Chris Gilmour takes a detailed look at the retail sector on the JSE, a vibrant part of our market that is filled with brands that we know and understand as consumers. Of course, there’s a big difference between choosing to shop somewhere and investing in that retailer.

The JSE-listed retail sector, effectively comprising the Food & Drug retailers and the General Retailers, presents a delicious conundrum for aspirant investors. On one hand, the companies contained in these sectors are almost all of a globally-high standard, operating in a largely consumer-driven economy. This tends to result in retailers being able to command a premium rating.

Having said that, South Africa is also at the beginning of an interest rate tightening cycle that probably has at least all of 2022 and most of 2023 to go before it is finished. With the best will in the world, that is bad news for consumer stocks generally.

So, which shares should investors be looking at in this environment?

In the normal course of events, one would intuitively pick non-discretionary fast-moving consumer goods (FMCG) shares, such as those found in the Food & Drug sector. Being non-discretionary, these companies should be more resilient to the economic cycle.

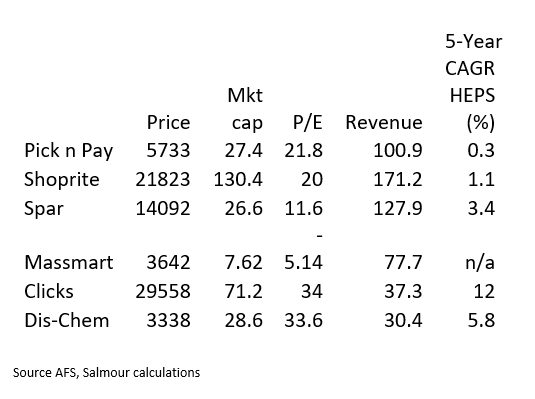

I have concentrated this week on non-discretionary retailers. Next week, we will look at the discretionary retailers. Take note: many of these non-discretionary stocks are sitting on Price/Earnings (P/E) ratios that are totally undeserved relative to their underlying earnings growth.

The investable universe for non-discretionary FMCG shares on the JSE consists of six companies: Pick n Pay, Shoprite, Spar, Massmart, Dis-Chem and Clicks.

There are many ways in which to measure retail efficiency, such as sales per square metre (also known as trading density) and then the usual suspects such as operating profit margin and the relationship between return on capital invested (ROCI) and the weighted average cost of capital (WACC). To make things trickier, not all retailers divulge this information!

The economic background

Private consumption expenditure (PCE) accounts for well over 60% of total South African GDP.

South Africa is well-known as a nation of shoppers and has one of the highest numbers of shopping malls per capita in the world. But with the economy hardly growing at all in the past few years (thanks to the COVID pandemic and Eskom’s continued rotational power cuts), consumer spending growth has been poor.

The recent upwards movement in interest rates combined with the massive inflationary impact of the war in Ukraine will make it even tougher for consumers to make ends meet. As interest rates rise, so retail sales growth falls.

The big three supermarket chains

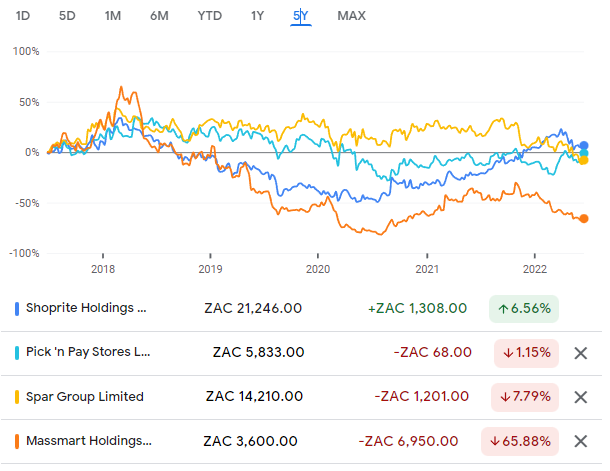

Here is a five-year share price chart for some context:

Shoprite dominates this segment, with its market capitalisation of R130 billion being almost three times the combined market capitalisation of Pick n Pay and Spar.

In the mid-1980s, Pick n Pay was the undisputed leader in this space and was seeking growth in Australia in anticipation of local growth slowing. By 1986, it had constructed its first hypermarket in Brisbane and took Australian retailing by storm. This store was fully scanning-capable, a feature that no Australian retail operation had anywhere. Pick n Pay was midway through building its second Australian store when it was forced out of the country by a combination of Australian retailers such as Coles-Myer, the very powerful trade union movement in Australia and the Australian government. Although it attempted a comeback in Australia via the purchase of Franklin’s in 2001, this was not successful and just became a distraction to the main operation in South Africa and was disposed of ten years later.

Back in the late 1990s, I vividly remember talking to then-CFO Carel Goosen about why Shoprite didn’t use scanning in its supermarkets. He explained that Shoprite’s customers were at the low end of the social spectrum and only bought small baskets of goods, hence scanning would have been over-capitalising. Fast forward ten years and Shoprite was at the forefront of retail technology in South Africa, not just in scanning but also in logistics, with special reference to centralised distribution.

Fifteen years ago, Pick n Pay and Shoprite were of similar size and had similar operating profit margins, but today, Shoprite could be operating on a different planet the gulf between the two is so wide. Pick n Pay lost out in a big way as a result of the resignation of long-time, hugely charismatic CEO Sean Summers and it took many years to find a suitable replacement for him. During that time, Pick n Pay lost substantial market share and it was only with the arrival of Richard Brasher from Tesco that the rot stopped.

Shoprite meanwhile was going from strength to strength, cementing its first mover advantage into the rest of Africa and bolting on a variety of new ways of improving its operating margin. The CEO at the time was James Wellwood “Whitey” Basson, a larger-than-life character who never missed an opportunity to take a crack at his opposition peers during lively analyst presentations at the Michelangelo Hotel.

And now we’re in new territory, with both Basson and Brasher having left and been replaced by Pieter Engelbrecht at Shoprite and Pieter Boone at Pick n Pay.

Engelbrecht had massive shoes to fill but he has flourished in the role of CEO and has taken Shoprite to new heights. Checkers, the upmarket chain within the Shoprite group, is unashamedly taking Woolworths Food on at its own game – and winning! And at the lower end, Shoprite continues to take market share away from all-comers. All of the operations are enabled by world-class bespoke retail technology.

But what of Pick n Pay? Pieter Boone is a man on a mission and his lengthy strategy session recently underlines that determination. Pick n Pay’s strategy is threefold: firstly to rapidly roll out the hugely successful Boxer chain at the low end of the social spectrum, secondly to cement a sustainable relationship with Takealot.com for the efficient execution of its home delivery business and thirdly, Project Red, a type of “halfway-house” between a full line Pick n Pay and Boxer.

What is really strange when comparing Pick n Pay and Shoprite is the fact that their P/E ratios are almost identical, yet Shoprite has a far better track record than Pick n Pay over the short, medium and long terms. Liquidity used to be an issue with Pick n Pay but that has long ago been resolved with the removal of the controlling pyramid share, Pikwik.

The market seems to believe that Pick n Pay has greater upside potential than Shoprite from the current level and is giving Boone the benefit of the doubt. Shoprite’s market share is also considerably higher than Pick n Pay’s and so there is perhaps a feeling that Shoprite may be nearing saturation in the local market. In recent times, Shoprite has deliberately reduced its exposure to the rest of Africa, only remaining in those jurisdictions in which it is comfortable.

This preference for Pick n Pay is understandable in that context, but this view conveniently ignores Shoprite’s ability to continually rise to new challenges. It also assumes that Boone’s strategies will work.

Spar is very different to both Shoprite and Pick n Pay in the sense that it hardly owns any of the stores that trade under the Spar banner. Spar has been in South Africa since 1962 and was separately listed in 2005, having been unbundled from its parent, Tiger Brands.

It is effectively a warehousing and distribution company, supplying Spar outlets in South Africa, Ireland, the south-west of England, Switzerland and Poland. Erroneously referred to as a franchise operation, it should more correctly be termed a banner group.

Spar doesn’t own most of the stores to which it delivers and so there is not a great deal of consistency in the Spar Group compared with Shoprite or Pick n Pay. Spar has never sought growth in the rest of Africa, preferring the developed world of Europe in which to expand. Its latest growth vector, Poland, is proving to be difficult and that jurisdiction’s proximity to Ukraine isn’t helping matters. Nevertheless, Spar has demonstrated that it is a solid performer and that trend seems likely to continue. It currently trades at just over half the rating of Pick n Pay and Shoprite.

The other three

Superficially at least, Massmart had everything going for it when it was announced in September 2010 that Walmart, the world’s largest retailer, was buying control of the company. There was genuine fear and trepidation among many local retailers, who feared that Walmart might crowd them out over time. To be fair, Whitey Basson at Shoprite was relatively dismissive about the transaction from the start and was confident that Shoprite could match Massmart’s pricing in the stores on general merchandising and anything else. In the end, he turned out to be right.

Massmart was also tipped to be the largest retailer in Africa, marching through the continent offering discount prices on everything from food to electronics. As with a number of other SA retailers, Massmart is no longer expanding into the rest of Africa but is retreating from it.

The honeymoon period between Massmart and the market lasted about three years and the share price peaked at around R160 in 2013, since which it has been in secular decline, punctuated only by a dead-cat bounce in the past couple of years. Since 2010, the company has had four CEOs, beginning with the mercurial corporate entrepreneur Mark Lamberti, followed by his protégé Grant Pattison, then the former CFO Guy Hayward and the current CEO, a Walmart appointee Michell Slape, since 2019.

Slape was brought in by Walmart as a final attempt to turn the ailing retailing conglomerate around. Since his appointment, Slape has certainly streamlined the business and has all but retreated from the rest of Africa. But this seems to be a classic case of saving yourself into bankruptcy. The model is manifestly wrong for South Africa. What works for low-end America doesn’t necessarily work in SA.

Already initiatives such as selling fresh produce beside electronic goods have been scrapped, Dion Wired has been closed down and Cambridge Foods is being sold to Shoprite. And yet, Massmart still keeps losing money.

Slape is a very bright fellow, to be sure. An alumnus of Thunderbird University in Arizona, which specializes in international relations, Slape obviously knows how to play the political game. But he’s not a dyed in the wool retailer. Massmart hasn’t had one since Lamberti. So it’s unlikely that Slape is going to stumble across the magic formula that is going to allow it to change direction and start making super profits again.

Majority shareholder Walmart must be getting irritated by the length of time Massmart is taking to turn around. What began as a brave new adventure into Africa has turned into a reputation-damaging nightmare. To be fair though, Walmart has hardly been a raging success anywhere outside of North America. It persevered with Asda in the UK for over twenty years, eventually limping away from it after selling it to the Issa Brothers / TDR Capital last year for almost exactly what they paid for it in 1999.

The most likely outcome in my honest opinion is that Walmart will buy out the minorities in Massmart, delist it from the JSE and sell off the assets piecemeal.

To finish off the section on Massmart, here is the same five-year chart as before, with Massmart now included:

Clicks is a highly iconic South African brand, offering pharmaceuticals, toiletries, cosmetics and selected general merchandise through an extensive network of stores in southern Africa. It rarely (if ever) shoots the lights out but the market seems to like its relative predictability and has been prepared to apply an extremely high rating for this consistent performance.

Is a 34x P/E ratio really justified when the earnings growth is so relatively pedestrian? Probably not.

Having said that, Clicks’ five-year CAGR of 12% is easily the best in this investable universe, which may go some way towards explaining why its P/E ratio is so rarefied in relation to most of the other shares.

And the same applies to Dis-Chem, although I have to confess to being a real Dis-Chem junkie when it comes to their stores, Their range of merchandise is so compelling that I rarely enter a DisChem and come out with less than a full basket or trolley. From a consumer perspective, their choice is way better than Clicks in my honest opinion and their prices are exceptionally keen.

But from an investment perspective, it’s a different story. The five-year compound annual growth rate (CAGR) in headline earnings per share at Dis-Chem is only 5.8% and most of that came in the 2022 financial year. The four-year CAGR between 2017 and 2021 was flat. So how on earth this share manages to command such a lofty P/E ratio, vying for the highest in the sector with Clicks, is beyond me. The market is probably expecting much higher growth out of Dis-Chem relative to Clicks in future as its market capitalisation is just over 1/3 of Clicks’ market cap. But in a moribund consumer economy, it’s not clear where that growth is coming from.

Here is a five-year chart of Clicks vs. Dis-Chem:

So, the non-discretionary retailers present a very confusing picture for the aspirant investor in this space. Foreign shareholders have tended to drive this market, with the local fund managers largely expressing a healthy scepticism regarding the outlook. One foreign fund manager gave a clue as to why foreigners like SA retailers. He said the combination of developed-market management and developing-market dynamics was unique. And in a sense, he was right. Nowhere else do you get such a compelling combination.

Another old-time emerging-market specialist gave me a different view when I asked him how SA stacked up against emerging market peers. He laughed loudly and stated quite categorically that SA is not an emerging market but rather a developed market with high unemployment. And that high unemployment mimics true emerging economy dynamics. I could also see the logic of that argument.

So the bottom line appears to be that Shoprite will probably continue growing its top line and defending/adding to its market share. It has two growth vectors: one at the top-end in the space currently dominated by Woolworths Foods and the other in the low-end, but that is going to get progressively tougher as Pick n Pay rolls out more and more Boxer stores. Bottom line growth at Shoprite will probably continue to be elusive.

Pick n Pay is embarking on another big hairy audacious goal (BHAG). It’s not the first for this group, nor will it be the last. Success will be measured by whether it can claw back profitable market share from Shoprite and the jury is out in this regard. We need to monitor its progress very carefully.

Spar will be judged on how well or how badly its foreign ventures turn out to be, especially the currently troublesome Polish operation. Having said that, it’s on a fairly undemanding P/E ratio, so the risk of investing in Spar relative to both Pick n Pay and Shoprite is lower.

As far as Massmart is concerned, it appears to be all over bar the shouting. If it can’t come right in the current environment with the benefit of a favourable base of comparison from the Covid-depressed levels of 2020, It is unlikely to do so in a higher interest rate environment. At some point in time, parent Walmart must surely throw in the towel.

Both the Clicks and Dis-Chem share prices have a lot of risk attached to them, due to their extremely high ratings. They daren’t put a foot wrong now and are priced for perfection.

Great article – thank you x

Great Article! It provides perspective of Retail industry!

Phenomenal overview and analysis of the sector!

Indeed a very detailed analysis looking and trade P/E, returns, economic and population and customer support and much more. Well done Chris

Hi Chris,

Thank you for an interesting article. My question is, how does Woolies stack up in this picture?

Hi Peter. I shall discuss Woolies next week in the context of discretionary retailers. As you know, Woolies is a hybrid food & clothing retailer. Its food is very expensive but also incredibly high quality. While Checkers is doing a great job of taking Woolies on at its own game, it would have to admit that it will take years before it is the same league as Woolies when it comes to cold chain. Woolies Foods operating profit margin is not too dissimilar to Shoprite’s, so it’s not as if it is making extraordinary profits. In my honest opinion, Woolies Foods is the only decent part of the entire Woolies group. The clothing side is very ordinary and Australia has been a disaster, with massive destruction of shareholder value from the David Jones debacle.

Nice article Chris except for a small error. I stood down as CEO of Massmart in 2007. Regards, M

Great article, well articulated, thank you.

Hi Chris,

Really learning a lot from your excellent commentary and analysis. Are you planning something similar on the clothing retailers like TFG, Mr Price, Edgars and others. This will be very interesting.

regards

Hi Ike – I can jump in here for Chris. He is planning to bring an article on the non-discretionary retailers to us next week, so look out for that on Monday!