South Africa’s retail giants have spared no expense, shelling out a staggering R2.4 billion to battle the disruptive force of loadshedding.

This phenomenon, characterised by sporadic power outages, has plagued the nation for several months, reaching unprecedented intensity levels, curtailing productivity, cutting retailers’ profits, and depressing market sentiment.

The repercussions of heightened power outages, which intensified in the latter half of 2022, have been dire for retailers nationwide. The mounting costs incurred range from diesel purchases to keeping generators running to substantial investments in backup power systems.

Take Food Lover’s Market, for example, which poured R50 million into securing reliable backup power systems within the past six months.

Acknowledging that these costs, particularly for food retailers, are ultimately transferred to the consumers is crucial.

South Africans are feeling the weight of this predicament as the prices of everyday goods continue to surge.

- Despite annual consumer price inflation (CPI) ticking down somewhat, arriving at 6.3% in May 2023, down from 6.8% in April 2023, food and non-alcoholic beverages remain a primary catalyst in keeping prices higher for longer.

- The most significant contributor to May’s 6.3% annual inflation rate was food and non-alcoholic beverages, which increased by 11.8% year-on-year, contributing 2.1 percentage points to the annual rate.

- Food prices surged 12% year-on-year in May, with vegetable prices rising by an eye-watering 20.8% year-on-year, while bread and cereals experienced an annual price increase of 18.1%, with milk, eggs and cheese increasing by 14.2% year-on-year.

- Non-alcoholic beverages experienced an annual price increase of 10%.

When analysing the contributions of different groups to the annual percentage change in headline inflation, food and non-alcoholic beverages remained the most significant contributor to the all-items index.

In April, food and non-alcoholic beverages contributed 2.4 percentage points to the headline figure of 6.8%, while, in May, the line item contributed 2.1 percentage points. This trend highlights the significant impact that loadshedding has had on keeping food prices elevated, subsequently contributing to the sticky headline inflation figure.

Peaking at 7.8% in July 2022, headline CPI has ticked down somewhat, coming in at 6.9% in January 2023, rising slightly higher in February and March, and lowering to 6.3% in May, down from 6.8% in April. Interestingly, annual headline inflation increased steadily in February and March when loadshedding was especially rife and power disruptions intensified to unparalleled levels, which implies that loadshedding is a direct catalyst towards sticky inflation in South Africa.

South Africa’s most prominent food retailers – Spar (JSE: SPP), Shoprite (JSE: SHP), Pick ‘n Pay (JSE: PIK) and Woolworths (JSE: WHL) – collectively splurged an astronomical R1.87 billion on direct costs associated with load shedding.

Between December 2022 and March 2023, Spar spent R700 million on direct costs associated with loadshedding, while Shoprite, Pick ‘n Pay and Woolworths, spent R560 million, R522 million and R90 million, respectively, to combat the devastating effects associated with constant power outages.

Across four food retailers, the cumulative direct costs associated with load shedding totalled R1.87 billion between December 2022 and March 2023, where headline inflation ticked up. This trend implies the possibility of a relatively strong correlation between loadshedding concerning the costs involved in mitigating the energy crisis and price levels, specifically food and non-alcoholic prices.

While backup power solutions like solar energy have helped alleviate the impact of load shedding, they come with their exorbitant costs for retailers. Despite some relief from power disruptions this winter, Shoprite anticipates that diesel prices will remain steep throughout 2023. While loadshedding has been less severe in June, one cannot discount the distinct possibility of its intensification beyond stage 6 as winter progresses.

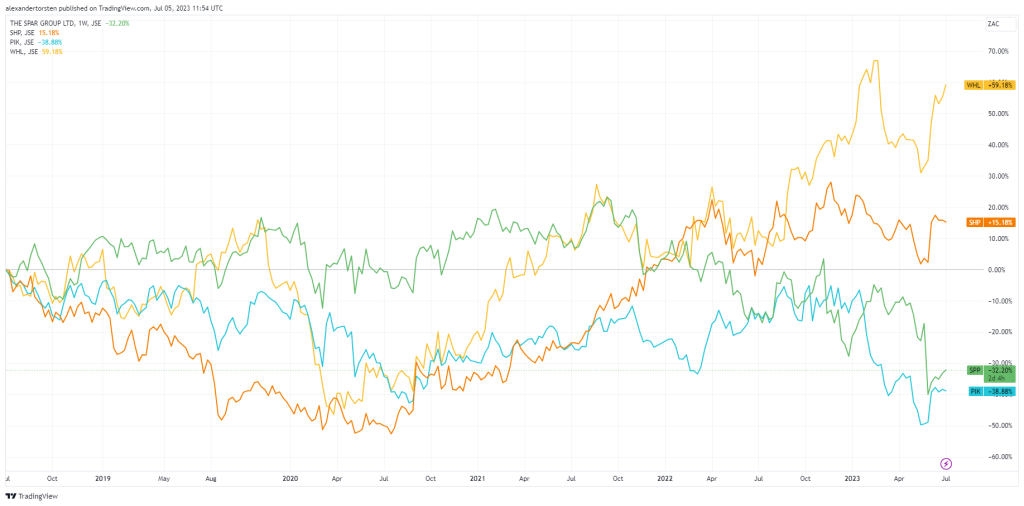

Analysing Share Price Performance: Comparing South African Food Retailers

- Over the most recent five-year time horizon, Woolworths (JSE: WHL) has prevailed as the winner in share price performance, returning close to 60% to shareholders (yellow line), with Shoprite (JSE: SHP) returning a cumulative return of just over 15% to shareholders (orange line) over the same five-year period.

- On the other hand, Spar (JSE: SPP) and Pick ‘n Pay (JSE: PIK) have prevailed as the ultimate losers concerning cumulative five-year share price performance, returning -32% (green line) and -38% (blue line) to shareholders, respectively.

Over the most recent twelve-month period, Woolworths has returned close to 42% to shareholders (yellow line), with Shoprite returning just under 16% to shareholders (orange line). Spar and Pick ‘n Pay have returned -21% (green line) and -28% (blue line) to shareholders over the last year.

Sources: Bloomberg, Business Tech, Stats SA, Trading View

With these sorts of figures do we need Eskom? They burning R3 billion in diesel a month. Maybe if we all become self sufficient we will be better off.. No free loading clients or municipalities..