In this episode of The Trader’s Handbook, Shaun Murison from IG Markets South Africa joined me to explore the world of commodity trading.

We discussed the nuances of trading popular commodities like gold and oil, comparing direct commodity trading to investing in mining stocks, and delved into the unique appeal and risks associated with each.

Listeners will also learn about key trading patterns, including double tops and double bottoms, and how technical analysis can guide market decisions. Tune in for insights that blend strategic knowledge with practical trading tips.

Listen to the episode below and enjoy the full transcript for reference purposes:

Transcript

The Finance Ghost: Welcome to Episode 10 of the Trader’s Handbook, featuring your host, the Finance Ghost as usual, and Shaun Murison of IG Markets South Africa. This is coming to you shortly after Halloween, which is always an exciting time for a ghost. You may have gotten some great outfits out and maybe had some scares here or there. Hopefully the market hasn’t been dishing out some scares along the way – it does tend to be quite good at that! Of course, there are many different ways to play the market and to have the good times and the not so good times that come with it, and hopefully more good times than bad.

Last week we covered forex, so there’s a good example of something you can trade on the markets outside of what might be your comfort zone. For example, certainly speaking for myself, I’ve come at this series of podcasts having historically only played around in equities. So forex is something quite new in that regard.

This week we are going to do something different as well, so I’m really looking forward to that. We are doing commodities and that of course is another very important asset class. I guess gold is always the one that springs to mind. For me, when someone says commodities, it’s amazing how that just sticks, that’s just the one that I think about. I guess we all have that one thing, but unlike in forex, you can actually choose to buy the commodity. You can choose to buy the companies that are mining those commodities. I’ve been a bit closer to commodities than I have to forex in my equities journey because it’s quite hard to find a company that specialises in forex, but you can find a whole lot of them that specialise in commodities.

Of course, what we’re talking about this week, Shaun, is the actual commodities. So let me welcome you to the show and perhaps just start there with a question around why traders might be interested in the gold itself or whatever other commodity rather than the gold miners on the equity markets?

Shaun Murison: Great. I think when you’re trading gold, it maybe just appears a little bit more simple because you’re actually trading the product. If you start dealing with a mining company, for example, let’s use gold as the example, if you’re looking at a mining company, you’re worried about all sorts of labour action, management, operational efficiencies, weather – there’s lots that can go wrong with the earnings of a company, things that can affect that share price.

When you look at the commodity, you’re not worried about the corporate around that product. You might be looking at companies in terms of what production is, how much gold is coming into the market, for example. This is seen as just a simpler way of trading the commodity. You want direct exposure to a commodity rather than just the business. With that, though, generally you forego yield. With companies who pay dividends, you’ll get a yield. Obviously with a commodity like gold, you’re just looking at trading the price and benefitting from that price movement.

If there’s a shortage of supply of gold, expect the price to rise. Then you’ll be taking long positions and hoping to benefit from the price. You’re not worried about what’s actually wrong with a business, the underlying businesses that produce that product themselves. And when you start looking at things like these very liquid commodities, gold is a huge, huge commodity. When you start looking at exchanges, I think it’s somewhere around $160 to $200 billion in gold that’s traded through the exchange on a daily basis. And as a basis of comparison, if you look at volume that’s traded through the Johannesburg Stock Exchange over the course of the week, you’re looking at about maybe R110 billion. It’s considerably bigger market, a lot more liquid, which makes it easier to get in and out of positions. And then I know we’ll talk about costs a little bit later, but your costs to trade those types of products is a lot less.

The Finance Ghost: Like everything in the markets, actually, it comes down to risk and reward, right? You forego the dividend, but I think that the mining companies can dish out some pretty big hidings on the market because bad news does happen. And what’s interesting is these mining companies, especially the gold miners, there’s no huge positive surprises. People know what the projects are. It’s not like they announced some amazing gold rush. You know, hey, we found a whole lot of gold that no one knew about. That’s just not how it works, whereas the downside risks are always possible. There’s been some kind of geological event or labour action to your point, or weather or something else. I feel like it’s always a risk on the miners that you can have a really, really bad day, whereas on a good day it’s going to be driven by the commodity price and you can pick that up by buying the commodity anyway. A bad day, yes, will be driven by the commodity price, but can also be driven by company-specific events. When you are trading on leverage, I guess that’s the problem, right?

Shaun Murison: Again, that double-edged sword. When you’re looking at those companies, the leverage is less, but the volatility is more, so the likelihood of a large percentage move range of movement during the course of a day on a share is more likely than you’re going to see on the underlying commodities price, like a gold price, for example. But then again, when you’re trading the commodity like gold, that leverage is higher so your profits and losses are magnified by more. It’s a bit of a give and take when you’re trading between the two products.

The Finance Ghost: So you’ve touched on the point there, which is the amount of leverage and it’s something we talked about on the forex show as well. Is it the same story with commodities? You can have more leverage when you’re trading commodities than when you are trading equities?

Shaun Murison: Yes. It varies depending on what commodity you’re trading, but it’s generally up to 30 times leverage. Whereas with equities, when you’re trading equities at CFDs, you’re looking at about 10 times leverage as a maximum, sometimes less.

The Finance Ghost: And I’m guessing it’s the more popular commodities where you can have more leverage, right? Because it’s a deeper market?

Shaun Murison: Yeah, a deeper market that’s a lot more liquid and so a lot more transactions going through.

The Finance Ghost: So let’s maybe touch on some of these popular commodities because as I say, gold is the first one that came to my mind. It was actually quite cool, I recently held some Krugerrands that belong to a friend of mine. It’s such a silly thing, there’s no reason why it should be cool, actually. But you’re holding something in your hand that is worth a lot of money. I don’t know if it’s the colour of the damn gold or what it is, but there’s a reason why in all the mythology gold has been a big feature – the treasure chest of gold and people stealing pirate ships to go get it and all the stories of dragons and everything else. Gold clearly is something people like. I don’t know what happens to us when we look at lots of it in a specific place, but it’s a bit different when you’re trading it on a screen, obviously, and probably for the better. You don’t get to see the beautiful yellow stuff in your hand. Is gold still the most popular of the commodities in terms of traders? I think oil would surely be right up there. What are the sort of most popular commodities for people to trade?

Shaun Murison: So gold and oil do rank amongst the top. If you look at production value in the underlying market, something like oil is actually far bigger than like the top 10 metal markets combined. But remember, there’s different types of oil products to trade, so it does get fragmented in terms of trading value. With a broker like IG, obviously I can’t speak for other brokers, but I would imagine it’d be quite similar. It’s neck and neck, you know, on a weekly basis.

If you look at oil and generally the US, crude oil seems to be the most popular. US and gold, they rank probably about 5 and 6 in terms of most popular traded products with us. There are a lot of other commodities that do have quite a lot of appetite with traders at IG. So if we look at the broad commodity spectrum, what we would offer is divided into categories.

We have energies – your oil, natural gas, gasoline. Then you’ve got your precious metals like gold, silver, palladium, platinum, and then you’ve got your base metals, your copper, zinc, iron ore, things like that.

In terms of those groups, energies, probably the most popular, that’s your natural gas, very, very popular product to trade. Crude as well.

Within the precious metals, gold and silver, as you might expect at the top, there’s been a lot of appetite for palladium. Obviously a major producer of palladium is Russia and we know what’s been going on there

And then the base metals, probably not as popular as those products, but still quite traded, predominantly your copper.

I didn’t actually mention the other one, which is, I think quite interesting, is the soft commodities. A lot of the stuff that is farmed and there, what you find a lot of interest in is coffee – coffee and cocoa.

The Finance Ghost: Got to hedge that morning cup, hey? Long coffee in your portfolio and short coffee in your cupboard as you use it up!

Let’s maybe touch on some of those different underlying categories of commodities because they all have different drivers, right? Gold is typically seen as the safe-haven play, although honestly I gave up a couple of years ago trying to really understand what moves the gold price. It’s not always high inflation because sometimes it depends on the yield you can get on Treasuries at the time, it’s a very complicated animal, but gold seems to have that sort of safe-haven flavour to it.

Oil seems to move with geopolitics and obviously demand as well. People forget how much demand can change for oil. You think, well, I have to drive somewhere. Actually you don’t always, if it’s expensive to go somewhere or it’s expensive to transport something, you just might not do it. It doesn’t always mean that it’s your home to work drive or home to school, especially at industrial level where the big users of oil can pare back or whatever the case may be. So there’s a lot of sort of economic activity in oil, whereas that isn’t really in gold, which is jewellery and some other stuff, but that’s not really what’s driving it. It’s stuff like central banks buying it, etc.

The base metals, those are also economic activity, right? Copper is seen as that kind of thing where traders are reading the news, they’re not reading a set of company accounts because that would be equities. Instead, they’re focusing on geopolitics and inflation and GDP releases as the drivers of commodities.

Shaun Murison: Yeah, it really just depends on what sort of commodities you’re talking about. Obviously geopolitical risk has been a big factor. We’ve got ongoing wars which affect oil. Then you have your OPEC+, your Organization of Petroleum Exporting Countries and Russia controlling prices. You’re looking at announcements there and demand.

When you start looking at your base metals, most of the consumption is in China, so we’re looking at the health of China. There’s obviously a lot to consider and there are lots of different products to trade.

When you look at gold, you’re looking at safe-haven appeal. Is it a hedge against inflation?

A lot of these products do obviously look at the dollar as well, so the dollar might be a consideration when you’re trading these products. Generally, a weaker dollar makes these products cheaper in other currencies.

You’re looking at soft commodities, you might be looking at weather, crops, but at the end of the day, as a technical trader, I always think that good technical analysis reflects the underlying fundamentals or macro is that it’s absorbing all that information and then it’s reflecting it in the price. That’s the great thing about looking at charting, is it’s just mathematical formulae that are absorbing every little bit of rational investment, irrational investment, sentiment and then spitting out a result.

We just look to in the short-term trade those results, trade that trend that emerges from all those factors out there. So not to oversimplify things, but that is the beauty for me about charting is that we can look at that to digest that information and help us assess direction and hopefully join that direction.

The Finance Ghost: And in terms of what we’re actually trading here, even though it’s commodities, is it still a CFD like we’ve seen in the other instruments on the IG platform? Because I’m aware there are lots of different ways to trade commodities, as futures, for example. But some of this is for large industrial players looking to hedge exposure, etc. Commodities are a very real-world thing I guess, much like forex, companies are trading in this stuff all the time. Traders looking to speculate and make a profit are almost playing on the fringes of some of these flows. The primary flows are quite industrial in nature.

Shaun Murison: Okay, firstly, everything that we offer is a type of CFD. The CFD is just a Contract For Difference and it’s a contract for the difference in price. It can be based on anything. I don’t want to over complicate things, but obviously we do have futures contracts, but it’s a type of CFD with us. You’re still trading the price and you want to buy at a lower price than you sell that futures contract. Where the CFD is different is if you’re buying a share, you don’t actually have physical ownership of the share. You don’t have voting rights. If it is a futures product like oil, it’s just looking at a future price of oil relative to interest rates and fair value.

At the end of a futures contract, you might be able to take delivery of that product, whether it be oil or gold. With CFDs, you don’t actually own the underlying asset, you’re just looking to benefit from the price. It might look like it’s a futures contract or listed and it might reflect that futures price, but it’s still a type of CFD for everything that we do offer.

The Finance Ghost: And then, Shaun, in terms of the popularity of commodities versus forex, for example, on the platform – I think what I learned on the Forex show is that there really is a huge amount of activity in that space. Same story for the equity indices, actually more so than single stocks. I always have to switch off that side of my brain that is more fundamental. I want to go and read detailed financials and understand what’s going on. That’s not how trading really works. So, how does this stack up in terms of the popularity contest?

Shaun Murison: It does vary week by week. But I’d say that the most popular products traded with IG are indices, the major forex pairs – specifically the euro dollar – and then gold and oil. And in any week, what’s at top in terms of trading activity can change. That’s a very high ranking in terms of activity. I don’t know what the last count is, but we have so many instruments available for traders, over tens of thousands of actual instruments that traders can trade with IG. When you start looking at the top 10, that is very, very highly liquid, very, very heavily traded products.

The Finance Ghost: Shaun, last question on commodities, and this is obviously a really important one, this is something that we covered when we did forex, is just the costs of trading. How do the commodities stack up? Because that’s one of the big appeals of forex, right? The costs to trade are really, really, really low compared to a lot of other things. Where do commodities sit on that scale?

Shaun Murison: Again, it’s quite a broad suite, it does vary from product to product, but the structure of the cost is the same – that is, that there’s no commission. Trading commodities is generally seen as cheaper than trading shares or equities as CFDs.

It sits in the realm somewhere between indices and forex. I think when you start looking at gold in particular, it can be as competitive as the forex market because that cost is just a spread. And remember, it’s because those markets are very, very highly liquid. A lot of trading activity and when there’s a lot of activity, generally you see the costs of those products are lower.

The Finance Ghost: Absolutely. Makes a world of sense. Charts here are going to be key, as they are in all trading activities. I think let’s maybe move on to that bit of the show where we do some interesting technical stuff. Again, as is always the case on the show, we’ll include a link in the show notes and maybe a chart or two from the excellent IG Markets Academy just showing some of these things. You really need to see them to understand them properly. So please go to the website, check out the show notes, go find the stuff. Go look on the IG Markets Academy, that’s actually where you should look. You should listen to this stuff and say, okay, that sounds interesting, let me go find that on the Academy and then go read it in detail.

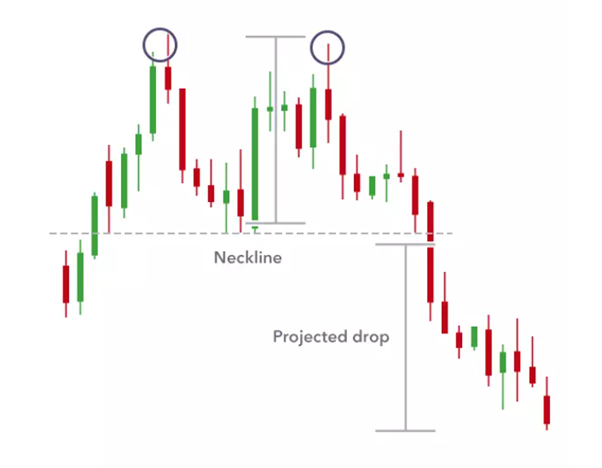

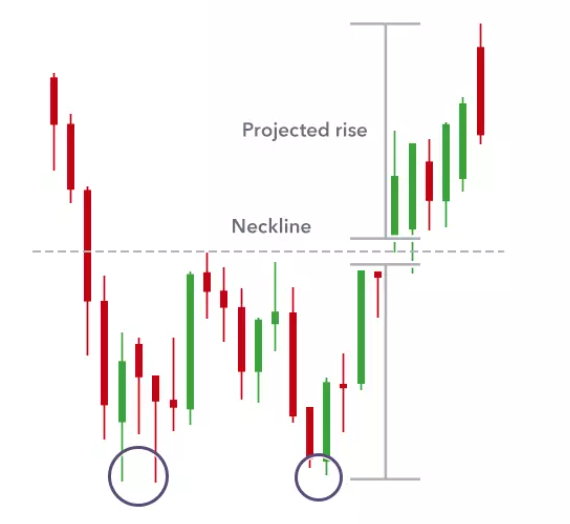

Last week we did the head and shoulders pattern, which was a very interesting way of figuring out where a share price or any price might go. Actually, never mind a share price, it could be an index, it could be forex, it could be commodities, any of the above. Moving on from that this week, I think we can do something that I’ve seen play out quite often and I’ve used with reasonable success in equities, and that is specifically double tops. The inverse of that would be a double bottom. It’s much like head and shoulders, I guess, where there’s the “normal” one and then there’s the inverse one.

I’ll just hand over to you to run us through that, Shaun, double tops, double bottoms, what are they? I guess the name is a strong clue. And what do they potentially tell us?

Shaun Murison: Okay, so double tops and double bottoms, they are reversal patterns. The suggestion is that a price trend is changing direction. When you look at a double top, if you look at the price action, it takes a shape of the letter M. The suggestion is that it’s marking a top of a market before changing direction from up to down. We have a neckline, we wait for it to break below that neckline and we say, okay, well, that trend is reversing from an uptrend into a downtrend.

Inversely, when you start looking at a double bottom, it takes the shape, it’s a price pattern, whatever instrument you’re trading, it’s a pattern that takes the shape of a W and it’s suggesting that a market that has been in a downtrend is now moving into a new uptrend. So as the name implies, like you said, double top is suggesting at least a short term top in the market, be wary of possible downside to follow. And a double bottom is the suggestion of, maybe we’ve hit the bottom of that market and we could be setting up for a bit of a rally or change in trend from down to up.

Very similar in implication to that of the head and shoulders which we talked about previously. That’s obviously also a reversal pattern here and certainly something that I do look at. Certainly if I see a double top, if I’m long in the market, I see a double top, I might use that as a signal, maybe it’s about to turn, maybe I’m just going to get out of the market right now. If there’s other conviction, maybe I’m using other indicators with that, I might look at short positions and the market trades with the view that we expect that market to fall further.

Inversely with the double bottom, if I see that pattern and I was short in the market, I might be looking at exit my short position. If I had conviction, maybe using other technical indicators or other indications, I might use that double bottom as a suggested entry, long entry, a buy opportunity into that particular market.

The Finance Ghost: Yeah, Shaun, thanks for those insights into double tops and double bottoms. I haven’t used double bottoms too much, but I’ll look out for those a bit more. And double tops, as I say, I’ve had some really good successes with that in the equity space, so not surprising that it translates really well into the other stuff as well.

Thank you as always for your time this week. I think it was another great show. To our listeners, go and check out the rest of the series. There’s a lot of really great stuff to help you learn all about trading and most importantly, go and open the demo account because that is the number one way to go and learn. Rather go and make the mistakes with Monopoly money. Rather go and figure out how the system works without your real money in there just yet. And then when you feel confident, you have the ability to then fund your account if you so choose and you can get started on your trading journey. Sean, thank you so much. I look forward to doing the next one with you in a couple of weeks. And yeah, all the best for a trading week ahead.

Shaun Murison: Thank you very much. Great being here.