In the current market environment, investing is incredibly complicated. As the longest bull market run in history comes to an end and inflation continues to rise steeply, investors are faced with the prospect of becoming poorer in real terms.

The increasingly difficult task of extracting alpha (excess returns in relation to the market) in traditional 60/40 (equities/bonds) portfolios is likely to further drive the popularity of alternative investments. According to Prequin research, the alternative investments industry is predicted to continue its surge from $13 trillion in assets under management today, to more than $23 trillion by 2026.

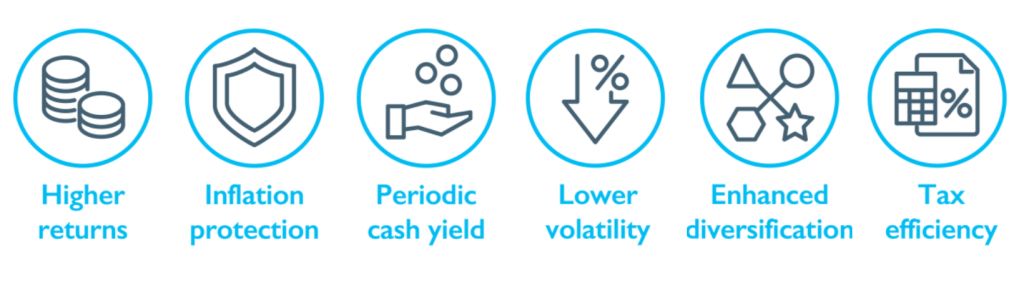

One of the world’s fastest growing alternative asset classes is private debt. When compared to traditional fixed income, private debt offers investors:

Investors are able to gain exposure to the asset class through Westbrooke’s local and offshore private debt funds (click here to find out more). In the offshore space, Westbrooke’s Yield Plus private debt fund is currently generating a trailing 12-month cash yield of 6.7% in GBP (net of fees and costs).

With a four year track record of successfully delivering returns within the target range of Cash + 5% – 7% in GBP, Westbrooke Yield Plus provides investors with a high yielding, fixed income alternative investment, through a diversified portfolio of 45 private debt transactions predominantly in the UK. The Fund delivers an asymmetric risk / return profile, by focusing on providing loans to lower and middle-market UK companies and real estate sponsors, a significantly under served UK market segment. Importantly, more than 70% of loans are floating rate in nature, providing investors with much needed inflation protection in the current environment.

It is our pleasure to invite clients to an exclusive offshore private debt overview webinar, in which we will be discussing the UK private debt industry, the Westbrooke Yield Plus offering and how you can gain exposure ahead of the 24 June investment deadline.

You can RSVP for the webinar by clicking on the image below.

Invest in private yield debts more information request