- Pick n Pay has released a genuinely impressive set of results, with recently-appointed CEO Pieter Boone clearly having an impact on the group. Cost containment measures have paid off, allowing the group to cushion the impact of inflation on customers. Find out more in this feature article.

- The CEO of mining giant BHP delivered a presentation at the Bank of America Global Metals, Mining and Steel Conference. The speech highlighted BHP’s strong balance sheet and world-class resources (including the largest copper resource and second largest nickel sulphide resource in the world), important ingredients for success in the current environment. Despite being a cyclical business, BHP’s diversification has helped flatten the peaks and troughs to deliver more consistent cash flows – by mining standards at least! There’s also a discussion on the decision to invest in potash, with Russia and Belarus contributing almost 40% of global production. BHP believes that the potash business can be at least as big as the petroleum business over time, which BHP is exiting through the deal with Woodside Petroleum. There are many more details in the full speech and presentation available at this link.

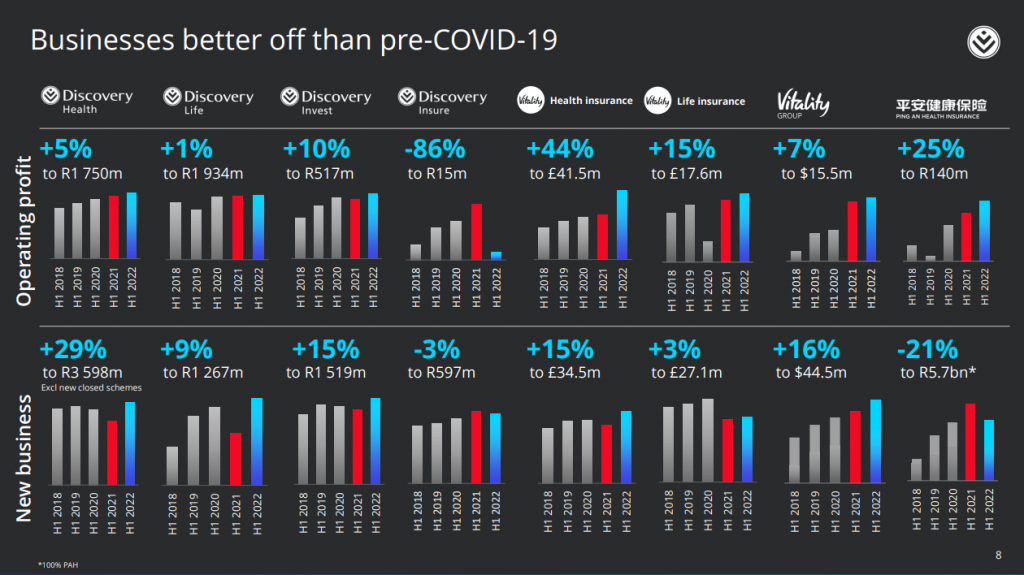

- Investors in Discovery would do well to flick through the DMTN roadshow presentation available at this link on the website. Although the presentation is being used to raise debt, the information is just as relevant to equity holders. I found the Discovery Bank metrics interesting, with over 400,000 clients and 850,000 accounts. The bank has attracted R9.5 billion in retail deposits and made R4.5 billion in advances. Operating losses of R498 million are substantial but Discovery says this is running ahead of plan. I also found this slide so interesting that it was worth sharing here:

- Quantum Foods has released a trading statement for the six months ended March 2022. HEPS will be between 14.5 cents and 17.1 cents, a decrease of between 36% and 46% from the comparable period. The pain was inflicted by an outbreak of avian influenza at the Lemoenkloof layer farm, a further reminder of the risks in the poultry industry. This had a negative impact of 8.6 cents per share and whilst an insurance claim is in process, no recovery can be recognised for the claim in this period as it isn’t finalised.

- Industrials business enX Group has released results for the six months to February 2022. Although revenue is up 16.6% and headline earnings per share (HEPS) from continuing operations has nearly doubled to 53 cents from 28 cents in the comparable period, net cash before financing activities (i.e. operating cash net of capital expenditure) has fallen sharply from R336.1 million to R29.9 million. The driver of this cash movement is that the comparable period had a huge positive swing in working capital which didn’t repeat in this period. Capital expenditure is noticeably lower at R658 million vs. R871 million in the comparable period. The overall cash position has improved substantially thanks to the receipt of cash from the sale of Impact Handling UK. In the months after the end of this reported period, enX also concluded the sale of EIE SA for a net transaction value of R676 million. The share price is down 28% over 3 years but up more than 63% in the past 12 months. I think this is a turnaround story worth watching.

- The soap opera at Ascendis Health continues. I may need to start calling it Descendis again. After the latest round of changes to the board, the debt facility from Apex Management Services and Pharma-Q Holdings was cancelled and made immediately due and payable, at the ratcheted (i.e. higher) interest rate just to add some spice. Never fear though, as there is yet another lender ready to take their place. These lenders and directors seem to come as a package deal. Austell Pharmaceuticals will lend R590 million to Ascendis at JIBAR plus 4% to settle the debt. This will also inject R10 million in working capital into the group. The debt is on more favourable terms than the previous debt package and is repayable by November 2022. A default is triggered if the Pharma business doesn’t end up being sold to Austell. The sales of Nimue and Ascendis Medical appear to be unaffected and must go ahead to help settle the debt. I still think Netflix is missing out on a boardroom drama here.

- Speaking of Ascendis, director Gary Shayne has been closed out of more CFD positions i.e. he has lost more money on Ascendis. Lightning just doesn’t stop striking here.

- Renewable energy company Kibo Energy has signed a rolling 5-year framework agreement with Enerox GmbH to develop and deploy CellCube Long Duration Energy Storage solutions in Southern Africa. This technology is based on vanadium redox flow batteries. The deal is exclusive for microgrid applications behind the meter (e.g. shopping centres and gated communities) and non-exclusive for any utility scale projects. Kibo hopes to sell this into an existing pipeline of projects ranging from 40kWh to 2,000kWh. If you want to see more of this technology in action, you’ll find the CellCube website here. There is unfortunately almost no trade in Kibo, with the share price having lost 93% of its value over the last five years.

- Insimbi Industrial Holdings has updated its trading statement for the year ended February 2022, reflecting expected growth in HEPS of between 127% and 147%. The expected earnings range is 23.5 cents to 25.6 cents. The share price closed at R1.07 yesterday.

- Gerrie Fourie, CEO of Capitec, has sold a whopping R56 million worth of Capitec shares. As director dealings go, that’s a biggie, though I must also note that this is a small part of his wealth. We can only dream, hey?

- Stefanutti Stocks has agreed to sell a property for R33 million. This is part of the company’s restructuring plan and proceeds will be used to reduce debt.

- Indluplace has released a trading statement for the six months ended March 2022. Distribution income will be just over R55 million, a decrease of 6.5% year-on-year. The good news is that the dividend is back, with 13.16350 cents per share declared as an interim dividend in accordance with the group payout ratio of 75% of distributable income.

- Premier Fishing and Brands released results for the six months to February 2022. Revenue fell by 22% and profit before tax dropped by 38%. Despite this, HEPS increased by 75% to 3.07 cents as profit attributable to shareholders of Premier (as opposed to minority shareholders in subsidiaries) was much higher than in the prior year.

- Equites shareholders should note that the dividend reinvestment alternative (receiving shares rather than a cash dividend) has been priced at R19.80 per share, a 3.2% discount to the 30-day volume weighted average price (VWAP). Those who elect to receive cash would receive a gross dividend of 84.61177 cents per share (the company’s previous announcement incorrectly said 80.56 cents per share).

Good morning,

Would it be possible to request an analysis of Purple Group? I have been having a very hard time with my investments in that company. I have bought the the last 4 dips but it just keeps dipping and I’m starting to wonder if I haven’t made a mistake..

Do you consider it to be a growth stock? Do you view it as a good long term investment? Any thoughts would be greatly appreciated.

Loving the new content style and layout by the way, keep it up!

Hi Lezander – that’s a particularly volatile stock and one that needs a very long term view! I am a huge fan of the EasyEquities product and the team clearly knows how to deliver something that resonates with a wide audience.

I wrote a balanced view on the company in InceConnect in April, shortly before the Ghost Mail rebrand.

You can read it here: https://www.inceconnect.co.za/article/purple-group-easyequities-profit-growth-stalls

Hope that helps!

I there. Thank you for this insightful publication. Can you please provide your view on the cannabis industry in SA and also, do you think Labat Africa is a good prospect since they made strategic acquisitions of late?

Hi Morne – I’m afraid that’s not an area of expertise for me at all. Labat has certainly been very busy, that much I do know! I would treat it as a high risk but interesting industry. I’m sorry I can’t be of more help than that!