Ghost Grad Sinawo Bikitsha couldn’t resist the appeal of dedicating this week’s Ghost Global to the infamous meme stocks – companies that experience sharp moves due to the collective efforts of traders on Reddit.

Meme stock millions

Bed Bath & Beyond suffered a wild week as its shares dropped by over 40%, after one of its largest shareholders (billionaire Ryan Cohen) sold his stake in the company.

For those who aren’t aware, Bed Bath & Beyond is a New Jersey homeware retailer founded in 1971 and currently operating more than 900 stores (after closing more than 200 during the pandemic) across the US as well as outside its borders in Canada, Columbia and Puerto Rico.

The company is listed on the NASDAQ stock exchange and has subsidiaries including Harmon Stores and Buy Buy Baby.

The homeware retailer has been experiencing problems for a while. Ryan Cohen is an entrepreneur and activist investor who co-founded eCommerce pet supplies company Chewy. He is also the chairman of GameStop, another famous meme stock. Spotting an opportunity, he became involved in Bed Bath & Beyond this year.

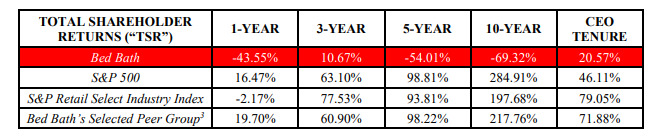

Earlier this year, Cohen and his affiliates acquired a stake of around 9.8% in the company. A letter to the board was made public in March 2022, in which the activist investors complained about the lack of financial delivery and the extent of executive compensation. This table was included in the letter and it clearly indicates the problem:

The letter even noted that the “strategy looks far better in a PowerPoint deck than it does in practice” – ouch! This didn’t stop Cohen acquiring more shares, reportedly taking the stake to nearly 12%.

Bed Bath & Beyond replaced CEO Mark Tritton in June and named Sue Gove as his interim successor, a restructuring expert. The pressure was clear. Fast forward another couple of months and Cohen shocked the market by filing an intention to sell his stake (this is required when shareholders of US companies hold more than 10%). To the disappointment of some on Reddit, he got the job done quickly by selling his shares and call options.

Cohen’s bank account certainly wasn’t disappointed, with profit of $68 million from selling directly into the meme stock resurgence. There is no reason at all for the correlation of Bed Bath & Beyond, GameStop and AMC Entertainment, other than the meme stock phenomenon:

Before Cohen feels too clever, 20-year-old US university student Jake Freeman made a one-month bet on Bed Bath & Beyond and banked a profit of $110 million. Of course, it’s useful that his family was able to put $25 million on the table to start with. The world we currently live in hey…

These meme stocks are extraordinary and rather problematic from a regulatory perspective, with many putting forward allegations of market manipulation. After all, large groups of people are effectively acting together via social media platforms to move share prices! Cohen is no stranger to these stocks, having invested in GameStop in 2020.

Moving away from the shareholder antics for a moment, Bed Bath & Beyond reported a 25% decline in net sales to $1.5 billion and an adjusted net loss of $225 million in results for the quarter ended 28 May 2022. The company has hit pause on store remodels and new store openings for the rest of the financial year. In line with many other companies, Bed Bath & Beyond reported that its operations were heavily affected by global supply chain disruptions, political conflicts and rising inflation.

Even Tom Cruise couldn’t save Cineworld

With media reports suggesting that box office takings this year are down by around 32% vs. 2019, cinema chains are struggling despite Tom Cruise’s best efforts.

British company Cineworld Group is preparing to file for bankruptcy in the US after operating for more than 25 years. The world’s second largest cinema chain (surpassed by AMC Entertainment) has been struggling to rebuild movie-theatre attendance from the pandemic drops and can no longer keep up with its debt.

Cineworld reported a loss after tax of $565.8 million, net debt (excluding lease liabilities) of $4.8 billion and lease liabilities of $4 billion in the December 2021 results. After an article by the Wall Street Journal highlighted the problems, the share price collapsed by around 85%.

Cineworld also owes $1 billion in damages to Canadian group Cineplex due to a fumbled acquisition back in 2020. Of course, whether there will be any cash available to pay those damages is highly debatable.

I find it necessary to mention that this isn’t the first time Cineworld has prepared to file for bankruptcy. Back in 2020, the company was in negotiations about debt restructuring with their lenders. Cineworld managed to score a favourable deal by having lenders agree to providing a $450 million rescue loan that would help the company in the short-term, saving the company from filing for bankruptcy.

The pandemic and especially its associated lockdowns went on longer than anyone could’ve anticipated. In the end, that loan just kicked the can down the road.

Planet of the APEs

Things are also tough for the leading cinema group AMC Entertainment. It was also hit hard by the pandemic and was arguably saved by the meme stock movement, raising equity capital as its share price rallied for no fundamental reason. The company remained loss-making in Q2 and doesn’t anticipate a great Q3, though the final quarter of the year holds much promise with the release of blockbuster films.

In an attempt to keep tapping into the meme stock movement, AMC announced a stock split that creates “AMC Preferred Equity” or APE units, a direct nod to the Reddit users who refer to themselves fondly as apes. This is a result of prior attempts to raise more capital through the issuance of ordinary shares, a move that shareholders eventually blocked after growing tired of dilution.

The preference shares are issued free of charge as a dividend and give the company an instrument for raising capital in the future. Here’s the trick though: an APE unit is convertible in future to an ordinary share, so this is just like a stock split.

Ultimately, this solution is all about the optics rather than the fundamentals. But after all, isn’t that exactly what meme stock trading is about?

Interested in global stocks? For just R99/month or R990/year, you can have access to institutional-quality research that is guaranteed to expand your investment knowledge. Visit the Magic Markets website to subscribe.