Corporate finance corner (M&A / capital raises)

- It didn’t take long for Walmart to move from a “potential offer” for Massmart to a firm intention announcement. The deal has been structured as a scheme of arrangement with a standby general offer that kicks in if the scheme fails. This is interesting, as it means that Walmart is willing to increase its stake in Massmart even if it can’t reach a 100% shareholding and delist the company. It’s worth highlighting that if a standby general offer is accepted by 90% of holders, there is provision in the Companies Act to allow Walmart to force the remaining holders to accept the offer. This would be a very weird outcome though, as shareholders would’ve needed to vote down the scheme and then accept the offer in order to create this position, which doesn’t make sense. The announcement notes that Massmart is going to need significant investment in the short-term and that turnaround measures will impact profitability, so my view is that Walmart wants to do this away from the public eye. The scheme consideration and general offer price are both R62 per share, a substantial premium of 68.7% to the 30-day volume weighted average price (VWAP). PwC is acting as independent expert and has concluded on a preliminary basis that the terms are fair and reasonable. One of the conditions to the scheme is that any appraisal rights exercised won’t exceed 5% of ordinary shares. The s164 opportunists in the market may find it tough to make money here, as justifying a higher value for Massmart than R62 per share is going to be extremely difficult based on recent results. In my view, we have a better chance of being Cricket World Cup champions than seeing the share price reach those levels in the absence of this offer. PwC seems to agree.

- A chapter has been closed – Barclays PLC no longer holds any shares in Absa. Barclays agreed to sell its remaining 7.44% stake in Absa through an accelerated bookbuild at a price of R169 per share. That’s 4.6% below the current price of R177 per share.

- All the way back in November 2020, Pan African Resources announced the acquisition of Mintails, a gold group where the holding company was placed into provisional liquidation in 2018. A definitive feasibility study concluded that the project has compelling economics and a significant impact for the group, with the potential to increase production by 25% through constructing a world-class tailings retreatment operation. The due diligence is in its final stages and the deadline has been extended from 31 August to 30 September.

- Impala Platinum has picked up another 0.27% in Royal Bafokeng Platinum, taking the stake to 39.13%.

- Mahube Infrastructure is in the process of restructuring and recapitalising its business and has released an important circular. If you are a shareholder, make sure you read it here.

Financial updates

- Impala Platinum has released results for the year ended June 2022. It’s been an unhappy time in the PGM sector, with rand revenue per 6E ounce down by 4%. This issue is made a lot worse by lower volumes (also down 4%) and a 17% increase in unit costs per 6E ounce. The safety performance also worsened, with seven fatalities at managed operations – this simply isn’t acceptable. Headline earnings per share (HEPS) fell by 17%. The balance sheet is strong at least, with R26.5 billion in net cash at the end of the period. Free cash flow was R28.8 billion (vs. R38.3 billion in the prior year), net of capital investment of R9.1 billion. The total dividend for the year is 1,575 cents per share, down 28.4% from the prior year. In terms of outlook, the palladium and rhodium markets are expected to remain tight (which is supportive of price) whereas the platinum prospects “remain muted” in the near term. The share price is down more than 23% this year.

- African Rainbow Minerals has released results for the year ended June 2022. HEPS has fallen from R66.88 to R57.87, a drop of 13.5%. Despite this, the final dividend is identical to last year at R20 per share, bringing the full year dividend to R32 per share (vs. R30 last year). The coal business was firmly the highlight, swinging from a headline loss of R250 million to headline earnings of R928 million. This is the smallest part of the group though (contributing 8% of earnings), so it couldn’t save a situation where the much larger ferrous and PGM businesses saw earnings drop by 16% and 34% respectively. Net cash improved by R2.97 billion to R11.18 billion. Operationally, the group has concluded the acquisition of the Bokoni Platinum Mine and will now focus on finalising a definitive feasibility study. Development capital of R5.3 billion is expected over three years to ramp up the mine to steady-state production.

- Santam has released its interim financial results for the six months to June 2022. Although gross written premium grew by a healthy 23%, the impact of the floods etc. drove a 53% decrease in HEPS. Of gross claims paid of R14.2 billion, R4.4 billion was attributable to the KZN floods. The group targets a net underwriting margin of 5% to 10% and could only manage 2.3% in this period. Despite the pressure, the interim dividend of 462 cents per share is 7% higher than the prior year.

- Sanlam has released a trading statement for the six months ended June 2022. The general insurance business has been suffering, driving a decrease in group HEPS of between 2% and 12%. The life insurance business put in good numbers thanks to lower mortality claims as Covid calmed down. The investment management business achieved higher asset-based income. The credit and structuring business enjoyed lower bad debt charges and higher net interest income. General insurance was hit by the floods in South Africa (with a severe impact on Santam) and lower investment return on insurance funds in Morocco. At group level, the lower equity markets over the period and higher project costs contributed to the decrease in earnings.

- Fortress REIT released a trading statement that significantly reduces the forecast distributable earnings for FY23. As the property fund is likely to lose its REIT status, it will now pay tax on its profits (an estimated charge of R350 million in FY23). I must point out that shareholders will pay dividend tax rather than income tax on distributions (i.e. a much lower tax rate as the company will pay some of the tax), so the biggest impact is on pension funds and institutional shareholders that are tax-exempt. They now experience genuine tax leakage, which is why I can’t see them sticking around on the shareholder register. The company’s assumption is that it will lose REIT status on 31 October and that retained cash will be used to reduce debt. Losing REIT status gives the fund a lot more balance sheet flexibility. It would be a spectacularly ironic outcome if everyone looks back five years from now and figures out that REIT status did more harm than good! The fund also released its results for the year ended June 2022, showing a 0.6% increase in NAV per share across the aggregate number of FFA and FFB shares in issue. The loan-to-value ratio has increased from 36.7% to 40% over the past year. Vacancies have reduced from 7.4% to 5.4%.

- Truworths has released results for the 53 weeks ended 3 July 2022. The group includes “pro forma” numbers which are on a comparable 52-week basis. As a reminder, retailers who report on a 52-week calendar would have a 53-week period every few years. This obviously limits comparability, so the group reports two sets of numbers to help investors. On that comparable basis, retail sales were up 6.6% and HEPS increased by 42.4%. The group managed to expand its gross margin to 53.5%. Cash generated from operations was R3.9 billion and the group used R1.6 billion for share buybacks. Net debt to equity is only 9.2%. The dividend per share is up 44% to 505 cents, of which 205 cents is the final dividend. After a strong recent rally based on the release of a trading statement, the price of R57.74 equates to a dividend yield of 8.7%. Truworths has underperformed for a long time, so the market treats it as a low-growth stock that needs to provide the bulk of the return as a dividend. Depending on your view on its growth prospects, this is either an opportunity or a value trap.

- Insimbi Industrial Holdings has released a trading statement for the six months ended August 2022. HEPS is expected to be at least 20% than the comparable period, which is the minimum disclosure required by the JSE to trigger the release of a trading statement. It often happens that the actual increase is a lot higher, though one cannot assume that this is always the case.

- Sasfin announced that GCR has affirmed its national scale rating of long-term BBB+(ZA) and short-term A2(ZA), with the outlook improved from negative to stable. This is some relief after a week of terrible PR for Sasfin related to a Daily Maverick investigation on smuggled illegal cigarette funds.

If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Operational updates

- Montauk Renewables has announced the planned construction of a second renewable natural gas processing facility at its Apex landfill gas project in Amsterdam, Ohio. This would increase processing capacity by an estimated 40%. The project is expected to be completed in 2024, with the key driver being forecasted biogas feedstock volumes from the host landfill. The expected capital investment is between $25 million – $30 million over the next 12 to 18 months.

Share buybacks and dividends

- It seems that South32 has returned to daily share buybacks, so at least British American Tobacco doesn’t need to feel lonely in its ongoing buybacks.

- Glencore has repurchased another £18.2 million worth of shares as part of the buyback programme that will run until February 2023.

Notable shuffling of (expensive) chairs

- Altron has appointed a new CEO to replace Mteto Nyati. The new man in the seat is Werner Kapp, who spent 22 years at Dimension Data including a role as CEO of Middle East and Africa. Kapp will take over from 1 October 2022.

- The CFO of Huge Group has resigned with effect from 1 September 2022. Yes, that is precisely zero days notice. Why, you ask? I don’t know, but it probably isn’t for good reasons. Either the relationship soured or the company disclosure sucks because the resignation happened a while ago. In the meantime, the Financial Manager at Huge Management (Peter Boyce) will take over as Interim CFO.

- Texton has changed its company secretary from one consulting entity to another. As a reminder, a company is allowed to appoint a juristic entity (i.e. a company) as its company secretary.

Director dealings

- Prepare yourself to feel poor. Bob van Dijk exercised Naspers share options awarded back in March 2014 and had to sell some to cover the taxes. The sales come to nearly R1.3 billion – that is not a typo! I would like to remind you that this was only a portion of the total options exercised. The total value was over R2 billion. For perspective, that’s the same as Aveng’s market cap!

- Directors of Sibanye-Stillwater have bought more shares. CEO Neal Froneman was good for $285k, the Chief Organisational Growth Officer (and his associate) tossed R4.5 million into shares and the Chief Sustainability Officer invested over R992k on the local market and over $46k into Sibanye ADRs in the US. The share price has taken a lot of pain this year and a show of faith from the management team goes a long way towards easing investor concerns.

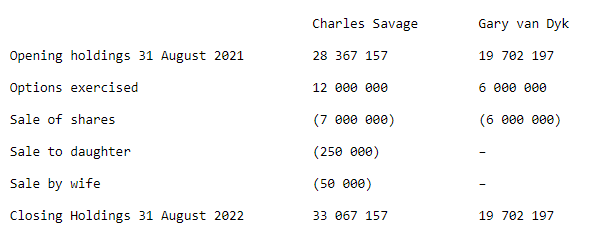

- Purple Group announced a sale of shares by Charles Savage as well as the CFO, Gary van Dyk. The group knew that the market would panic on this news, so Purple provided a table showing the movement in their respective holdings this year. The point is that Charles has been a net buyer of shares and Gary is flat:

- The CEO of Tradehold (and his wife) have exercised an option to sell shares to Christo Wiese at net asset value per share, which is considerably higher than the current share price. They have exercised this option to the value of over R9.8 million.

- A non-executive director of Astral Foods has acquired shares in the company worth R250k.

Unusual things

- After 27.14% of the votes were cast against a non-binding advisory vote related to the remuneration policy, Gemfields has invited shareholders to attend a call on 13th September to “express their views” – i.e. complain to the manager.