After staying out of the headlines for most of the last couple of months, South Africa waited until the back-end of the year to get all the attention. The team from TreasuryONE explains the rollercoaster.

In the past week, we have seen President Ramaphosa embroiled in the “farmgate,” or Phala Phala situation. We have had reports of the President willing to resign, then making an abrupt U-turn as he was convinced by senior members of the ANC and Business SA to fight the findings. We have also seen that the ANC is standing by the President, which makes the base case that the ANC elective conference will probably go as expected, but never say never.

Rand rollercoaster

What has the Phala Phala situation done to the Rand?

We saw the rand trading below the R17.00 mark last week, as we had the US Fed stating that they will be less aggressive with its interest rate hikes, and the rand tested the R16.90 level against the US dollar. After the report broke and rumours were flying about the President resigning, the rand lost almost R1.00 in one day and touched a high of R17.95 against the US dollar!

With a sense of normality in the market, we have seen the rand trading back toward the R17.30 level, but given that the US dollar is losing some ground, we can safely assume that there is currently a risk premium in the rand.

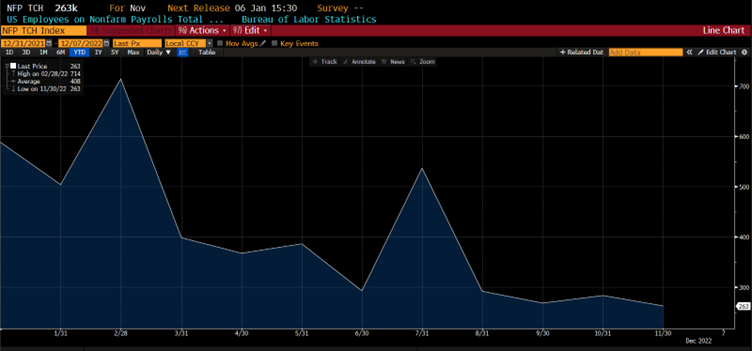

Speaking of the US dollar, we have seen the greenback trading upwards of the 1.05 level in the last couple of days. With the market expecting the US Fed to be a little less aggressive, the US dollar has started to drift higher against most currencies. Although the economic data releases haven’t been bad as of yet, with the employment data being better than expected for the last couple of months, the fact that the Fed seems happy with the trajectory of inflation gives credence to the notion that the worst of the hiking cycle is behind us and a Fed pivot could be par for the course next year.

US employment

On the data side, we have little top tier data out of the US this week, which focuses the mind on South African news and events for movements in the rand. With the storm regarding Phala Phala seemingly dying down in the market, we can expect the rand to trade within fairly narrow bands as it begins to track the US dollar again. The South African GDP number out yesterday surprised to the top side; the latest gross domestic product numbers for the third quarter of 2022 showed surprising growth of 1.6% in the quarter. The year-on-year figure is 4.1% but needs to be netted off against the low base that it was measured against from last year.

While we had our start of December jolt, especially in the rand market, we expect a period of consolidation and sideways movement before we head into the crux of the month with the ANC conference, US Fed meetings and US CPI out. Expect these events to concentrate most of the market volatility, but now that South Africa is in focus, any adverse news regarding the Presidency could send the rand running again.