Amid the rollercoaster ride of uncertainty in the equity market, is PepsiCo, Inc (NASDAQ: PEP) a refreshing oasis?

Like the effervescence in its legendary cola, PepsiCo has a dividend track record that shines brightly and entices investors looking for resilience in this environment. Management has managed to blend a tantalizing range of products with a dividend growth that never seems to lose its fizz.

PepsiCo’s performance in the first quarter of its 2023 fiscal year spoke volumes.

The company showcased its robustness with earnings per share (EPS) of $1.40 and revenue hitting an impressive $17.84 billion. Notably, revenue increased by 10.2% compared to last year’s quarter, driven by 14.3% organic growth.

This growth provided a strong foundation for the year ahead, prompting management to upgrade their full-year organic revenue growth projection from 6% to an impressive 8%. Furthermore, the EPS growth forecast received a boost, up from 8% to a solid 9%.

These impressive results demonstrate PepsiCo’s ability to navigate challenging market conditions, leveraging its substantial pricing power and strategic positioning within the industry.

Technical

- The bulls gained support in the first week of June to begin the retracement from the swing low at $179.47, where they have moved towards the 38.2% Fibonacci retracement at $186.03 on the 1D chart.

- With the momentum currently in the bulls’ favour, a break above the 50-day moving average of $187.08 could indicate further immediate positive momentum, which might encourage the bulls to extend the retracement towards the Fibonacci midpoint at $188.10 and the golden ratio at $190.17. The rise may continue in the direction of the channel resistance at $196.70 if the bulls capitalize on the momentum to break above the $193.12 level. From there, the estimated fair value of $208.08 is in sight, offering a possible upside of 12.5% from the existing levels.

- The bullish investor could, however, also hold out for more enticing entry positions that might become open if the market rejects the golden ratio. In such a scenario, lower support between $182.61 and $177.30 could be crucial as the market might find support there.

Fundamental

- PepsiCo finds its place within the consumer staples sector, renowned for its resilience against the ups and downs of the macroeconomic cycle. Among the numerous factors that make PepsiCo an enticing choice for investors during periods of high inflation is its adeptness at transferring increasing input costs to the end consumer. In the most recent quarter, inflationary pressures were especially intense, compelling the company to raise its average prices by 16%.

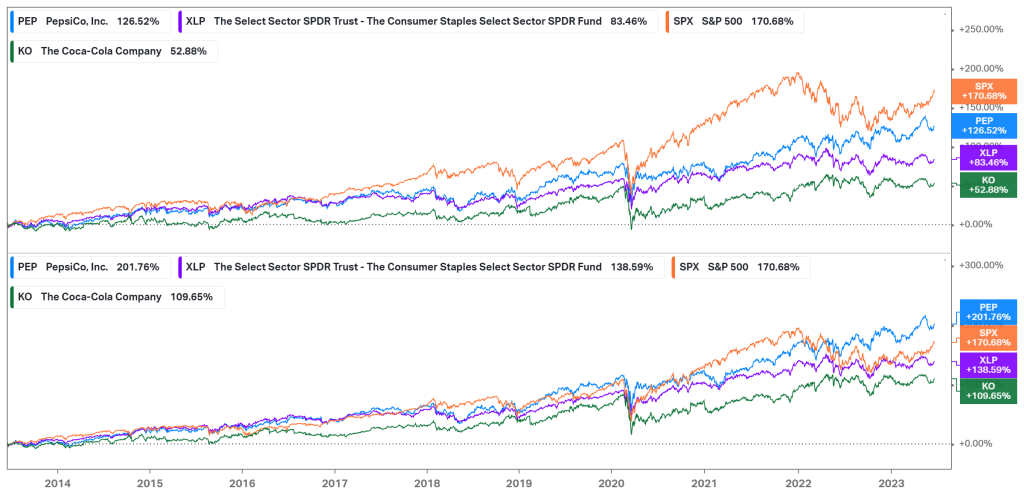

Surprisingly, this move only led to a modest 2% decline in organic volume, thanks to PepsiCo’s robust brand presence and its inherent ability to command favourable pricing. Consequently, the company successfully maintained an attractive gross margin of 55.2%, reflecting its impressive capacity to weather inflationary challenges while preserving profitability. - However, while the insulation against negative shifts in the economic cycle has its advantages, it also comes with an opportunity cost of potentially missing out on market upturns. This trade-off is evident when comparing the price return of the consumer staples sector, as depicted in the graph below. Over a 10-year period, the consumer staples sector shows a price return of 83.5%, which falls short of the S&P 500’s impressive return of 170.9%. However, it is worth noting that the consumer staples sector generally experiences lower volatility.

- Both PepsiCo (126.5%) and Coca-Cola (52.9%) significantly underperformed the broader market. However, PepsiCo managed to generate a respectable return that surpasses that of the consumer staples sector. It is essential to consider that the top half of the graph primarily reflects price returns.

When factoring in total returns, including dividends, PepsiCo emerges as an outperformer. Over the course of ten years, PepsiCo exhibits a total return of 201.8%, surpassing that of the S&P 500. This highlights the significance of PepsiCo’s robust dividend payments, which contribute to the overall returns enjoyed by its shareholders.

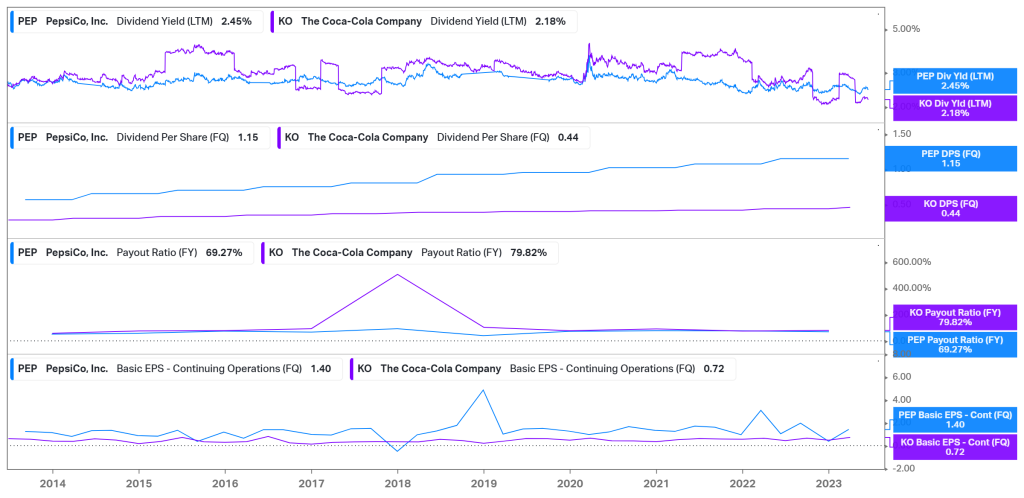

- Illustrated in the graph below, PepsiCo showcases its financial strength through a considerable 2.54% dividend yield and an impressive track record of 51 consecutive annual dividend increases. This translates to a dividend per share (DPS) payout of $1.15, with a payout ratio of 69%.

In contrast, Coca-Cola operates with a relatively higher payout ratio of 80%, partially influenced by its lower earnings per share (EPS). Coca-Cola’s dividend payout stands at $0.44 per share, accompanied by a dividend yield of 2.18%. These figures highlight PepsiCo’s robust dividend performance when compared to its primary competitor, underscoring its position as a dividend powerhouse.

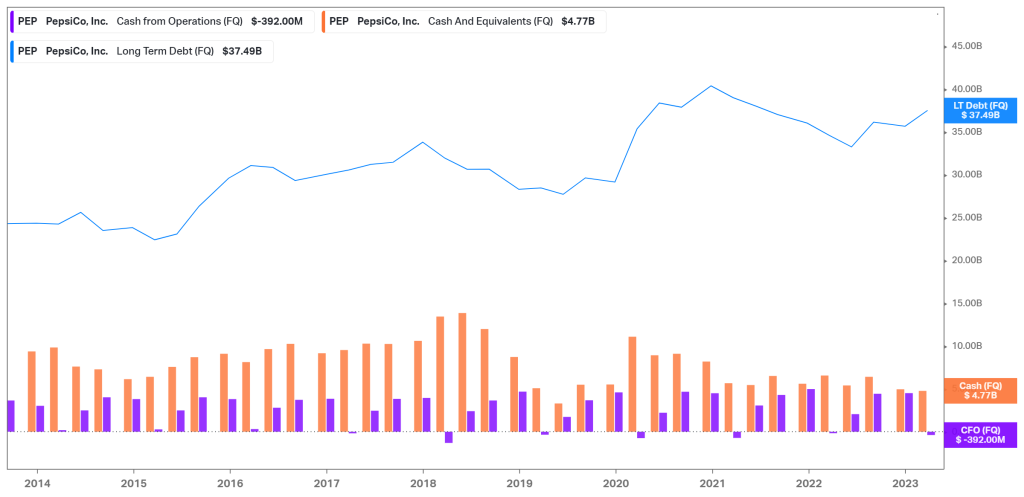

- However, certain concerns emerge when evaluating the long-term sustainability of these dividends. The first issue is exemplified in the graph below, shedding light on the company’s relatively modest cash reserves and its limited generation of cash from operations, particularly when compared to its long-term debt obligations. However, this is not an immediate cause for alarm, as PepsiCo maintains a well-structured debt schedule with only $5.95 billion of its long-term debt maturing in 2024, which its available cash can comfortably cover.

Nonetheless, a more prolonged concern arises regarding the company’s ability to consistently increase its dividends, as it may be required to allocate a portion of its future generated cash towards reducing its debt burden. This raises questions about the company’s capacity to sustainably grow dividends in the long run, which is what makes it an attractive investment opportunity to start with.

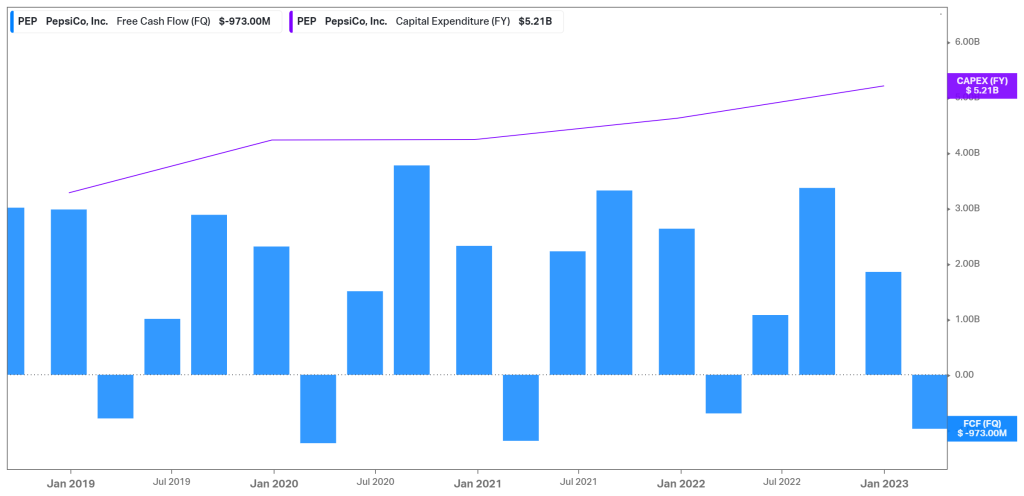

- In addition to its significant debt burden, the company exhibits meagre free cash flow levels, with multiple quarters experiencing negative cash flow over the past five years. As depicted in the graph below, the company’s free cash flows have been inconsistent, lacking steady growth. Recent quarters have seen increased capital expenditures due to investments in supply chain enhancements, manufacturing capacity, and leveraging IT for growth opportunities.

However, investors would ideally expect this increased spending to translate into a consistent generation of free cash flow, which can be distributed to shareholders. Until that occurs, the company’s appealing dividend payments are primarily funded by its debt position. Although this is not an immediate cause for concern, as mentioned earlier, it is not sustainable in the long term unless the company can achieve consistent free cash flow expansion.

Summary

PepsiCo has solidified its position as a profitable and secure investment option, shielding investors from the inherent volatility of the stock market. While their enticing dividend payouts contribute to impressive overall returns, it is important for investors to monitor the sustainability of these dividends. The company carries a significant debt burden and has limited free cash flows available to support the enticing dividend payments.

However, there is potential for improvement in the future, as PepsiCo is making considerable capital investments in growth initiatives. If these investments lead to a recovery in free cash flows and consistent growth, concerns regarding the debt position may be alleviated. In such a scenario, there is a potential upside of 12.5% if the share price reaches the estimated fair value of $208.

Sources: Koyfin, Tradingview, Reuters, Yahoo Finance, PepsiCo, Inc.