Adding to a significant day of property updates, Hyprop released a pre-close update. The retail-focused fund was hammered by the pandemic, with the share price still 50% off pre-pandemic levels. Let’s take a closer look.

The balance sheet has been a major focus for investors, so it’s not surprising that the announcement starts there. Hyprop has investments in Eastern Europe, so there’s a mix of rand- and euro-denominated debt in the group.

The sale of Delta City Mall in Montenegro was implemented in May 2022 and put €70 million into the bank. Hyprop promptly used this to reduce euro-denominated debt. Along with other repayments, the euro-denominated debt has reduced from €373 million in June 2021 to €110 million currently.

Rand-denominated debt has headed in the other direction, up from R5.1 billion to R6.4 billion. This was driven by the purchase of four Eastern European assets from European investment vehicle Hystead for €173 million.

There’s a short comment on how US dollar-denominated debt in Nigeria hasn’t changed, other than capitalised interest. The group notes the ongoing US dollar illiquidity in Nigeria. If you’re a shareholder in the likes of Nampak or MTN, you should take note of that.

The group loan-to-value (LTV) is around 40% which is uncomfortably high for the complexity and risks of the group. In recent periods, Hyprop disclosed a see-through LTV and a consolidated LTV, due to the Hystead structure. It now only discloses a consolidated LTV, which went as high as 51.7% in June 2020.

The announcement goes into great detail about tenant news at Canal Walk, CapeGate, Rosebank Mall and other centres. One thing I’ll highlight is that Exclusive Books seems to be hanging on, with stores upgraded to the “latest specification” – as a great lover of books, I’m happy to see that!

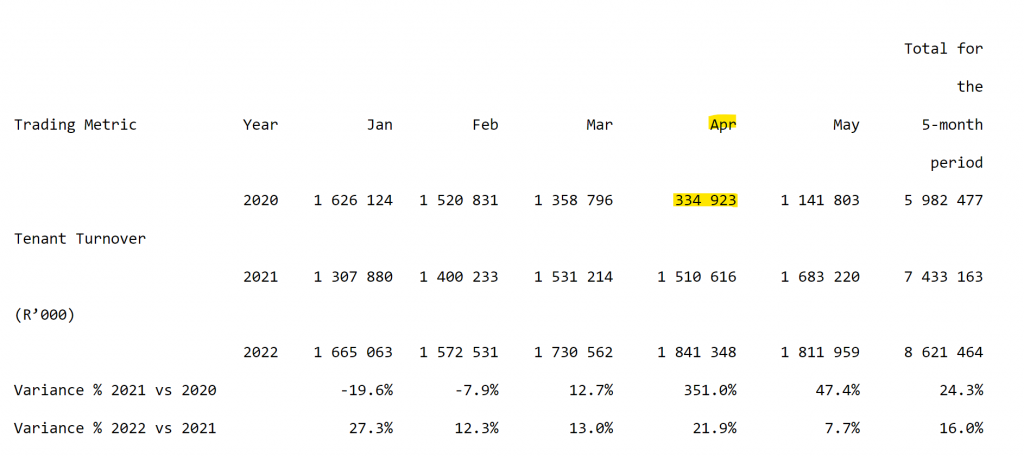

In case you’ve forgotten what happened in March and especially April 2020, here’s a spectacular reminder from the announcement:

I would also like to highlight that although trading density is running higher than February 2020 (rand sales per square metre), foot count is still lower. This is in line with most of the commentary I’ve seen from retail property funds: people are spending more per trip and doing fewer trips.

The trading at entertainment tenants has shown significant improvement. With masks out of the way, that can only improve further from here.

If you’re wondering whether things will go back to normal in retail, the trading metrics in Eastern Europe may help. Masks were burned in March 2022 and everything has improved since then: turnover, trading density and footfall. Recent performance is in line with pre-Covid levels.

That’s really bullish commentary when you consider that the mask mandate has only just been lifted in South Africa. Will we see a strong second half of the year in retail-focused property funds in South Africa?

Hyprop is trying to sell its assets in the rest of Africa, including in Ghana where it is co-invested with Attacq. Currency risks and dollar liquidity are the major issues, as the update makes it sound as though performance at the malls themselves is rather strong. South African businesses in many sectors have learned hard lessons about rushing off into Africa.