Step into the world of retail excellence with JD.com (NASDAQ: JD), the e-commerce champion that has been sprinting ahead, leaving competitors in its dust.

With its impressive growth, unwavering determination, and strategic manoeuvres, JD.com has cemented its position as a force to be reckoned with. From surging revenues, innovative strategies, unremitting focus on customer satisfaction and relentless expansion into new markets to its ability to adapt to the ever-changing landscape, JD.com has proven time and again that it knows how to captivate investors and deliver remarkable returns.

As investors seek to navigate the dynamic landscape of the retail industry, JD.com emerges as a shining star with a proven record of constantly adapting to changing environments while continually outperforming its peers.

As the saying goes, “Fortune favours the bold,” and JD.com has boldly embraced new markets, expanded its ecosystem, and harnessed the power of digital transformation to cement its position as a true titan of e-commerce.

Technical

The daily chart shows that the company’s share has been under bearish pressure within a descending channel, helping the share decline over 34.8% year-to-date (YTD). The sharp YTD decline could offer an opportunity for a long position at a discounted price, with the share’s current pre-market value of $36.89/share offering the potential for a 48.39% upside as the share converges towards its estimated discounted cash flow fair value of $54.74/share (green line).

Should the bearish momentum continue to push the price lower, the $31.57/share support level could offer an opportunity for a long at a further discount. A sustained break below the $31.57/share price level could trigger a sell-off to lower levels, with the $26.54/share support level offering an opportunity for a long at 48.48% discount from the share’s fair value.

However, should the bulls be successful in breaking above the channel and sustain a move above the 23.60% Fibonacci retracement level, investors could look to the $45.16/share resistance level at a 17.5% discount from the share’s fair value for potential exposure to the company.

Fundamentals

JD.com has been sprinting ahead like a retail champion, leaving competitors in its dust. In 2022, the company’s revenue saw a remarkable surge of 19.4%, crossing the finish line at an impressive $151.7 billion, while its net income galloped ahead by 17.5% to reach a hefty $3.1 billion.

This financial performance is a testament to its ability to ride the e-commerce wave and navigate new markets with the agility of a seasoned shopper. As online shopping gained momentum in China, JD.com rode the digital wave with finesse. Its e-commerce revenue soared by an astounding 21.2% to a staggering $147.6 billion in 2022, proving that they knows how to fill virtual shopping carts and turn browsing into big business.

Not content to stick to familiar aisles, JD.com embraced the adventurous spirit of the retail industry. Venturing into Southeast Asia and India as they cast their net wider, they captured new markets like a retail trailblazer. Just as a savvy shopper explores every aisle for hidden treasures, these expansion efforts have unlocked new opportunities and driven their impressive growth.

With the recent release of its 2023 Q1 financial report, JD.com continues to demonstrate its retail prowess.

Despite undergoing proactive organizational restructuring and operational reforms, JD.com raced ahead with a remarkable 1.4% year-on-year increase in net revenues, reaching a milestone of CN¥243 billion (US$35.4 billion). Their net service revenues surged ahead by a staggering 34.5%, amounting to CN¥47.4 billion (US$6.9 billion).

It’s as if JD.com has mastered the art of retail enchantment, providing seamless services that keep customers coming back for more. Their unwavering determination, innovative strategies, and ability to capitalize on the e-commerce revolution have positioned them as a true titan in the retail industry. With each stride, JD.com proves that success in the e-commerce realm is more than just window shopping – it’s about making bold moves, embracing new markets, and delighting customers every step of the way.

The Chinese internet sector, including JD.com, has experienced remarkable growth and profitability. Major companies in this sector saw combined profits surge by an impressive 62.1% YoY, reaching CN¥ 38.4 billion. Business revenue also showed positive momentum, increasing by 3.3% to CN¥ 408.3 billion. This reflects a favourable business environment and rising consumer demand.

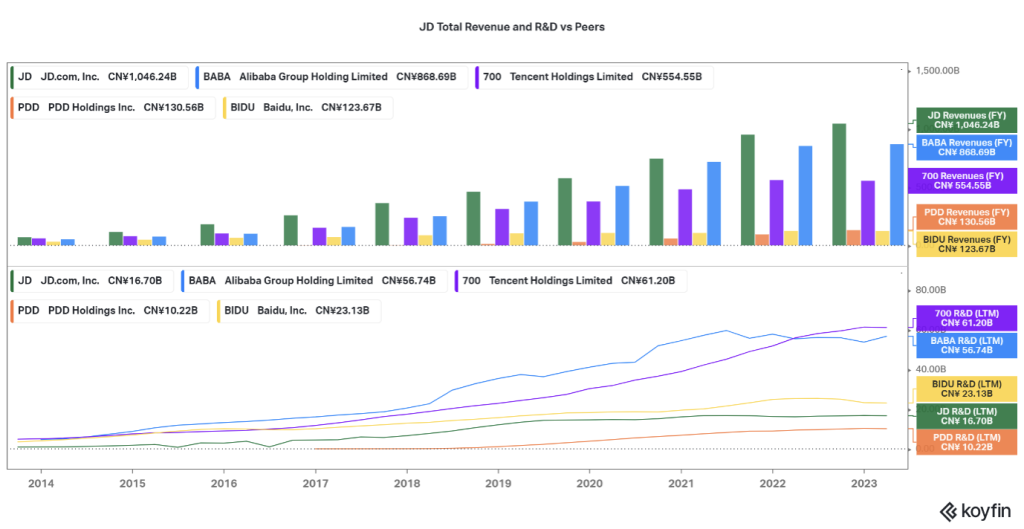

However, it’s important to monitor the declining R&D spending among these companies. While the decline has slowed, reduced investment in R&D could impact long-term innovation and competitiveness. As the saying goes, “You have to spend money to make money.” Cutting back on R&D is like dulling the cutting edge of a sword, potentially hindering companies’ ability to stay ahead.

In this digital landscape, JD.com and its counterparts must strike a balance between profitability and fostering innovation. It’s essential to invest wisely and nurture long-term growth. Innovation remains the lifeblood of the e-commerce world, ensuring continuous success in an ever-changing marketplace.

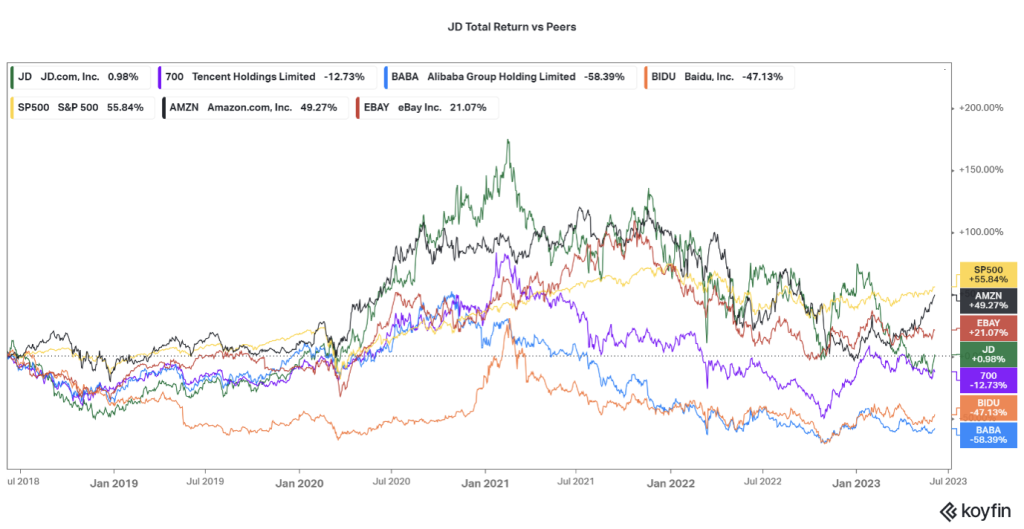

The accompanying graph illustrates the impact of various macroeconomic factors on China’s retail industry over the past five years, encompassing events like COVID-related lockdowns and unpredictable Sino-US tensions. Unfortunately, the industry has faced challenges and struggled to perform. Key players such as Alibaba (blue line), Tencent (purple line) and Baidu (orange line) have all delivered negative total returns, with JD.com showing a relatively better performance with the only a positive return of 0.98%.

The volatile macroeconomic conditions in the region have caused these companies to lag behind their US peers, such as eBay (with a total return of 21.07%) and Amazon.com (with a total return of 49.27%), which have both underperformed the overall US stock market represented by the S&P 500 Index (depicted by the black line), which achieved a robust return of 55.84% over the same period.

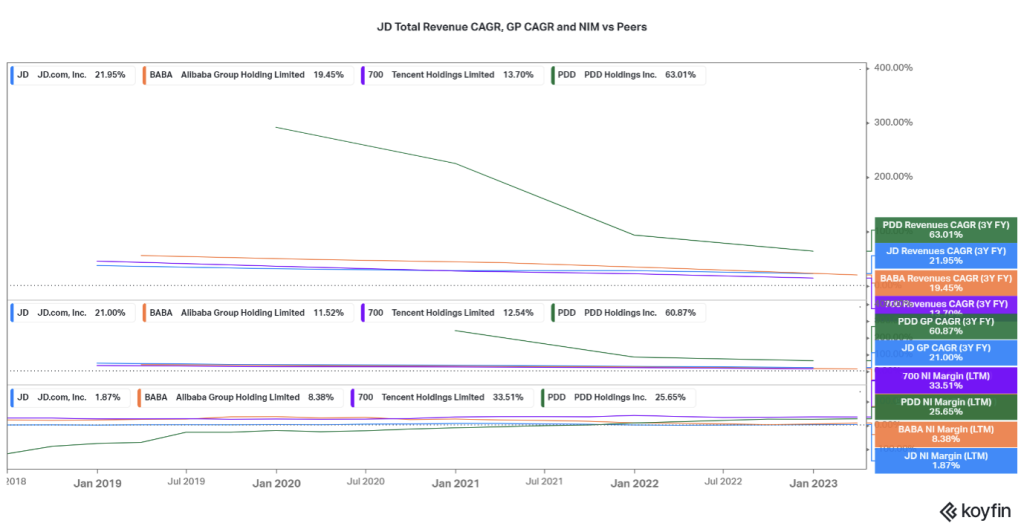

The company’s financial statements present a complex scenario that may raise concerns for investors considering an investment in the company. On the one hand, it boasts the highest revenue among its peers, reaching CN¥1,049.54 billion, with a respectable cumulative annual growth rate (CAGR) of 21.95% over the past three years, with PDD Holdings’ remarkable revenue CAGR of 63% for the same period the only figure to surpass JD.com’s. These figures highlight the company’s strong top-line growth and market presence.

However, the company’s gross profit CAGR (GPCAGR) for the past three years and net income margin (NIM) of 21.00% and 1.87%, respectively, are the lowest compared to its peers. This could be a grave concern for investors. The low GPCAGR suggests a lack of comparative advantage against its peers, potentially jeopardizing its long-term performance and market share. Furthermore, the low NIM indicates operational inefficiency, which could have a detrimental impact on the company’s overall performance over time.

The Chinese company has faced the wrath of the country’s battle against the COVID-19 pandemic.

As the world braces for another potential wave of infections, investors should closely monitor developments that could sway the company’s fortunes. With the menacing XBB variant predicted to surge to a staggering 60 million cases per week, a return to the stringent COVID policy looms large, potentially impacting the company’s short-term performance. Investors should exercise caution in this volatile landscape. However, amidst these challenges, the company has shown resilience by proactively adjusting to the post-COVID era.

It has refocused on its core business, optimizing product mix and sales channels to improve efficiency and quality. Scaling back on non-essential ventures, the company concentrates resources on ventures with long-term value. The company aims to enhance management efficiency and operational effectiveness by streamlining its organizational structure, empowering frontline teams, and nurturing young talent. Its goal is to build a robust ecosystem that attracts high-quality third-party merchants, particularly SMEs.

As the saying goes, “Tough times don’t last; tough companies do.” The company’s proactive measures amid adversity showcase its determination to weather the storm. Vigilant monitoring of market dynamics is crucial as investors navigate the e-commerce and retail industry. Investors can position themselves wisely in this ever-evolving landscape by staying informed and adapting to changing trends.

Summary

JD.com emerges as a dominant force in the highly competitive Chinese e-commerce industry despite facing challenges from the volatile Chinese economy and Sino-US tensions. The company’s ability to navigate these uncertainties and outperform its rivals is a testament to its strategic prowess.

While competition from other e-commerce companies in China is intensifying, JD.com’s impressive growth, customer-centric approach, and adaptability have positioned it as a formidable player. With its strong market position and continuous innovation, JD.com remains a compelling investment choice in the ever-evolving Chinese e-commerce landscape.

Sources: KoyFin, TradingView, Seeking Alpha, CNBC, JD.com.

Disclaimer: Trive South Africa (Pty) Ltd, Registration number 2005/011130/07, and an Authorised Financial Services Provider in terms of the Financial Advisory and Intermediary Services Act 2002 (FSP No. 27231). Any analysis/data/opinion contained herein are for informational purposes only and should not be considered advice or a recommendation to invest in any security. The content herein was created using proprietary strategies based on parameters that may include price, time, economic events, liquidity, risk, and macro and cyclical analysis. Securities involve a degree of risk and are volatile instruments. Market and economic conditions are subject to sudden change, which may have a material impact on the outcome of financial instruments and may not be suitable for all investors. When trading or investing in securities or alternative products, the value of the product can increase or decrease meaning your investment can increase or decrease in value. Past performance is not an indication of future performance. Trive South Africa (Pty) Ltd, and its employees assume no liability for any loss or damage (direct, indirect, consequential, or inconsequential) that may be suffered from using or relying on the information contained herein. Please consider the risks involved before you trade or invest.