 815% to 835% as the comparable period was loss-making on a normalised basis. The share price chart this year looks like the side of a mountain, with a precipitous drop at the start of June that led to the current position of being down more than 40% year-to-date. That drop was caused by the withdrawal of a cautionary announcement after discussions with a potential offeror fell over despite the completion of a successful due diligence. It isn’t a deal until binding documents have been signed! If the counterparty is Elon Musk, it still might not be a deal at that stage.

- Murray & Roberts has released a trading statement for the year ended June 2022. Terms like “record-high order book” and “strong project pipeline” inject happiness straight into the veins of investors. If we include the full group, HEPS has swung from a loss of 14 cents to a profit of 30 – 32 cents. If we only look at continuing operations, HEPS has moved from positive 16 cents to between 59 cents and 61 cents. The share price was down 4.5% by afternoon trade to around R11.30, which strikes me as a lofty earnings multiple. I’m no expert in this space though and I would imagine that the valuation reflects the pipeline rather than the earnings over the past year. Still, the share price is down nearly 20% this year.

- Octodec had a strong day on the market, closing nearly 14% higher based on a trading statement for the year ended August 2022. Distributable income per share is expected to be between 17% and 37% higher, coming in at between 158 cents and 185 cents. The distribution is expected to be between 117 cents and 140 cents for the full year, of which 50 cents has already been paid out. Even after the rally, the closing price of R9.39 is a trailing dividend yield of around 13.7% at the midpoint of guidance.

- OneLogix has released results for the year ended May 2022. As we know from previous announcements, the company had a very tough year. Other than the obvious stuff like civil unrest, OneLogix also suffered damage from a hailstorm during September 2021 that nailed large shipments of passenger cars being processed by the company. The group carried the risk of minor repairs and the end result wasn’t minor when so many cars were damaged – the cost net of insurance was R25 million. For context, trading profit for this period was R178.8 million. Although revenue increased by 24% and EBITDA by 12%, things went badly wrong further down the income statement. Headline earnings per share (HEPS) fell by 69%. Even “Core HEPS” took a 60% knock. No dividend has been declared. Although the board has been considering a take-private of the company with a R3.30 per share offer, recent performance put those plans on ice. It’s unclear whether an offer will be forthcoming. The share price is trading at just above R2.90.

Operational updates

- Kibo Energy has initiated a process for Requests for Proposals (RFPs) to investigate feasibility of replacing coal with renewable biofuel. The company hopes to fuel existing utility scale power projects with biomass on a sustainable basis, which means a full assessment across economic, environmental and social metrics. The biomass would need to fuel a 300 MW power plant over a 20- to 25-year power purchase agreement period. Work completed by the company thus far has been encouraging, so this is to take it to the next level with the appointment of an international expert. Sit down for this one: Kibo’s share price has increased 4x over the past month from R0.05 to R0.20 per share!

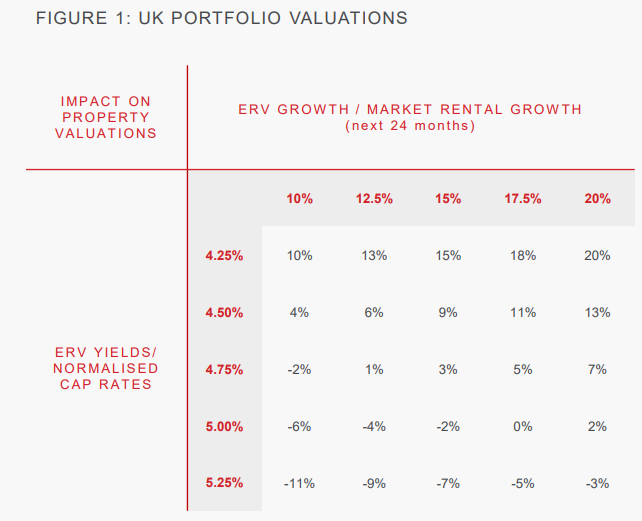

- Equites Property Fund released a pre-close investor presentation that includes numerous important insights. For example, UK logistics had a wider base of tenants in this period, with online retailers dropping from 35% of take-up in 2021 to 18% in the first half of 2022. In South Africa, warehouse footprints are being expanded by national retailers and third-party logistics companies, with market rental growth of between 10% and 20% at the top-end of the market. I had to include the below table from the presentation, which shows the impact on property valuations of market rental growth vs. yields used to value the properties. The base yield is 4.25%, so this means that 17.5% rental growth is needed to offset +75 basis points in yield. Over the next 24 months, Equites expects a marginal decrease in property valuations. Although the asset class is thought of as an inflation hedge, this is only on an income basis. The impact on valuations can be flat or negative, as inflation is often accompanied by higher rates.

Share buybacks and dividends

- I’m running out of creative ways to tell you that British American Tobacco is still repurchasing shares on a daily basis.

- FirstRand’s shareholders overwhelmingly approved the transaction to repurchase the bank’s preference shares. We’ve seen extensive repurchases of bank preference shares in the market as this has become a less desirable source of capital under new banking capital regulations.

Notable shuffling of (expensive) chairs

- Buffalo Coal has appointed Tushar Agrawal as the chairperson of the board. He is the ultimate beneficial owner of Belvedere Resources, the largest shareholder in Buffalo Coal.

Director dealings

- Barloworld had some pretty bad errors in recent announcements for director dealings. The worst is a mistake related to a director who was announced as having acquired over R4 million in shares – in reality, he sold that value of shares! The recent purchases by a trust related to the CEO were also incorrectly disclosed as being for 26,180 shares vs. the correct number of 22,580 shares. They at least got the direction right on that one.

- The CEO of Sirius Real Estate has bought some shares in the company to add to his self-invested pension. This was a small purchase (£15k) which takes his total stake in the group to 0.83% of shares in issue.

- A director of Kaap Agri has purchased shares worth just over R51k.

- A director of a major subsidiary of Nu-World has sold shares in the holding company worth over R65k.

- A non-executive director of Bytes Technology Group has bought shares in the company worth nearly R200k.

Unusual things

- New Frontier Properties has been booted off the Stock Exchange of Mauritius (SEM) for failing to publish outstanding financial statements for the year ended August 2020. It’s quite spectacular to note that this company won a PwC award for corporate reporting in 2017. Talk about hero to zero.

- Mr Price’s shareholders are less than enamoured with the company’s remuneration policies, with 48% of shareholders voting against the remuneration implementation report in a non-binding advisory vote. There will now be a process of engagement with shareholders. Although I must point out that many companies are experiencing this issue (like MultiChoice with a 31.7% vote against the report), a 48% “no” vote is rather high and especially after Mr Price engaged with major shareholders before the meeting. To put both of those into perspective, over 60% of Naspers shareholders were unhappy with the remuneration policy and 89% voted against putting unissued shares under the control of directors. Ouch.