Andre Botha of TreasuryONE sets the scene ahead of the MPC meeting on Thursday, in which a hike of 75 basis points is expected.

Taking a look at the last couple of weeks and the performance of the rand, it raises the debate of whether there is still some life in the rand rally, or whether we have we done too much in too short a time and a move higher is now more likely than a sustained move lower.

To understand the move lower, we need to understand what has caused the rand and other EM currencies to strengthen as much as they did. As we have become accustomed to over the last year, most of the movement in currency markets is down to the US dollar, and for the most part the Fed, and how they handle the inflation environment currently in the US.

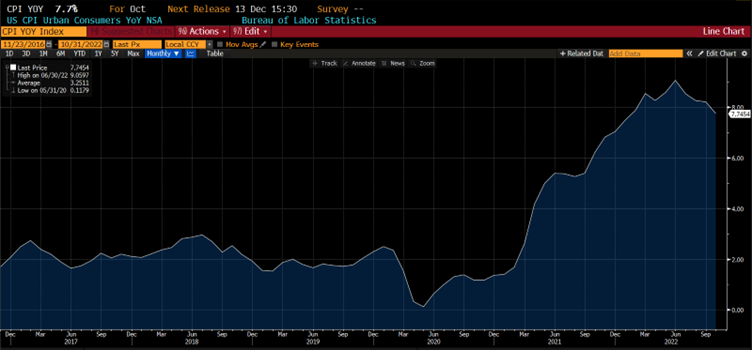

That narrative has not changed in the slightest, as we have seen that inflation printed at 7.7%, which the market has seen as a time for the Fed to start tapering its hawkish talk around interest rates.

US inflation down

The key question to ask is whether we have seen enough of a pullback in inflation to warrant a change of tack by the Fed. The answer is most likely not, as the FOMC minutes will probably indicate.

The minutes will show that the Fed will be headstrong in chasing the 5% Fed funds rate before they start to change its tone regarding interest rates. In saying that, the fact that inflation is coming down will appease the Fed, and the next meeting in December will be key, as any change in stance from the Fed will filter through in that meeting and we could see some action in the back-end of December.

Now back to markets and what has happened in the last week. We have seen the US dollar on the back foot and drifting all the way to 1.0400 against the euro. That has meant that the rand has retraced all the way back to R17.2000 in the wake of the better-than-expected inflation numbers and the current optimism of the Fed pivoting sooner rather than later.

We have seen that the market is skittish on any China Covid news, but the effects of such news are temporary as the optimism outweighs any bad news from China. On the horizon, however, the looming recession is taking centre stage, and it’s only a matter of time before we could see the impact on EM currencies.

Rand enjoying the optimism

Although a lot of attention is being paid to the US Fed minutes, in South Africa we have the MPC meeting this week. We expect the MPC to hike interest rates by 75 basis points on Thursday, mainly in line with the hikes being done by the Fed. The key is what tone the MPC will strike after the announcement as growth in South Africa is anaemic at best and more hikes will hike us into a recession.

The rand has failed to sustain a break below the R17.2000, which leads us to believe that the rand is building a base currently and could look to trade weaker in the short term, where levels above R17.5000 should be used by exporters as we expect the rand to stage a recovery in the second half of 2023.

I do enjoy reading Ghostmail. I just find the grey font very difficult to read. Please consider a darker font on your web pages, for those whose eyesight is failing!

Hi Les – we will look into this, thank you!

Hi Les – we have tweaked the colour of the font to be darker. Love to get your feedback if this is a better read for you.