The chair of the US Federal Reserve (The Fed) announced last Wednesday 15th June that the Federal Open Market Committee (FOMC) had decided to increase the US federal funds rate by 75 basis points. It’s probably too little, too late and markets have already baked in a significantly higher interest rate environment by year end. But will it be enough to contain inflation? Perhaps not. Chris Gilmour explains.

The late Archie Shapiro told me decades ago that if you’re bullish and you’re wrong, people will forgive you. Conversely, if you’re bearish and you’re wrong, people remember and never let you forget it. Ever since then I have tried wherever possible not to be bearish on markets, even when my gut told me it was the wrong approach.

And of course this is not just a South African phenomenon; it applies to all financial markets worldwide.

But lots of other people have been expressing bearish sentiment recently, notably Jamie Dimon, CEO of JP Morgan Chase, who predicted a few weeks ago that an economic “hurricane” was about to hit US financial markets. He cited loose monetary policy, massive fiscal stimulus by the US government and the impact of the war in Ukraine on food and fuel prices as the main factors feeding this hurricane.

South African-born Tesla CEO Elon Musk fears an imminent recession in the US and has “a super-bad feeling” about the economy. This is why he feels it necessary to cull 10% of the group’s workforce. This was just after he issued a blunt warning to workers to return to workplace in person or consider themselves as having resigned.

And John Waldron, President and COO of US investment bank Goldman Sachs echoed the warnings, citing a series of concomitant unprecedented factors hurting the economy, including a commodity shock (mainly oil and gas) and an unprecedented amount of fiscal and monetary stimulus.

One of the most authoritative voices out there is former US Treasury Secretary Larry Summers, who accurately predicted last year that inflation in the US was getting out of control and that if the US Federal Reserve didn’t act quickly, it would get a lot worse. Now, with inflation at a 40-year high of 8.6% in the US, Summers is sounding even more alarmist, suggesting that only a full-blown recession will be able to tame inflation.

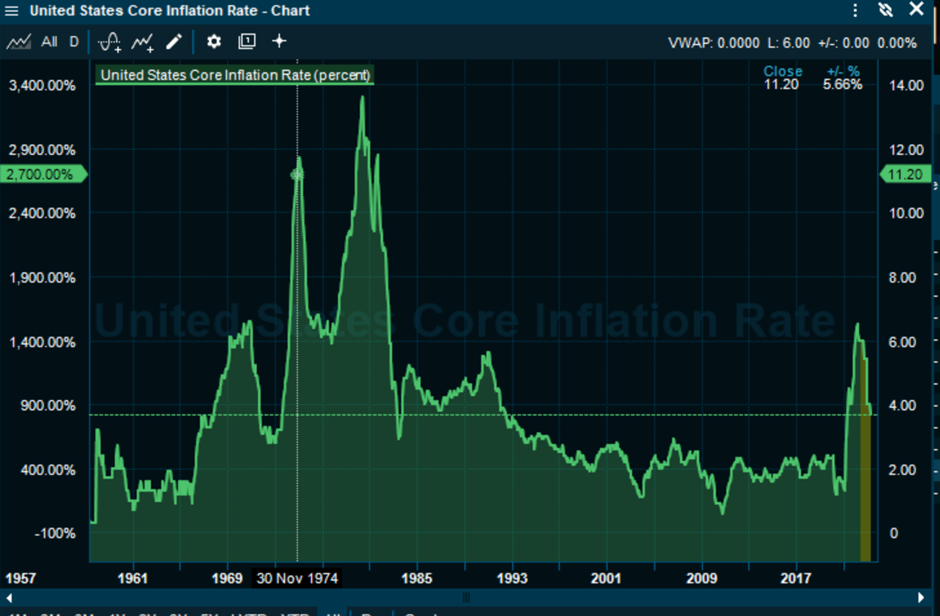

The research at the National Bureau 0f Economic Research (NBER) can be read in its entirety in a free download at this link, but the essence of it is that Summers and his co-authors claims to have found a better way of analyzing inflation than using the CPI method. Using this alternative method, Summers and his co-authors reckon that current inflation levels are much closer to past inflation peaks than the official CPI series would suggest.

One of the biggest divergences between the Summers et al method and the traditional CPI method is the way in which housing inflation in calculated. The NBER paper states that prior to 1983, the CPI did not correctly account for consumer spending on housing, including either the final home purchase value or the value of mortgage rates spread out over 30 years. The pre-1983 index included both home purchase prices and the total outlay of mortgage payments, despite mortgages being paid out gradually over several years. By including both, the CPI method effectively double-counted housing inflation between 1953 and 1983. The net effect was that inflation measures before 1983 looked artificially high at the start of the tightening cycle but they dissipated artificially quickly.

Applying the NBER methodology, the current inflation rate in the US is eerily close to a period in US history when there was considerable financial distress and the and the only way to cure it, according to Fed chair at the time Paul Volcker, was to crush it with extremely high interest rates.

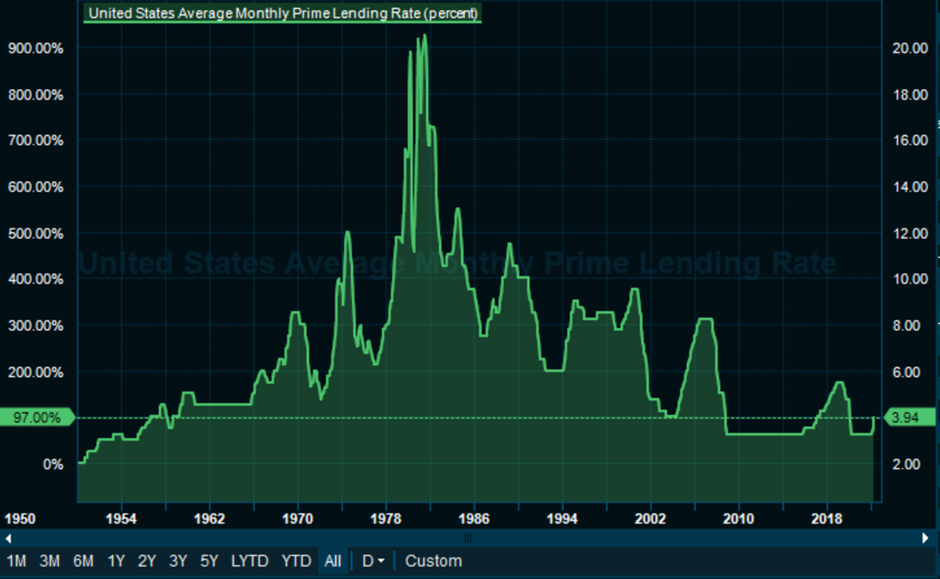

In 1980, the official CPI inflation rate was 13.6% but applying the NBER methodology, that would reduce to 9.1%. Volcker raised interest rates in the US to over 20% in the early 1980s, a move that tipped the US into the most severe recession since the Great Depression of the 1930s. Unemployment soared to almost 11%, but the end goal of taming inflation was achieved.

Volcker was a single-minded civil servant who just got on with the job of running the Fed, which he did extremely well over two terms and two administrations. He was very different to his successors such as Alan Greenspan, Ben Bernanke, Janet Yellen and now Jerome Powell who have all used a variety of tools to attempt to keep prices stable. Volcker understood the power of interest rates. Period.

Here is a chart of the United States average monthly prime lending rate:

And here is a chart of the United States core inflation rate:

To raise interest rates to the levels that Volcker did back in the 1980s would have devastating effects on the real economy. This is the last thing that Powell or president Joe Biden needs and neither of them probably have the intestinal fortitude to go down that road.

Another way of looking at this issue is to examine how the Fed has handled the COVID-19 pandemic. With the benefit of hindsight, it is now clear that Powell and his FOMC made a disastrous decision to throw so much money at the situation and not expect inflationary consequences. Powell exacerbated the situation with his stubborn insistence until relatively recently that the inflation that had been generated was only transitory and would soon evaporate.

He and his team completely missed the consequences of massively disrupted supply chains, for example.

Now the US finds itself in the unenviable position of having a Fed that is still relatively accommodative, despite the recent rate increases, coupled with supply chain disruptions that are likely to persist well into next year and beyond and the war in Ukraine is just making everything much more expensive.

This is a perfect inflationary storm.

Reading Powell’s statement after the rate increase announcement, it is clear that he genuinely believes that inflation will be back to much more manageable levels by 2024. The clue lies in the wording. It seems reasonable to agree that inflation will indeed be more “manageable” within two years but it may not necessarily have been tamed.

No matter, at least it should be going in the right direction. We need to be realistic.

While a return to a Volcker-type approach appeals to the fundamentalist in me, I have to admit that the cost in terms of financial wipeout would probably be too great to bear. Back in Volcker’s day, life was far simpler. Today, everything is far more connected and as a consequence, perhaps more fragile.

At the time of writing, the S&P 500 was down 23% from its peak. Put another way, its market capitalisation is 23% below its all-time high of just over $40 trillion in early January this year. So, about $10 trillion has been wiped off the value of US stocks in this current rout.

That in itself will provide a substantial deflationary effect to the US economy, so pervasive is share ownership in America, and if sustained for any period of time will result in the Fed not having to do an awful lot more in the way of further tightening.

Powell and his peers in central banks across the globe must tread a very fine line between attempting to contain inflation and preventing the real global economy from stalling. So once again, a repeat of the Volcker-type approach to tightening may not be required. If this line of thinking becomes conventional wisdom, it may not be too long before we reach a bottom in the S&P 500 and even in the tech-heavy Nasdaq.

Where it goes from there, however, is anyone’s guess.

A period of going nowhere slowly for a couple of years would seem likely. As another old-timer on the markets also said to me many decades ago:

“Nobody rings a bell at the top of the bull market or the bottom of the bear market”

I love straightforward analysis that is relatively objective. Discussing different perspectives on one article is rare these days.

Chris’ time frame for this Bear Market sounds entirely plausible, at 25 to 30 % of the 12 year Bull.