The red hat is a familiar sight in South African clothing retail. Mr Price has been on a major acquisition spree recently, so the company is on the radar of investors (and I entered a long position based on recent share price weakness as well). The release of Mr Price’s integrated annual report gave Ghost Grad Jordan Theron a good reason to dig in.

Since its first store opened in 1987, Mr Price has won the hearts of many South Africans. This has been further cemented by their reputation for great value and sponsorship of various sporting events and teams such as the Comrades and Team South Africa at the 2021 Tokyo Olympics.

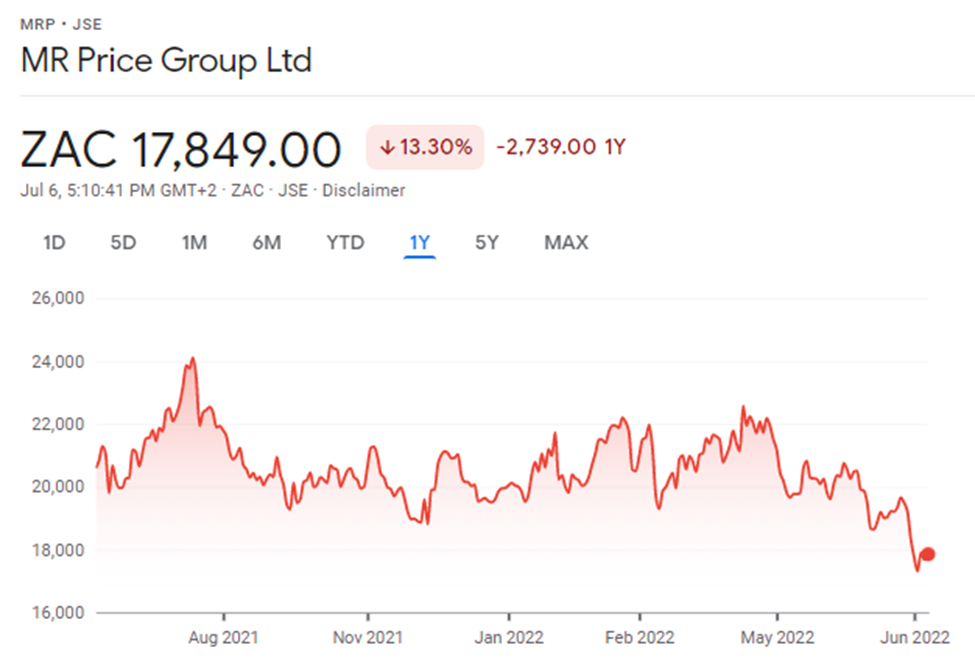

The share price itself is in need of some sponsorship, down 13.3% over the past year:

A podium-worthy CAGR

Feel-good sponsorships aside, this is a serious business and Mr Price has produced a 36-year sales CAGR (Compound Annual Growth Rate) of 17.5%. This is a remarkable performance, particularly over such a long period. If the US market wasn’t on fire right now, this kind of growth rate would even get US growth investors excited!

I had to dig deep into the investor relations sections of the websites to find this information: Truworths has achieved a 19-year sales CAGR of 15.3% and The Foschini Group has managed 13.2% over a 17-year period. These obviously aren’t directly comparable to the period given by Mr Price, but it’s still interesting to compare them.

Mr Price is hugely popular among shoppers

Over 3 months, Mr Price’s resonance with customers drove customer engagement to such a level that the group is the most shopped fashion retailer in the country, with 5.7 million shoppers. With approximately 35% of South Africa’s population living in rural areas where even Mr Price may not have a presence, this is a particularly impressive statistic in terms of share of (realistic) total addressable market.

Clothes, yes, but also cellphones

The financial services and telecoms segment at Mr Price grew operating profit by 85% in the last financial year. Although this segment may be small, the cellular side of the business grew by 32%. In years gone by, the cellular division barely got mentioned in annual reports.

These days, investors know that clothing retailers have tapped into the lucrative cellphone market. It’s all about having an attractive retail footprint and enough trust from customers to bring them additional products.

Second only to Takealot

Mr Price makes wonderful profits and Takealot still doesn’t. In fact, Takealot even made a loss during the pandemic, which was surely a golden period for online shopping. If you think that Takealot operates in a competitive vacuum and that profits are guaranteed to come, think again.

Mr Price has moved strongly into the online space through capital investments and acquisitions. The group’s share of online traffic is 13.3%, which is second only to Takealot among omni-channel and pure-play retailers. This puts Mr Price ahead of Woolworths and The Foschini Group.

Moving along the LSM curve

In South African retail, a group like Shoprite has shown us the value of operating throughout the LSM curve (i.e. having lower-income and higher-income store formats). Mr Price has made a strong move into the premium market segment, which we know is lucrative in this country.

Mr Price agreed to acquire a 70% stake in Blue Falcon, which owns the Studio 88 Group, from RMB Holdings for R3.3 billion. The deal was announced in mid-April. This is a strategic move to “buy” market share in the more premium and ever-expanding Athleisure segment. Studio 88 is South Africa’s largest independent retailer of branded leisure, lifestyle and sporting apparel, with footwear also included under their umbrella.

Riots, unrest and unhappy things

An assessment of Mr Price wouldn’t be complete without a look at how the group handled the period of despair in 2021 when riots broke out mainly in KwaZulu-Natal. This is the province in which Mr Price has its primary distribution centre.

The riots resulted in 539 stores temporarily closing during that week and 111 remaining closed due to damage. There were 96 stores reopened by end of the 2022 financial year, with five reopening in 2023 and ten in 2024.

After enduring this disaster, Mr Price received R296 million from SASRIA for stock, cash, and fixed asset losses as well as R92 million in business interruption insurance which somewhat mitigated the negative impact.

The future

It’s easy to be pessimistic about South Africa. Mr Price thankfully doesn’t feel that way and is ambitiously growing in the local market, through a combination of acquisitions and organic initiatives.

It’s always a risky strategy, as acquisitions are notoriously difficult to integrate and companies tend to overpay for businesses that they want. Only time will tell how this plays out.

Over the past 10 years, Mr Price has only delivered a share price CAGR of 4.1% which is disappointing. With a goal to become Africa’s largest retailer, could the next 10 years will look different?

Super article on Mr Price. Love your updates – keep it coming

Great article!! Looking forward to more.

Thanks for a good Article.

Mr Price has the worst customer service! Have sent e-mails, called and whatsapps, and up to not one response. Went to the retail store who sent me to another store, no assistance! Pathetic