Corporate finance corner (M&A / capital raises)

- Buffalo Coal Corporation sold convertible debt of $27 million to Belvedere Resources for $2 million. Investec needed to consent to the assignment of the loan, which was supposed to happen before 31 August. As the bank is still negotiating with the parties around a settlement of all amounts owing, the date has been extended to 31 October. In the meantime, monthly repayment of principal and interest amounts remains effective.

- The sale by Datatec of its stake in Analysys Mason was given a resounding approval by shareholders, so the deal is now expected to be completed by the end of September.

- Heriot’s offer to Safari shareholders is still being discussed with the Takeover Regulation Panel (TRP), as there are some complex elements to the offer. Heriot needs to post a circular by 30 September.

Financial updates

- Cognition Holdings, the company selling its stake in Private Property for a wonderful price, has released results for the year ended 30 June 2022. Despite the price being achieved, the group has recognised an impairment charge of R41.6 million for this asset. EBITDA was R9.2 million vs. R33.3 million in the prior year, so the operating performance has been poor due to a nearly 35% increase in operating expenses, most of which relate to Private Property. That stake is being sold for R150 million and Cognition has a further R114 million in cash. Trade receivables and payables are of similar value, so the only other liability is “third party prize money” of R17 million. This implies a value of R247 million even if everything else in the group is considered to be worthless. The market cap is only R176.5 million! It’s a real pity that there is no liquidity in the stock. The only way to participate in this value unlock to a meaningful level is indirectly through Caxton.

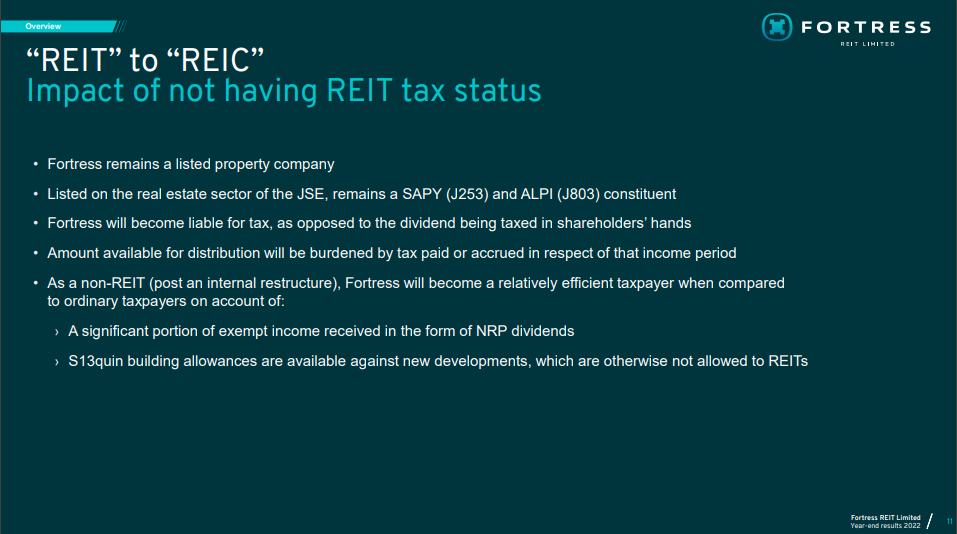

- Fortress REIT is becoming really interesting to follow, as we will finally see what happens when a property fund loses its REIT status. I may sound crazy, but I think that Fortress might look back on this one day and be thankful, as the balance sheet flexibility from not being a REIT is really useful. Here’s a slide from the investor presentation that highlights key considerations:

- Here’s one for your diary – Bowler Metcalf will be releasing results on 6 September and the analyst presentation will be on 9 September.

If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Operational updates

- Although Transnet doesn’t have an equity listing on the JSE, it makes use of the debt market and I always include updates in Ghost Bites as it has such relevance to the mining sector. Transnet and CRRC E-Loco have reached an in-principle agreement to resolve legal disputes, which should help Transnet Freight Rail address customer demand on an urgent basis. The agreement gives immediate access to components and spares and paves the way for a return to service of long-standing locomotes. The parties also hope to expedite further delivery of locomotives.

Share buybacks and dividends

- British American Tobacco, Glencore and South32 are all executing daily share buybacks.

Notable shuffling of (expensive) chairs

- Stephen Roper, an independent non-executive director of African Dawn Capital, has resigned from his role on the board.

- A rotation of independent directors at Shoprite Holdings will take place in November, which is part of good governance. Dr Anna Mokgokong, Joseph Rock and Johan Basson will all be retiring as directors in November. Executive director Ram Harisunker will also be retiring in November.

- William Bassie Maisela has joined the board of Purple Group as an independent non-executive director. He is the CEO of NBC Holdings, the first Black-Owned employee benefits company in South Africa. This gives us some indication of the type of strategic partnerships that the group might be looking for going forward.

Director dealings

- Entities related to Des de Beer continue to make significant investments in Lighthouse Properties shares, this time for almost R6.5 million.

- A non-executive director of Stadio Holdings has acquired shares in the company worth R256.

- A shareholder with a 43.1% stake in Globe Trade Centre has appointed a director to the board.

- An associate of the company secretary of Stor-Age has acquired shares worth nearly R523k.

Unusual things

- The Takeover Regulation Panel (TRP) is currently investigating Extract Group Limited, EnX Group Limited, Zarclear Holdings Limited, African Phoenix Investments Limited and others. Interested parties were given until 1 September to make submissions. The TRP has now extended the submission deadline to 9 September as there was some confusion around the timing of announcements.

- There’s another update on a TRP investigation, this time involving the previous findings made by the panel regarding Magister Investments and its concert parties, which include Gold Leaf Tobacco Corporation and its directors, Simon Rudland and Ebrahim Adamjee. You may recall that this was related to a proposed rights issue to recapitalise the business of Tongaat Hulett. Unless you’ve been living under a rock recently, you would’ve read about the proceedings that SARS has brought against Gold Leaf and its directors in the High Court, alleging that they went to great efforts to avoid paying tax to SARS. Although the TRP has no jurisdiction over tax, it does “jealously guard its regulatory mandate” and will be assessing whether this conduct of Rudland may contradict information that was previously provided under oath by both Rudland and Adamjee. Long story short, these guys are in serious trouble.

At this point I just wish Purple would do something interesting.

I’ve been buying shares for a while now and it feels like poking at a stone with a stick: [BORING].

Also, any idea on when we will see growth at Sibanye?

Have a great day and as always, thanks for another great read.

Hi – the challenge with Purple at these prices is that SO much growth has already been priced in. It’s why I’ve avoided the stock, despite how great the underlying story is. Look at STADIO as well – flying operationally, yet such tepid share price growth. As for Sibanye, I’m a long-term holder. The battery metals story is interesting. It’s good to see the execs buying at these levels but I wouldn’t expect much short-term happiness!