Earnings season is drawing to a close and it feels like we’ve all earned a holiday. In considering how the first few months of the year have played out, some surprising winners have emerged.

The performance in gold is simply a case of the sector carrying on where it left off in 2024, but what about platinum? And where did that telecoms rally come from? Also, have retail stocks continued their slide since the previous episode of Ghost Wrap that focused on that issue?

This podcast gives you great context to the year-to-date performance on the JSE.

The Ghost Wrap podcast is proudly brought to you by Forvis Mazars, a leading international audit, tax and advisory firm with a national footprint within South Africa. Visit the Forvis Mazars website for more information.

Listen to the podcast here:

Transcript:

Where have the local wins been in 2025?

It feels like earnings season is nearly over. Well done – we survived! Personally, I feel like I need a holiday.

In the previous edition of Ghost Wrap, I looked at how the retailers really struggled in the first month or so of the new calendar year, so I suspect many of them felt like they needed a holiday as well. In literally the past couple of days, the stocks have finally stopped dropping and have turned higher. Still, some of these retailers are down more than 20% year-to-date, so the consumer-facing stuff has been ugly for local investors.

But what have the winners been? Where could you have really made money on the JSE thus far in 2025? Bearing in mind that we are roughly three months in, a reasonable annual return expectation means you should be smiling if you’re up 3% or so this year. But then why is a Top 40 ETF up 9.3% year-to-date? And how can this performance be so different to buying the S&P 500 as a local ETF, in which case you would be down 7% year-to-date in rand?

The answer lies in the constituents of the index of course, as well as the rotation away from US stocks this year. On that note, we better start with mining. After all, that’s where the action has been on the local market.

Gold is glittering

Gold. We simply have to start there. The glittering has continued this year, with the yellow metal going over $3,000 an ounce for the first time. This has allowed the gold miners to continue their run from 2024, with the likes of Gold Fields up 50%. It almost doesn’t matter where you look, as Harmony is up 41% and AngloGold Ashanti has done 43%.

But what of Pan African Resources? Why is that “only” up 17%? I think this is a particularly interesting one, as this is the long position that I added in the past few weeks. The company had a disappointing period in the six months to December 2024, with production coming in below expectations. Obviously, when the gold price is doing well, investors want to see production being as efficient as possible to really take advantage of that price. Now, whilst I agree that poor numbers need to be punished in a share price, the reality is that production guidance for 2025 was maintained by Pan African. In other words, they expect to claw back the issues in the second half of the year. Looking ahead to FY26, there are major projects coming on stream to boost production. To add to my bull case, there’s a gold derivative that expired at the end of February, so they are now seeing the full benefit of the gold price, and yet the share price reacted so negatively to news of production in the first six months – I just couldn’t help but put on a position on the basis of that sell-off.

Watch this one closely. I wouldn’t be surprised if by the end of this year, Pan African Resources is top of the pile if we use that post sell-off base for comparative purposes – and that was my in-price. Hopefully, it works out.

Platinum – is that you?

By now, reading about a supply deficit in the platinum market is nothing new. It feels like this is the same story over and over again, usually accompanied by a chart showing how EV demand isn’t living up to expectations and thus demand for platinum in Internal Combustion Engine (ICE) cars must continue. Now, at some point, the supply and demand dynamics come true and there is a deficit. If prices stay depressed for a long time, investment in mining capacity is low or non-existent and hence supply shrinks. If you do then see an uptick in demand, inevitably the price spikes and this encourages investment in capacity, which then solves the supply issue and hence prices come down. This is why these are called cyclical industries. Platinum just has particularly tricky cycles to manage – and there’s a worry about structural decline in the market.

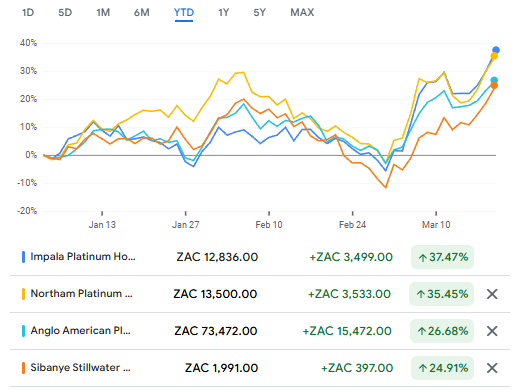

Thus far in 2025, the market seems to be believing something about the platinum story other than a structural decline. The price of Platinum Futures is up 9.5% year-to-date. Before you get too excited, it’s only up 12% in the past year and it’s been really range-bound over the period. Still, with prices of the commodity having gone in the right direction, we’ve seen quite a rally in the sector. Impala Platinum is up 37%, Northam Platinum is up 35% and Amplats has done 27%.

By the way, Sibanye-Stillwater is so downtrodden that the share price is up only 25%, below the platinum peers and the gold peers even though those are the major commodities at the group. Still, 25% up is a lot better than punters are used to seeing recently.

The variance over 12 months within the sector is astonishing though, showing how marginal the economics have been in this industry. It really does separate the better-quality companies from the ones that are struggling. Where companies are producing efficiently and lower down the cost curve, there’s performance to be enjoyed. For example, Impala Platinum is up 83% over 12 months, while Amplats is up just 7.6%! Timing and base effects make a difference here, but it’s very different to gold, where basically everything is up and by substantial margins. Platinum is far more volatile and riskier.

What about the rest of the market?

I’ve gotta tell you that things haven’t been great outside of the mining sector. For context, the Resource 10 index is up 27% year-to-date, so clearly the rest of the market isn’t shooting the lights out if overall JSE returns are in the single digits. If you look at the Small Cap index, you’ll clearly see the impact of the risk-off environment in equities that we’ve seen in the US, as that’s down 7.5% year-to-date. The mid-cap index is down 1.5%. The Financial 15 index is down 1%. This really leaves us with the industrials index to look at, which is basically the polony of the JSE – the index where they put everything that doesn’t have an obvious home anywhere else. And it has been doing well, which means we need to look at the constituents.

A good example of what’s in here would be Naspers, which has the largest contribution to the capped industrial index. Thanks to a resurgence in belief in China, it’s up 19% year-to-date. Prosus is up even more, with a 22% return. I’m invested in Prosus, a position I picked up in January when there was sell-off that didn’t make sense to me. Happily, that means I’m up 31%! I just wish it was a bigger proportion of my portfolio.

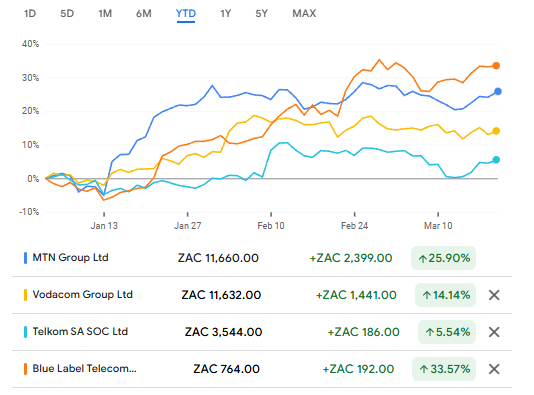

An area where I have no exposure at all is the telecoms space. Most of the time, I don’t feel like I’m missing out, as it hasn’t been a great performer over a long time period. But this year, that’s been another growth area on the JSE. MTN is up 26% year-to-date, Vodacom is up 14% and Telkom is up nearly 6%, well below the other two but still really good when you annualise that return. But the winner by far is Blue Label Telecom, up 34% this year as the market puts more belief in the Cell C strategy.

Why is the telecoms sector doing well this year? Some of it is probably related to a general outlook that 2025 will be a better year for African currencies. Honestly, they deserve a break, as recent times have been incredibly bad and have really hurt these businesses. A lot of it is also some of the recent growth in South Africa, which has been pretty decent by telecom standards. Of course, when you see moves like these, what it really tells you is that the valuation was so depressed that even a small amount of good news makes a difference.

What am I watching?

A lot of things – but what I will highlight on the local market is that some of the banking moves are worth keeping an eye on. For example, does it make sense that Standard Bank is up 8.4% this year, yet Absa – which also has major Africa exposure – is down over 2%? Absa is now on a trailing dividend yield of 7.9%. Sure, it’s certainly no rocket ship from a growth perspective and we do have the interest rate cycle to worry about, but that’s just one of the names that I’m keeping an eye on. They also have a new CEO coming on board, which is interesting.

The great thing about the markets is that they keep dishing up volatility and thus opportunity. Stay disciplined and stay alert to silly moves especially, like the gift that the market delivered in Prosus in January.

It’s going to be particularly interesting this year to see whether there’s follow-through in the mining and telecoms industries. They’ve both had a hard time for a long time. Maybe this is their year? Time will tell.