Corporate finance corner (M&A / capital raises)

- Mediclinic has published the circular related to the offer by Remgro and MSC Mediterranean Shipping Company, acting through Manta Bidco Limited. The independent Mediclinic directors consider the terms to be fair and reasonable, having taken advice from both Morgan Stanley and UBS (thereby racking up a bill that would make some medical specialists blush). You’ll find the scheme document at this link and all related documents at this link.

- Mahube Infrastructure is in the process of restructuring and recapitalising its business. Shareholders are also being asked to approve the revised investment policy. The JSE has granted a dispensation for the rule to dispatch a circular within 60 days of the announcement. A circular will be issued to shareholders before 5 September 2022.

Financial updates

- Conduit Capital’s journey to zero (or pretty close) continues, with the Prudential Authority lodging an application to the High Court to place Constantia Insurance Company Limited into liquidation, with a court date in September. This subsidiary represents 94.4% of the revenue of the consolidated group. With 200,000 shares bid and over 2.5 million shares offered, those stuck in the structure are trying to get out.

- Harmony Gold fell by 11% after releasing results for the year to June 2022 that reflected the full extent of the pain. Although revenue increased by 2%, production profit fell by 20%. Operating cash flow decreased by 55%. Guidance for next year doesn’t look like much to get excited about, with production in a similar range to this year and all-in sustaining cost “below R900,000/kg” vs. R835,891/kg this year. The final dividend of 21 cents per share is a small consolation prize for a share price that has fallen more than 28% this year.

- Master Drilling released interim results for the six months to June 2022. On a USD basis, revenue was up 34% and profit increased by 47.9%, so that’s a fantastic set of numbers. Headline earnings per share (HEPS) is measured in ZAR and was up 55.5%. The accounting earnings growth hasn’t fully translated into cash earnings growth, with net cash from operating activities only up by 19%. The committed order book is $242.7 million. To put that into perspective, revenue for this period was $96.5 million. Master Drilling doesn’t typically declare interim dividends and this period is no different. The share price is up more than 50% in the past 12 months as activity has picked up significantly in the mining sector. This is about as close to “shovels in the gold rush” as you can get.

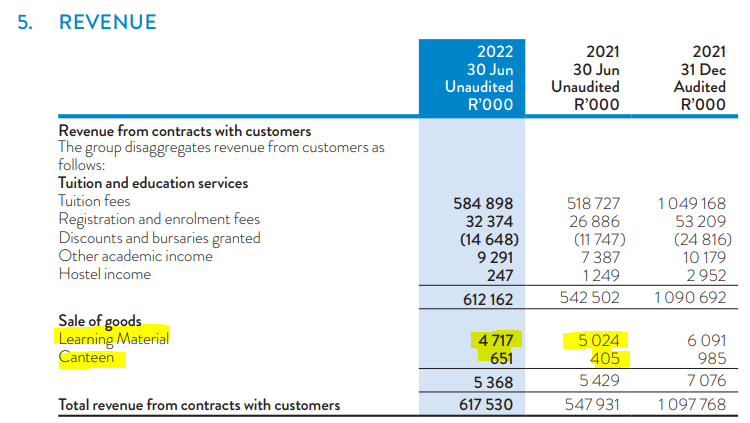

- STADIO Holdings (and yes, they insist on capital letters) released solid results for the six months to June 2022. When you’ve grown HEPS by 18%, you’re allowed to take the upper case route. That result has been driven by 11% growth in student numbers, which led to 13% revenue growth. It’s worth noting that STADIO negotiated the early settlement of the CA Connect acquisition (a runaway success) through issuing Milpark shares, thereby diluting its interest in Milpark from 87.2% to 68.5%. STADIO only pays annual dividends rather than interim dividends, so there’s no dividend for this period. Despite the world returning to normal, contact learning student numbers fell by 4% and distance learning increased by 14%, with distance learning now contributing 85% of the student base. Back in 2017, it was only 80%. STADIO has no debt and a cash balance of R167 million, so the group really is in a strong position. This is a classic case of a great story that has already been priced in, as the share price is down over 5% this year. In today’s edition of Bad Conclusions, we also note that STADIO’s students are learning less and eating more:

- Old Mutual released results for the six months to June 2022 and the market hated them, sending the share price down over 6.5% by afternoon trade. That’s a little embarrassing when the first line of the announcement talks about a “strong set of results” – well, the market says otherwise. The words “more than offset” are also frequently used, mainly because the bad news tended to outweigh the good news. Net client cash flows fell by 27% and funds under management dropped by 7%. Value of new business fell by 4%. The highlight was probably Life APE sales, up 15%. Thanks to the pandemic mostly disappearing from our lives, results from operations increased by 87%. Adjusted headline earnings would’ve been up 19% if income from Nedbank was excluded from the prior period, as Old Mutual unbundled the stake in November 2021. That doesn’t seem terrible on an overall basis, but the market looked through the net result to the underlying performance and clearly had different expectations. The interim dividend of 25 cents per share (44% of adjusted headline earnings) is below the dividend policy (ordinary dividend cover of 1.5x to 2x of adjusted headline earnings over a financial year) and many in the market had hoped for more. The share price is down nearly 17% this year.

- Kaap Agri has released a voluntary trading update for the ten months ended July 2021. The agriculture industry has been impacted by higher fertilizer and fuel costs due to the conflict in Ukraine, as well as logistical issues related to the floods. The Agri trade business achieved real growth of 16.6% vs. the prior period and the Retail trade business grew turnover by 1.6% excluding the acquisition of PEG Retail Holdings. Margins in both businesses have improved relative to the prior period. Kaap Agri notes “severe fuel volume decreases” in the broader industry based on high fuel prices, as consumers have been forced to reduce travel. The impact on Kaap Agri’s fuel business has been a reduction in volumes of only 2.8% (excluding PEG), which is good under the circumstances. As the PEG acquisition became effective on 1 July, only one month of its performance is included in the numbers for the 10 months ended July 2022. Those operations have exceeded expectations. Kaap Agri reports recurring HEPS as the most meaningful measure of profitability, with that measure expected to be between 15.3% and 21.3% higher in the year ended September 2022.

- Super Group released results for the year ended June 2022. Revenue increased by 17% and EBITDA was up by a substantial 69.8%. In a rather unusual shape to the income statement, the impact on HEPS was lower than on EBITDA, with that metric up by 33.4%. Cash generated from operations was up by 38%, which is always an important line to consider. The dividend is 34% higher at 63 cents per share. The share price has lost more than 16% this year.

- Transpaco has released results for the year ended June 2022. HEPS is 41% higher at 475.5 cents and the total dividend per share is 215 cents. This result was made possible by revenue growth of 12.5% and operating profit growth of 35.1%, with operating margin expanding from 79% to 9.6%. The Plastic division contributed 58% of group operating profit and grew operating profit by 31%, with the Paper and Board division contributing 31% of group operating profit and growing its profit by a meaty 44%. The rest of the operating profit came from properties and group services, in case you were doubting your maths. The share price is up 48.5% this year.

- Brimstone Investment Corporation released results for the six months to June 2022. I only ever look at the intrinsic net asset value (INAV) per share, as this is an investment holding company and the consolidated results reflect the roll-up of underlying companies, which makes it difficult to draw meaningful conclusions. One such conclusion is that Brimstone continues to disappoint investors, with INAV per share down by 18.4% year-on-year. No interim dividend has been declared, so there is nothing to ease the burn for investors. The share price is flat this year and the bid-offer spread is even wider than the frowns on the faces of investors.

- Lewis Group has been upgraded by Global Credit Ratings (GCR) from A(za) to A+(za) for its long-term rating. The short-term rating has been affirmed at A1(za) and the outlook is stable. GCR noted Lewis’ resilient performance through the pandemic and its strong operating margin that the rating agency expects to continue trending upwards. Despite many reasons to feel good about the business, the share price is flat year-to-date.

- Equites Property Fund has also announced an update from GCR, affirming its existing ratings and revising its outlook to positive.

If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Operational updates

- Southern Palladium presented at the 2022 Africa Down Under event and has made the presentation available online. It has useful information on the PGM value chain in South Africa and the drilling plans for the company. You can find it here.

- MC Mining Limited has announced updates for its Makhado project, Vele Colliery and Greater Soutpansberg Projects. The company is facing a decision around whether to move the Vele coal processing plant and modify it at Makhado, or construct a bespoke coal processing plant at Makhado. At this stage, the most attractive project NPV (net present value) is to move the Vele plant to Makhado. The construction of a bespoke plant gives almost the same return and retains the optionality around the Vele asset. The company has initiated discussions with BOOT (build, own, operate, transfer) funders. Other exploration assets in Limpopo (like the Greater Soutpansberg Projects) are longer-term opportunities.

Share buybacks and dividends

- Last week, Prosus repurchased shares with a total value of nearly $208 million.

- Lighthouse Properties is offering shareholders a scrip dividend of 1.625 EUR cents per share or a cash distribution of 1.462 EUR cents per share (a 10% discount to the scrip option). A scrip dividend means that shareholders receive shares in the company instead of cash. Lighthouse is incentivising shareholders to take the scrip option, as this helps the fund retail cash.

- Reinet shareholders have approved a dividend of €0.28 per share and the exchange rate for the conversion to rand will be announced on 6th September.

- British American Tobacco continues to repurchase shares on a daily basis.

Notable shuffling of (expensive) chairs

- AngloGold Ashanti has appointed Ms Gillian Doran has the CFO with effect from 1 January 2023. Ms Doran is currently the CFO of Aluminium within the Rio Tinto Group, based in Montreal.

- Mpact has appointed a new independent non-executive director, which is particularly important given the battle that the company is having with Caxton & CTP, an activist shareholder in the company. Alethea Conrad has been appointed to the board and brings 16 years of experience at Oceana Group.

- The company secretary of Calgro M3 is stepping down and being replaced by Juba Statutory Services. This is the only official company role that can be filled by a legal entity (obviously with a suitably qualified person behind it) rather than a warm body.

Director dealings

- The directors of Sibanye-Stillwater are buying the dip, with Neal Froneman himself picking up over $682k in shares. Admittedly, that is relatively small change for him, dwarfed even by the Chief Regional Officer: Americas buying $731k in shares. A non-executive director bought nearly R2m worth of shares on the local exchange.

- The group CFO of Famous Brands doesn’t mess around when it comes to investment positions in the company. He has bought contracts for difference (a leveraged position) with exposure of nearly R1.05 million.

- An associate of a director of NEPI Rockcastle has bought shares in the company worth over R3.7 million.

- A director of a subsidiary of Stefanutti Stocks has bought shares worth nearly R184k.

- A director of ISA Holdings increased his exposure to the company through a transaction further up in his personal investment holdings. In other words, there was no changing of hands of the shares in the listed company. The look-through exposure increased.

Unusual things

- Tsogo Sun Hotels will trade under its new name, Southern Sun Limited, from 7th September.